Portfolio optimization under

value-at-risk constraint

Traian A Pirvu

1

Department of Mathematics

The University of British Columbia

Vancouver, BC, V6T1Z2

tpirvu@math.ubc.ca

October 21, 2005

Abstract

In this paper, we analyze the effects arising from imposing a Value-at-Risk con-

straint in an agent’s consumption and portfolio selection problem. The market

consists of m risky assets (stocks) plus a risk free asset. The stocks are modelled

as exponential Brownian motions with random drift and volatility. The risk of the

trading portfolio and consumption is reevaluated dynamically and hence the agent

must satisfy the Value-at-Risk constraint continuously. We derive the optimal con-

sumption and portfolio allocation policy in closed form for the case of logarithmic

utility. The problem for general power utility is reduced to a deterministic control

one, which is analyzed and solved numerically. The VaR constraint remains active

once it becomes active and reduces the consumption and investment in the risky

assets. The optimal policies are projections of the optimal unconstrained ones onto

the constraint set.

JEL classification: G10

Mathematics Subject Classification (2000): 91B30, 60H30, 60G44

1

Introduction

Managers limit the riskiness of their traders by imposing limits on the risk of their portfo-

lios. Lately, the Value-at-Risk (VaR) risk measure has became a tool used to accomplish this

purpose. The increased popularity of this risk measure is due to the fact that VaR is easily un-

derstood. It is the maximum loss of a portfolio over a given horizon, at a given confidence level.

The Basle Committee on Banking Supervision requires U.S. banks to use VaR in determining

the minimum capital required for their trading portfolios.

Basak and Shapiro (2001) analyze the optimal dynamic portfolio and wealth-consumption

policies of utility maximizing investors who must manage risk exposure using VaR. They find

that VaR risk managers pick a larger exposure to risky assets than non-risk managers, and

1

Work supported by NSERC under research grant 88051 and NCE grant 30354 (MITACS).

consequently incur larger losses when losses occur. In order to fix this deficiency they choose

another risk measure based on the risk-neutral expectation of a loss. They called this risk

measure Limited Expected Loss (LEL). One drawback of their model is that the portfolios VaR

is never reevaluated after the initial date, making the problem a static one. In a similar setup,

Berkelaar, Cumperayot and Kouwenberg (2002) show that VaR reduces market volatility, but

in some cases raises the probability of extreme losses. Emmer, Kl¨

uppelberg and Korn (2001)

consider a dynamic model with Capital-at-Risk (a version of VaR) limits. However, they

assume that portfolio proportions are held fixed during the whole investment horizon and thus

the problem becomes a static one as well.

Cuoco, He and Issaenko (2001) develop a more realistic dynamically-consistent model of

the optimal behavior of a trader subject to risk constraints. They assume that the risk of

the trading portfolio is reevaluated dynamically by using the conditioning information, and

hence the trader must satisfy the risk limits continuously. Another assumption they make

is that when assessing the risk of a portfolio, the distribution of the portfolio composition is

kept unchanged over a given horizon (more exactly the proportions of different assets are kept

unchanged). Besides VaR risk measure, they consider a coherent risk measure Tail value at

Risk (TVaR), and establish that it is possible to identify a dynamic VaR risk limit equivalent

to a dynamic TVaR limit. Another of their findings is that the risk exposure of a trader subject

to VaR and TVaR limits is always lower than that of an unconstrained trader.

In my Ph.D. thesis Pirvu (2005) we start with the model of Cuocco, He and Issaenko

(2001). We find the optimal growth portfolio subject to these risk measures. Our main finding

is that the optimal policy is a projection of the optimal portfolio of an unconstrained log agent

(the Merton proportion) onto the constraint set with respect to the inner product induced by

the variance-covariance volatilities matrix of the risky assets. We manage to get closed-form

solutions even when the constraint set depends on the current wealth level. We extend the

model from the constant coefficient market to one with random coefficients.

In his Ph.D. thesis Rivera (2004) considers a similar model, but he chooses to keep the

actual number of shares unchanged, rather than the proportion. He solves the investment

problem in a general semimartingale market model. Cuoco and Liu (2001) study the dynamic

investment and reporting problem of a financial institution subject to capital requirements

based on self-reported VaR estimates. For a market with constant price coefficients, they show

that optimal portfolios display a local three-fund property. Leippold, Trojani and Vanini (2002)

analyse VaR-based regulation rules and their possible distortion effects on financial markets.

They show that in partial equilibrium the effectivnes of VaR regulation is closely linked to the

leverage effect, the tendency of volatility to increase when the prices decline.

Yiu K.F.C. (2004) looks at the optimal portfolio problem, when an economic agent is

maximizing utility of her intemporal consumption over a period of time under a dynamic VaR

constraint. A numerical method is proposed to solve the corresponding HJB-equation. He

finds that investment in risky assets are optimally reduced by the VaR constraint. Atkinson

and Papakokkinou (2005) derive the solution to the optimal portfolio and consumption subject

to CaR and VaR constraints by using stochastic dynamic programming.

This paper extends Pirvu (2005) by allowing for intertemporal consumption. We address

an issue raised in Yiu K.F.C. (2004) and Atkinson and Papakokkinou (2005) by considering

a market with random coefficients. Section 2 describes the model, including the definition

of Value-at-Risk constraint. Section 3 formulates the objective problem and it shows the

limitations of the stochastic dynamic programming approach. Section 4 treats the special case

of logarithmic utility. The problem of maximizing expected logarithmic utility of intertemporal

consumption is solved in closed form solutions. This is done by reducing it to an optimization

problem which is solved pathwise. One finding is that at the final time the agent invests the

least proportion of her wealth in stocks. The optimal policy is a projection of the optimal

portfolio and consumption of an unconstrained agent onto the constraint set. After some

time VaR constraint starts being active and it remains active. Section 5 treats the case of

power utility. The portfolio and consumption problem is reduced to a deterministic control

one. We establish existence of an optimal solution for it. We characterized the solutions by

Pontryagin maximum principle (first order necessary conditions). Then it is shown that the

necessary conditions are also sufficient. Section 8 contains an appropriate discretization of the

deterministic control problem. It leads to a nonlinear program which can be solved by standard

methods. It turns out that the necessary conditions of the discretized problem converges to the

necessary conditions of the continuous problem. We conclude the paper with some numerical

experiments done with AMPL, a nonlinear programming solver.

2

The Model

2.1

Stocks

We consider a market whose risk-free interest rate r is positive and which has multiple risky

assets. There are m stocks driven by n independent Brownian motions. Here we assume

m ≤ n, i.e., there are at least as many sources of uncertainty as assets:

dS

i

(t) = S

i

(t)

α

i

(t) dt +

n

X

j=1

σ

ij

(t) dW

j

(t)

, 0 ≤ t ≤ ∞, i = 1, . . . , m.

• the drift process α(·) is assumed positive and continuous.

• the matrix-valued volatility process σ(·) is assumed continuous and with linearly inde-

pendent rows.

We define the excess rates of return µ

i

(t) = α

i

(t) − r, which are assumed positive. We denote

by µ(t) = (µ

i

(t)) the column vector of excess rates of return and by W (t) = (W

j

(t)) the column

vector of independent Brownian motions on a filtered probability space (Ω, {F

t

}

0≤t≤T

, F, P).

2.2

Wealth

Let ζ

i

(t) denote the proportion of an agent’s wealth in stock i at time t, and let ζ(t) = (ζ

i

(t))

denote the column vector of proportions. The intermediate consumption process is denoted

C(t) and is assumed positive and adapted. The agent’s wealth is then given by

dX(t) = X(t)

£¡

r − c(t) + ζ

T

(t)µ(t)

¢

dt + ζ

T

(t)σ(t) dW (t)

¤

,

where c(t) =

C(t)

X(t)

is the expenditure rate. Define

Q(t, ζ, c) , r − c + ζ

T

µ(t) −

1

2

|ζ

T

σ(t)|

2

,

(2.1)

and for each number p < 1 define

Q

p

(t, ζ, c) , r − c + ζ

T

µ(t) +

p − 1

2

|ζ

T

σ(t)|

2

.

(2.2)

Then

X(t) = X(0) exp

½Z

t

0

Q

¡

u, ζ(u), c(u)

¢

du +

Z

t

0

ζ

T

(u)σ(u) dW (u)

¾

.

(2.3)

2.3

Value-At-Risk Limits

For a given path ω lets denote ω

(t)

= (ω

s

)

s≤t

the projection up to time t of its trajectory.

Starting at time t, for a fixed ω

(t)

, hold the proportions ζ and c constants over a time interval

of length τ > 0 and imagine that the processes µ(·) and σ(·) will remain fixed over the time

interval [t, t + τ ], holding the values they have at t. Then

X(t + τ ) = X(t) exp

©

Q(t, ζ, c)τ + ζ

T

σ(t)

¡

W (t + τ ) − W (t)

¢ª

,

so

X(t) − X(t + τ ) = X(t)

£

1 − exp

©

Q(t, ζ, c)τ + ζ

T

σ(t)

¡

W (t + τ ) − W (t)

¢ª¤

.

For a fixed ω

(t)

, the random variable ζ

T

σ(t)

¡

W (t + τ ) − W (t)

¢

is normal with mean zero and

standard deviation |ζ

T

σ(t)|

√

τ , we can write it as Y |ζ

T

σ(t)|

√

τ , where Y is a standard normal.

We lose money when this is small, in which case X(t) − X(t + τ ) is large. Let α ∈ (0,

1

2

] be

given. The α-percentile of X(t) − X(t + τ ) is

X(t)

£

1 − exp

©

Q(t, ζ, c)τ + N

−1

(α)|ζ

T

σ(t)|

√

τ

ª¤

,

where N (·) denotes the standard cumulative normal distribution function. This will lead to

the following definitions:

VaR

α,ζ,c

(t, x) ,

x

£

1 − exp

©

Q(t, ζ, c)τ + N

−1

(α)|ζ

T

σ(t)|

√

τ

ª¤

+

.

We fix a constant a

V

∈ (0, 1). The Value-at-Risk constraint is that at every time t ≥ 0 the

agent must choose a portfolio proportion ζ(t) and an expenditure rate c(t) in the set F

V

(t)

defined by

F

V

(t) ,

n

ζ ∈ R

m

, c ≥ 0 : VaR

α,ζ,c

(t, x) ≤ a

V

x

o

.

(2.4)

Note that this set depend on the path ω

(t)

. We notice that for fixed ω

(t)

and fixed time t, the

set F

V

(t)(ω

(t)

) is compact and convex, being the level set of the following convex, unbounded

function:

f

V

(t, ζ, c) , −Q(t, ζ, c)τ − N

−1

(α)|ζ

T

σ(t)|

√

τ ,

(2.5)

F

V

(t) =

½

ζ ∈ R

m

, c ≥ 0 : f

V

(t, ζ, c) ≤ log

1

1 − a

V

¾

.

Because α ∈ (0,

1

2

], N

−1

(α) ≤ 0 and hence the function f

V

is convex.

3

Objective

Given a finite time horizon T and a positive initial wealth X(0), an agent seeks to choose a

portfolio proportion process ζ(t), and an expenditure rate process c(t) t ≥ 0, so that X(t) > 0

and (ζ(t), c(t)) ∈ F

V

(t) for all 0 ≤ t ≤ T almost surely so that the expected value of the

random variable

Z

T

0

e

−δt

U

1

(C(t))dt + e

−δT

U

2

(X(T )),

(3.6)

is maximized over all portfolio proportions and expenditure rates processes satisfying the same

constraints. Here U

1

, and U

2

are utility functions. In other words the agent facing VaR

constraints is deriving utility from the intermediate consumption and from terminal wealth

process. Let us notice that the constraints are enforced at the final time T as well. We consider

also the case of deriving utility from the intermediate consumption only. This corresponds to

maximizing

E

Z

T

0

e

−δt

U

1

(C(t))dt,

(3.7)

over the constraint sets. Maximizing expected utility of the final wealth under VaR and other

types of risk constraints was considered in my Ph.D thesis [16]. Let us assume for the moment

that the market coefficients are constant. In this case the constraint set F

V

(t) does not depend

on time and we denote it F

V

. Then one can use the dynamic programming techniques to

characterize the optimal portfolio and consumption policy. The problem is to find a solution

to the HJB-equation. Define the optimal value function as

V (x, t) = max

(ζ,c)∈F

V

E

t

·Z

T

0

e

−δt

U

1

(C(t))dt + e

−δT

U

2

(X(T ))

¸

,

where E

t

is the conditional operator given the information known up to time t and X(t) = x.

The HJB equation is

max

(ζ,c)∈F

V

J(t, x, ζ, c) = 0,

where

J(t, x, c, ζ) , e

−δt

U

1

(cx) +

∂V

∂t

+ x(r − c + ζ

T

µ)

∂V

∂x

+

|ζ

T

σ|

2

2

∂

2

V

∂x

2

,

with boundary the condition V (x, T ) = e

−δT

U

2

(x). The value function V inherits the concavity

from the utility functions U

1

and U

2

. It is obvious that the function J is jointly concave on ζ, c

so it is maximized over the set F

V

at a unique point (ζ, c). Moreover this point should lie on

the boundary of F

V

and one can derive first order conditions by means of Lagrange multipliers.

Together with the HJB equation yield a highly nonlinear system which is hard to solve even

numerically. If the market coefficients are random one cannot derive HJB equations unless

the coefficients are functions of some state variables. In what follows we tackle the portfolio

optimization problem by reducing it to a deterministic control problem. Our method, however

works only for the case U

1

(x) = U

2

(x) =

x

p

p

, where p < 1 is the coefficient of relative risk

aversion (CRRA). We are able to solve the portfolio problem in closed form for logarithmic

utility.

4

Logarithmic utility

For the sake of simplicity let us consider the case in which the agent is deriving utility from

intermediate consumption only. Itˆo’s lemma applied to the wealth process X(t) gives:

log X(t) = log X(0) +

Z

t

0

Q(s, ζ(s), c(s))ds +

Z

t

0

ζ

T

(s)σ(s) dW (s).

(4.8)

Thus

Z

T

0

e

−δt

log C(t)dt =

Z

T

0

e

−δt

log (c(t)X(t))dt =

1 − e

−δT

δ

log X(0) +

Z

T

0

e

−δt

log c(t)dt

+

Z

T

0

Z

t

0

e

−δt

Q(s, ζ(s), c(s))dsdt +

Z

T

0

e

−δt

Z

t

0

ζ

T

(s)σ(s) dW (s)dt.

By Fubini’s Theorem

Z

T

0

Z

t

0

e

−δt

Q(s, ζ(s), c(s))dsdt =

Z

T

0

µZ

T

s

e

−δt

Q(s, ζ(s), c(s))dt

¶

ds

=

Z

T

0

e

−δt

− e

−δT

δ

Q(t, ζ(t), c(t))dt,

hence

Z

T

0

e

−δt

log C(t)dt =

1 − e

−δT

δ

log X(0)+

Z

T

0

e

−δt

µ

log c(t) +

1

δ

(1 − e

−δ(T −t)

)Q(t, ζ(t), c(t))

¶

dt

+

Z

T

0

e

−δt

Z

t

0

ζ

T

(s)σ(s) dW (s)dt.

(4.9)

Let ζ

M

(t) , (σ(t)σ

T

(t))

−1

µ(t) be the optimal portfolio proportion (for log utility) in the

absence of risk constraints. Let us assume that

E

Z

T

0

|ζ

T

M

(u)σ(u)|

2

du < ∞.

(4.10)

Lemma 4.1 For every (ζ(t), c(t)) ∈ F

V

(t) the process

R

t

0

ζ

T

(s)σ(s) dW (s), where t ∈ [0, T ] is

a martingale.

Proof: In order to prove the martingale property of

R

t

0

ζ

T

(s)σ(s) dW (s) it suffices to show

E

Z

T

0

|ζ

T

(u)σ(u)|

2

du < ∞.

(4.11)

Let us notice that

|ζ

T

(t)µ(t)| = |ζ

T

(t)σ(t)σ

T

(t)ζ

M

(t)| ≤ |ζ

T

(t)σ(t)| · |ζ

T

M

(t)σ(t)|.

(4.12)

For (ζ(t), c(t)) ∈ F

V

(t), we have

µ

r − c(t) + ζ

T

(t)µ(t) −

1

2

|ζ

T

(t)σ(t)|

2

¶

τ + N

−1

(α)|ζ

T

(t)σ(t)|

√

τ ≥ log(1 − a

V

).

This combined with (4.12) gives

|ζ

T

(t)σ(t)| ≤ k

1

+ k

2

∨ |ζ

T

M

(t)σ(t)|,

(4.13)

for some positive constants k

1

and k

2

. In the light of the assumption (4.10) the inequality

(4.11) follows.

¦

The above Lemma implies

E

Z

T

0

e

−δt

Z

t

0

ζ

T

(s)σ(s) dW (s)dt = 0

after interchanging the order of integration. The identity (4.9) becomes

E

Z

T

0

e

−δt

log X(t)dt =

1 − e

−δT

δ

log X(0)+E

Z

T

0

e

−δt

µ

log c(t) +

1

δ

(1 − e

−δ(T −t)

)Q(t, ζ(t), c(t))

¶

dt.

Therefore to maximize

E

Z

T

0

e

−δt

log C(t)dt,

over the constraint set it suffices to maximize

log c(t) +

1

δ

(1 − e

−δ(T −t)

)Q(t, ζ(t), c(t))

pathwise over the constraint set.

Let us fix a path ω and a time t. The concave objective function

g(t, ζ, c) , log c +

1

δ

(1 − e

−δ(T −t)

)Q(t, ζ, c)

(4.14)

is maximized over R

m+1

by (ζ

M

(t), c

M

(t)), where c

M

(t) ,

δ

1−e

−δ(T −t)

. If this point is in the

constraint set, then is the optimal solution. Otherwise the concave objective function is maxi-

mized over the compact, convex set at a unique point (ζ

V

(t), c

V

(t)); moreover, this point must

be on the boundary of F

V

(t). Hence it solves the optimization problem

(P 1)

maximize g(t, ζ, c)

subject to f

V

(t, ζ, c) , −Q(t, ζ, c)τ − N

−1

(α)|ζ

T

σ(t)|

√

τ = log

1

1−a

V

.

Let us assume that the optimal ζ

V

(t) is not the zero vector. According to the Lagrange

multiplier theorem, either ∇f

V

(t, ζ

V

(t), c

V

(t)) = 0 or else there is a positive λ(t) such that

∇g(t, ζ

V

(t), c

V

(t)) = λ(t)∇f

V

(t, ζ

V

(t), c

V

(t)).

(4.15)

Since

∇f

V

(t, ζ, c) =

µ

(−µ + σ(t)σ(t)

T

ζ)τ −

N

−1

(α)

√

τ

|ζ

T

σ(t)|

σ(t)σ(t)

T

ζ, τ

¶

6= 0,

it follows

ζ

V

(t) = c

M

(t)(1 + λ(t)τ )

µ

1 + λ(t)τ −

N

−1

(α)

√

τ

|ζ

T

V

(t)σ(t)|

¶

−1

ζ

M

(t),

c

V

(t) =

µ

1

c

M

(t)

+ λ(t)τ

¶

−1

.

This shows that the optimal solution (ζ

V

(t), c

V

(t)) also solves

(P 2)

maximize l(λ

1

, λ

2

)

subject to f

V

(t, λ

1

ζ

M

(t), λ

2

c

M

(t)) = log

1

1−a

V

,

where

l(λ

1

, λ

2

) , g(t, λ

1

ζ

M

(t), λ

2

c

M

(t)),

(4.16)

and the maximization is with respect to the positive λ

1

and λ

2

. This concave function is

maximized over R

2

by (1, 1). We know this point is not in the constraint set, hence the optimal

(λ

1

(t), λ

2

(t)) must satisfy

1 − λ

1

= −

β(t)c

M

(t)

|ζ

T

M

(t)σ(t)|

2

¡

τ (1 − λ

1

)|ζ

T

M

(t)σ(t)|

2

+

√

τ N

−1

(α)|ζ

T

M

(t)σ(t)|

¢

,

(4.17)

1

λ

2

− 1 = β(t)τ c

M

(t),

(4.18)

for a positive Lagrange multiplier β(t). By dividing the two identities we can eliminate β(t)

and get λ

2

= u(t, λ

1

), where

u(t, x) , 1 +

√

τ |ζ

T

M

(t)σ(t)|

N

−1

(α)

(1 − x).

(4.19)

Therefore λ

1

= λ

1

(t) is a root of the equation

f

V

(t, xζ

M

(t), u(t, x)c

M

(t)) = log

1

1 − a

V

,

(4.20)

in the variable x. The function h(t, x) , f

V

(t, xζ

M

(t), u(t, x)c

M

(t)) − log

1

1−a

V

is convex, un-

bounded in x and h

³

t, 1 +

N

−1

(α)

|ζ

T

M

(t)σ(t)|

√

τ

´

≤ 0. This shows that the equation (4.20) has a unique

root λ

1

(t) > 1 +

N

−1

(α)

|ζ

T

M

(t)σ(t)|

√

τ

. If h(t, x) ≤ 0 this root is nonnegative. Otherwise λ

1

(t) < 0 and

this is a contradiction. In this case

³

0, r +

1

τ

log

1

1−a

V

´

is the optimal solution and

r +

1

τ

log

1

1 − a

V

≤ c

M

(t) ,

δ

1 − e

−δ(T −t)

.

Moreover h(t, 1) < 0 since we assumed (c

M

(t), ζ

M

(t)) is not in the constraint set and this

implies λ

1

(t) < 1. We argue that if λ

1

(t) > 0 then ζ

1

(t) = λ

1

(t)ζ

M

(t), c

1

(t) = u(t, λ

1

(t))c

M

(t)

is the optimal solution. Since it satisfies the first order conditions and the function l defined

by (4.16) is strictly concave, (ζ

1

(t), c

1

(t)) solves the following perturbed problem.

(P 2 ²)

maximize l(λ

1

, λ

2

)

subject to f

V

(t, λ

1

ζ

M

(t), λ

2

c

M

(t)) ≤ log

1

1−a

V

, λ

1

≥ ²,

for a small positive ². Let us assume that

³

0, r +

1

τ

log

1

1−a

V

´

is the optimal solution for P 1.

Consider a point ζ

2

(t) = δ

1

ζ

M

(t), c

1

(t) = δ

2

c

M

(t) on the line segment joining

³

0, r +

1

τ

log

1

1−a

V

´

and (ζ

1

(t), c

1

(t)), with f

V

(t, δ

1

ζ

M

(t), δ

2

c

M

(t)) ≤ log

1

1−a

V

and δ

1

≥ ². Then by the strict con-

cavity of the objective function g, (see (4.14)) one has l(δ

1

, δ

2

) > l(λ

1

(t), u(t, λ

1

(t))c

M

(t)),

which contradicts optimality of (ζ

1

(t), c

1

(t)) for the problem P 2 ². At this point we are ready

to state the following theorem.

Theorem 4.2 The problem of maximizing

E

Z

T

0

e

−δt

log C(t)dt,

over processes (ζ(t), c(t)) ∈ F

V

(t), 0 ≤ t ≤ T, has the optimal solution

ζ

V

(t) = (1 ∧ (λ

1

(t) ∨ 0))ζ

M

(t),

(4.21)

c

V

(t) = u(t, (1 ∧ λ

1

(t)))c

M

(t)1

{λ

1

(t)>0}

+

µ

r +

1

τ

log

1

1 − a

V

¶

1

{λ

1

(t)≤0}

,

(4.22)

where λ

1

(t) is the root of the equation (4.20), ζ

M

(t) , (σ(t)σ

T

(t))

−1

µ(t), c

M

(t) ,

δ

1−e

−δ(T −t)

,

and the function u(·, ·) was defined in (4.19).

Proof: See the above analysis.

¦

Remark 4.3 Since at the final time c

M

(T ) = ∞ and c

V

(T ) is bounded we must have λ

1

(T ) =

0 or otherwise λ

1

(T ) = 1+

N

−1

(α)

|ζ

T

M

(t)σ(t)|

√

τ

. This shows that for a market with coefficients constants

in time ζ

V

(T ) ≤ ζ

V

(t), for any t ≤ T, (where the inequality is meant componentwise) and it

says that at the final time the agent invests the least proportion of her wealth in stocks. Note that

λ

1

(t) is an decreasing function in t since c

M

(t) is increasing. This says that once the constraint

starts being active it remains active. By (4.18) and (4.21) it follows that ζ

V

(t) ≤ ζ

M

(t), and

c

V

(t) ≤ c

M

(t), for any 0 ≤ t ≤ T. Therefore the solution for the constrained problem is a

projection of the solution for the unconstrained problem onto the constraint set. We can perform

some crossectional analysis. Let T

1

and T

2

two final times, T

1

> T

2

. Because c

M

(t, T

1

) <

c

M

(t, T

2

), from the equations (4.19) and (4.20) we conclude that λ

1

(t, T

1

) > λ

1

(t, T

2

), hence

ζ

V

(t, T

1

) > ζ

V

(t, T

2

), and c

V

(t, T

1

) > c

V

(t, T

2

). Therefore long-term agents can afford to invest

more in the stock market and consume more than short term agents (in terms of proportions).

5

Non-logarithmic utility

Let us recall that we want to maximize:

E

Z

T

0

e

−δt

C

p

(t)

p

dt + Ee

−δT

X

p

(T )

p

,

(5.23)

and

E

Z

T

0

e

−δt

C

p

(t)

p

dt,

(5.24)

over processes (ζ(t), c(t)) ∈ F

V

(t), 0 ≤ t ≤ T. Direct computations show:

X

p

(t) = X

p

(0) exp

µZ

t

0

pQ(s, ζ(s), c(s))ds +

Z

t

0

pζ

T

(s)σ(s) dW (s)

¶

= X

p

(0)M (t)Z(t),

where

M (t) , exp

µZ

t

0

pQ

p

(s, ζ(s), c(s)) ds

¶

,

(5.25)

Z(t) , exp

µ

−

1

2

Z

t

0

p

2

|ζ

T

(s)σ(s)|

2

ds +

Z

t

0

pζ

T

(s)σ(s) dW (s)

¶

,

(5.26)

and Q, Q

p

were defined by (2.1) and (2.2). We assume that

E

·µ

exp

p

2

2

Z

T

0

|ζ

T

M

(u)σ(u)|

2

du

¶¸

< ∞,

(5.27)

and market coefficients are totally unhedgeble, i.e. the drift process α(·) and the matrix-valued

volatility process σ(·) are assumed to be adapted to the filtration ˘

F(t) , σ( ˘

W (s), 0 ≤ s ≤ t),

generated by the m-dimensional Brownian motion ˘

W (·) = (W

n+1

(·), . . . , W

n+m

(·)), which is

assumed independent of the n-dimensional Brownian motion ˆ

W (·) = (W

1

(·), . . . , W

n

(·)). The

risk due to market coefficients cannot be hedged and the economic intuition is that the agent

should ignore it.

Lemma 5.1 For every ζ(t) ∈ F

V

(t) the process Z(t), where t ∈ [0, T ] is a martingale.

Proof: The assumption (5.27) combined with (4.13) and The Novikov Condition (see Karatzas and Shreve [12],

page 199, Corollary 5.13), makes the processes Z(t) a martingale.

¤

One has

Z

T

0

e

−δt

C

p

(t)

p

dt =

Z

T

0

e

−δt

c

p

(t)

p

X

p

(t) dt

=

Z

T

0

e

−δt

c

p

(t)

p

M (t)(Z(t) − Z(T )) dt + Z(T )

Z

T

0

e

−δt

c

p

(t)

p

M (t) dt

Let us prove

E

Z

T

0

e

−δt

c

p

(t)

p

M (t)(Z(t) − Z(T ))dt = 0.

By conditioning and Lemma 4.1 we get

E[c

p

(t)M (t)(Z(t) − Z(T ))] = E[E[c

p

(t)M (t)(Z(t) − Z(T ))|F

t

]]

= E[c

p

(t)M (t)[E(Z(t) − Z(T ))|F

t

]]

= 0,

and Fubini’s Theorem proves the claim. Hence

E

Z

T

0

e

−δt

C

p

(t)

p

dt = E Z(T )

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt.

(5.28)

This suggests to maximize

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt,

(5.29)

and

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt + e

−δT

M (T )

p

,

(5.30)

pathwise over the constraint set for the case of an agent with CRRA p < 1, who derives utility

from intermediate consumption ( 5.23) and also from final wealth ( 5.24). Therefore we have

to analyze deterministic control problems.

5.1

Deterministic Control

In the language of deterministic control we can write (5.29) as a cost functional I[x, u] given

in the form

I[x, u] =

Z

T

0

f

0

(t, x(t), u(t)) dt,

where u = (ζ, c) is the control and the function

f

0

(t, x, u) , e

−δt

c

p

p

x,

(5.31)

is defined on the set

A = {(t, x, u)|(t, x) ∈ [0, T ] × (0, K], u ∈ F

V

(t)} ⊂ R

m+3

.

(5.32)

The state variable x is defined by the differential equation

dx

dt

= f (t, x(t), u(t)), 0 ≤ t ≤ T,

(5.33)

with the boundary condition x(0) = 1, where

f (t, x, u) , x(pr − pc + pζ

T

µ(t) +

p(p − 1)

2

|ζ

T

(t)σ(t)|

2

).

In fact

x(t) = e

R

t

0

f

1

(t,c(u),ζ(u)) du

,

(5.34)

with

f

1

(t, c, ζ) , pr − pc + pζ

T

µ(t) +

p(p − 1)

2

|ζ

T

σ(t)|

2

.

The constraints are (t, x(t)) ∈ [0, T ] × (0, K] and u(t) ∈ F

V

(t). Due to the compactness of

the set F

V

(t), 0 ≤ t ≤ T it follows that K < ∞. A pair (x, u) satisfying the above conditions

is called admissible. The problem of finding the maxima of I[x, u] within all admissible pairs

(x, u) is called the Lagrange problem of control. Alternatively for (5.30) we can consider the

cost functional I[x, u] given in the form

I[x, u] = g(x(T )) +

Z

T

0

f

0

(t, x(t), u(t)) dt,

g(x) , e

−δT

x

p

,

(5.35)

together with the same differential equation and constraints as above. The problem of finding

the maxima of this functional is called the Bolza problem of control. We investigate the

existence of maximizers for these problems. The next step is to find out necessary conditions.

Then we question whether or not this conditions are also sufficient.

5.1.1

Existence

The classical existence theory for deterministic control problems involves the set

˜

Q(t, x) , {(z

0

, z)|z

0

≥ −f

0

(t, x, u), z = f (t, x, u), u ∈ F

V

(t)}

(5.36)

The following theorem is known as the Fillipov existence theorem for Bolza and Lagrange

problems (see Theorem 9.3i in Cesari [5])

Theorem 5.2 Let the set A defined by (5.32) be compact, g lowersemicontinuous and f

0

(t, x, u)

and f (t, x, u) continuous on A. Let us assume that for almost all (t, x) ∈ [0, T ] × (0, K] the sets

˜

Q(t, x) are convex. Then the functional I[x, u] given by (5.35) has an absolute maximum.

However in our case it is rather cumbersome to verify the convexity of ˜

Q(t, x) hence we

proceed with a direct proof of existence. Let us recall that for u(t) = (ζ(t), c(t)) ∈ F

V

(t),

|ζ

T

(t)σ(t)| ≤ k

1

+ k

2

∨ |ζ

T

M

(t)σ(t)|,

(5.37)

hence |ζ

T

(t)σ(t)| is uniformly bounded on [0, T ] due to the continuity of market coefficients.

Moreover one can conclude that |ζ(t)| ≤ M and c(t) ≤ M for some constant M. From (5.33)

by Gronwall’s Lemma x(t) ≤ N and ˙x(t) ≤ N on [0, T ] for some constant N.

Theorem 5.3 There exist a solution for the above control problems.

Proof: Let (x

n

(·), u

n

(·)) be a maximizing sequence, i.e. I[x

n

, u

n

] −→ sup I[x, u]. It is easily

seen that the sequence x

n

(·) is uniformly bounded and equicontinuous, thus Arzela-Ascoli

theorem gives uniform convergence to some function ˜

x(·). According to Kolmos Lemma (see

Lemma A1.1 in [8]) we can find some sequences of convex combinations ζ

∗

n

∈ conv(ζ

n

, ζ

n+1

, . . . )

and c

∗

n

∈ conv(c

n

, c

n+1

, . . . ) which converges a.e. to some measurable function ζ

∗

(·) and c

∗

(·),

such that u

∗

(t) , (ζ

∗

(t), c

∗

(t)) ∈ F

V

(t) , 0 ≤ t ≤ T, due to the convexity and compactness

of the sets F

V

(t). Let us denote x

∗

n

(·) the sequence of state variables corresponding to these

controls, i.e.,

x

∗

n

(t) = e

R

t

0

f

1

(t,c

∗

n

(s),ζ

∗

n

(s)) ds

, 0 ≤ t ≤ T,

(see (5.34)). Assume p > 0, the other case is similar. Due to the concavity of the function

f

1

, ln x

∗

n

(t) ≥ conv(ln x

n

(t), ln x

n+1

(t), . . . ), where the convex combination is the one defining

ζ

∗

n

, c

∗

n

. If y

∗

n

, exp(conv(ln x

n

(t), ln x

n+1

(t), . . . )), then x

∗

n

(t) ≥ y

∗

n

(t), and y

∗

n

(t) −→ ˜

x(t), i.e.,

y

∗

n

(t) − x

n

(t) −→ 0 for t ∈ [0, T ]. By dominated convergence theorem x

∗

n

(t) −→ x

∗

(t), 0 ≤ t ≤

T, a.e., where

x

∗

(t) = e

R

t

0

f

1

(t,c

∗

(s),ζ

∗

(s)) ds

, 0 ≤ t ≤ T.

By Fatou’s Lemma, the dominated convergence theorem and the concavity of the function f

0

(see (5.31)) in u it follows that

I[x

∗

, u

∗

] ≥ lim sup I[x

∗

n

, u

∗

n

] ≥ lim sup I[y

∗

n

, u

∗

n

] = lim sup I[x

n

, u

∗

n

] = sup I[x, u].

This concludes the existence proof for The Lagrange problem. The same arguments apply for

the Bolza problem.

¤

5.1.2

Necessary Conditions

We need a vector ˜

λ = (λ

0

, λ

1

) and the Hamiltonian function

H(t, x, u, ˜

λ) = λ

0

f

0

(t, x, u) + λ

1

f (t, x, u).

The necessary conditions for the Lagrange and Bolza problems, also known as Pontryagin

maximum principle take the form below (see Theorem5.1.i in Ceasari [5]).

Theorem 5.4 Let x(t), u(t) = (ζ(t), c(t)) ∈ F

V

(t), 0 ≤ t ≤ T be an optimal pair, i.e. gives

the maximum for the functional I[x, u]. Then there is an absolutely continuous nonzero vector

function of Lagrange multipliers λ(t) = (λ

0

, λ

1

), 0 ≤ t ≤ T, with λ

0

a constant, λ

0

≥ 0 such

that the function M (t) , H(t, x(t), u(t), ˜

λ(t)) is absolutely continuous and one has:

1. Adjoint equations:

dM

dt

= H

t

(t, x(t), u(t), ˜

λ(t)) a.e.,

(5.38)

dλ

1

dt

= −H

x

(t, x(t), u(t), ˜

λ(t)) a.e.,

(5.39)

2. Maximum condition:

u(t) ∈ arg max

v∈F

V

(t)

H(t, x(t), v, ˜

λ(t)) a.e.,

3. Transversality:

λ

1

(T ) = λ

0

g

0

(x(T )),

where g ≡ 0 for the Lagrange problem.

Proof: See page 252 in Cesari [5].

¦

Remark 5.5 For the case of unconstrained Lagrange problem we can find the optimal control

in closed form by solving the above equations. The maximum condition gives : ζ(t) =

ζ

M

(t)

1−p

and

c(t) = p

1

p−1

e

δt

p−1

(λ

1

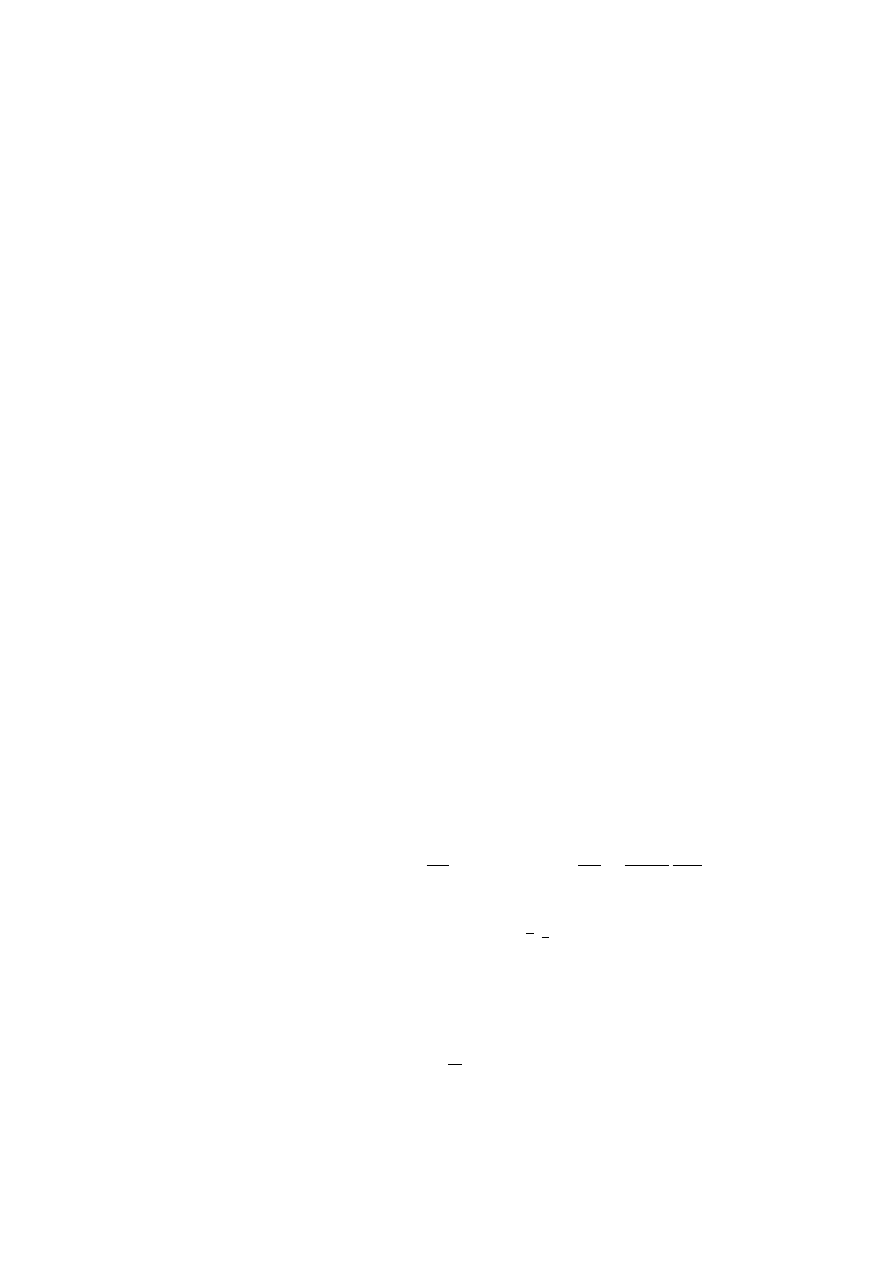

(t))

1

p−1

. We can pick λ

0

= 1 and then the adjoint equation for λ

1

becomes

dλ

1

dt

= −λ

1

(t)

h

γ(t) − p

p

p−1

e

δt

p−1

λ

1

(t) − p

1

p−1

e

pδt

p−1

(λ

1

(t))

1

p−1

i

,

where

γ(t) , pr +

p

2(1 − p)

|ζ

T

M

(t)σ(t)|

2

.

One can transform this ordinary differential equation in a Riccati type equation with transver-

sality condition λ

1

(T ) = 0, solve for λ

1

(t) and get in the end

c(t) =

δ −

R

t

0

γ(s) ds

t

(1 − p)(1 − exp(ψ(t)(t − T )))

,

(5.40)

where

ψ(t) ,

δ −

R

t

0

γ(s) ds

t

1 − p

.

Let us notice that lim

t→T

c(t) = ∞. Similarly for the unconstrained Bolza problem we can find

the optimal control in closed form. Arguing as above ζ(t) =

ζ

M

(t)

1−p

and the new transversality

condition λ

1

(T ) =

e

−δT

p

gives

c(t) =

e

−δ(T −t)

+

µ

δ −

R

t

0

γ(s) ds)

t

¶

p−1

[(1 − p)(1 − exp(ψ(t)(t − T )))]

p−1

1

p−1

.

(5.41)

5.1.3

Sufficient Conditions

The following question now arises: suppose we find an admissible pair (x(t), u(t)) such that all

conditions in Theorem 5.4 are satisfied. Will (x(t), u(t)) be optimal? The answer is in general

no. However in this special case we prove that the necessary conditions of Theorem 5.4 are also

sufficient. This result is a consequence of the Hamiltonian being linear in the state variable.

Theorem 5.6 Suppose (x(t), u(t)) is an admissible pair satisfying all the conditions of The-

orem 5.4. Then (x(t), u(t)) is an optimal pair, i.e. gives the maximum for the functional

I[x, u].

Proof: Let us consider λ

0

= 1, and define the maximized Hamiltonian

H

∗

(t, x, ˜

λ) , max

v∈F

V

(t)

H(t, x, v, ˜

λ).

Let (x(t), u(t)) be another admissible pair. Since the Hamiltonian is linear in x, by the adjoint

equation for λ

1

and maximum condition:

H(t, x(t), u(t)˜

λ(t)) − H(t, x(t), u(t), ˜

λ(t)) ≥ H

∗

(t, x(t), ˜

λ(t)) − H

∗

(t, x, ˜

λ(t)) (5.42)

= λ

0

1

(t)(x(t) − x(t)).

One has

I[x, u] − I[x, u] =

Z

T

0

[H(t, x(t), u(t), ˜

λ(t)) − H(t, x(t), u(t), ˜

λ(t))] dt

+

Z

T

0

[λ

1

(t)( ˙x(t) − ˙x(t)) dt]

The inequality (5.42) and the transversality condition yield:

I[x, u] − I[x, u] ≥

Z

T

0

[λ

0

1

(t)(x(t) − x(t))] dt +

Z

T

0

[λ

1

(t)( ˙x(t) − ˙x(t)) dt]

= λ

1

(T )[x(T ) − x(T )]

= g

0

(x(T ))[x(T ) − x(T )]

= g(x(T )) − g(x(T ),

proving optimality of (x(t), u(t)).

¤

Let M (t) the process defined in (5.25). According to the Theorem 5.3, for a fixed path ω,

there exists a solution (ζ(ω), c(ω)) for maximizing

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt

(5.43)

or

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt + e

−δT

M (T )

p

(5.44)

over the constraint set. We claim it also solves the objective problem.

Theorem 5.7 A solution of maximizing

E

Z

T

0

e

−δt

C

p

(t)

p

dt,

or

E

Z

T

0

e

−δt

C

p

(t)

p

dt + Ee

−δT

X

p

(T )

p

,

over processes (ζ(t), c(t)) ∈ F

V

(t), is (ζ(t), c(t))

0 ≤ t ≤ T.

Proof: Let (ζ(t), c(t)) ∈ F

V

(t), be another control. Let M (t), M (t) defined as in (5.25)

and Z(t), Z(t) as in (5.26). Let us recall that ˘

F(t) , σ( ˘

W (s), 0 ≤ s ≤ t), is the filtration

generated by the market coefficients and is independent of the filtration generated by stocks.

The processes Z(t), and Z(t) are martingales by Lemma 4.1 and by an independence argument

E[Z(T ) | ˘

F(T )] = E[Z(T ) | ˘

F(T )] = 1.

Theorem 5.4 shows that the processes M (t) and c(t) are measurable with respect to ˘

F(t).

Therefore by (5.28) and iterated conditioning

E

Z

T

0

e

−δt

C

p

(t)

p

dt = E Z(T )

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt

= E(E[Z(T )

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt | ˘

F(T )])

= E

µZ

T

0

e

−δt

c

p

(t)

p

M (t)dt E[Z(T ) | ˘

F(T )]

¶

= E

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt,

Since (ζ(t), c(t)) is maximizing (5.43)

E

Z

T

0

e

−δt

C

p

(t)

p

dt = E Z(T )

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt

≤ E(E[Z(T )

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt | ˘

F(T )])

= E

µZ

T

0

e

−δt

c

p

(t)

p

M (t)dt E[Z(T ) | ˘

F(T )]

¶

= E

Z

T

0

e

−δt

c

p

(t)

p

M (t)dt.

This shows (ζ(t), c(t)) is optimal for a constrained agent deriving utility from the intermediate

consumption only. If (ζ(t), c(t)) is maximizing (5.44), same arguments show that it is optimal

for a constrained agent deriving utility from the intermediate consumption and final wealth.

¤

Remark 5.8 Using arguments of this proof and the Remark 5.5 we conclude that ζ(t) =

ζ

M

(t)

1−p

and c(t) defined by (5.40) or (5.41) are optimal for maximizing

E

Z

T

0

e

−δt

C

p

(t)

p

dt,

or

E

Z

T

0

e

−δt

C

p

(t)

p

dt + Ee

−δT

X

p

(T )

p

,

without constraints.

Remark 5.9 Let us consider the case of stochastic interest rate. In defining the risk limits

imagine that the process r(·) will remain fixed over the time interval [t, t + τ ], holding the value

it has at t. In the formulas of f

V

(t, ζ, c), Q(t, ζ, c) and Q

p

(t, ζ, c), the constant r gets replaced

by r(t). All the results remain true if we consider the interest rate r(t) to be a nonnegative

continuous process adapted to ˘

F (t), and E

R

T

0

r(u) du < ∞. The last condition is needed for

Lemmas 4.1 and 5.1.

Remark 5.10 We considered the case of Value-at-Risk (VaR) constraint in doing the analysis

of optimal consumption and investment. All the findings would hold if one considers other

measures of risk, as long as the corresponding constraint set is convex.

6

Numerical Solution

In Theorem 5.7 we prove that the solution for every path of a Lagrange or Bolza problem is

optimal for maximizing (5.23) or (5.24) subject to a VaR type constraint. For a fixed path

we studied these problems and establish the existence of a solution in Theorem 5.3. These

solutions are characterized by Pontryagin maximum principle and this is done in Theorem

5.4. It turns out that the necessary conditions are also sufficient (see Theorem 5.6). In this

section by an appropriate discretization of control and state variables, the Lagrange and Bolza

problems are transformed into a finite dimensional nonlinear program which can be solved by

standard sequential quadratic programming (SQP) methods. Furthermore it can be shown

that necessary first order conditions of the discretized problem converge to the necessary first

order conditions of the continuous problem. The first step is to transform the Lagrange and

Bolza problem into a Mayer control problem. This can be accomplished by introducing a

new state variable x

0

, with the boundary condition x

0

(0) = 0 and an additional differential

equation,

dx

0

dt

= f

0

(t, x(t), u(t)).

The cost functional becomes I[x, u] = x

0

(T ) for the Lagrange problem and I[x, u] = x

0

(T ) +

g(x(T )) (see 5.35) for the Bolza problem. Let us denote y = (x

0

, x) the vector of states

variables which satisfy the differential equation

dy

dt

= ˜

f (t, x(t), u(t)),

with ˜

f = (f

0

, f ) (see (5.31) and(5.33)). The following discretization scheme is taken from [15].

A partition of the time interval

0 = t

1

< t

2

< · · · < t

N

= T,

is chosen. The parameters Y of the nonlinear program are the values of control and state

variables at the grid points t

j

, j = 1, · · · , N and the final time t

N

= T,

Y = (u(t

1

), · · · , u(t

N

), y(t

1

), · · · , y(t

N

), t

N

) ∈ R

4N +1

.

The controls are chosen as piecewise linear interpolating functions between u(t

j

) and u(t

j+1

),

for t

j

≤ t < t

j+1

,

u

app

(t) = u(t

j

) +

t − t

j

t

j+1

− t

j

(u(t

j+1

) − u(t

j

)).

The states are chosen as continuously differentiable functions and piecewise defined as cubic

polynomials between y(t

j

) and y(t

j+1

) with ˙y

app

(s) = ˜

f (x(s), u(s), s) at s = t

j

, t

j+1

,

y

app

(t) =

3

X

k=0

c

j

k

µ

t − t

j

h

j

¶

k

,

t

j

≤ t < t

j+1

j = 1, · · · , N − 1,

c

j

0

= y(t

j

),

c

j

1

= h

j

˜

f

j

,

c

j

2

= −3y(t

j

) − 2h

j

˜

f

j

+ 3y(t

j+1

) − h

j

˜

f

j+1

,

c

j

3

= 2y(t

j+1

) + h

j

˜

f

j

− 2y(t

j+1

) + h

j

˜

f

j+1

,

where ˜

f

j

, ˜

f (x(t

j

), u(t

j

), t

j

),

h

j

, t

j+1

− t

j

.

We impose the Value-at-Risk constraint (see (2.5)) at the grid points

f

V

(t

j

, u(t

j

)) ≤ log

1

1 − a

V

,

u = (ζ, c),

j = 1, · · · , N.

Another constraint imposed is the so called collocation constraint

˙y

app

(t

c,j

) = ˜

f (x(t

c,j

), u(t

c,j

), t

c,j

) j = 1, · · · , N,

where t

c,j

,

t

j

+t

j+1

2

, and the boundary condition y(0) = (0, 1).

The Lagrangian of the nonlinear program of the discretized problem can be written as

L(Y, φ, υ) = I[y

N

, t

N

] +

N −1

X

j=1

φ

0

j

(f

0

(x(t

c,j

), u(t

c,j

), t

c,j

) − ˙x

0

app

(t

c,j

)) +

N −1

X

j=1

φ

1

j

(f (x(t

c,j

), u(t

c,j

), t

c,j

) − ˙x

app

(t

c,j

)) +

N

X

j=1

υ

j

µ

f

V

(t

j

, u(t

j

)) − log

1

1 − a

V

¶

,

with φ = (φ

1

, · · · , φ

N −1

) ∈ R

N −1

and υ = (υ

1

, · · · , υ

N

) ∈ R

N

. A solution of the nonlinear

program satisfies the necessary first order conditions of Karush, Kuhn, and Tucker. Among

others these are

∂L

∂ζ

i

= 0,

∂L

∂c

i

= 0,

∂L

∂x

i

= 0,

i = 1, · · · , N.

Let h , max{h

j

= t

j+1

− t

j

: j = 1, · · · , N − 1} be the norm of the partition. Letting h → 0

after some calculations (see [15]) it is shown that at t = t

i

∂L

∂ζ

i

−→

3

2

φ

1

i

∂f (x(t

i

), u(t

i

), t

i

)

∂ζ

+

3

2

φ

0

i

∂f

0

(x(t

i

), u(t

i

), t

i

)

∂ζ

+ υ

i

∂f

V

(u(t

i

), t

i

)

∂ζ

,

∂L

∂c

i

−→

3

2

φ

1

i

∂f (x(t

i

), u(t

i

), t

i

)

∂c

+

3

2

φ

0

i

∂f

0

(x(t

i

), u(t

i

), t

i

)

∂c

+ υ

i

∂f

V

(u(t

i

), t

i

)

∂c

,

and

∂L

∂x

i

−→

3

2

˙

φ

1

i

+

3

2

φ

1

i

∂f (x(t

i

), u(t

i

), t

i

)

∂x

+

3

2

φ

0

i

∂f

0

(x(t

i

), u(t

i

), t

i

)

∂x

.

Therefore the equations

∂L

∂ζ

i

= 0 and

∂L

∂c

i

= 0 converge to an equation equivalent to the maxi-

mum condition from Theorem 5.4, and

∂L

∂x

i

= 0 converge to the adjoint equation 5.39 from the

same Theorem.

The problem of optimal investment and consumption under VaR constraint was reduced to

a nonlinear problem, which can be solved by a standard nonlinear programming solver. In what

follows we use AMPL, a computer language for solving large-scale optimization problems, to

solve the nonlinear problem described above. In doing the numerical experiments we consider

only one stock following a geometric Brownian motion with drift α

1

= 0.12, volatility σ = 0.2.

The choice of the horizon τ and the confidence level α, are largely arbitrary, although the

Basle Committee proposals of April 1995 prescribed that VaR computations for the purpose of

assessing bank capital requirements should be based on a uniform horizon of 10 trading days

(two calendar weeks) and a 99% confidence level (see [10]). We take τ =

1

25

, α = 0.01, the

interest rate r = 0.05 and the discount factor δ = 0.1.

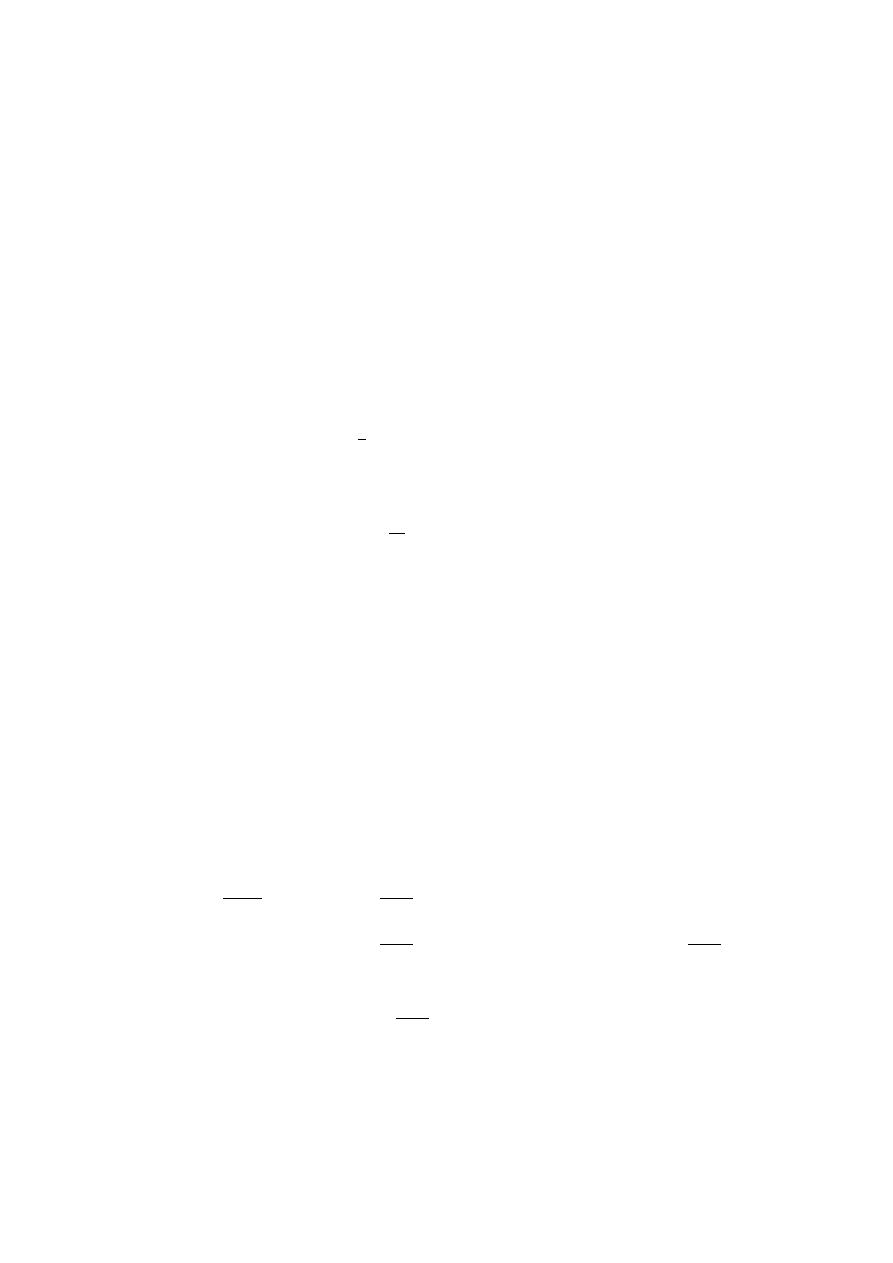

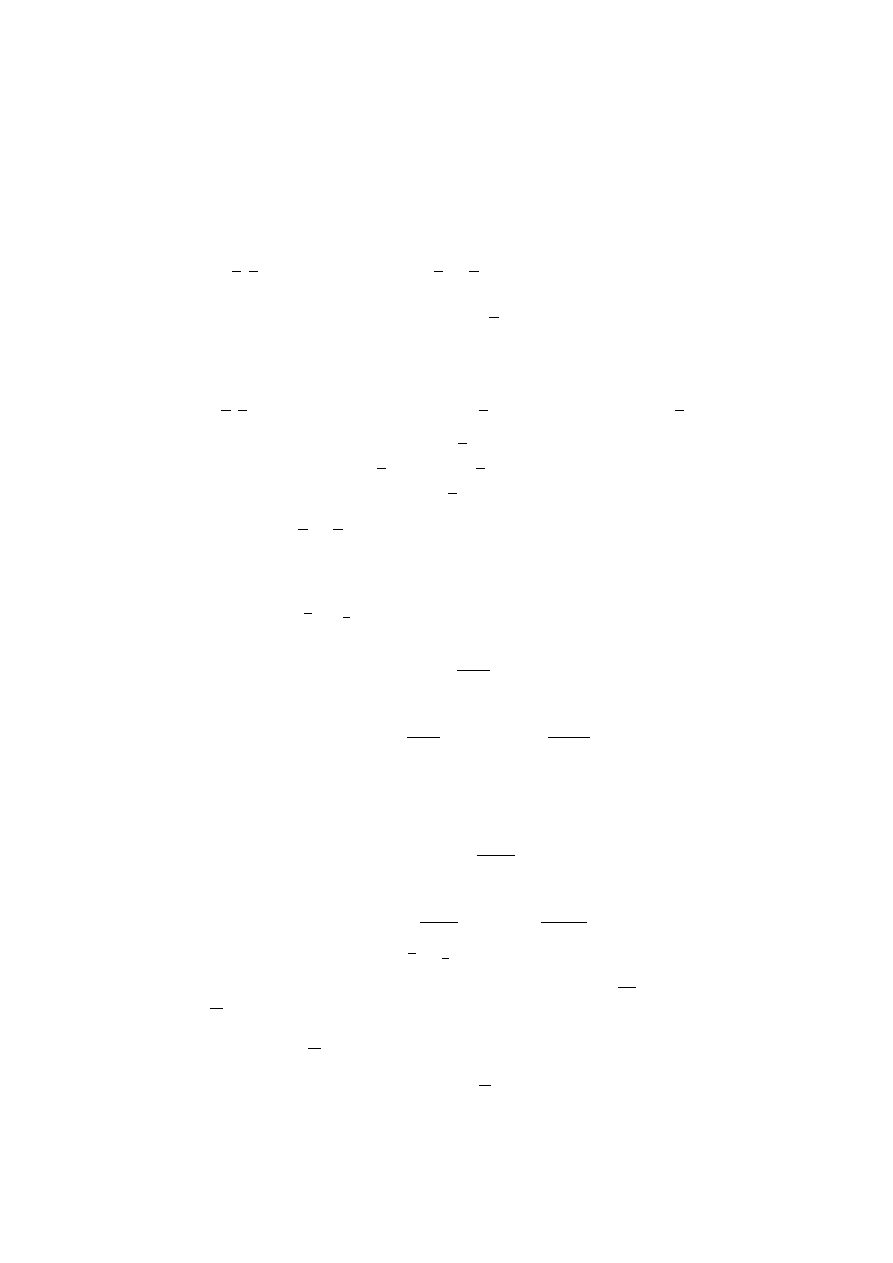

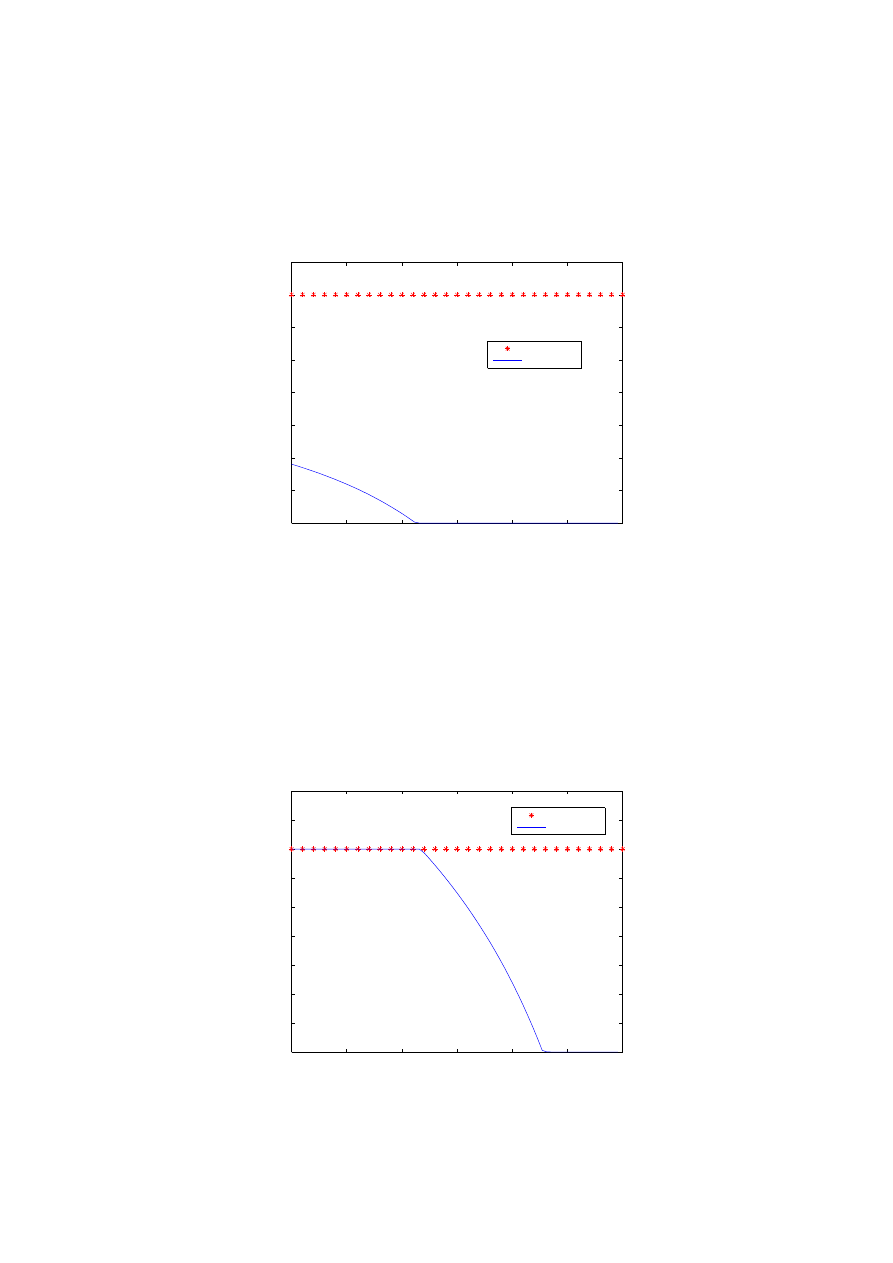

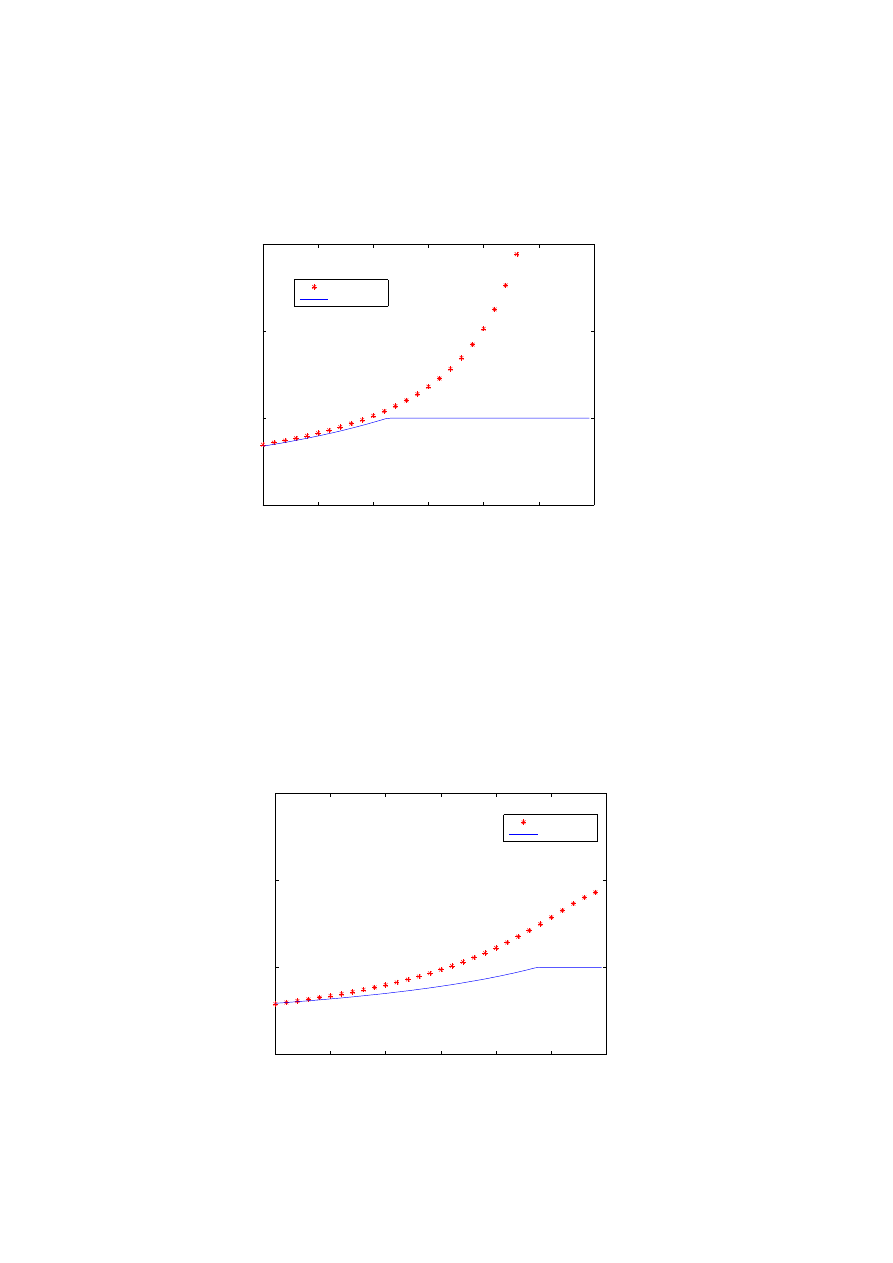

Fig. 1. Asset allocations with and without VaR constraints, for the utility maximizition of

intemporal consumption. The graphs corresponds to different values of CRRA p; p = −1.5,

p = −1, p = −0.5, p = 0, p = 0.5. The x axis represents the time and the y axis the proportion

of wealth invested in stocks. Let us notice the Merton line and, as time goes by the portfolio

value increases hence the VaR constraint becomes binding and reduces the investment in the

risky asset. At the final time the agent is investing the least in stocks (in terms of propor-

tions). When CRRA p increases, i.e., when the agent becomes less risk averse the effect of

VaR constraint becomes more significant.

0

0.5

1

1.5

2

2.5

3

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.2

0.4

0.6

0.8

1

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.2

0.4

0.6

0.8

1

1.2

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

2

2.5

3

3.5

4

unconstrained

constrained

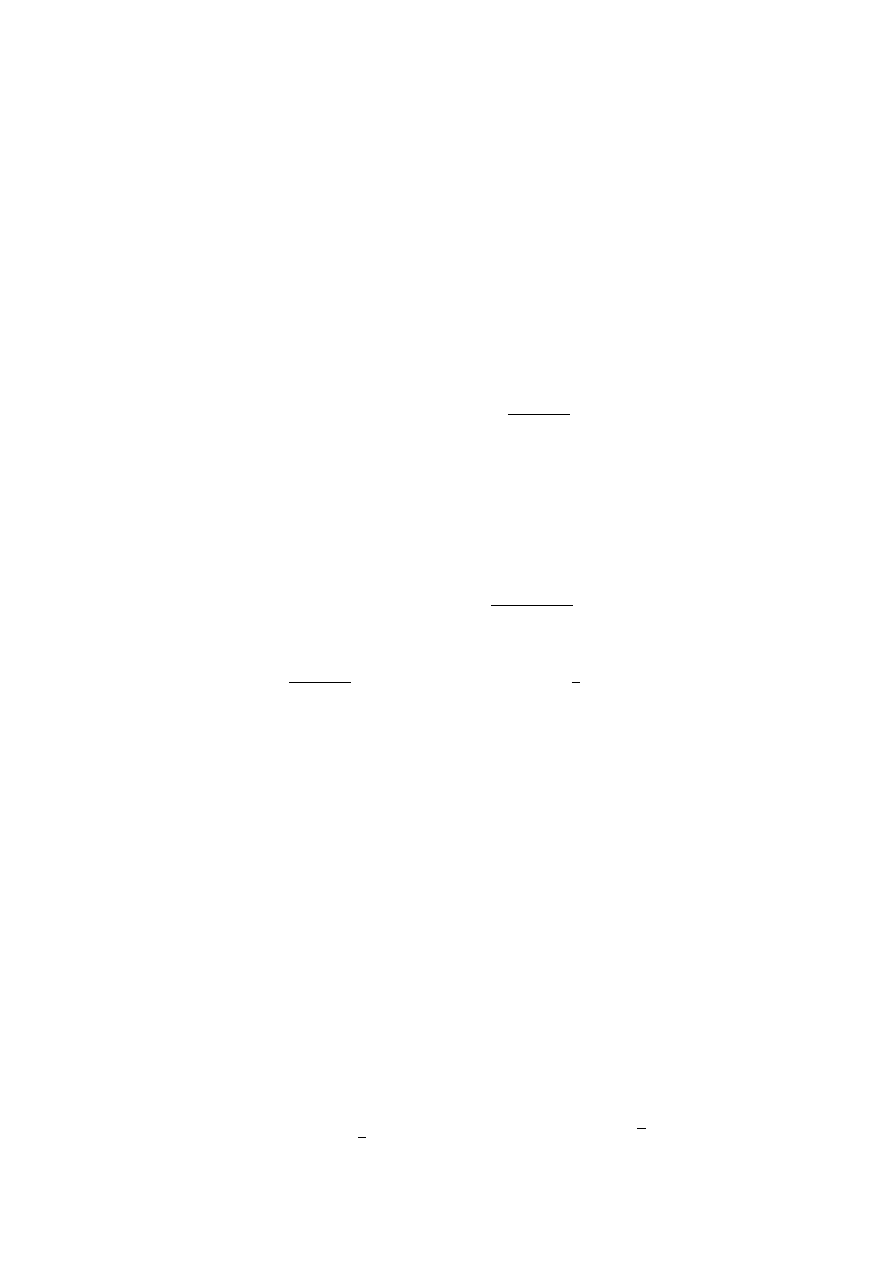

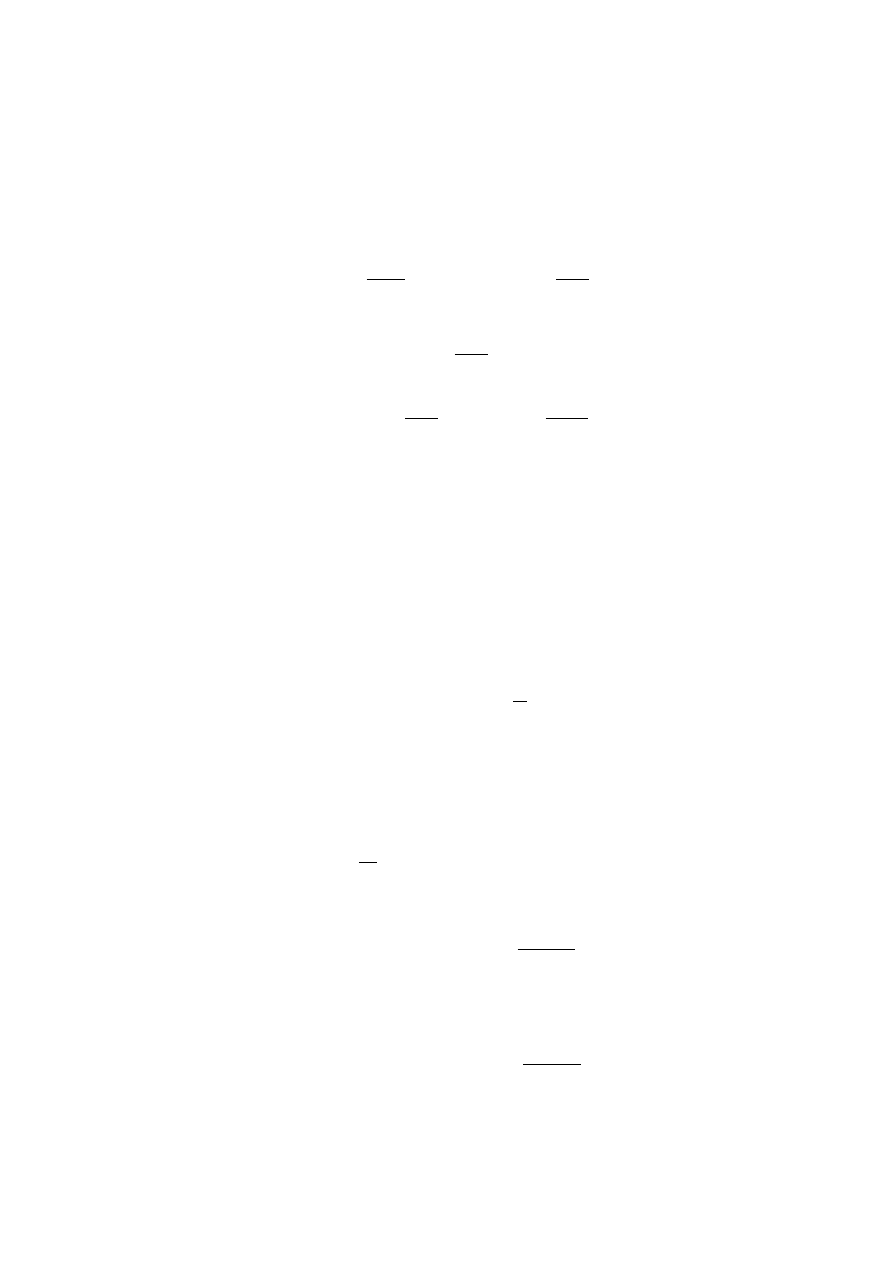

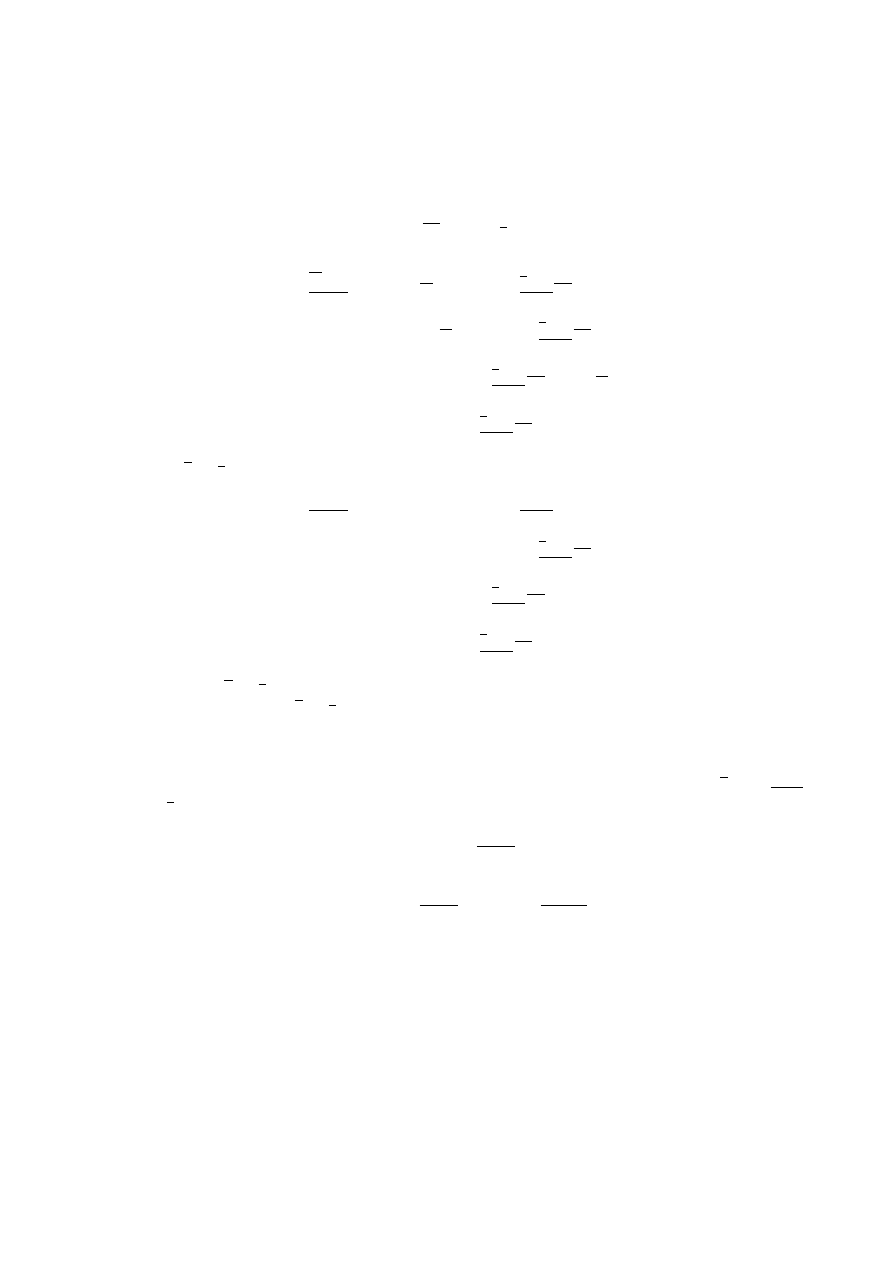

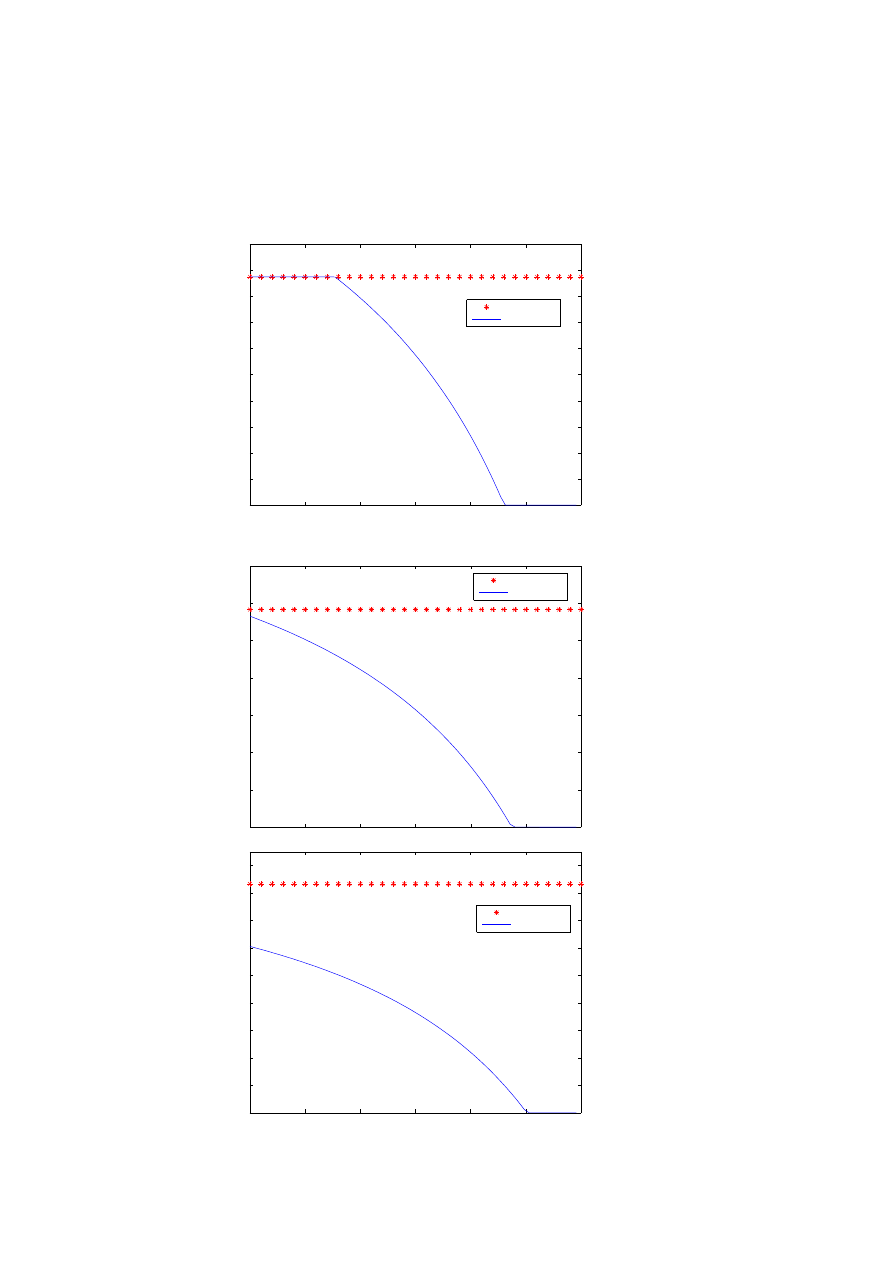

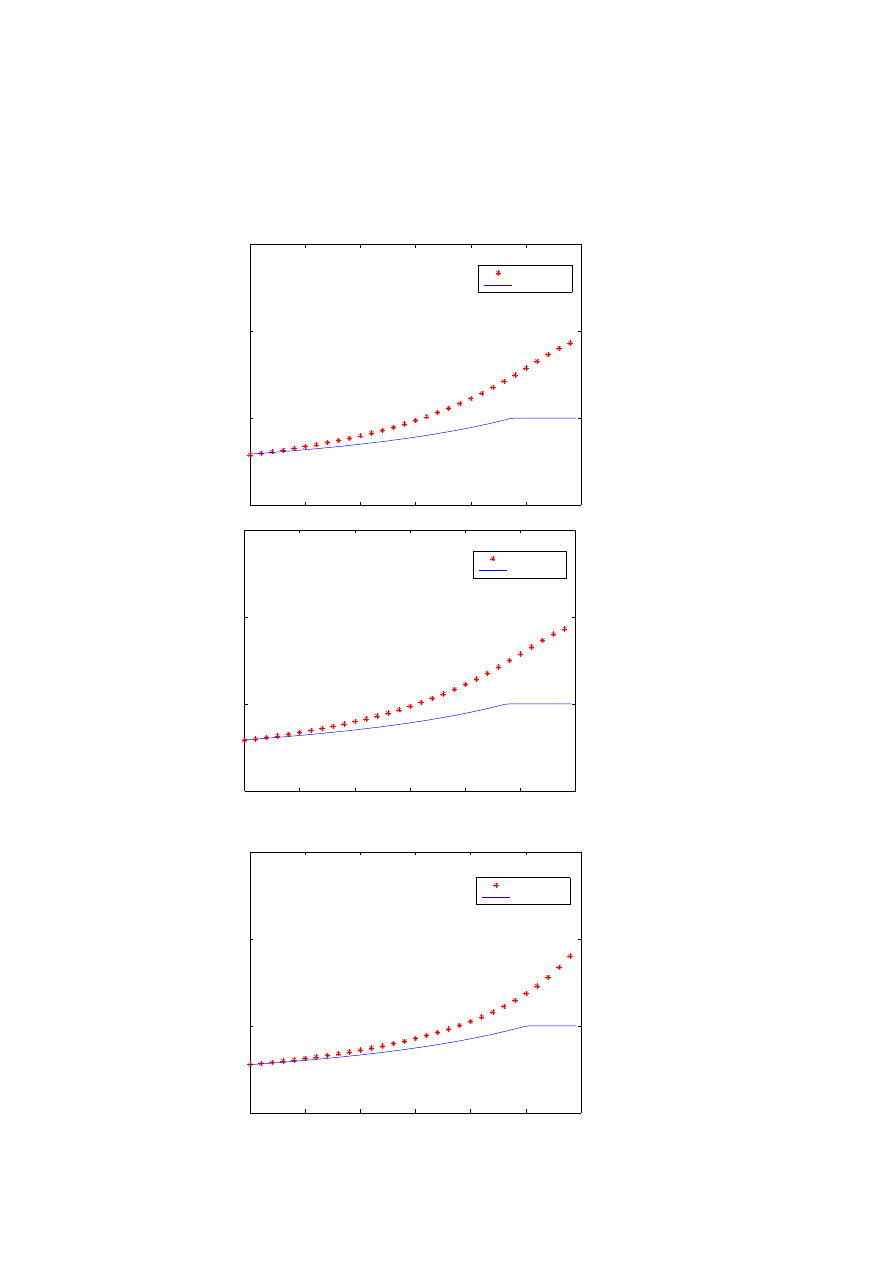

Fig. 2. Asset allocations with and without VaR constraints, for the utility maximizition of

intemporal consumption and terminal wealth. The graphs corresponds to different values of

CRRA p; p = −1.5, p = −1, p = −0.5, p = 0, p = 0.5. The x axis represents the time and the

y axis the proportion of wealth invested in stocks.

0

0.5

1

1.5

2

2.5

3

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.2

0.4

0.6

0.8

1

1.2

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

2

2.5

3

3.5

4

unconstrained

constrained

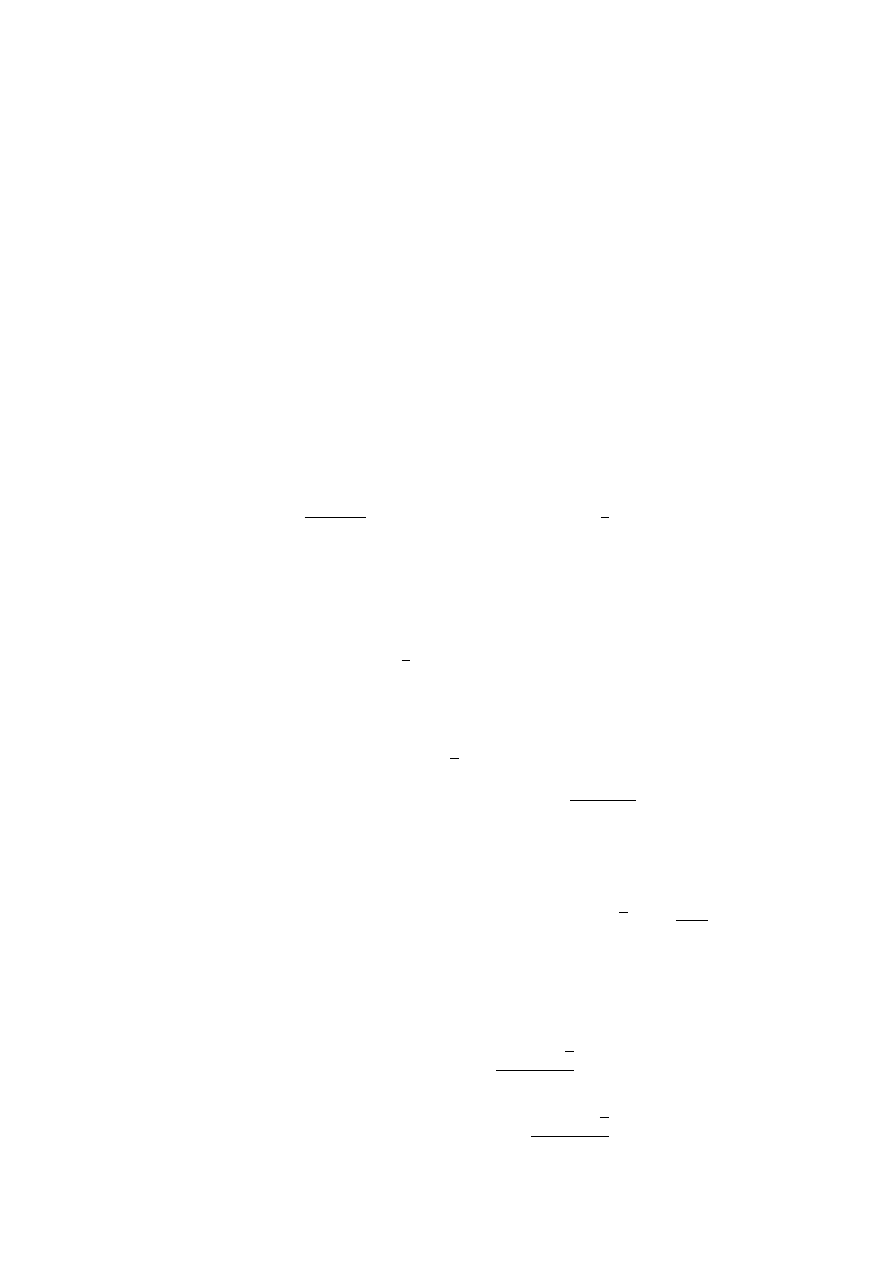

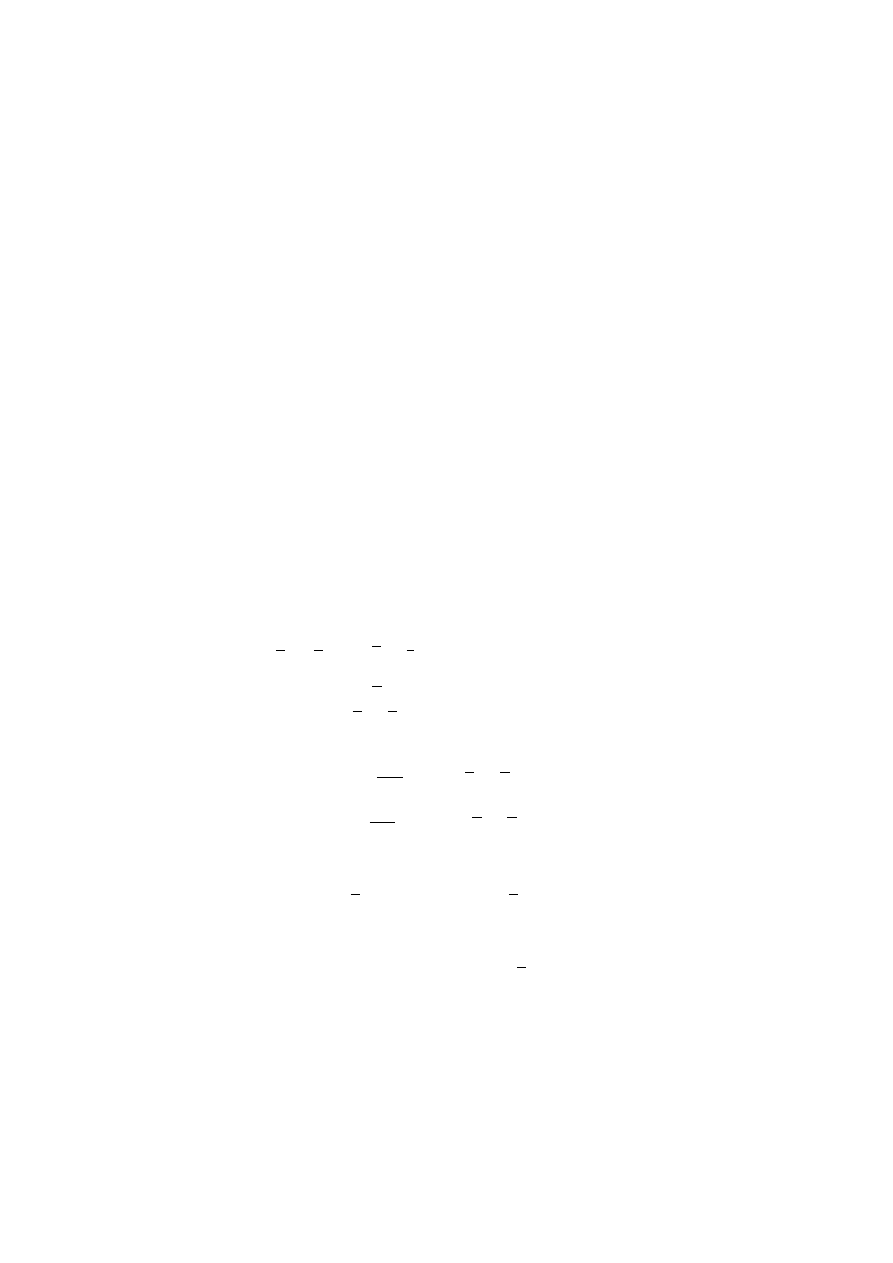

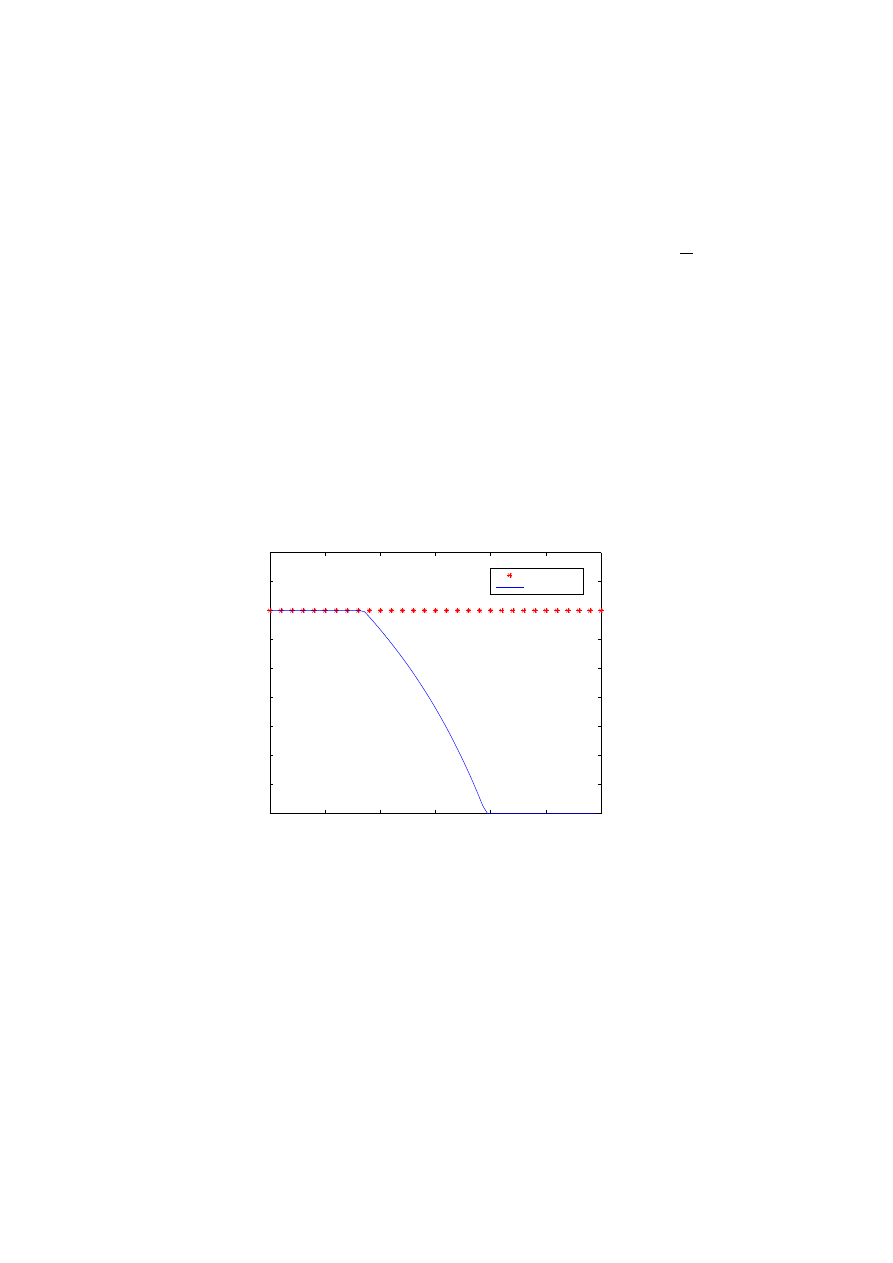

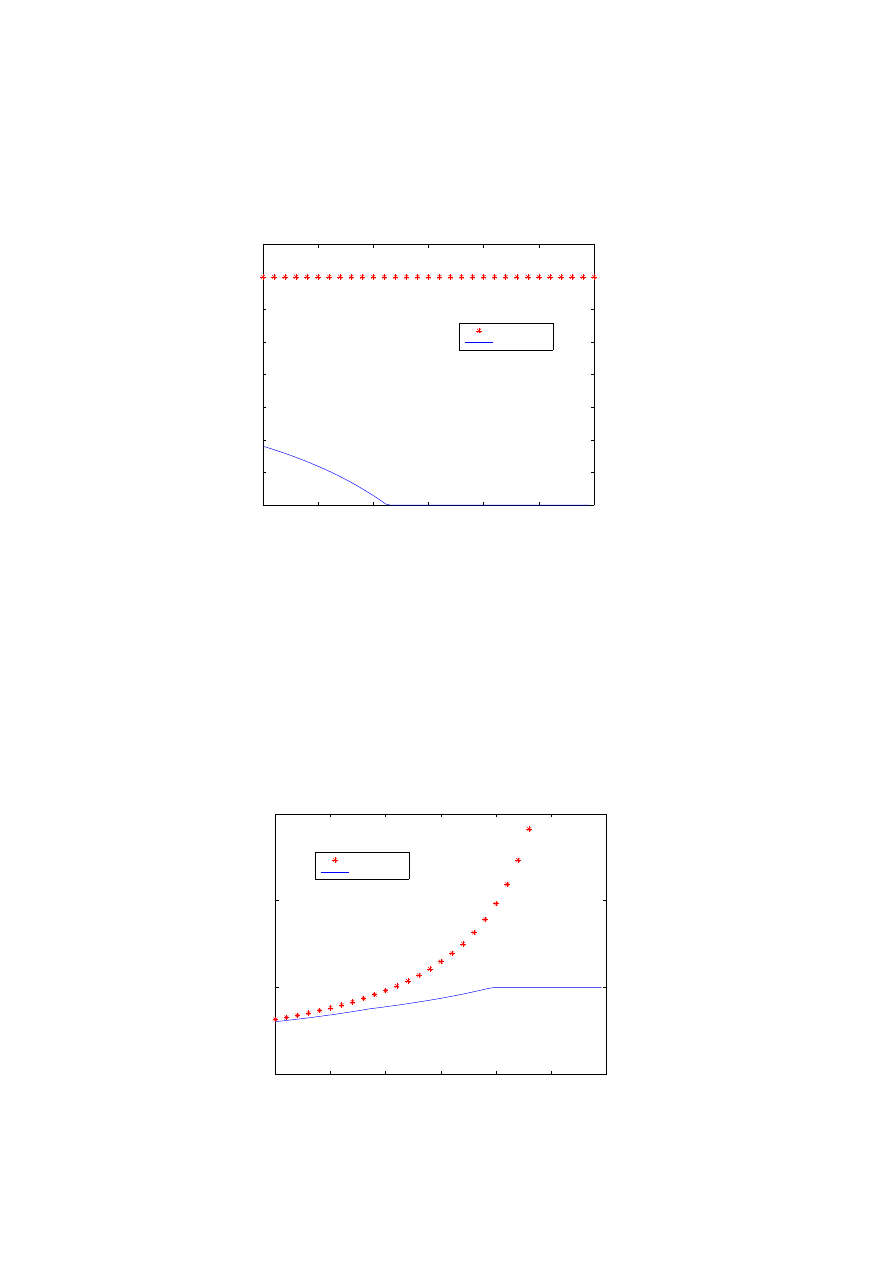

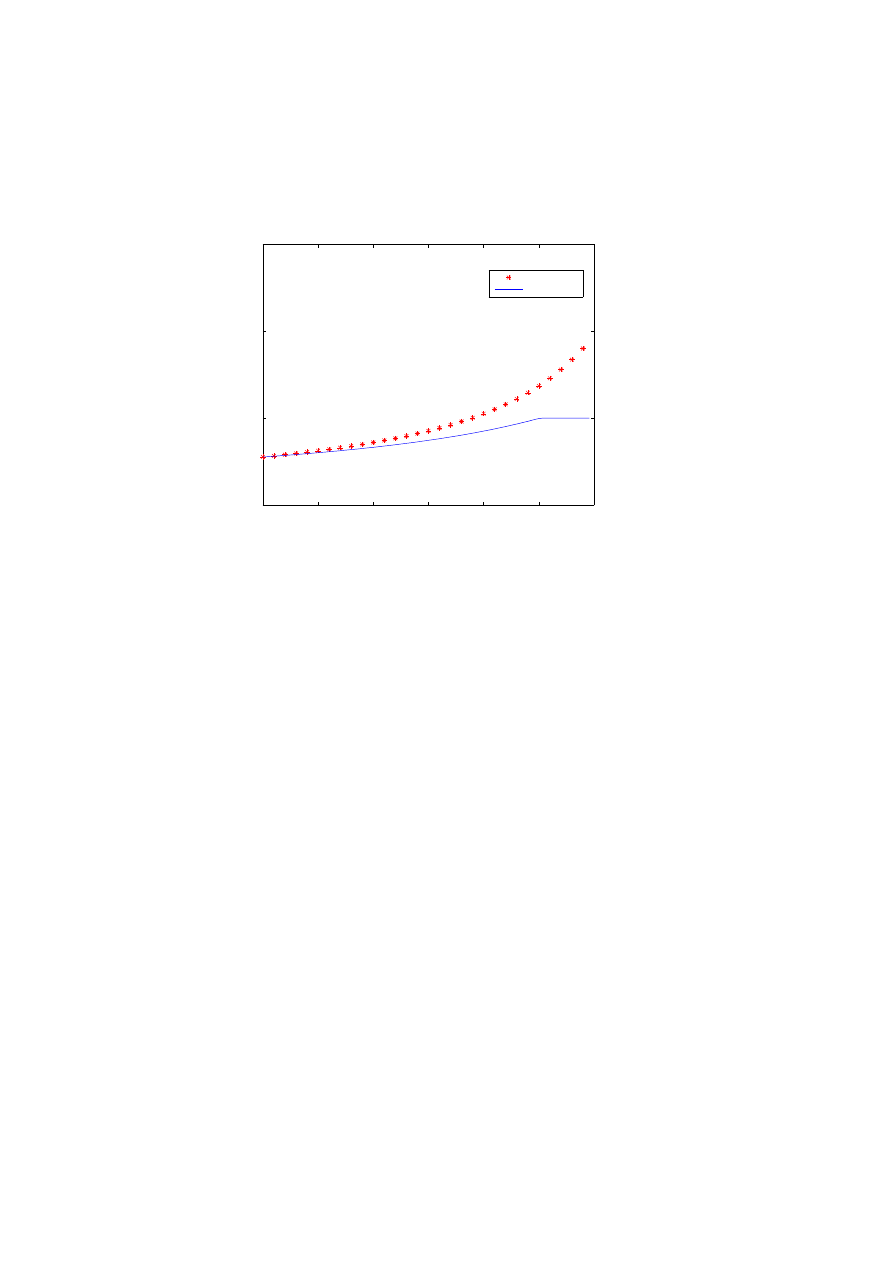

Fig. 3. Optimal consumption with and without VaR constraints, for the utility maximizition

of intemporal consumption. The graphs coresponds to different values of CRRA p; p = −1.5,

p = −1, p = −0.5, p = 0, p = 0.5. The x axis represents the time and the y axis the proportion

of wealth consumed (the expenditure rate). As time goes by, the VaR constraint becomes

active and reduces the consumption (in terms of proportions).

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

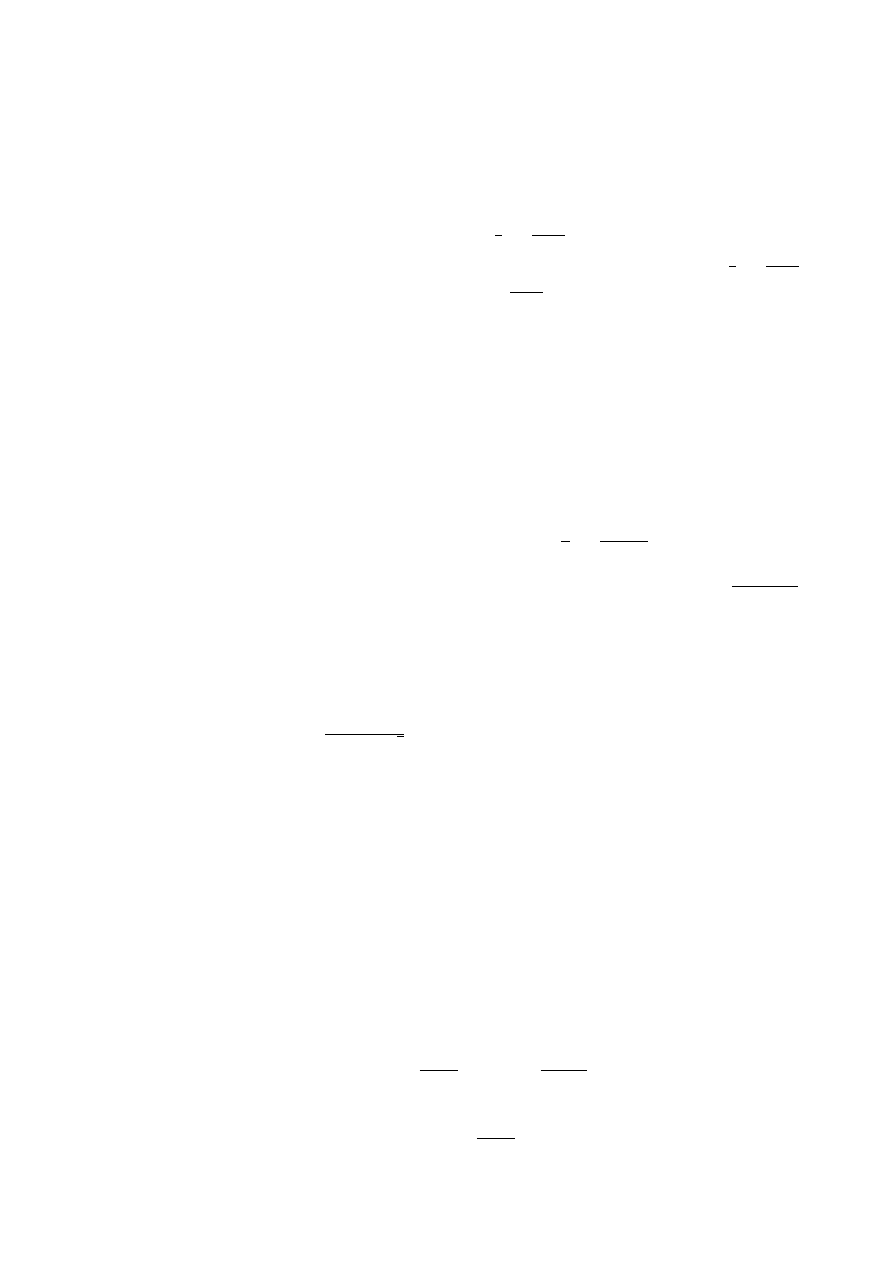

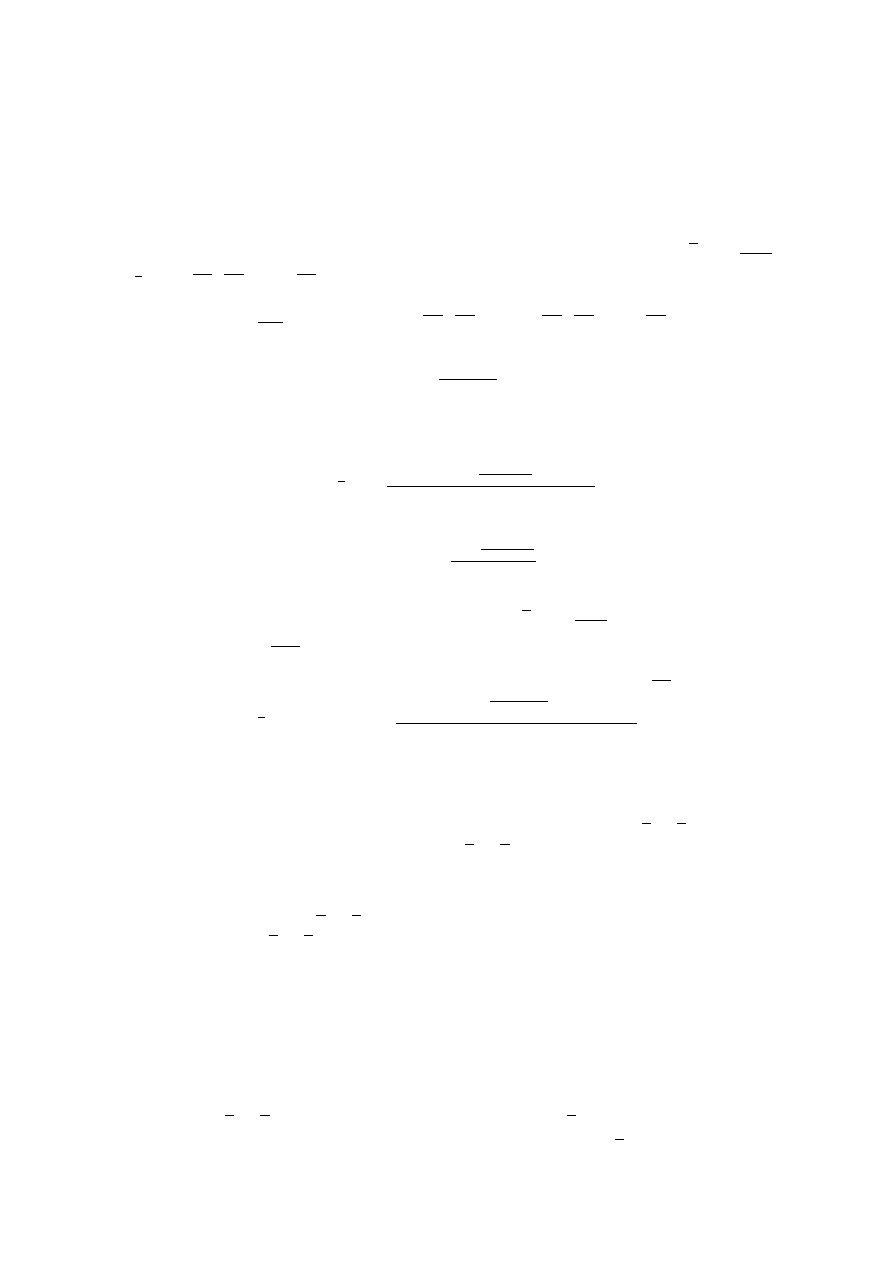

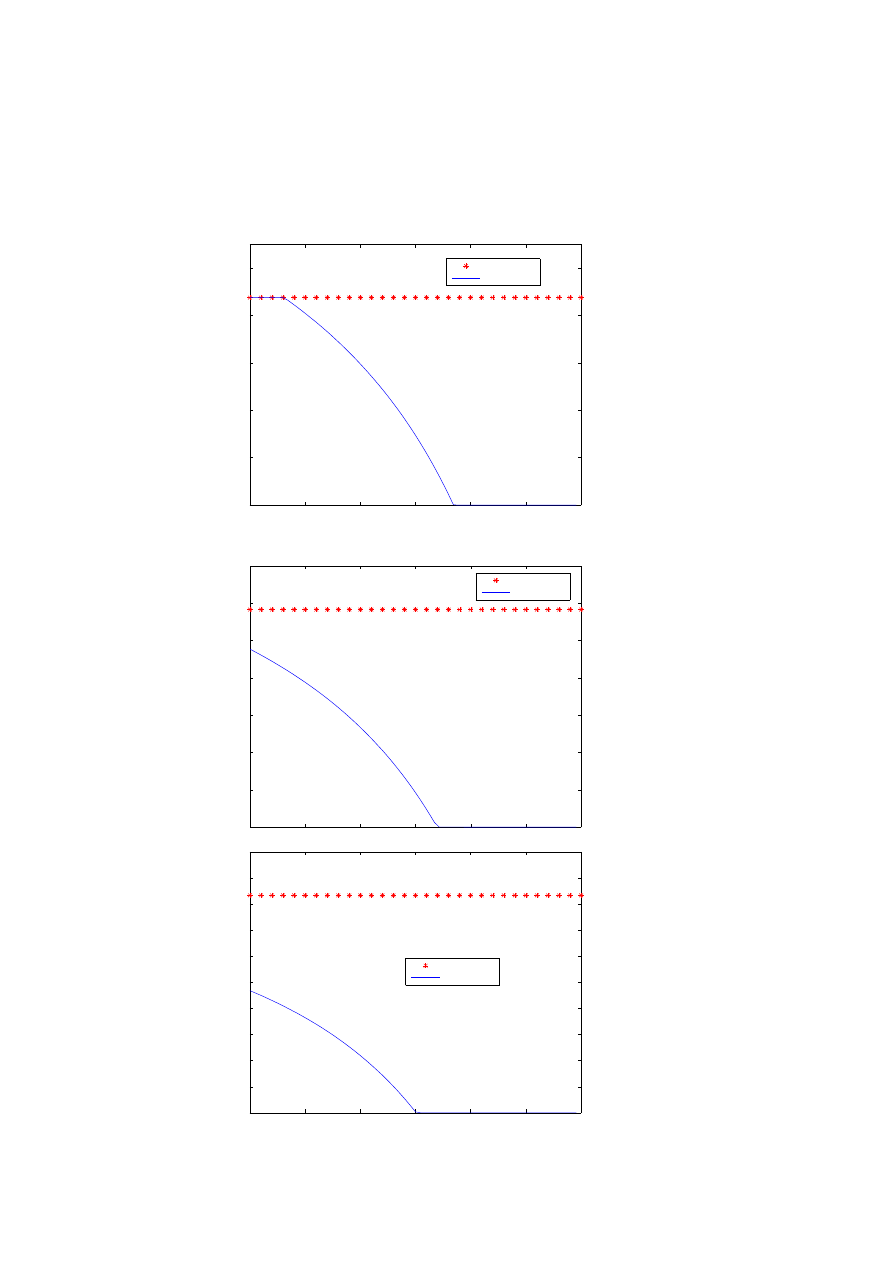

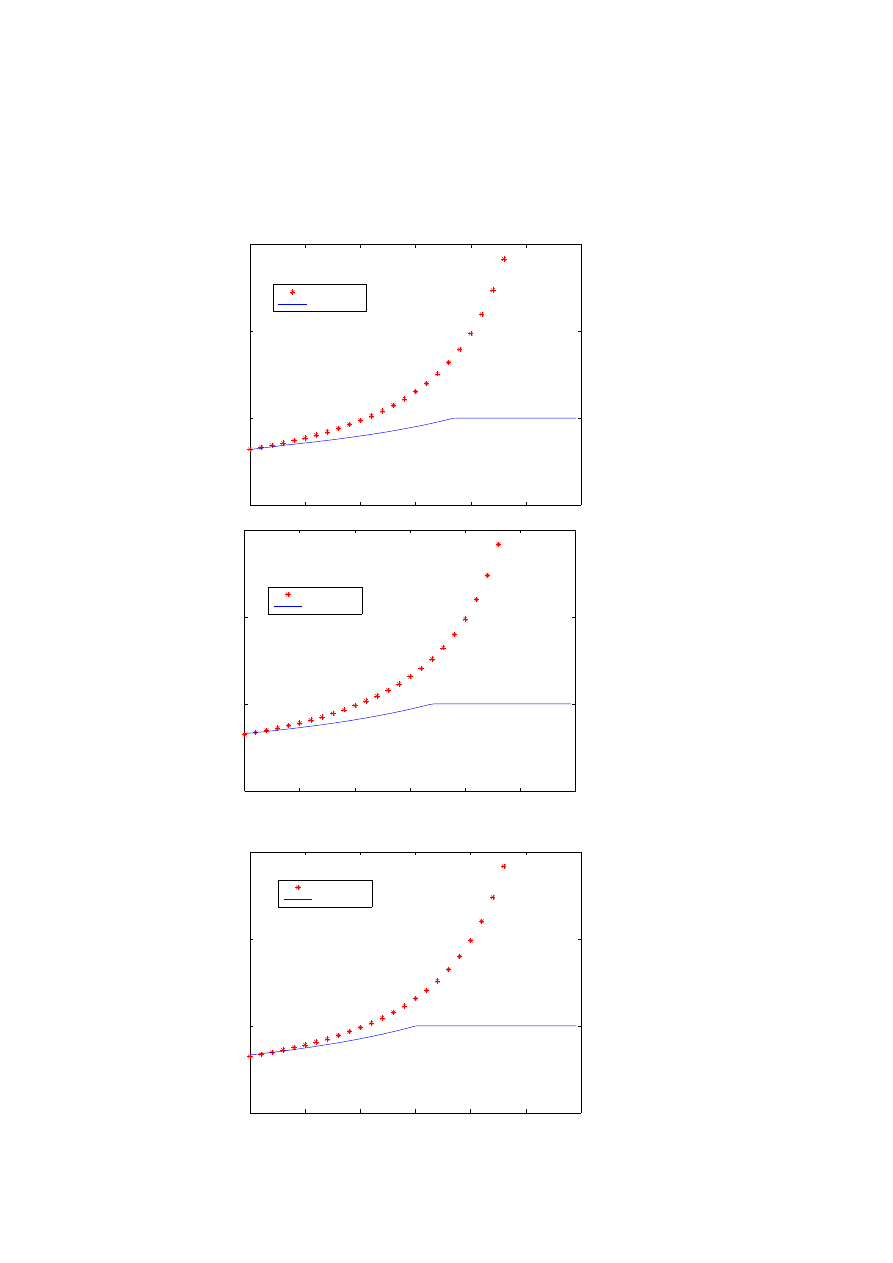

Fig. 4. Optimal consumption with and without VaR constraints, for the utility maxi-

mizition of intemporal consumption and final wealth. The graphs coresponds to different

values of CRRA p; p = −1.5, p = −1, p = −0.5, p = 0, p = 0.5. The x axis represents the time

and the y axis the proportion of wealth consumed (the expenditure rate).

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

0

0.5

1

1.5

2

2.5

3

0

0.5

1

1.5

unconstrained

constrained

References

[1] Albanese, C. (1997) Credit exposure, Diversification Risk and Coherent VaR, Working

Paper, Department of Mathematics, University of Toronto.

At

[2] Atkinson, C. and Papakokinou, M. (2005) Theory of optimal consumptionand port-

folio selection under a Capital-at-Risk (CaR) and a Value-at-Risk (VaR) constraint, IMA

Journal of Management Mathematics 16, 37–70.

BS

[3] Basak, S. and Shapiro, A. (2001) Value-at-risk-based risk management: optimal poli-

cies and asset prices, Rev. Financial Studies 14, 371–405.

[4] Berkelaar, A.,Cumperayot P.,Kouwenberg R. (2002) The effect of VaR-based risk

management on asset prices and volatility smile Europen Financial Management 8, 139-

164. 1, 65–78.

[5] Cesari, L. Optimization-theory and applications problems with ordinary differential

equations, Springer-Verlag, New York, 1983.

[6] Cuoco, D., Hua, H. and Issaenko, S. (2001) Optimal dynamic trading strategies with

risk limits, preprint, Yale International Center for Finance.

[7] Cuoco, D. and Liu, H. (2003) An Analysis of VaR-based Capital Requirements,

Preprint, Finance Department, The Wharton School, University of Pennsylvania.

[8] Delbaen F., Schachermayer W. (1994), A general version of the fundamental theorem

of asset pricing , Mathematische Annalen 300, 463-520.

[9] Emmer S., Kl¨

uppelberg and Korn R. (2001), Optimal portfolios with bounded cap-

ital at risk, Mathematical Finance 11, 365-384.

[10] Jorion, P. (1997) Value at Risk, Irwin, Chicago.

[11] Leippold, M., Trojani F. and Vanini P. (2002) Equilibrium impact of value-at-risk,

Preprint, Swiss Banking Institute, University of Zurich, Switzerland.

[12] Karatzas, I. and Shreve, S. E., Brownian Motion and Stochastic Calculus, 2nd Ed.,

Springer-Verlag, New York, 1991.

[13] Merton, R. C. (1969) Lifetime portfolio selection under uncertainty: the continuous-

time case. Rev. Econom. Statist. 51, 247–257.

[14] Merton, R. C. ( 1971) Optimum consumption and portfolio rules in a conitinuous-time

model. J. Economic Theory, 3, 373–413.

[15] Stryk, O (1993) Numerical solution of optimal control problems by direct collocation,

Optimal Control-Calculus of Variations, Optimal Control Theory and Numerical Methods,

International Series of Numerical Mathematics 111, 129–143.

[16] Pirvu, T. A. (2005) Maximizing Portfolio Growth Rate under Risk Constraints, Doctoral

Dissertation, Department of Mathematics, Carnegie Mellon University.

[17] Rivera, J. C. (2004) Portfolio choice under risk limits: a coherent approach, Doctoral

Dissertation, Department of Mathematics, Carnegie Mellon University.

[18] Yiu, K. F. C. (2004) Optimal portfolios under a value-at-risk constraint Journal of

Economic Dynamics& Control 28, 1317-1334.

Wyszukiwarka

Podobne podstrony:

Value at risk

Value at Risk portfel

Value at Risk portfel

Head at risk in LCP

Whos at Risk

Helen Shelton Heart at Risk [MMED 924] (v0 9) (docx) 2

Developing a screening instrument and at risk profile of NSSI behaviour in college women and men

Jaekle Urban, Tomasini Emlio Trading Systems A New Approach To System Development And Portfolio Opt

3 T Proton MRS Investigation of Glutamate and Glutamine in Adolescents at High Genetic Risk for Schi

Prospect theory an analysis of decision under risk

Portfolio Risk Reduction

A Cebenoyan Risk Management, capital structure and lending at banks Journal of banking & finance v

Sexual harassment over the telephone occupational risk at call centres

At the Risk of Forgetting A M Wilson

PORTFOLIO DESIGN AND OPTIMIZATION USING NEURAL NETWORK BASED MULTIAGENT SYSTEM OF INVESTING AGENTS

PIENINY kRoscienko under constr

więcej podobnych podstron