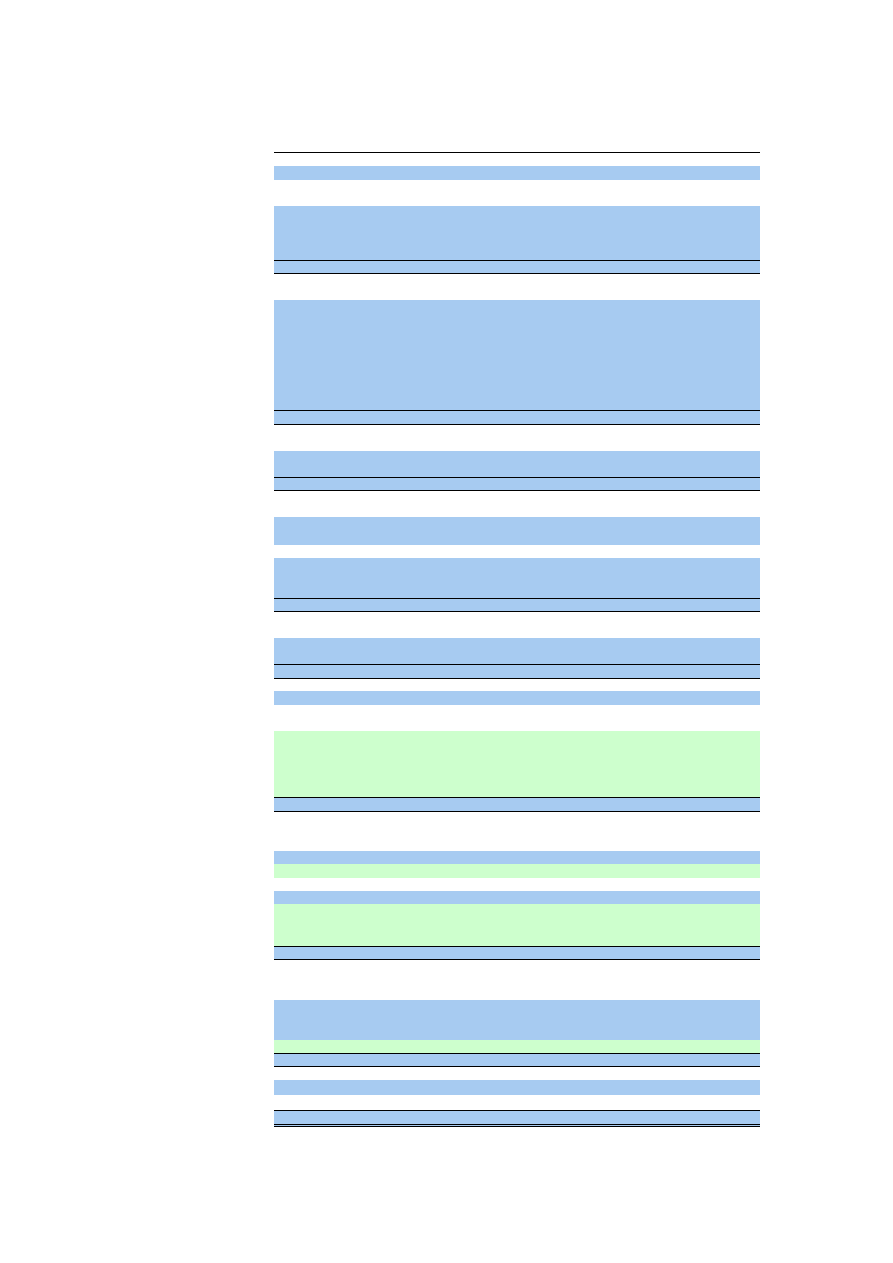

DREWNICA DEVELOPMENT Sp. z o.o.

Balance Sheet

(All amounts are stated in PLN)

(All amounts are stated in USD)

ASSETS

31.10.2010

31.12.2010

31.12.2009

31.10.2010

31.12.2010

31.12.2009

Fixed assets

20 027 237,18

20 212 223,94

19 955 452,42

6 936 320,15

6 819 008,79

7 001 176,16

Intangible fixed assets

Development costs

-

-

-

-

-

-

Goodwill

-

-

-

-

-

-

Other intangible fixed assets

-

-

-

-

-

-

Prepayments for intangible fixed assets

-

-

-

-

-

-

-

-

-

-

-

-

Tangible fixed assets

Fixed assets

412 524,27

372 421,14

382 855,18

142 875,44

125 643,92

134 321,01

land (including perpetual usufruct of land)

-

-

-

-

-

-

buildings, premises and civil and water engineering

structures

360 581,82

356 515,28

371 443,08

124 885,47

120 277,75

130 317,19

technical equipment and machinery

51 413,53

15 588,51

9 825,35

17 806,78

5 259,10

3 447,13

vehicles

-

-

-

-

-

-

other tangible fixed assets

528,92

317,35

1 586,75

183,19

107,06

556,70

Fixed assets under construction

178 419,89

-

-

60 193,61

-

Prepayments for tangible fixed assets

-

-

-

-

-

-

412 524,27

550 841,03

382 855,18

142 875,44

185 837,53

134 321,01

Long-term receivables

From related parties

-

-

-

-

-

-

From other parties

-

-

-

-

-

-

-

-

-

-

-

-

Long-term investments

Investment property

18 968 546,91

18 968 546,91

18 904 300,24

6 569 648,78

6 399 428,80

6 632 389,66

Intangible fixed assets

-

-

-

-

-

-

Long-term financial assets

in related parties

-

-

-

-

-

-

in third parties

-

-

-

-

-

-

Other long-term investments

-

-

-

-

-

-

18 968 546,91

18 968 546,91

18 904 300,24

6 569 648,78

6 399 428,80

6 632 389,66

Prepayments and deferred expenses

Deferred tax asset

646 166,00

692 836,00

668 297,00

223 795,93

233 742,45

234 465,50

Other prepayments and deferred expenses

-

-

-

-

-

-

646 166,00

692 836,00

668 297,00

223 795,93

233 742,45

234 465,50

Current assets

2 919 702,83

3 365 656,08

2 628 820,01

1 011 222,54

1 135 473,19

922 295,90

Inventory

Raw materials

38 981,33

178 907,35

103 148,00

13 500,96

60 358,07

36 188,47

Semi-finished products and work in progress

-

-

-

-

-

-

Finished products

-

-

-

-

-

-

Merchandise

-

-

-

-

-

-

Prepayments for inventory

-

-

-

-

-

-

38 981,33

178 907,35

103 148,00

13 500,96

60 358,07

36 188,47

Short-term receivables

Receivables from related parties

-

-

-

-

-

trade receivables

-

-

-

-

-

-

other

-

-

-

-

-

-

Receivables from third parties

trade receivables

553 242,54

448 779,81

465 527,72

191 612,42

151 405,08

163 325,87

taxation and social security debtors

2 278,14

9 952,74

3 164,39

789,02

3 357,76

1 110,20

other

-

-

10 279,24

-

-

3 606,37

receivables subject to legal proceedings

-

-

-

-

-

-

555 520,68

458 732,55

478 971,35

192 401,44

154 762,85

168 042,43

Short-term investments

Short-term financial assets

in related parties

-

-

-

-

-

-

in third parties

-

-

-

-

-

-

cash and cash equivalents

2 208 317,80

2 722 214,00

2 038 473,58

764 838,36

918 394,79

715 178,61

Other short-term investments

-

-

-

-

-

-

2 208 317,80

2 722 214,00

2 038 473,58

764 838,36

918 394,79

715 178,61

Short-term prepayments and deferred expenses

116 883,02

5 802,18

8 227,08

40 481,77

1 957,48

2 886,39

TOTAL ASSETS

22 946 940,01

23 577 880,02

22 584 272,43

7 947 542,69

7 954 481,97

7 923 472,07

All amounts translated with average National Bank of Poland rate as at the balance sheet date

2,8873

2,9641

2,8503

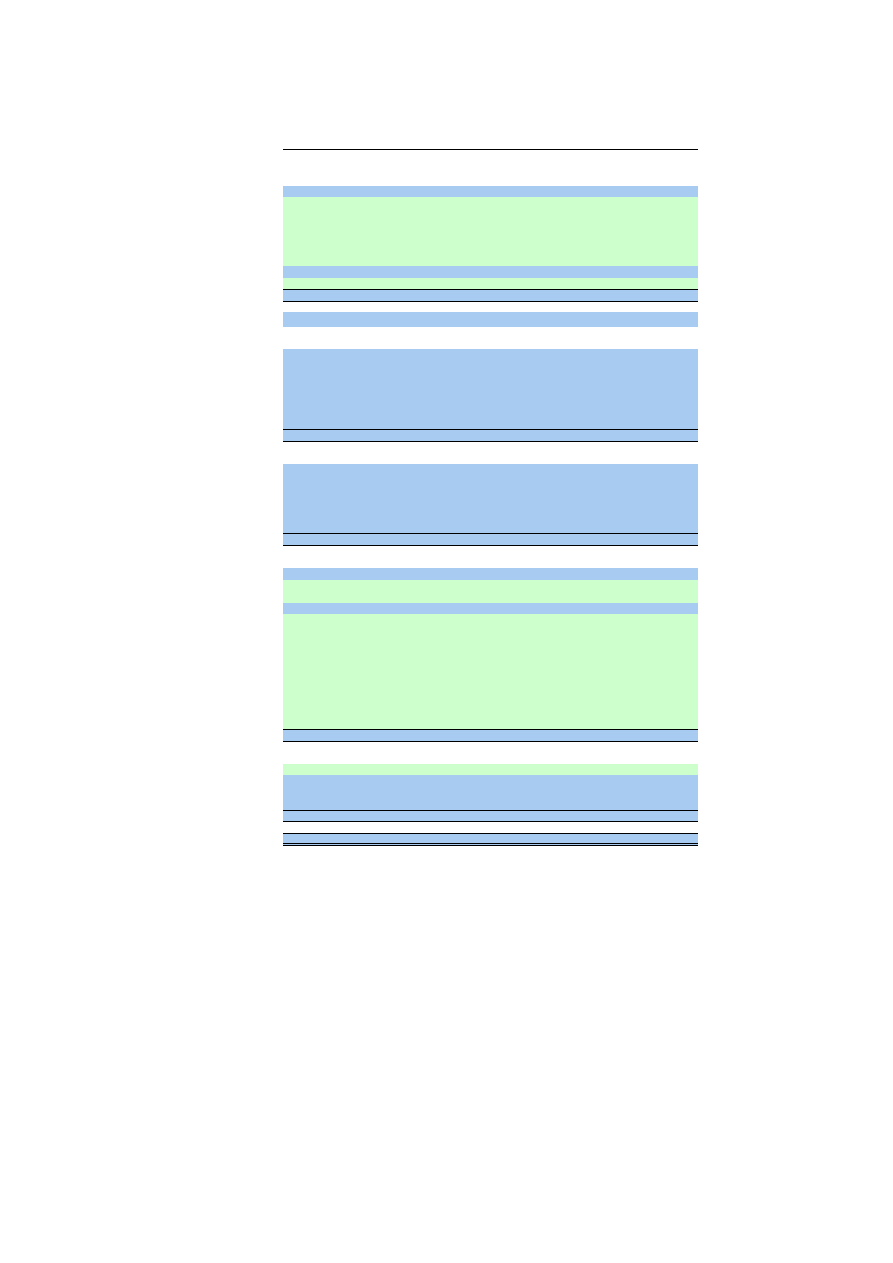

DREWNICA DEVELOPMENT Sp. z o.o.

Balance Sheet

(All amounts are stated in PLN)

(All amounts are stated in USD)

EQUITY AND LIABILITIES

31.10.2010

31.12.2010

31.12.2009

31.10.2010

31.12.2010

31.12.2009

Equity

Share capital

5 541 800,00

5 541 800,00

5 541 800,00

1 919 371,04

1 869 640,03

1 944 286,57

Outstanding share capital contributions

-

-

-

-

-

-

Treasury shares

-

-

-

-

-

-

Reserve capitals

8 093 676,23

8 093 676,23

740 632,23

2 803 198,92

2 730 567,87

259 843,61

Revaluation reserve

5 705 419,74

5 705 419,74

5 705 419,74

1 976 039,81

1 924 840,50

2 001 690,96

Other capital reserves

-

-

-

-

-

-

Accumulated profit from previous years

(471 007,76)

(471 007,76)

7 353 044,00

(163 130,87)

(158 904,14)

2 579 743,89

Net profit/(loss)

436 764,23

490 402,92

(471 007,76)

151 270,82

165 447,50

(165 248,49)

Appropriation of the net profit during the financial year

-

-

-

-

-

-

19 306 652,44

19 360 291,13

18 869 888,21

6 686 749,71

6 531 591,76

6 620 316,53

Liabilities and provisions for liabilities

3 640 287,57

4 217 588,89

3 714 384,22

1 260 792,98

1 422 890,22

1 303 155,53

Provisions for liabilities

Deferred tax liability

1 338 308,00

1 369 018,00

1 342 459,00

463 515,40

461 866,33

470 988,67

Provision for retirement and similar benefits

-

-

5 422,88

-

-

1 902,56

- long-term

-

-

-

-

-

-

- short-term

-

-

5 422,88

-

-

1 902,56

Other provisions

504 977,37

726 714,82

594 234,39

174 896,05

245 172,17

208 481,35

- long-term

-

-

39 828,00

-

-

13 973,27

- short-term

504 977,37

726 714,82

554 406,39

174 896,05

245 172,17

194 508,08

1 843 285,37

2 095 732,82

1 942 116,27

638 411,45

707 038,50

681 372,58

Long-term liabilities

Related party liabilities

-

1 501 026,35

-

-

506 402,06

-

Liabilities due to third parties

-

-

-

-

-

-

credits and loans

-

-

-

-

-

-

debt securities

-

-

-

-

-

-

other financial liabilities

-

-

-

-

-

-

other

-

-

-

-

-

-

-

1 501 026,35

-

-

506 402,06

-

Short-term liabilities

Related party liabilities

1 498 440,00

-

1 498 440,00

518 976,21

-

525 713,08

trade

-

-

-

-

-

-

other

1 498 440,00

-

1 498 440,00

518 976,21

-

525 713,08

Liabilities due to third parties

298 562,20

620 829,72

273 827,95

103 405,33

209 449,65

96 069,87

credits and loans

-

-

-

-

-

-

debt securities

-

-

-

-

-

-

other financial liabilities

-

-

-

-

-

-

trade liabilities

170 484,02

499 911,29

117 744,27

59 046,17

168 655,34

41 309,43

advance payments received

-

-

-

-

-

-

bills of exchange payable

-

-

-

-

-

-

taxation, custom duties and social security

43 700,12

51 696,15

71 341,14

15 135,29

17 440,76

25 029,34

payroll liabilities

-

-

-

-

-

-

other

84 378,06

58 566,54

84 742,54

29 223,86

19 758,62

29 731,09

Special funds

-

-

-

-

-

-

1 797 002,20

620 829,72

1 772 267,95

622 381,53

209 449,65

621 782,95

Accruals and deferred income

Negative goodwill

-

-

-

-

-

-

Other

-

-

-

-

-

-

- long-term

-

-

-

-

-

-

- short-term

-

-

-

-

-

-

-

-

-

-

-

-

TOTAL EQUITY AND LIABILITIES

22 946 940,01

23 577 880,02

22 584 272,43

7 947 542,69

7 954 481,97

7 923 472,07

All amounts translated with average National Bank of Poland rate as at the balance sheet date

2,8873

2,9641

2,8503

Krzysztof Sobolewski

President of the Management Board

Sylwia Urban

Person responsible for Financial Accounting

Gdansk, 17-02-2011

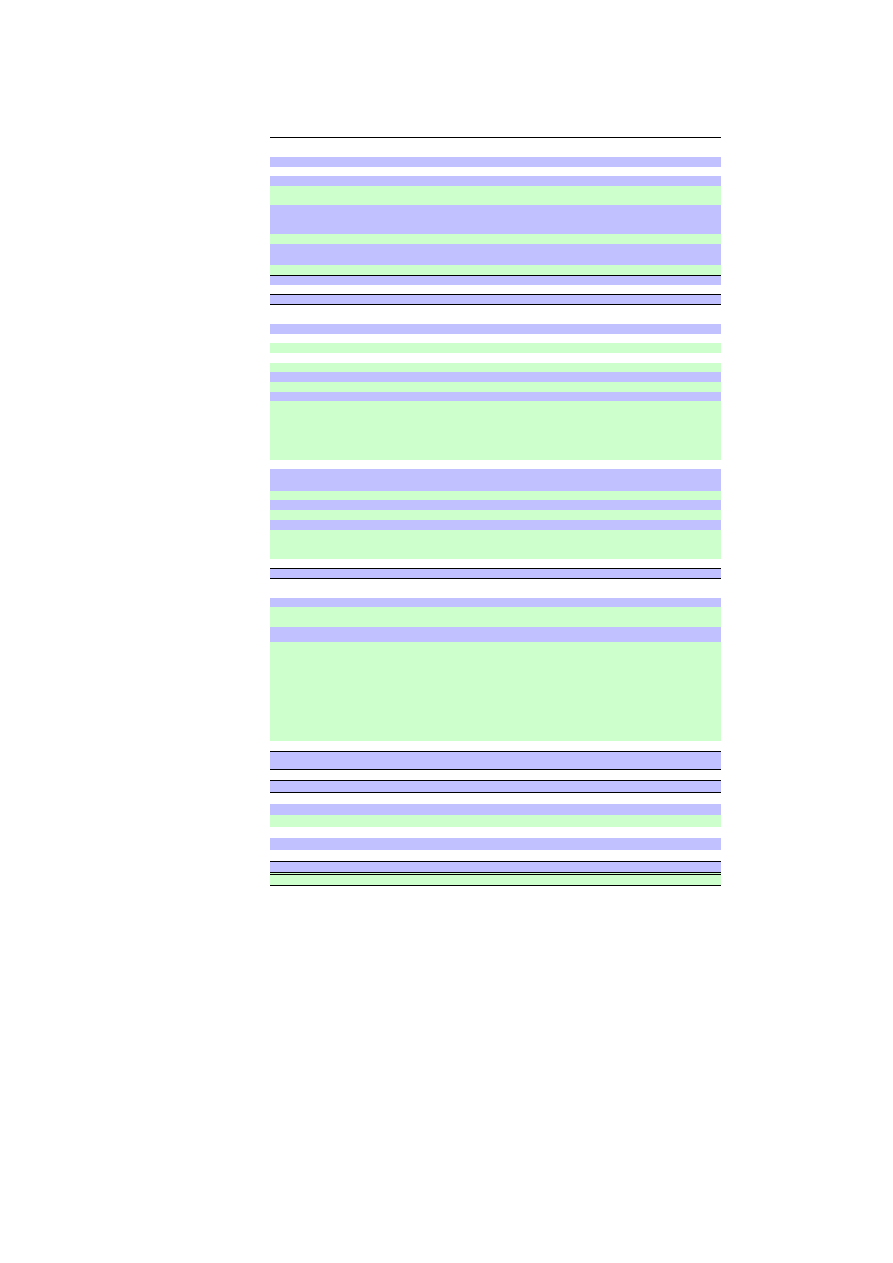

DREWNICA DEVELOPMENT Sp. z o.o.

Profit and Loss Account

(All amounts are stated in PLN)

(All amounts are stated in USD)

01.01.2010 -

31.10.2010

01.11.2010 -

31.12.2010

01.01.2010 -

31.12.2010

29.10.2008 -

31.12.2009

01.01.2010 -

31.10.2010

01.11.2010 -

31.12.2010

01.01.2010 -

31.12.2010

29.10.2008 -

31.12.2009

Net revenues and net revenue equivalents, including:

- from related parties

-

-

-

-

-

-

Net revenues from the sale of finished products

3 540 326,90

922 759,29

4 463 086,19

5 481 621,82

1 169 466,82

312 217,66

1 479 950,32

1 759 072,53

Change in inventory position

-

-

-

-

-

-

-

-

Cost of products produced for own needs

-

-

-

-

-

-

-

-

Net revenues from the sale of merchandise and raw materials

-

-

-

-

-

-

-

-

3 540 326,90

922 759,29

4 463 086,19

5 481 621,82

1 169 466,82

312 217,66

1 479 950,32

1 759 072,53

-

Operating expenses

-

Depreciation

(24 054,68)

(4 953,10)

(29 007,78)

(824 374,87)

(7 945,92)

(1 675,89)

(9 618,92)

(264 544,92)

Materials and energy

(241 863,52)

(40 875,54)

(282 739,06)

(316 115,86)

(58 698,13)

(35 541,27)

(93 755,70)

(101 442,74)

External services

(1 391 658,32)

(466 053,08)

(1 857 711,40)

(2 147 986,74)

(459 702,81)

(157 690,10)

(616 013,33)

(689 296,82)

Taxes and charges including:

(1 592 915,24)

(314 560,77)

(1 907 476,01)

(2 002 065,22)

(526 183,48)

(106 432,34)

(632 515,17)

(642 470,07)

- excise tax

-

-

-

-

-

-

-

-

Payroll

(51 772,08)

(27 067,88)

(78 839,96)

(432 413,93)

(17 101,73)

(9 158,48)

(26 143,17)

(138 763,21)

Social security and other benefits

(11 808,00)

(1 878,22)

(13 686,22)

(130 071,49)

(3 900,51)

(635,50)

(4 538,32)

(41 740,42)

Other expenditures by kind

(61 964,47)

(7 043,85)

(69 008,32)

(44 715,46)

(20 468,56)

(2 383,30)

(22 883,02)

(14 349,35)

Cost of merchandise and raw materials sold

-

-

-

(21 196,01)

21 710,94

-

-

(3 376 036,31)

(862 432,44)

(4 238 468,75)

(5 897 743,57)

(1 115 197,14)

(291 805,93)

(1 405 467,64)

(1 892 607,53)

-

Profit/(loss) on sales

164 290,59

60 326,85

224 617,44

(416 121,75)

54 269,68

20 411,72

74 482,69

(133 534,99)

-

Other operating revenues

-

Profit on the disposal of non-financial fixed assets

-

-

-

1 400,00

-

-

-

449,27

Grants

-

-

-

-

-

-

-

-

Other operating revenues

259 529,16

6 044,99

265 574,15

555 847,90

85 729,58

2 045,34

88 063,85

178 373,63

259 529,16

6 044,99

265 574,15

557 247,90

85 729,58

2 045,34

88 063,85

178 822,89

-

Other operating expenses

-

Loss on the disposal of non-financial fixed assets

-

-

-

-

-

-

-

-

Revaluation of non-financial assets

-

-

-

-

-

-

-

-

Other operating costs

(331,81)

(6 870,05)

(7 201,86)

(183 846,34)

(109,61)

(2 324,50)

(2 388,12)

(58 996,96)

(331,81)

(6 870,05)

(7 201,86)

(183 846,34)

(109,61)

(2 324,50)

(2 388,12)

(58 996,96)

-

Operating profit/(loss)

423 487,94

59 501,79

482 989,73

(42 720,19)

139 889,65

20 132,56

160 158,41

(13 709,07)

-

Financial revenue

-

Dividends received and share in profits, including:

-

-

-

-

-

-

-

-

- from related parties

-

-

-

-

-

-

-

-

Interest, including:

87 289,45

40 737,06

128 026,51

86 475,99

28 834,09

13 783,47

42 453,33

27 750,46

- from related parties

-

-

-

-

-

-

-

-

Profit on the disposal of investments

-

-

-

-

-

-

-

-

Revaluation of investments

-

-

-

-

-

-

-

-

Other

-

-

-

-

-

-

-

-

87 289,45

40 737,06

128 026,51

86 475,99

28 834,09

13 783,47

42 453,33

27 750,46

-

Financial expenses

-

Interest, including:

(7 091,16)

(2 620,35)

(9 711,51)

(34 319,49)

(2 342,40)

(886,60)

(3 220,32)

(11 013,25)

- from related parties

-

-

-

-

-

-

-

-

Loss on the disposal of investments

-

-

-

-

-

-

-

-

Revaluation of investments

-

-

-

-

-

-

-

-

Other

(16 534,81)

(16 534,81)

(359 698,07)

-

(5 594,59)

(5 482,91)

(115 428,43)

(7 091,16)

(19 155,16)

(26 246,32)

(394 017,56)

(2 342,40)

(6 481,19)

(8 703,23)

(126 441,68)

-

Gross profit/(loss) on business activities

503 686,23

81 083,69

584 769,92

(350 261,76)

166 381,34

27 434,85

193 908,52

(112 400,28)

-

Results of extraordinary events

-

Extraordinary gains

-

-

-

-

-

-

-

-

Extraordinary losses

-

-

-

-

-

-

-

-

-

Profit/(loss) before taxation

503 686,23

81 083,69

584 769,92

(350 261,76)

166 381,34

27 434,85

193 908,52

(112 400,28)

-

Corporate income tax

(66 922,00)

(27 445,00)

(94 367,00)

(120 746,00)

(22 106,17)

(9 286,08)

(31 291,91)

(38 747,83)

current income tax

48 942,00

43 405,00

92 347,00

119 871,00

16 166,88

14 686,18

30 622,08

38 467,04

deferred income tax

17 980,00

(15 960,00)

2 020,00

875,00

5 939,29

(5 400,10)

669,83

280,79

Other obligatory charges decreasing the profit/increasing the loss

-

-

-

-

-

-

-

-

Net profit/(loss)

436 764,23

53 638,69

490 402,92

(471 007,76)

144 275,17

18 148,77

162 616,61

(151 148,12)

All amounts translated with average National Bank of Poland rate for a period

3,0273

2,9555

3,0157

3,1162

Krzysztof Sobolewski

President of the Management Board

Sylwia Urban

Person responsible for Financial Accounting

Gdansk, 17-02-2011

DREWNICA DEVELOPMENT Sp. z o.o.

Statement of Changes in Equity

(All amounts are stated in PLN)

(All amounts are stated in USD)

01.01.2010 -

31.10.2010

01.11.2010 -

31.12.2010

01.01.2010 -

31.12.2010

29.10.2008 -

31.12.2009

01.01.2010 -

31.10.2010

01.11.2010 -

31.12.2010

01.01.2010 -

31.12.2010

29.10.2008 -

31.12.2009

Equity at the beginning of the period

18 869 888,21

19 306 652,44

18 869 888,21

17 987 851,97

6 535 478,89

6 513 495,64

6 366 144,26

6 310 862,71

- correction of errors

-

-

-

7 353 044,00

-

-

-

2 579 743,89

- effect of changes in accounting policy

-

-

-

-

-

-

-

-

Restated equity at the beginning of the period

18 869 888,21

19 306 652,44

18 869 888,21

25 340 895,97

6 535 478,89

6 513 495,64

6 366 144,26

8 890 606,59

Share capital at the beginning of the period

5 541 800,00

5 541 800,00

5 541 800,00

11 541 800,00

1 919 371,04

1 869 640,03

1 869 640,03

4 049 328,14

Changes in share capital

additions relating to:

-

-

-

-

-

-

-

-

- share issue

-

-

-

-

-

-

-

-

deduction relating to:

-

-

-

(6 000 000,00)

-

-

-

(2 105 041,57)

- redemption of shares

-

-

-

(6 000 000,00)

-

-

-

(2 105 041,57)

Share capital at the end of the period

5 541 800,00

5 541 800,00

5 541 800,00

5 541 800,00

1 919 371,04

1 869 640,03

1 869 640,03

1 944 286,57

Outstanding share capital contributions at the beginning of the period

-

-

-

-

-

-

-

-

Changes in outstanding share capital contributions

additions relating to:

-

-

-

-

-

-

-

-

deduction relating to:

-

-

-

-

-

-

-

-

Outstanding share capital contributions at the end of the period

-

-

-

-

-

-

-

-

Reserve capital at the beginning of the period

740 632,23

8 093 676,23

740 632,23

740 632,23

256 513,78

2 730 567,87

249 867,49

259 843,61

Changes in reserve capital

additions relating to:

7 353 044,00

7 353 044,00

-

2 546 685,1

-

2 480 700,38

-

- profit allocation

7 353 044,00

-

7 353 044,00

-

2 546 685,1

-

2 480 700,38

-

deductions relating to:

-

-

-

-

-

-

-

-

- loss coverage

-

-

-

-

-

-

-

-

Reserve capital at the end of the period

8 093 676,23

8 093 676,23

8 093 676,23

740 632,23

2 803 198,92

2 730 567,87

2 730 567,87

259 843,61

Revaluation reserve at the beginning of the period

5 705 419,74

5 705 419,74

5 705 419,74

5 705 419,74

1 976 039,81

1 924 840,50

1 924 840,50

2 001 690,96

Changes in revaluation capital

additions relating to:

-

-

-

-

-

-

-

-

deductions relating to:

-

-

-

-

-

-

-

-

- fixed assets disposals

-

-

-

-

-

-

-

-

Revaluation reserve at the end of the period

5 705 419,74

5 705 419,74

5 705 419,74

5 705 419,74

1 976 039,81

1 924 840,50

1 924 840,50

2 001 690,96

Other capital reserves at the beginning of the period

-

-

-

-

-

-

-

-

Changes in other reserve capital

additions relating to:

-

-

-

-

-

-

-

-

deductions relating to:

-

-

-

-

-

-

-

-

Other capital reserves at the end of the period

-

-

-

-

-

-

-

-

7 353 044,0

7 353 044,0

-

2 546 685,1

-

2 480 700,4

-

Accumulated profit from previous years at the beginning of the period

-

-

- correction of errors

-

-

-

7 353 044,00

-

-

-

2 579 743,89

- effect of changes in accounting policy

-

-

-

-

-

-

-

-

7 353 044,00

7 353 044,00

7 353 044,00

2 546 685,14

-

2 480 700,38

2 579 743,89

additions relating to:

-

-

-

-

-

-

-

-

deduction relating to:

(7 353 044,00)

(7 353 044,00)

-

(2 546 685,14)

-

(2 480 700,38)

-

- profit allocation to reserve capital

(7 353 044,00)

(7 353 044,00)

(2 546 685,14)

-

(2 480 700,38)

Accumulated profit from previous years at the end of the period

-

-

-

7 353 044,00

-

-

-

2 579 743,89

Accumulated loss from previous years at the beginning of the period

(471 007,76)

(471 007,76)

(471 007,76)

-

(163 130,9)

(158 904,1)

(158 904,14)

-

- correction of errors

-

-

-

-

-

-

-

-

- effect of changes in accounting policy

-

-

-

-

-

-

-

-

(471 007,76)

(471 007,76)

(471 007,76)

-

(163 130,9)

(158 904,1)

(158 904,14)

-

additions relating to:

-

-

-

-

-

-

-

deductions relating to:

-

-

-

-

-

-

-

-

Accumulated loss from previous years at the end of the period

(471 007,76)

(471 007,76)

(471 007,76)

-

(163 130,9)

(158 904,1)

(158 904,14)

-

Accumulated (loss)/profit from previous years at the end of the period

(471 007,76)

(471 007,76)

(471 007,76)

7 353 044,0

(163 130,9)

(158 904,1)

(158 904,14)

2 579 743,9

Net profit/(loss) after taxation for the financial year

net profit

436 764,23

53 638,69

490 402,92

-

151 270,8

18 096,1

165 447,5

-

net loss

-

-

-

(471 007,76)

-

-

-

(165 248,49)

appropriation of profit

-

-

-

-

-

-

-

-

Equity at the end of the period

19 306 652,44

19 360 291,13

19 360 291,13

18 869 888,21

6 686 749,71

6 531 591,76

6 531 591,8

6 620 316,53

19 306 652,44

19 360 291,13

19 360 291,13

18 869 888,21

6 686 749,71

6 531 591,76

6 531 591,8

6 620 316,53

-

-

All amounts translated with average National Bank of Poland rate as at the balance sheet date

2,8873

2,9641

2,9641

2,8503

Krzysztof Sobolewski

President of the Management Board

Sylwia Urban

Person responsible for Financial Accounting

Gdansk, 17-02-2011

Zestawienie zmian w kapitale w?asnym nale?y analizowa? ??cznie z dodatkowymi informacjami i obja?nieniami,

które stanowi? integraln? cz??? sprawozdania finansowego.

4

DREWNICA DEVELOPMENT Sp. z o.o.

Statement of Cash Flows

(All amounts are stated in PLN)

(All amounts are stated in USD)

01.01.2010 -

31.10.2010

01.11.2010 -

31.12.2010

01.01.2010 -

31.12.2010

29.10.2008 -

31.12.2009

01.01.2010 -

31.10.2010

01.11.2010 -

31.12.2010

01.01.2010 -

31.12.2010

29.10.2008 -

31.12.2009

Cash flow from operating activities

Net profit/(loss)

436 764,23

53 638,69

490 402,92

(471 007,76)

144 275,17

18 148,77

162 616,61

(151 148,12)

Total adjustments:

Depreciation and amortization

24 054,68

4 953,10

29 007,78

824 374,87

7 945,92

1 675,89

9 618,92

264 544,92

Foreign exchange (profit)/loss

-

-

-

1 578 310,80

-

-

-

506 485,72

Interest and share in profits (dividend income)

2 586,35

2 586,35

47 016,73

-

875,10

857,63

15 087,84

(Profit)/loss on investing activity

-

-

-

(1 400,00)

-

-

-

(449,27)

Change in provisions

(98 830,90)

252 447,45

153 616,55

(1 506 999,73)

(32 646,55)

85 416,16

50 938,94

(483 601,74)

Change in inventory

(80,00)

(75 679,35)

(75 759,35)

-

(26,43)

(25 606,28)

(25 121,65)

-

Change in receivables

(76 549,33)

96 788,13

20 238,80

11 672 487,05

(25 286,34)

32 748,48

6 711,15

3 745 743,87

Change in short-term liabilities (excluding loans and bank credits)

(10 415,75)

357 417,52

347 001,77

165 920,25

(3 440,61)

120 933,01

115 065,08

53 244,42

Change in prepayments, accruals and deferred income and expenses

(86 524,94)

108 639,04

22 114,10

231 660,33

(28 581,55)

36 758,26

7 332,99

74 340,65

Other adjustments

-

-

-

-

(248 346,24)

702 924,04

454 577,80

13 011 370,30

(82 035,56)

237 835,91

150 737,08

4 175 396,41

Net cash flow from operating activities

188 417,99

756 562,73

944 980,72

12 540 362,54

62 239,62

255 984,68

313 353,69

4 024 248,30

Cash flow from investing activities

Proceeds:

-

-

-

1 400,00

-

-

-

449,27

Disposal of tangible and intangible fixed assets

-

-

-

1 400,00

-

-

-

449,27

Disposal of investment property and intangible fixed assets

-

-

-

-

-

-

-

-

From financial assets, including:

-

-

-

-

-

-

-

-

of related parties

-

-

-

-

-

-

-

-

of third parties

-

-

-

-

-

-

-

-

- sale of financial assets

-

-

-

-

-

-

-

-

- dividends and share in profits

-

-

-

-

-

-

-

-

- repayment of long-term loans

-

-

-

-

-

-

-

-

- interest

-

-

-

-

-

-

-

-

- other proceeds from financial assets

-

-

-

-

-

-

-

-

Other proceeds from investing activities

-

-

-

-

-

-

-

-

Disbursements:

(18 573,77)

(242 666,53)

(261 240,30)

(331 513,65)

(6 135,42)

(82 106,76)

(86 626,75)

(106 383,95)

Purchase of tangible and intangible fixed assets

(18 573,77)

(242 666,53)

(261 240,30)

(331 513,65)

(6 135,42)

(82 106,76)

(86 626,75)

(106 383,95)

Purchase of investment property and intangible fixed assets

-

-

-

-

-

-

-

-

For financial assets, including:

-

-

-

-

-

-

-

-

of related parties

-

-

-

-

-

-

-

-

of third parties

-

-

-

-

-

-

-

-

- purchase of financial assets

-

-

-

-

-

-

-

-

- long term loans provided

-

-

-

-

-

-

-

-

Other investment disbursements

-

-

-

-

-

-

-

-

Net cash flow from investing activities

(18 573,77)

(242 666,53)

(261 240,30)

(330 113,65)

(6 135,42)

(82 106,76)

(86 626,75)

(105 934,68)

Cash flow from financing activities

Proceeds:

-

-

-

-

-

-

-

-

Issue of debt securities

-

-

-

-

-

-

-

-

Other financial proceeds

-

-

-

-

-

-

-

-

Disbursements:

-

-

-

(10 171 775,89)

-

-

-

(3 264 160,16)

Purchase of treasury shares

-

-

-

-

-

-

-

-

Dividends and other payments to shareholders

-

-

-

(4 522 548,88)

-

-

-

(1 451 302,51)

Other payments relating to profit distribution, excluding

-

-

-

-

-

-

-

-

payments to shareholders

-

-

-

-

-

-

-

-

Repayment of bank credits and loans

-

-

-

(5 602 210,28)

-

-

-

(1 797 769,81)

Redemption of debt securities

-

-

-

-

-

-

-

-

Other financial obligations

-

-

-

-

-

-

-

-

Payments relating to finance lease obligations

-

-

-

-

-

-

-

-

Interest

-

-

-

(47 016,73)

-

-

-

(15 087,84)

Other financial disbursements

-

-

-

-

-

-

-

-

Net cash flow from financing activities

-

-

-

(10 171 775,89)

-

-

-

(3 264 160,16)

Net cash flow

169 844,22

513 896,20

683 740,42

2 038 473,00

56 104,19

173 877,92

226 726,94

654 153,46

Balance sheet change in cash, including:

169 844,22

513 896,20

683 740,42

2 038 473,00

56 104,19

173 877,92

226 726,94

654 153,46

- change in cash from foreign exchange differences

-

-

-

-

-

-

-

-

Cash at the beginning of the financial year

2 038 473,00

2 208 317,80

2 038 473,00

-

673 363,39

747 189,24

675 953,51

-

Cash at the end of the financial year, including:

2 208 317,80

2 722 214,00

2 722 214,00

2 038 473,00

729 467,78

921 067,16

902 680,64

654 153,46

- restricted cash

-

-

-

-

-

-

-

-

All amounts translated with average National Bank of Poland rate for a year

3,0273

2,9555

3,0157

3,1162

Krzysztof Sobolewski

President of the Management Board

Sylwia Urban

Person responsible for Financial Accounting

Gdansk, 17-02-2011

Wyszukiwarka

Podobne podstrony:

Smolensk ostateczna prawda, tragedja Narodu polskiego powódz i 2010 10 kwietnia i inne tragedje

Ostateczne rozwiązanie kwestii smoleńskiej, SMOLENSKN 10 04 2010 MORDERSTWO W IMIE GLOBALIZACJI

Katecheza o Eschatologii rzeczach ostatecznych Porto San Giorgio 2010

spis lab I sem 2010

2010 ZMP studenci

Prezentacja konsument ostateczna

W4 2010

WYKŁAD PL wersja ostateczna

wyklad 14 15 2010

W 8 Hormony 2010 2011

RI 12 2010 wspolczesne koncepcje

2009 2010 Autorytet

wyklad 2 2010

Wykład 3 powtórzenie 2010 studenci (1)

PD W1 Wprowadzenie do PD(2010 10 02) 1 1

BIOMATERIALY IV 2010

spis wykład I sem 2010

więcej podobnych podstron