Trend-Reversal Entry Strategies*

Market Wise Trading School

Breakfast of Champions

December 10, 1999

William R. Prebble, Ph.D.

*Robert Miner’s Dynamic Trader 1997

Trend-Reversal Entry Strategies

• The Purpose of Technical Analysis Is to Identify Markets

That Are in a Position to Allow a Trade With Relatively Low

Risk and Acceptable Capital Exposure.

• Loss Control or Identifying the Protective Stop-loss Level Is

the Most Important Factor in Trading.

• The Same Methodology That Governs Your Trade

Opportunity Should Provide the Exact Market Activity That

Voids That Opportunity.

• Your Stop-loss Level Must Always Be Determined Before a

Trade Entry Is Initiated.

• If the Market Activity Does Not Allow Entry Within Your

Acceptable Capital Exposure, Then Don’t Enter the Trade.

Trend-Reversal Entry Strategies

• Three Reversal Patterns

– Reversal Day (RD)

– Signal Day (SD)

– Snap - Back Reversal Day

• These Reversal Patterns Are Designed to

Buy at or Near the Bottom and Sell at or

Near the Tops

Trend-Reversal Entry Strategies

(cont.)

• These Daily Reversal Signals Are Only Valid As

Trend Reversal Signals When the Technical

Analysis Indicates the Market Is in a Position for

Trend Reversal.

• These Daily Reversal Signals Frequently Occur in a

Trending Market, but Will Not Result in Reversal

Unless the Market Is in a Time and Price Position

for a Reversal.

• For Most Markets, One of These Signals Will

Occur at 70%-80% of Trend Reversals of All

Degrees.

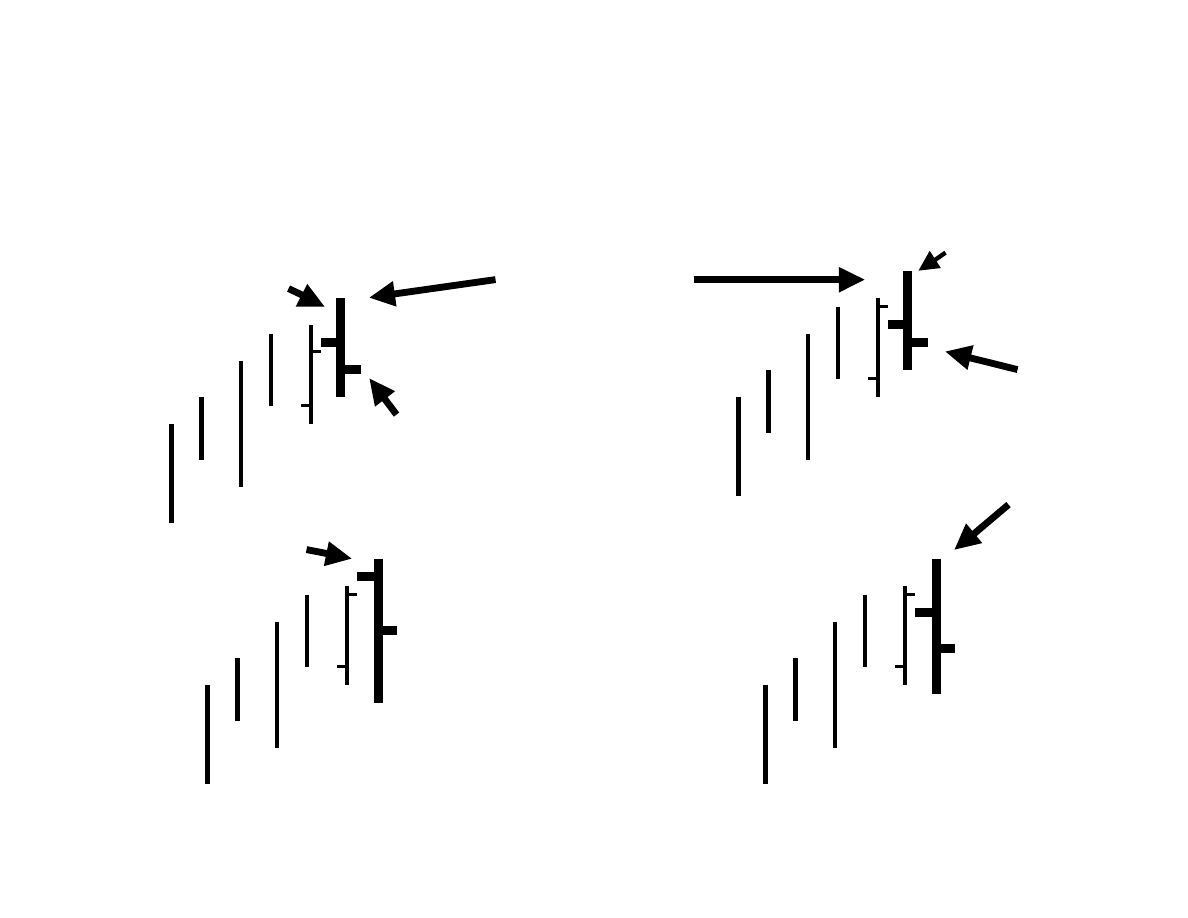

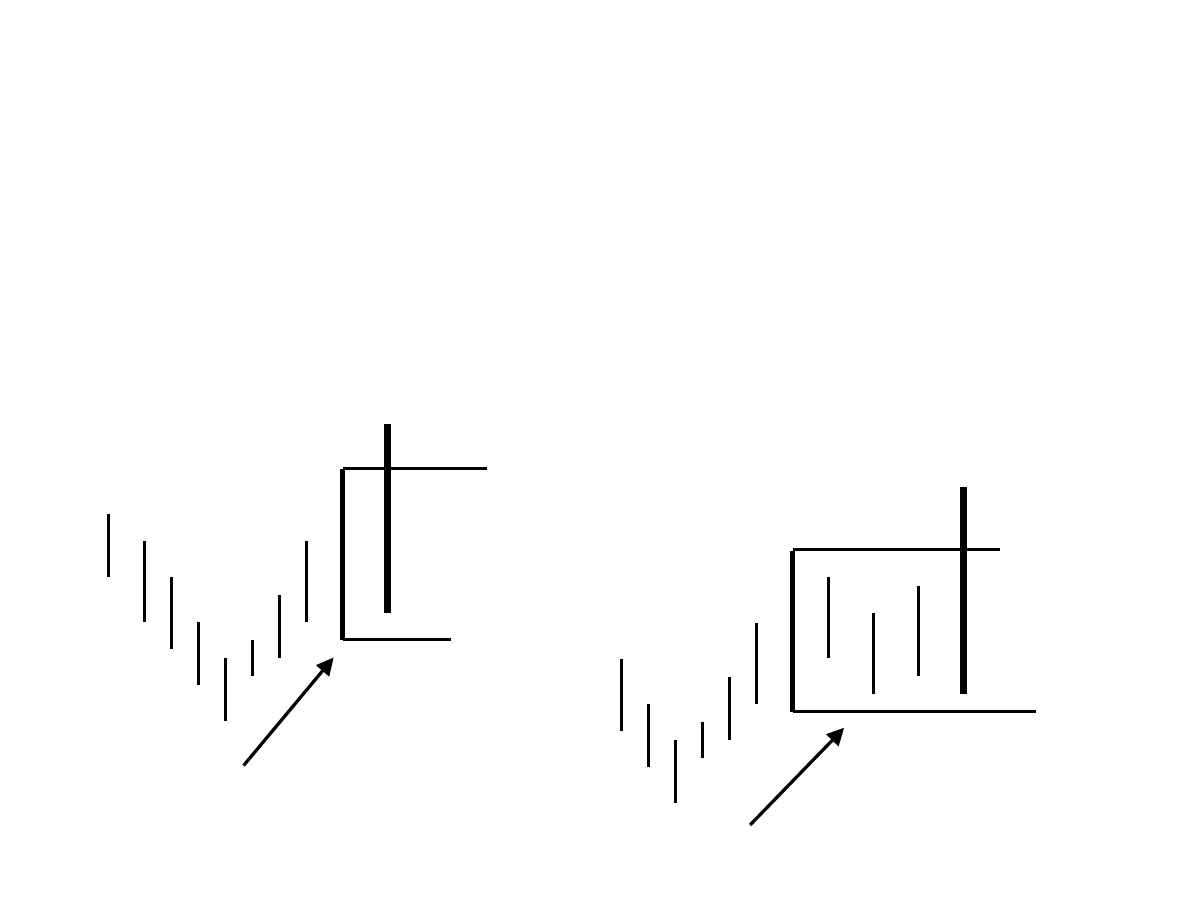

Reversal Day (RD) Entry Signal

RD

KRD

Lower Open &

Close Below Open.

Lower Close

OSRD

OSKRD

A reversal day top is made when a market makes a new daily high

but closes below the prior day’s close and the current day’s open.

New High

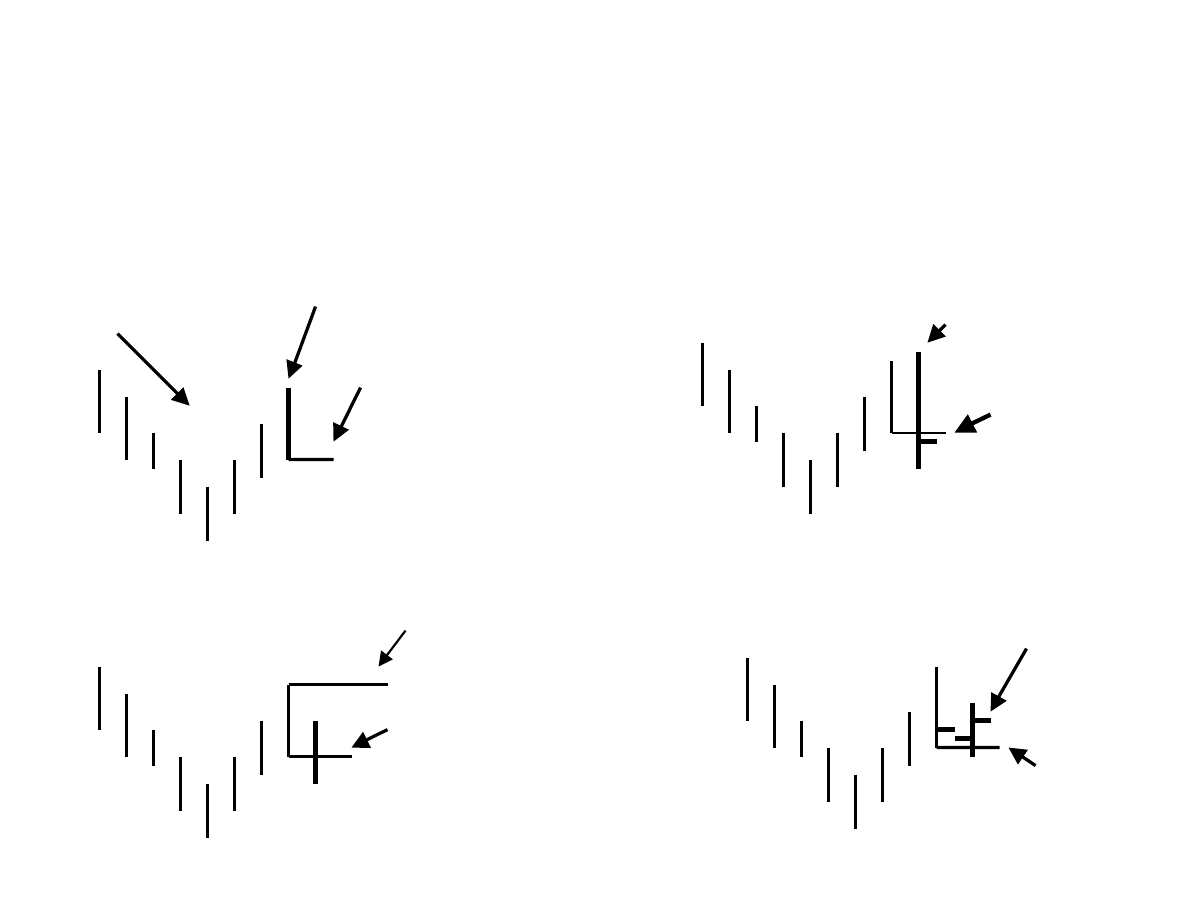

Signal Day (SD) Entry Signal

SD

The close does not

have to be below the

prior day’s close.

GSD

Gap

Gap left at the

close of the day.

Open above the prior day’s close followed by a new high.

The open must be in the top 1/3 and close in bottom 1/3 of the daily range.

The close does not have to be below the prior day’s close, only the current

day’s close.

The initial protective stop-loss is placed one tick above the signal day high.

Gap Signal Day (GSD) is a very strong daily reversal signal.

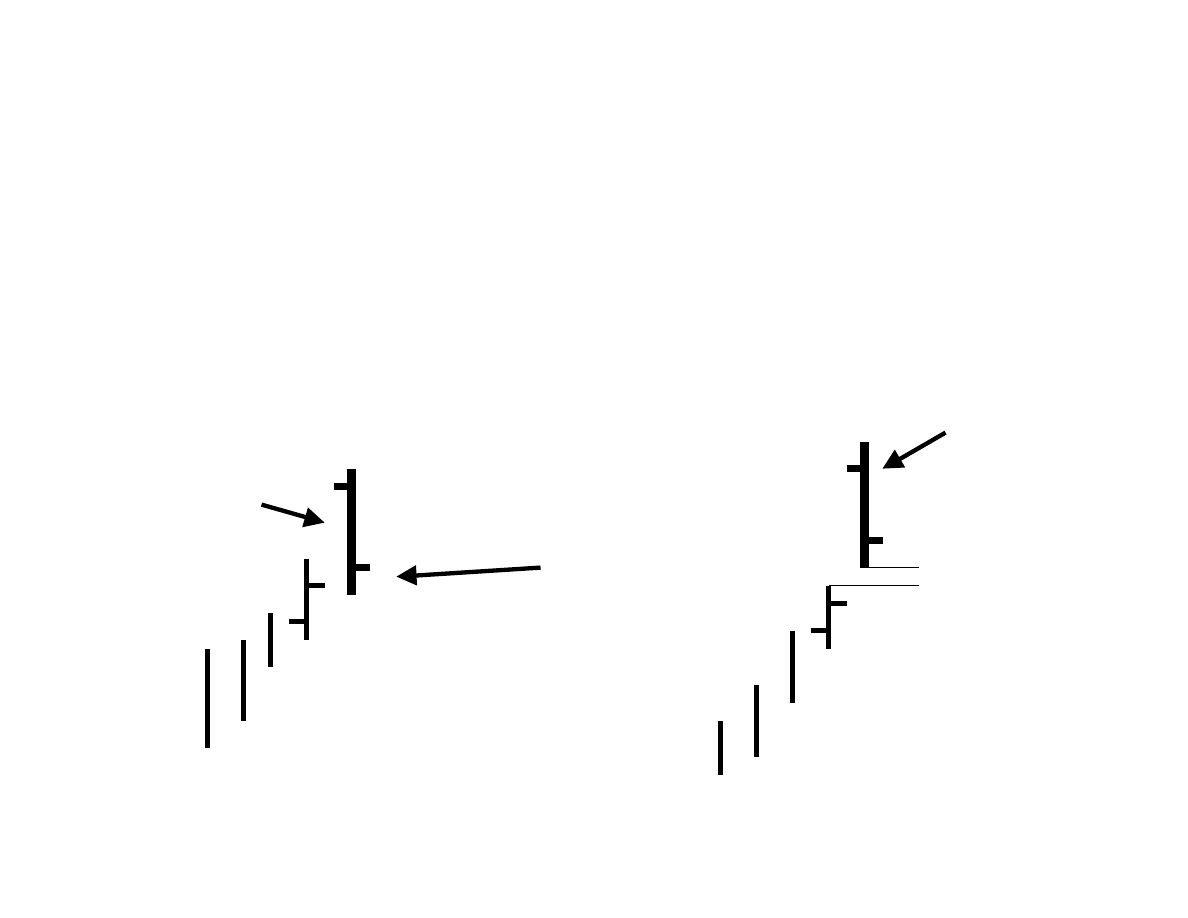

Snap-Back Reversal Day

(SBRD) Entry Signal

This is a two-day reversal signal.

Day 1: New high and open in the lower 1/3 of the daily range and close in the

upper 1/3.

Day 2: Open in the upper 1/3 of the daily range and close in the lower 1/3. The

two days may be in any position to each other. The initial protective stop-loss is

placed one tick above he higher high of the two days.

Reversal-Confirmation Day

Signal (RCD)

A Trend reversal is suspected, but one of the three trend-

reversal patterns was not present. Sell on the close if the close is

below the current day’s open and prior day’s close. For a more

reliable signal add the qualifier that the low of entry day must

exceed the prior day’s low.

RCD

RCD + new

daily low

Trend-Reversal Summary

• These Trend-reversal Entry Strategies

Only Work at True Trend-reversal -- Not

for Trend Continuation.

• If One of These Daily Reversal Signals

Does Not Occur Then Don’t Take the

Trade or Use Another Entry Technique

Such As Reversal-confirmation Day

(RCD) Entry Signal.

• Remember to Maximize Profits - Only

Take High Probability Trades.

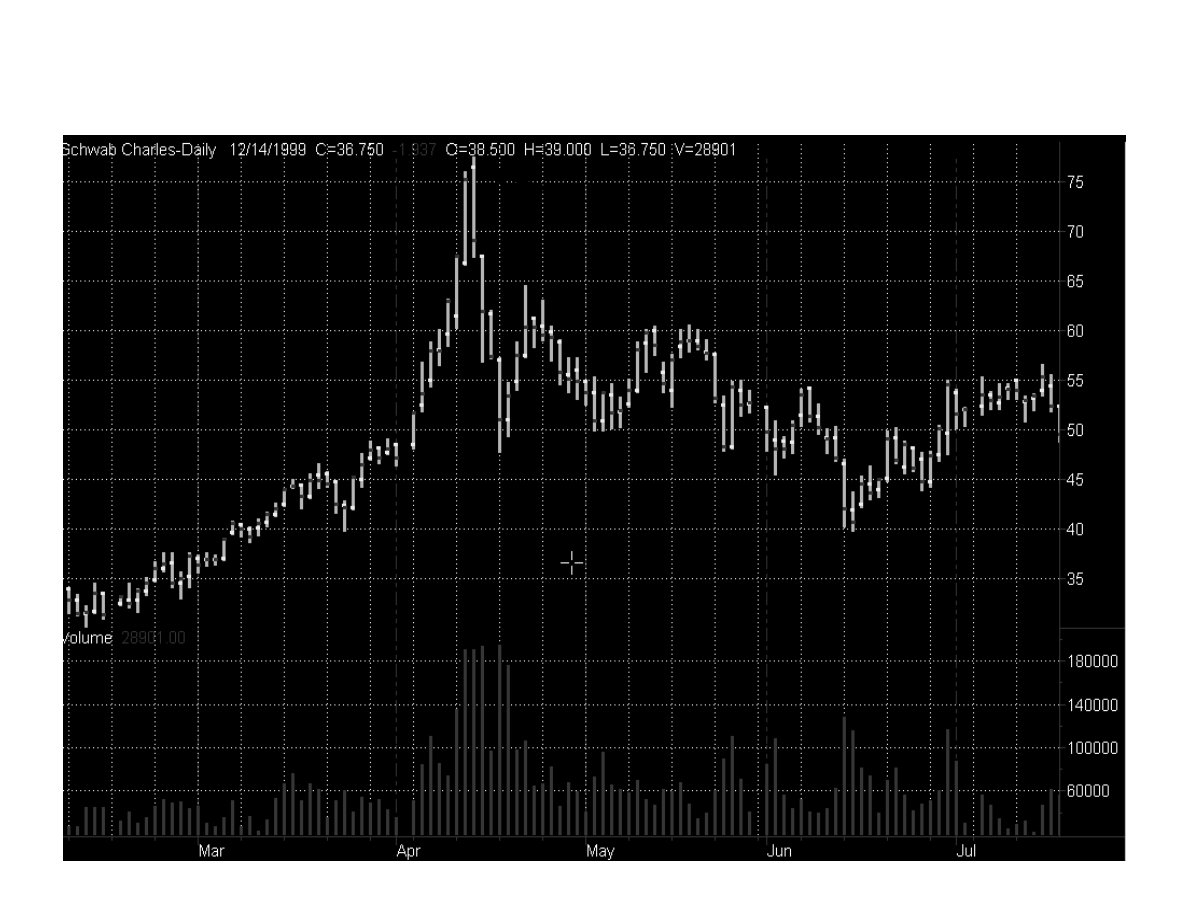

Charles Schwab

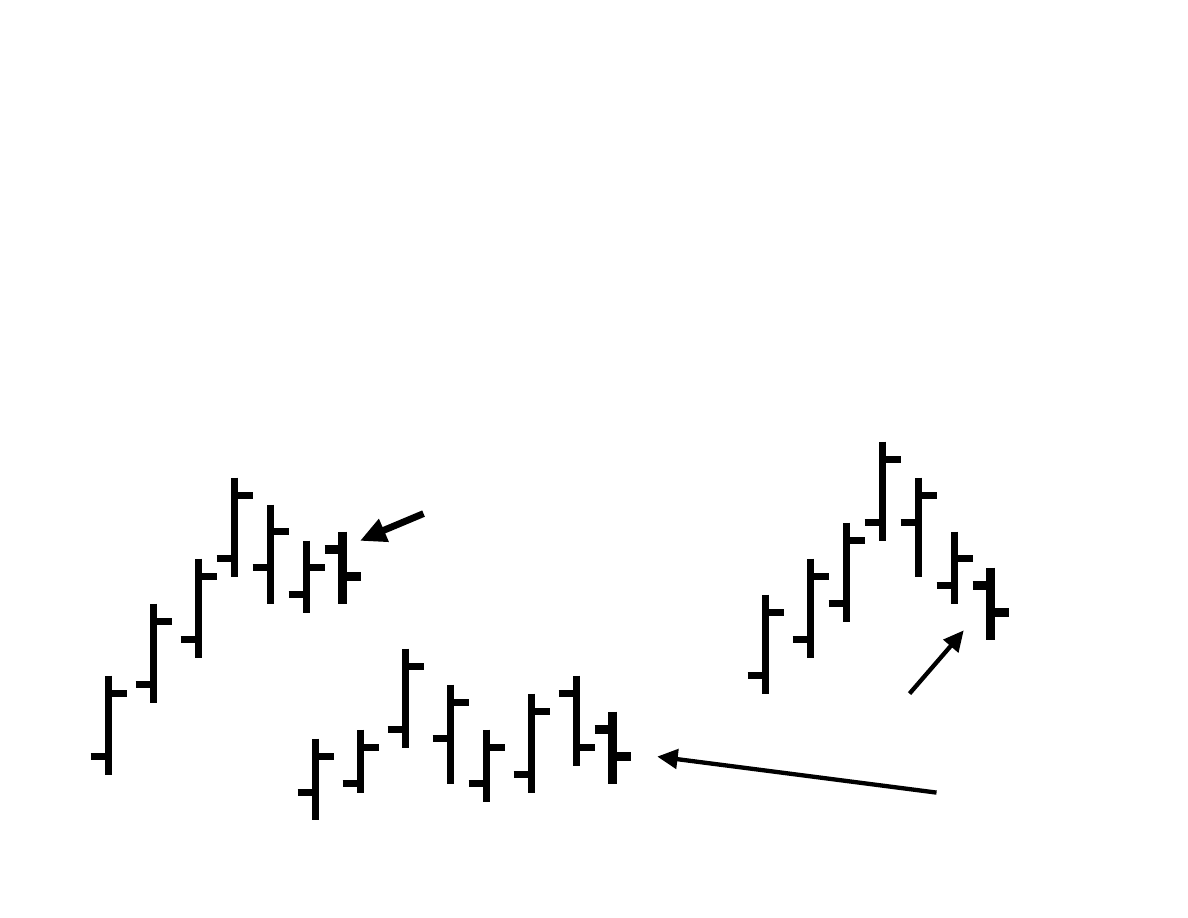

Snap-Back Reversal Day

Trend-Continuation Entry

Strategies

• Inside-Day Trade Set-Ups

• Outside-Day Trade Set-Ups

• Gann Pull Back Trade Set-Up

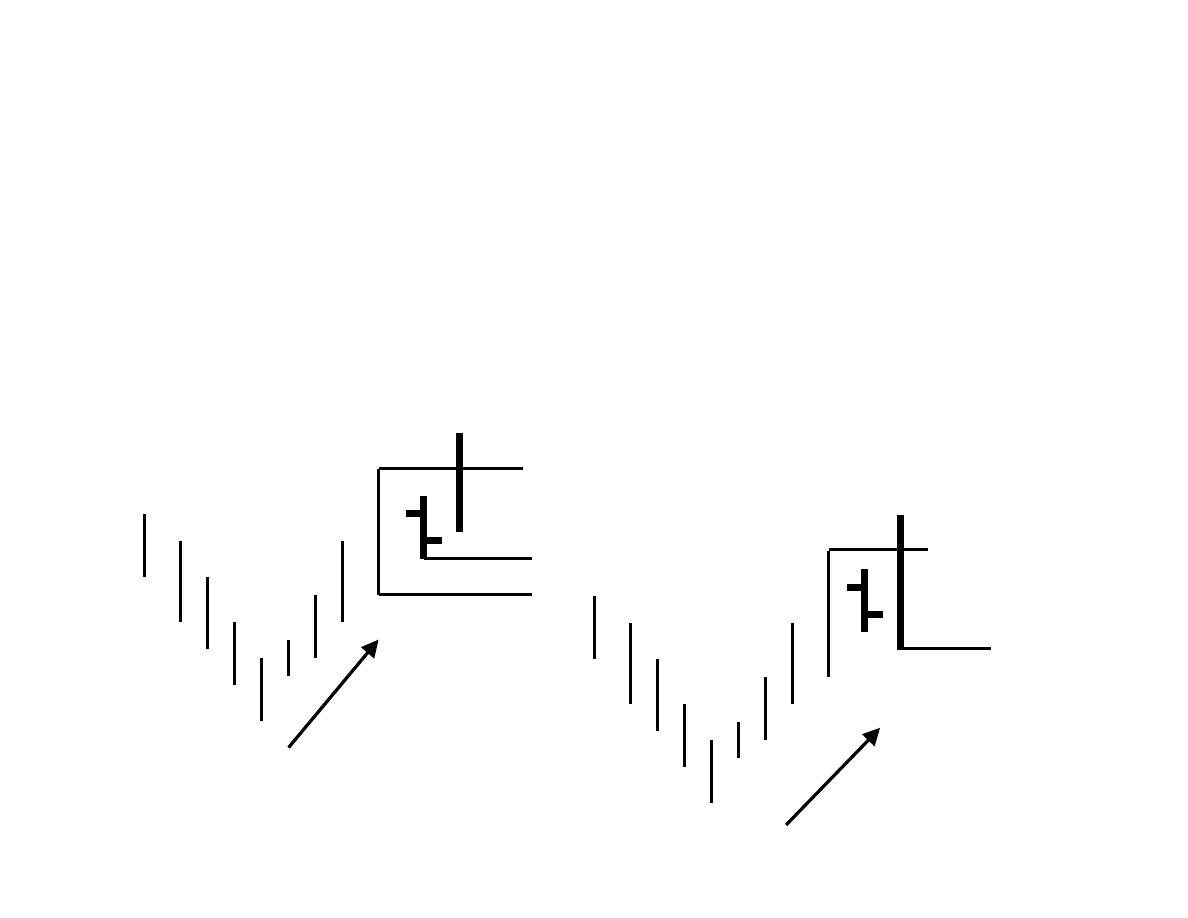

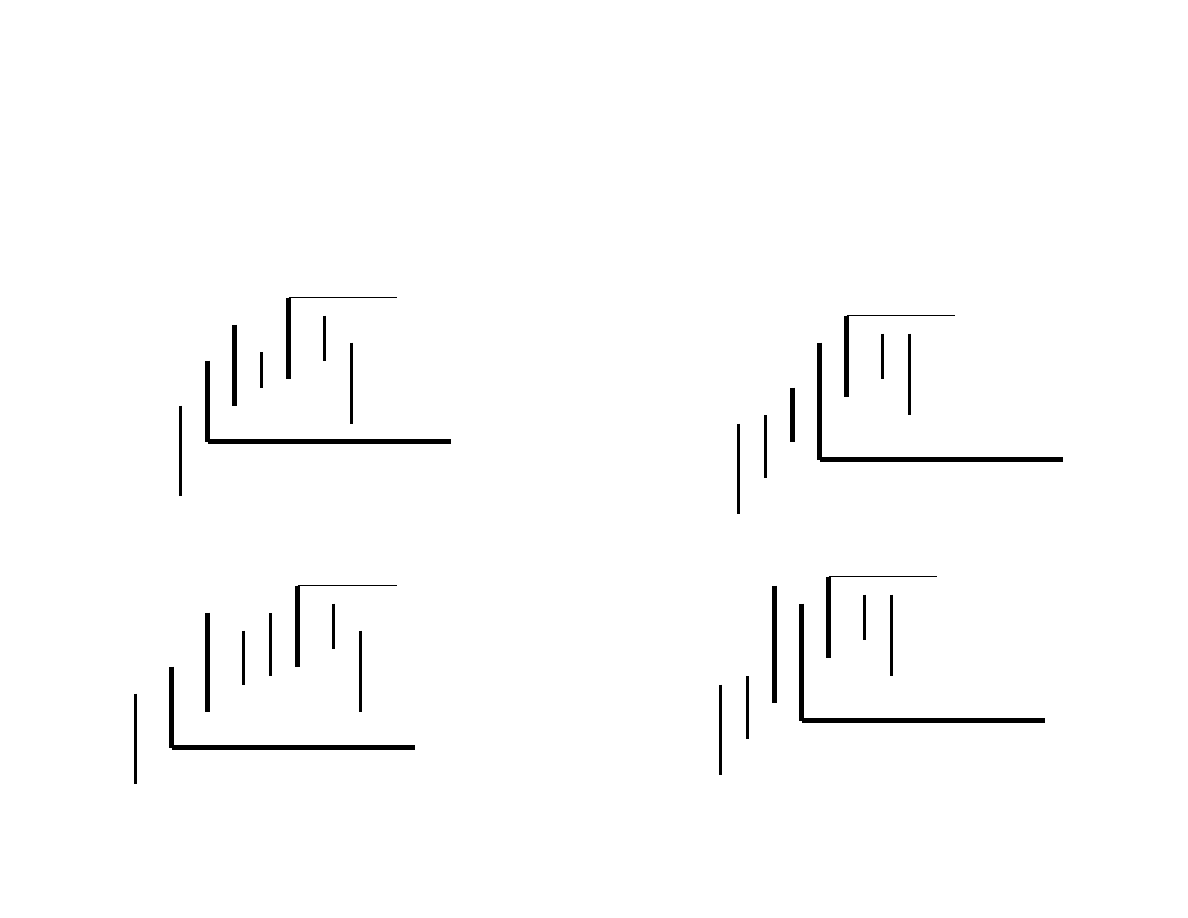

Inside-Day Trade Set-Ups

As long as the low of the day prior to the inside-day has not

been exceeded, buy the break above the high of the day

prior to the inside-day.

Place the initial protective sell-stop one tick below the

lower of the inside-day or entry-day low.

Trend Up

Trend Up

Buy-Stop to Enter

Protective Sell-Stop

Buy Stop

Protective Sell-

Stop lower of

inside-day or

entry-day low.

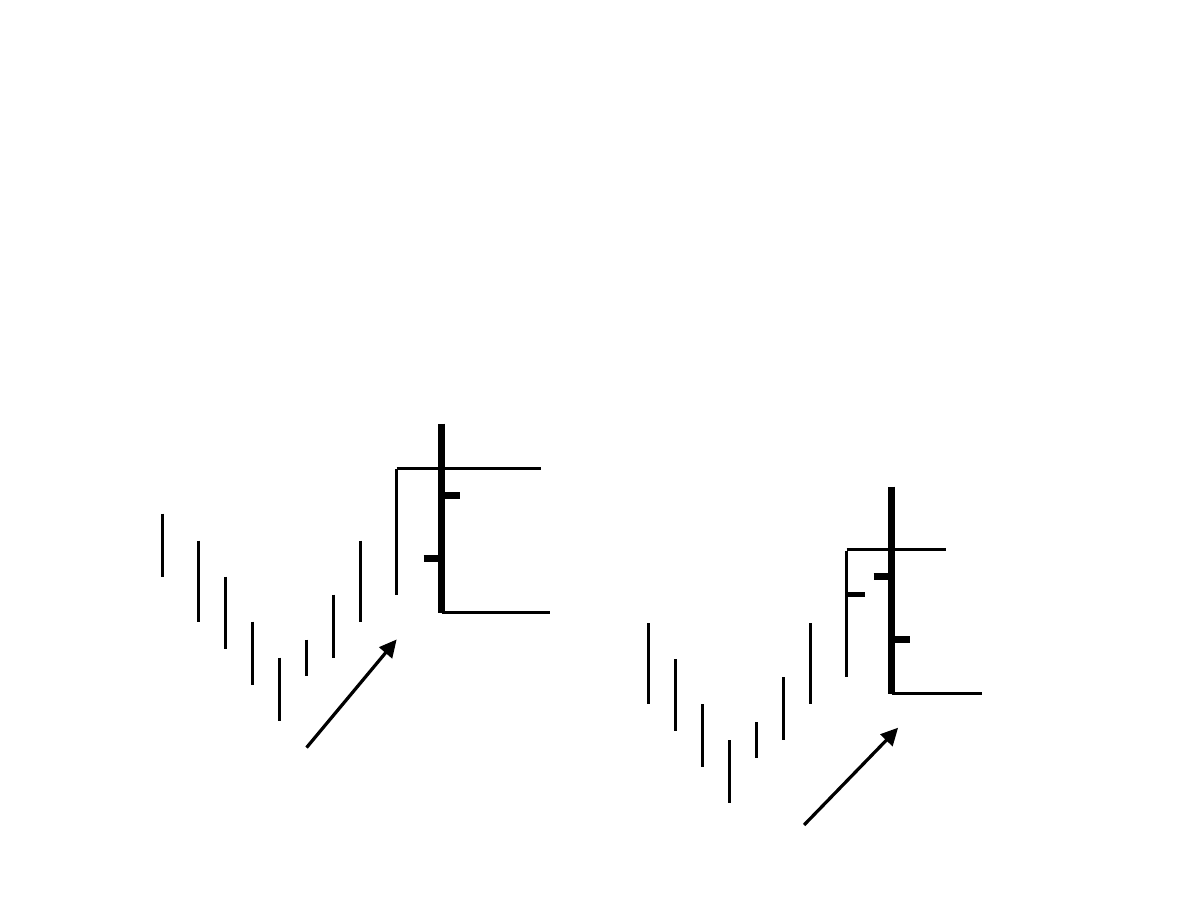

Outside-Day Trade Set-Ups

If the market has first exceeded the prior day’s low, buy the break above

the prior day’s high.

Place the protective sell stop one tick below the low of the entry day,

Exit the trade on the close if the close is below the current day’s open and

the prior day’s close.

Trend Up

Trend Up

Buy-Stop to Enter

Protective Sell-Stop

Buy Stop

Exit on Close

Trend Up

Trend Up

Buy-Stop to Enter

Protective Sell-Stop

Buy Stop

PSS

Outside-Day Plus Entry Set-Ups

Only trade in the direction of the trend.

For an up trend, place a buy-stop one tick above the high of the outside-day.

Maintain the buy-stop until the price range of the outside day is exceeded.

Place the initial protective sell-stop one tick below the low of the outside-day.

“Every market makes a top or

bottom on some exact

mathematical point in proportion

to some previous move.”

W. D. Gann

Gann Pull Back Trade Set-Up

Trend

Down

Three higher highs.

Set-up conditions to sell complete.

Sell-stop to enter one tick

below the prior day’s low.

Place the protective buy-stop (PBS)

one tick above the higher of the entry-

day high or prior day’s high.

PBS

Sell Stop to Enter

Sell Stop to

Enter

PBS

Exit on close if the close

is above the entry day

open and the prior day

close.

Sell Stop

to Enter

If the market has made at least a three day counter-trend, on the next day sell one tick

below the prior day’s low.

Place the initial protective buy-stop one tick above the high traded for the correction.

“All market analysis and trading strategies

are a matter of probabilities. Losses are

inevitable and a cost of doing business. The

trading plan must provide a stop-loss

approach that minimizes losses when they

occur.”

Robert C. Miner

Protective Stop-Loss Placement

•

The Protective Stop-loss Should Be Kept Relatively Far

From the Current Market Position Until the Trend Is

Confirmed.

•

The Protective Stop-loss Should Be Brought Relatively

Close to the Market When the Trend Is Scheduled to End.

•

As Trend Continues, Traders Must Have a Plan to Adjust

Protective Stops to Either Reduce the Capital Exposure for

a Loss or Protect Unrealized Profits.

•

If a Market Approaches a Set-up Indicating a High

Probability That the Trend Is Terminating, the Protective

Stop-loss Should Be Brought Very Close to the Current

Market Position.

Protective Stop-Loss Placement

• Swing Stop-Loss

• Three-Day Low or High (3DL or H)

• Adjusting PSL to the 2DL and 1DL

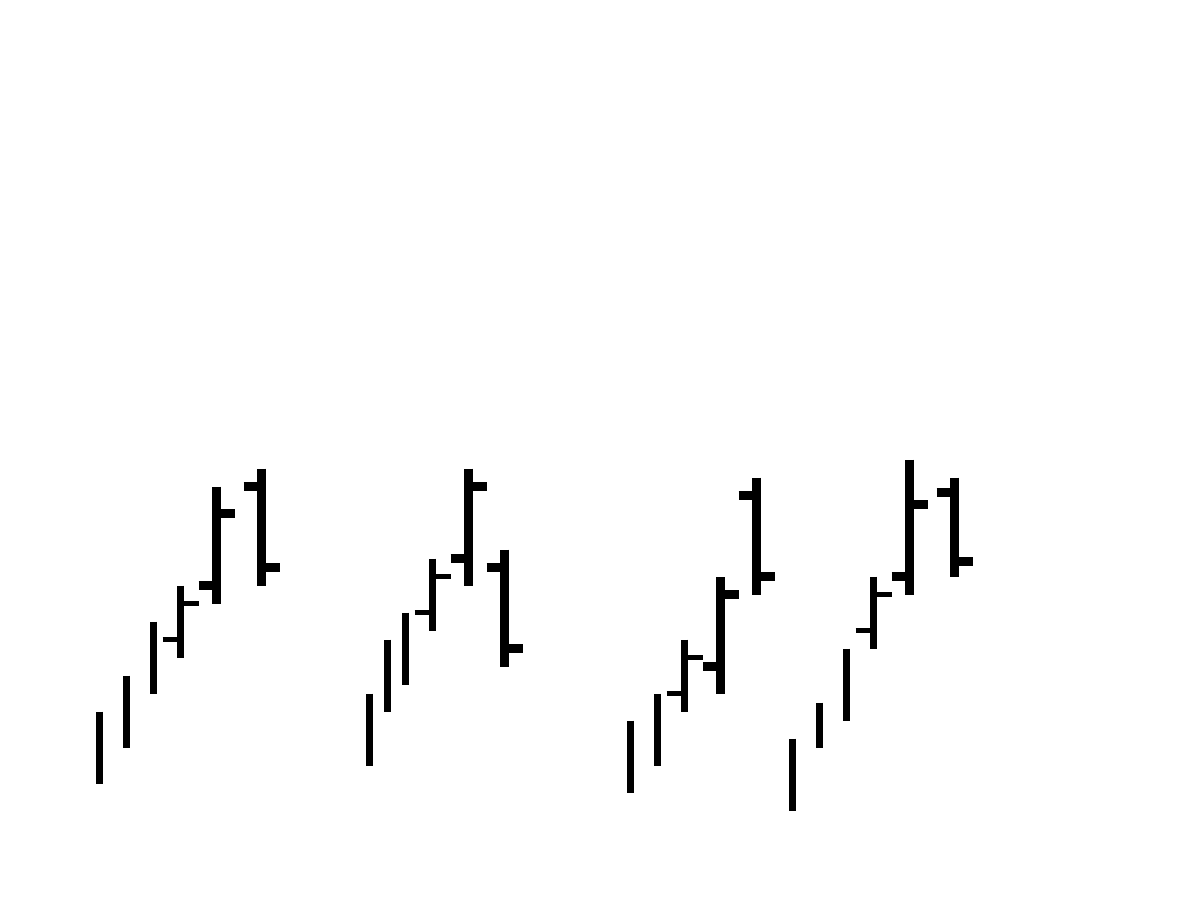

Three-Day Low or High (3DL or H)

The lowest price of the three days from the extreme high,

inclusive of the high. Inside days are not counted.

1

Figure 1

2

3

3DL (inside-day not counted)

1

Figure 4

2

3

3DL

1

Figure 3

2

3

3DL (inside-days not counted)

b

a

Figure 2

2

3

3DL

1

Wyszukiwarka

Podobne podstrony:

PODSTAWY MARKETINGU WSZIB KRAKÓW Strategie marektingowe przedsiębiorstw

PODSTAWY MARKETINGU WSZIB KRAKÓW Strategie cenowe polityka zorientowana na konkurencję, na popyt, n

Strategie marketingowe prezentacje wykład

W 6 STRATEGIE MARKETINGOWE FIRMA USúUGOWYCH

Formułowanie strategii marketingowej

strategie wartosci w internecie, Nowe technologie w marketingu, Doligalski, TDoligalski, NTwM1, 2009

Materiały z wykładu strategie marketingu

Market Leader 3 Intermediate entry test

Legendarne Strategie Liderów Network Marketingu

Marketing i strategie sprzedazy(1)

Paley The Marketing Strategy

więcej podobnych podstron