Baltic Accountants and Consultants

STATE AUTHORIZED PUBLIC ACCOUNTANTS

BIURO AUTORYZOWANYCH AUDYTORÓW I KONSULTANTÓW

Kurt Iversen Baltic Accountants and Consultants

Poland 01524 WARSZAWA, Al. Wojska Polskiego 11

Tel; + 48 22 869 06 66, fax: + 48 22 869 06 60

Paweł Trojanek

Page 1 of 5

Polish tax system

1. Basics:

A. Companies:

·

Companies having its legal seat or management office in Poland are considered

Polish corporate tax residents.

·

Resident companies are taxable to Poland on its worldwide income.

·

Companies shall pay::

o

Corporate Income Tax – 19%

o

Social Security Contributions and other employment related Funds – app. 21%

o

Value Added Tax – 22%, and for particular items: 7% and 3%

o

Real Estate Tax shall depend on the item:

§ Land up to 0,66 PLN per square meter ,

§ Buildings – up to 17,98 per square meter

§ Constructions – 2% of value

·

Tax losses can be carried only forward for 5 years (minimum two years).

·

There is no separate capital gains tax, and gains of that kind are part of ordinary

income.

·

Antiavoidance regulations: Thin capitalization rules and transfer pricing rules.

B. Individuals:

§ Individuals having a place of living in Poland are considered tax residents for income

tax purposes.

§ Partnerships are transparent tax –wise, therefore partners are taxed individually on

their share of the profits.

§ An individual shall pay:

o

Personal Income Tax – up. to 40%, with certain exceptions, like:

o

Dividends (worldwide) , capital gains from trading in shares, securities 19%

o

Business income under certain conditions – 19%

o

Social security contributions – app. 19%

o

Value Added Tax 22%, and for particular items: 7% and 3%

o

Real Estate Tax shall depend on the item:

§ Land up to 0,66 PLN per square meter ,

§ Buildings – up to 17,98 per square meter

§ Constructions – 2% of value

§ Tax losses can be carried only forward for 5 years (minimum two years).

§ Antiavoidance regulations: Thin capitalization rules and transfer pricing rules.

Baltic Accountants and Consultants

STATE AUTHORIZED PUBLIC ACCOUNTANTS

BIURO AUTORYZOWANYCH AUDYTORÓW I KONSULTANTÓW

Kurt Iversen Baltic Accountants and Consultants

Poland 01524 WARSZAWA, Al. Wojska Polskiego 11

Tel; + 48 22 869 06 66, fax: + 48 22 869 06 60

Paweł Trojanek

Page 2 of 5

2. Introduction to Polish Tax system

A. taxation of companies

The Polish tax system is a classical tax system. That means that corporate income is fully taxed at

the company level. Corporate Income Tax rate – 19%.The distributed profits are in the hands of the

shareholders by way of a withholding tax.Withholding tax in Poland on dividend 19% unless

preferential rate resulting from a double tax treaty or the EU Directive is applicable. For all non

resident shareholders ( individual shareholders and companies) , the withholding tax is final in

Poland. For resident corporate shareholders the tax on dividend is credited against their corporate

income tax liability, even though the dividends are not added to the total taxable income.

Application of the tax rate under the double taxation avoidance agreement or the one resulting from

the EU legislation shall be possible provided that the taxpayer from another country submits a

declaration stating his place of residence for tax purposes, said declaration having been issued by

the competent tax administration authority "certificate of residence".

1. Losses

Losses may be carried forward for 5 years, up to 50% of the loss may be set off in each year.

Loss carryback is not allowed

.

2. Taxation of nonresident companies

Nonresident companies, for income tax purposes, are legal entities whose legal seat and

management office are located outside Poland. The provisions of Corporate Income Tax (CIT) Act

shall also apply to foreign entities having no legal personality under condition that they are treated as

corporate income tax payers in their home country, as well as to foreign permanent establishment,

when in accordance with the regulations of the foreign country they are corporate taxpayers taxed on

the worldwide income, assuming that they have any Polish source of income.

All foreign entities carrying on an economic activity in Poland are obliged to keep Polis accounts.

If the tax base resulting from Polish books of a foreign entity can not be accepted, it can be estimated

by tax authorities as a percentage of the Polish sales. For instance whole sale and retail – tax base

shall be 5% of the turnover in Poland. Construction – 10%, services of consultants and experts –

80%, agents – 60%, other – 20%. Example: Wholesaler of electronic appliances via its office within

the territory of Poland constituted a permanent establishment (PE. The turnover of the PE was

1.000.000. Polish books showing 10.000 in profits were not accepted by tax authorities. Therefore

the tax assessment was the following. 5% of 1.000.000 = 50.000 (tax base) x 19% (tax rate)=9.500

(tax to be paid).

3. Dividends

Nonresident taxpayers are subject to tax on their Polish source income and capital gains (including

gains on shares in Polish companies) the term used in the Polish Act is “ income from share in legal

persons an other incomes from participation in legal persons. From 1 May 2004, under the provisions

that implement the EC ParentSubsidiary Directive in Poland, dividend distributions by resident

subsidiaries to their nonresident EU parent companies are exempt form any withholding tax. For this

exemption it is required that the EU Parent company is subject to corporate income tax in its sate of

residence and owns at least 20% of the capital of the Polish company for an uninterrupted period of

at least 2 years( it can lapse after payment of dividend).

4. Interest

Interest paid to nonresident companies is subject to final withholding tax levied on the gross amount.

The rate is 20% unless a reduced rate applies under a tax treaty.

5. Royalties

The rate is 20% unless the treaty applies.

6. Consulting and other similar services

There is 20% tax on income derived from advisory services, accounting, advertising, data

processing, market research, recruiting, and management and control services.

As above the double tax treaty can provide different provisions.

Baltic Accountants and Consultants

STATE AUTHORIZED PUBLIC ACCOUNTANTS

BIURO AUTORYZOWANYCH AUDYTORÓW I KONSULTANTÓW

Kurt Iversen Baltic Accountants and Consultants

Poland 01524 WARSZAWA, Al. Wojska Polskiego 11

Tel; + 48 22 869 06 66, fax: + 48 22 869 06 60

Paweł Trojanek

Page 3 of 5

7. Thin capitalization

Interest paid on a loan granted by a shareholder owning at least 25% of the share capital or by a

group of shareholders owning in aggregate at least 25% of the share capital, or

between companies in which another company owns at least 25% of the share capital

is not deductible if a debt to equity ratio of 3: 1 is exceeded.

8. Taxable period

Unless decided otherwise by a tax payer, the tax year for companies is a period of 12 consecutive

months. For those starting up their activity in the second half of the year there is a possibility to

combine the “start up period” till the end the tax year with the next tax year.

9. Tax returns

A preliminary tax return is to be filed till the end of the third month of the following year. The final

return has to be filled in 10 days after the financial statement are approved.

10. Advance payments of tax

Advance payments are to be paid till the 20

th

day of the next following month.

A taxpayer under certain condition can apply simplified form for payment of tax within the tax year.

11. Rulings

On the basis of written application of a tax payer tax authorities are obliged to issue a written

interpretation regarding “the applicability of the tax laws in a particular case”. The interpretation is

binding for the tax authorities.

12. Group treatment

Resident companies with an average capital of 1 million PLN (at least) can form a tax group.

The tax base for the whole group is a difference between profits and losses of all companies of the

group.

13. Transfer pricing

In case of related entities (the same persons performing management, supervision, or controlling in

both entities, family links, shareholdings links assuming minimum 5% holding) Polish tax payers are

obliged to prepare transfer pricing documentation. When the transfer pricing documentation is not

presented in 7days time an eventual difference between taxpayers records and calculation made by

tax authorities can be at 50% rate. In case when prices between the related entities do not satisfy

the arm’s length principle the tax authorities can adjust the prices using primarily the three methods:

the comparable uncontrolled price, the resale price or the cotsplus method.

If the above mentioned methods cannot be applied profit based ,methods can be used.

14. Depreciation and amortization

Depreciation allowances are listed.

Examples of annual rates (%):

·

Buildings and constructions – 1,5 4,5

·

Machines and equipment – 18– 20

·

Computers 30

·

Vehicles, Mobile phones, Cash registers 20

In general the straightline method applies, but the decliningbalance method can be used as well

under certain conditions.

Some items like land and perpetual usufruct to land, certain buildings and structures may not be

depreciated for tax purposes.

15. Double tax treaties

Poland concluded conventions on avoidance of double taxation with 80 countries.

The actual list: http://www.mf.gov.pl/dokument.php?dzial=150&id=9741

Baltic Accountants and Consultants

STATE AUTHORIZED PUBLIC ACCOUNTANTS

BIURO AUTORYZOWANYCH AUDYTORÓW I KONSULTANTÓW

Kurt Iversen Baltic Accountants and Consultants

Poland 01524 WARSZAWA, Al. Wojska Polskiego 11

Tel; + 48 22 869 06 66, fax: + 48 22 869 06 60

Paweł Trojanek

Page 4 of 5

B. taxation of individuals

An individual is considered to be a resident for income tax purposes if his place of living is in Poland.

Partnerships are not taxable entities as such therefore partners are taxed individually on their share

of profits.

Tax is generally levied on the aggregate income from all categories for instance: income from

dependent and independent services, income from business, rental income, investment income.

However certain income items for instance dividends, interest, income from participation in

investment funds, and capital gains from the sale of shares and other securities considering that they

are not arising in the course of a business, are taxed separately at 19% flat rate. Usually tax credit

method applies for withholding tax paid abroad. 19% rate on a difference between revenues and

deductible expenses applies to some business income when applied, except for managerial services

being subject to tax brackets.

1. Taxes on income and capital gains for nonresident taxpayers

Nonresident taxpayers are subject to tax only on Polish source income and capital gains (including

gains on shares in Polish companies.

The following income of nonresidents is subject to final withholding tax:

dividends at 19%;

interest at 20%;

royalties at 20%;

directors’ remuneration at 20%;

income derived from provision of advisory services, accounting, advertising, data processing,

market research, recruiting and management control services at 20%;

income form independent services at 20

Foreigners carrying on an economic activity in Poland can apply for 19% tax.

2. Taxes on capital

There is no wealth tax. Nonresidents who own immovable property located in Poland are subject

tom real estate tax

.

3. Real Estate Tax

The tax rates, which are fixed by the municipal councils may not exceed:

PLN 0,63 per m

2

for land used in businesses;

PLN 0,31 per m

2

for other land;

PLN 0,52 per m

2

for dwellings

PLN 17,42 per m

2

for buildings used in businesses

PLN 5,62 per m

2

for other buildings;

2% of the value of fixed installations.

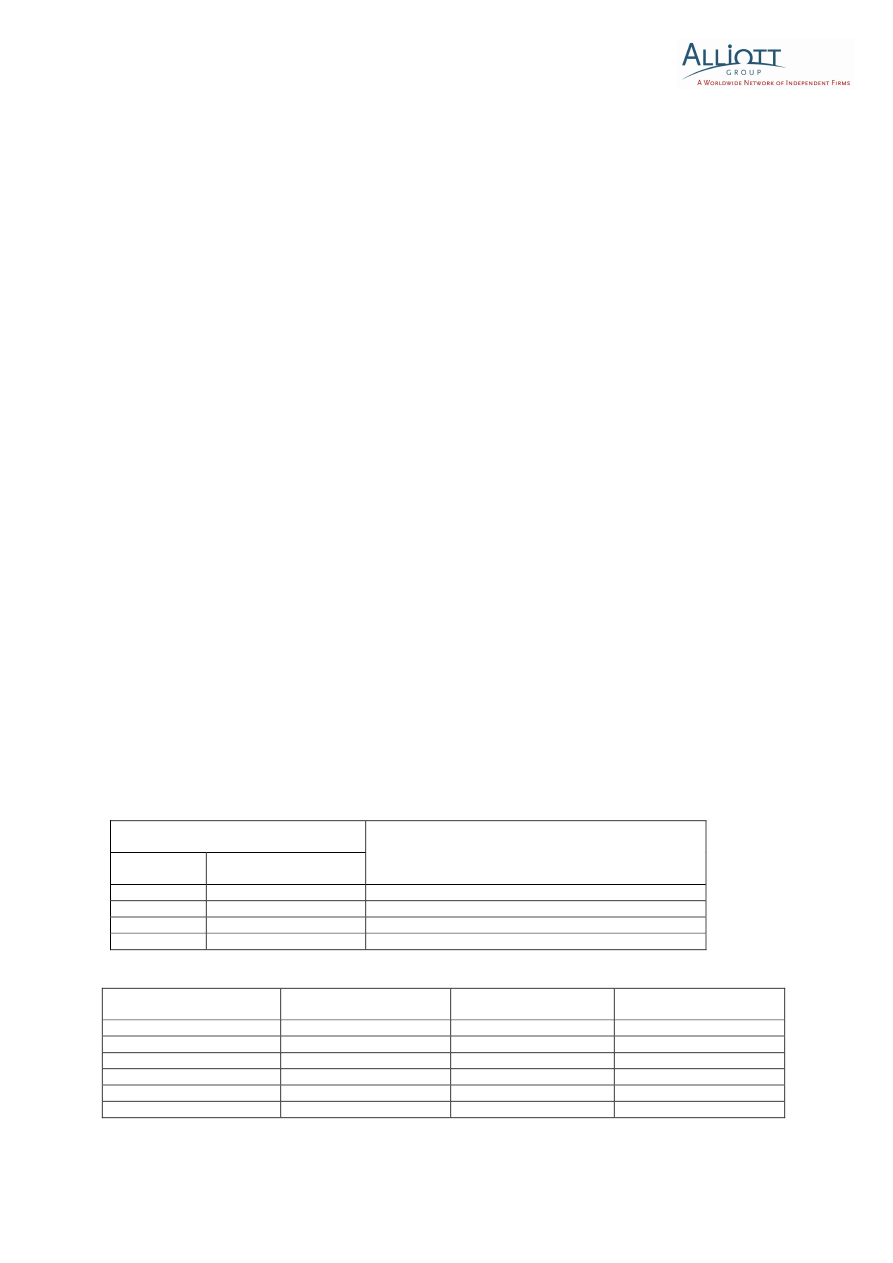

4. Polish brackets

Tax base

in Polish zlotys (PLN)

over

below

Tax amount in zlotys

37,024

19 per cent of the tax base less 530,08

37,024

74,048

6,504.48 plus 30 percent of surplus over 37,024.00

74,048

600,000

17,611.68 plus 40 per cent of surplus over 74,048.00

600,000

227,992.48 plus per cent of surplus over 600,000

5. Social Security Contributions

Social security contribution

Financed by Employer

Financed by Employee

As a percentage of

the tax base in total

Pension

9,76

9,76

19,52

Disability

6,50

6,50

13

Sickness

2,45

2,45

Accident

0,97 – 3,86

0,97 – 3,86

Labour Fund

2,45

2,45

Total

20,64

18,71

39,35

Baltic Accountants and Consultants

STATE AUTHORIZED PUBLIC ACCOUNTANTS

BIURO AUTORYZOWANYCH AUDYTORÓW I KONSULTANTÓW

Kurt Iversen Baltic Accountants and Consultants

Poland 01524 WARSZAWA, Al. Wojska Polskiego 11

Tel; + 48 22 869 06 66, fax: + 48 22 869 06 60

Paweł Trojanek

Page 5 of 5

Wyszukiwarka

Podobne podstrony:

A SURVEY OF UK TAX SYSTEM

Polish tax

Guide to Polish Tax Law Research

the slovakian tax system

What the U S can learn from Polish educational system

DIALOG Polish and British political system docx

PL Planning System in Polish

System finansowy w Polsce 2

Systemy operacyjne

Systemy Baz Danych (cz 1 2)

Współczesne systemy polityczne X

System Warset na GPW w Warszawie

003 zmienne systemowe

elektryczna implementacja systemu binarnego

09 Architektura systemow rozproszonychid 8084 ppt

SYSTEMY EMERYTALNE

więcej podobnych podstron