!"#$%&'(#)*'+#,'#$-./*(0!12!3.0+4#$

#$0+.#+*5!*$value investing$!$growth investing

6./*53./$7!83"#9*4!:/

*

$

+.*0/:/*'!*;$ !"#$# !"!#$%&'()*+*$,!-'$./!01234%12!$-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%$3&%.$*#2!,-93:

42!12!$,!,$4 6!&-6!)'(42!$-'&%'!;22$214!-'34%12%$4 4%&'3<=$>value investing?$3&%.$214!-'34%12%$4!$4.&3-'$

>growth investing?@

%!&'('"')*+#,+(+-*+#$#A6&%934%12!$#%$9B%&%)'!&$#!'3/(9.1($2 -)*62%$-27$1%$4+%<924(#$.&3.*#2!12*$2-'3'($

-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%@$C %&'()*"!$4()3&.(-'%13$)&('(9.1D$%1%"2.7$"2'!&%'*&($3&%.$#!'3/($%1%:

"2.(E$-(1'!.($2 63&F41%GE$,%)$&F412!H$4123-)34%12%$6&.!.$%1%"3;27@$

./-*0#I$C(12)2!#$%&'()*+*$,!-'$6&.!/-'%42!12!$/!0129,2$-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%$3&%.$*#2!,:

-9342!12!$,!,$4 )31'!)<92!$-'3-34%1(9B$1%$&(1)*$-'&%'!;22$214!-'34%12%$4 4%&'3<=$2 4!$4.&3-'@

12/)*-+"-'3456+2&'34# I$ A&(;21%"13<=$ 36&%934%12%$ 6&.!,%42%$ -27$ 4 %*'3&-)2!,$ /!0129,2$ -2+($ 5*1/%#!1'%"1!,$

6&.!/-27823&-'4%$3&%.$6&.!+3H!12*$,!,$1%$6&39!-$214!-'(9(,1(@

"34#$8,&:/34*;$-2+%$5*1/%#!1'%"1%$6&.!/-27823&-'4%E$4%&'3<=$4!417'&.1%E$J%"*!$21J!-'21;E$;&34'B$21J!:

-'21;E$;&34'B$%'$&!%-31%8"!$6&29!$>KLMN?$

<-.34#(/*'!*

O2+%$ 5*1/%#!1'%"1%$ 6&.!/-27823&-'4%$ '3$ '!$ 634-.!9B12!$ *H(4%1($ 6&.!.$ %1%"2'()F4E$

214!-'3&F4E$% '%)H!$8%/%9.($%)%/!#29)29B$.%,#*,D9(9B$-27$214!-'(9,%#2$1%$&(1)*$)%62'%:

+34(#@$N3#2#3$'!,$636*"%&13<92E$'&*/13$,!-'$.1%"!P=$4 "2'!&%'*&.!$/!52129,7$'!;3$'!*E$

93$ 6&34%/.2$ /3$ 6&.(62-(4%12%$ #*$ 42!"*$ .1%9.!G$ "*8$ '!H$ '&%)'34%12%$ ;3$ ,%)3$ -432-'!;3$

-"3;%1*E$8!.$6&.(42D.(4%12%$427)-.!,$4%;2$/3$'!;3E$93$-27$63/$12#$)&(,!@

C&%.$. &3.43,!#$&(1)F4$)%62'%+34(9BE$%1%"2.($5*1/%#!1'%"1!,$2 ,!,$1%&.7/.2$3&%.$'%:

)29B$ )319!69,2$ .%&.D/.%12%E$ ,%)$ 7+"8!# ,+9!(# :+-+)!:!-&E$ 93&%.$ 8%&/.2!,$ *42/%9.12%$ -27$

6&38"!#$8&%)*$9.('!"1!,$/!52129,2$-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%E$% 93$.%$'(#$2/.2!E$

'&*/13<=$4 2/!1'(52)%9,2$)"*9.34(9B$-5!&$2 9.(112)F4E$4 ,%)29B$-27$31%$38,%42%@

!"!#$%&'()*+*$,!-'$.%'!#$4(6!+12!12!$'!,$"*)2$2 ./!521234%12!$63,792%$-2+($5*1/%#!1:

'%"1!,$6&.!/-27823&-'4%E$% 631%/'3$*#2!,-9342!12!$)319!69,2$-2+($5*1/%#!1'%"1!,$4 )31:

'!)<92!$ -'&%'!;22$ 214!-'34%12%$ 4 4%&'3<=$ >value investing?$ 3&%.$ 214!-'34%12%$ 4!$ 4.&3-'$

>growth investing?@

!" #$#%&'()*+!%(&,+!-"#$!$(%" . !.,/"),!0*%12%345

Finanse, Rynki Finansowe, Ubezpieczenia nr 67 (2014)

-@$QRSIQQS

*

/&$K&.!;3&.$T2)3+%,!429.E$U%'!/&%$ 31'&3""21;*E$L1%"2.($V21%1-34!,$2$C(9!1(E$W124!&-('!'$X)313#29.1($4$N3:

.1%12*E$!:#%2"Y$;@#2)3"%,!429.Z*!@63.1%1@6"@

QR[

;2<!)'2<#%*0'=+>!6*?<

=>$$?3(4#,!'@$-391:!#$0!"@$%&'(#)*'+#,'*9

K!1!.($634-'%12%$63,792%$-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%$*6%'&(4%=$1%"!H($4 ana:

"2.2!$5*1/%#!1'%"1!,

\

E$',@$4-.!9B-'&311!,$%1%"2.2!$#%)&3:$3&%.$#2)&33'39.!12%$63+D9.31!,$

z %1%"2.D$417'&.%$4(8&%1!,$-6F+)2E$#%,D9!,$1%$9!"*$4(9!17$6&.!/#23'*$%1%"2.($2 -53&#*+3:

4%12!$&!)3#!1/%9,2$214!-'(9(,1!,

R

@$]%)3$B3&(.31'$9.%-34($6&.(,#34%1($,!-'$1%$3;F+$3)&!-$

<&!/123:$2 /+*;3'!ࡖ(E$6&.($9.(#$12!$,!-'$31$,!/13.1%9.12!$-6&!9(.34%1(@

L1%"2.%$ 5*1/%#!1'%"1%$ *#3H"242%$ #312'3&34%12!$ 2 )"%-(52)34%12!$ %)'(4F4$ 63/$

4.;"7/!#$29B$,%)3<92$214!-'(9(,1!,$2 #3H"24!,$/3$3-2D;12792%$-'36($.4&3'*$>M2'9B2!$\^^SY$

\^E$ Q\?@$ !"!#$ %1%"2.($ 5*1/%#!1'%"1!,$ ,!-'$ 3)&!<"!12!$ 6&%4/.24!,E$ 4!417'&.1!,$ >12!3/:

+D9.1!,?$4%&'3<92$4%"3&*E$8($4 4(6%/)*$,!,$3/82!;%12%$3/$9!1($&(1)34!,$>% 4279$12!/3:

4%&'3<9234%12%$"*8$6&.!4%&'3<9234%12%?$4()3&.(-'%=$'7$42!/.7$2 63/,D=$/!9(.,7$3 )*612!$

"*8$-6&.!/%H($/%1!;3$%)'(4%@$C(-'7634%12!$&FH129($#27/.($4!417'&.1D$4%&'3<92D$%)9,2$

a ,!,$ 9!1D$ &(1)34D$ ,!-'$ 4279$ /"%$ 214!-'3&%$ -(;1%+!#$ /3$ 63/,792%$ /!9(.,2$ 214!-'(9(,1!,@$

U*634%12!$63$9!1%9B$12H-.(9B$3/$4%&'3<92$4!417'&.1!,$-'%1342$/"%$214!-'3&%$#%&;21!-$

8!.62!9.!G-'4%$>:+2)*-#'@#9+@!&/?$>K&%B%#E$_3//$R``^Y$QSRIQSa?@$L1%"2.%$5*1/%#!1'%"1%$

12!$4()"*9.%$#3H"243<92$)*61%$4%"3&*$4 -('*%9,2E$;/($,!;3$9!1%$&F41%$-27$4%&'3<92$4!:

417'&.1!,@$C '%)2#$6&.(6%/)*$214!-'3&$12!$634212!1$,!/1%)$39.!)24%=$*.(-)%12%$631%/:

6&.!927'1!,$-'36($.4&3'*@$b /&*;2!,$-'&31($4%&'3$6%#27'%=E$H!$1%4!'$.%$8%&/.3$/38&D$-6F+)7$

12!$4%&'3$6&.!6+%9%=@

L1%"2.7$5*1/%#!1'%"1D$9!9B*,!$36'(#2.#$63.1%49.(E$% 4279$6&.!)31%12!$3 #3H"243:

<92$ 63.1%12%$ #!9B%12.#F4$ 2 9.(112)F4$ )-.'%+'*,D9(9B$ 4%&'3<=$ 6&.!/-27823&-'4%@$ c%)2!$

63/!,<92!$8(4%$9.7-'3$)&('()34%1!$.!$4.;"7/*$1%$2-'12!12!$12!-)3G9.31!,$"29.8($9.(112:

)F4E$)'F&!$#3;D$3//.2%+(4%=$1%$4%&'3<=$6&.!/-27823&-'4%$3&%.$6!&9!69(,1!$3;&%129.!12%$

%1%"2'()F4E$214!-'3&F4@$U&('(9($%1%"2.($5*1/%#!1'%"1!,$4(#2!12%,D$'%)H!$4<&F/$,!,$-+%:

8(9B$-'&31$38%4($93$/3$42%&(;3/13<92E$,%)3<92$2 %)'*%"13<92$4()3&.(-'(4%1(9B$/%1(9BE$

'&*/13<92$4 6&.(62-%12*$4+%<924!,$4%;2$63-.9.!;F"1(#$9.(112)3#E$)3#6!'!19,!$%1%"2'(:

)F4E$3;&%129.31D$9.%-343$4%H13<=$6&3;13.$2 &!)3#!1/%9,2E$1%/#2!&1D$42%&7$4 '3E$H!$&(:

1!)$/3-'&.!H!$4%&'3<=$4!417'&.1DE$12!#3H"24($/3$*9B4(9!12%$46+(4$./%&.!G$"3-34(9BE$

219(/!1'%"1(9B$3&%.$8&%)$4-)%.%G$93$/3$9.%-*$)*61%d-6&.!/%H($> 3-'%$R```?@

C(H!,$4(#2!1231!$)4!-'2!$12!$6&.!)&!<"%,D$,!/1%)$4!/+*;$%*'3&%$%&'()*+*$*H('!9.13:

<92$%1%"2.($5*1/%#!1'%"1!,$4 6&39!-2!$214!-'(9(,1(#@$N3#2#3$2H$12!$/%$-27$6&.!%1%"2.3:

4%=$46+(4*$4-.(-')29B$9.(112)F4$1%$4%&'3<=$5*1/%#!1'%"1D$6&.!/-27823&-'4%E$% nasza

6!&9!69,%$63/"!;%$3;&%129.!123#E$12!$3.1%9.%$'3E$H!$%1%"2.%$'%)%$,!-'$8!.9!"34%$2 powinno

\$

e2!)'F&.($%*'3&.($>16@$c%&9.(G-)%:f*12!4-)%$R`\QY$QgE$Q[?$-D$./%12%E$H!$'!$'!1$4(43/.2$-27$4$427)-.(#$

-'3612*$.$%1%"2.($/.2%+%"13<92$6&.!/-27823&-'4%$"*8E$4$47H-.(#$*,792*E$%1%"2.($01%1-34!,$6&.!/-27823&-'4%E$)'F&!$

"!HD$*$63/-'%4$%1%"2.($5*1/%#!1'%"1!,@$C(/%,!$-27$,!/1%)E$H!$6&.(63&.D/)34%12!$'!;3$'!*$/3$/4F9B$62!&4:

-.(9B$&3/.%,F4$%1%"2.$6343/*,!$*'&%'7$'&!<92E$,%)D$31$.$-38D$12!-2!E$%$#2%134292!$*'&%'7$.$B3&(.31'*$%1%"2.($8%&/.3$

2-'3'1!,$)4!-'22E$,%)D$,!-'$4%&'3<=$63/#23'*@

R$

C$.%"!H13<92$3/$)2!&*1)*$%1%"2.($>#%)&33'39.!12!$h$#2)&33'39.!12!$h$-6F+)%$"*8$1%$3/4&F'?$4(&FH12=$

#3H1%$/4%$63/!,<92%$4$%1%"2.2!$5*1/%#!1'%"1!,Y$AB #@2+:!6'20$>!?'-':/C#*-(89&2/C#?':D+-/?E$'.4@$63/!,<92!$topE

E('6-$3&%.$ BA#@2+:!6'20$>?':D+-/C#*-(89&2/C#!?'-':/?E$'.4@$63/!,<92!$,'&&':E8D@

QR^

F*=+#@8-(+:!-&+"-+#D2<!(9*G,*'29&6+#+ strategie value investing i growth investing

-27$,!,$.%12!9B%=@$]*H$8342!#$-%#$6&39!-$%1%"2.(E$"3;29.1!;3$&3.823&*$63;+782%$1%-.D$42!:

/.7$4 .%)&!-2!$-('*%9,2$6&.!/-27823&-'4%E$% 93$.%$'(#$2/.2!E$.#12!,-.%$1%-.$12!63)F,$2 do:

-'%&9.%$#!&('3&(9.1(9B$6&.!-+%1!)$/3$63/,792%$/!9(.,2@

T(<"$ 3 6&!9(.(,1(#$ 3)&!<"!12*$ 4%&'3<92$ 4!417'&.1!,$ 6&.!/-27823&-'4%$ 12!$ 634211%$

6%&%"2H34%=$/.2%+%G$214!-'3&F4@$]%)$-'42!&/.%$]@ @$M2'9B2!$>\^^SY$QR?Y$i1%"!H($./%4%=$-3:

82!$ -6&%47E$ H!$ 4 4%&*1)%9B$ 12!6!413<92$ -.%9*1)2$ 4%&'3<92$ 4!417'&.1(9B$ 12;/($ 12!$ -D$

-'*6&39!1'343$6&!9(.(,1!@$O'%1342D$31!$'(")3$6*1)'$3/12!-2!12%E$4.;"7/!#$)'F&!;3$39!:

12%$-27$%)'*%"1!$9!1($4 <42!'"!$39.!)24%1(9B$6&.(-.+(9B$4%&*1)F4$;3-63/%&9.(9B$3&%.$

211(9B$4(/%&.!Gj@$k14!-'3&.($63&*-.%,D$-27$&%9.!,$4 6!41(9B$6&.!/.2%+%9B$4%&'3<92$12H$

63-.*)*,D$'!,$,!/1!,E$)31)&!'1!,$>K&%B%#E$_3//$R``^Y$l[E$gg?

Q

@

MF412!H$#3#!1'$)*61%d-6&.!/%H($12!$634212!1$3/;&(4%=$'%)$/*H!,$&3"2E$,%)%$,!-'$#*$

6&.(62-(4%1%$6&.!.$12!)'F&(9B$214!-'3&F4@$]%)$-'42!&/.%,D$m@$K&%B%#$2 _@n@$_3//$>K&%:

B%#$R``SY$\S^I\[Ro$K&%B%#E$_3//$R``^Y$QlIQa?E$.%#2%-'$#F42=$3 )*634%12*E$-6&.!/%4%:

12*$9.!;3<$4 3/6342!/12#$9.%-2!$>'.4@$#!'3/%$3)&!<"%12%$9.%-*?E$"!62!,$#F42=$3 )*634%12*E$

-6&.!/%4%12*$9.!;3<$63$4+%<924!,$9!12!$>#!'3/%$3)&!<"%12%$9!1(?@$C+%<924!$.%-'3-34%12!$

)319!69,2$214!-'34%12%$36%&'!,$1%$%1%"2.2!$5*1/%#!1'%"1!,$6342113$8342!#$.%6!412=$21:

4!-'3&342$39B&317$6&.!/$12!-63/.2!4%1(#2$./%&.!12%#2@$M3"7$8*53&%$6!+12$'*$4-63#12%1($

,*H$49.!<12!,$#%&;21!-$8!.62!9.!G-'4%$>*,!#1%$&FH129%$#27/.($.%6+%931D$9!1D$% 4%&'3<92D$

4!417'&.1D$4%"3&*?@$]!<"2$4279$1%4!'$214!-'(9,%$3)%H!$-27$#12!,$%'&%)9(,1%E$634211%$1%/%"$

.%6!412=$214!-'3&342$-%'(-5%)9,31*,D9($/39BF/$>K&%B%#E$_3//$R``^Y$S`QIS`l?@

N3/-'%4D$ 4123-)34%12%$ 4 &%#%9B$ %1%"2.($ 5*1/%#!1'%"1!,$ ,!-'$ 6&.!)31%12!$ 3 2-'12!:

12*$ -2"1(9B$ .42D.)F4$ 6&.(9.(1343:-)*')34(9B$ 63#27/.($ -('*%9,D$ !)313#29.1D$ -6F+:

)2$% 9!1D$,!,$%)9,2@$c%$62!&4-.%$#%$-43,!$P&F/+3$4 *4%&*1)34%12%9B$4!417'&.1(9BE$,%)$

i .!417'&.1(9B$/.2%+%"13<92$6&.!/-27823&-'4%$>-D$31!$.#2!11!E$4 .42D.)*$. 9.(#$.#2%12!$

*"!;%$'%)H!$4%&'3<=$4!417'&.1%?E$'%$/&*;%$>9!1%$&(1)34%?$634211%$#3H"242!$1%,6!+12!,$

3/.42!&92!/"%=$.#2%1($4%&'3<92$4!417'&.1!,@$M!%)9,%$9!1$&(1)34(9B$634211%$8(=$-.(8:

)%$2 %/!)4%'1%E$8!.$6FP12!,-.(9B$)3&!)'$-6343/34%1(9B$639.D')34D$6&.!-%/1D$"*8$.8('$

#%+D$.#2%1D$4%&'3<92$4%"3&*@$O'362!GE$%/!)4%'13<=$3&%.$-.(8)3<=E$. ,%)D$&(1!)$)%62'%+3:

4($*4.;"7/12%$2153&#%9,!$2 .#2%1($4%&'3<92$4!417'&.1!,$4 9!1%9B$%)9,2E$*.%"!H1231!$-D$

3/$,!;3$!5!)'(413<92

l

@

L1%"2.*,D9$ )4!-'27$ !5!)'(413<92$ &(1)F4$ 521%1-34(9B$ 2 -)*'!9.13<92$ %1%"2.($ 5*1:

/%#!1'%"1!,E$ /3)31*,!$ -27$ 9.7-'3$ .8('12!;3$ *6&3-.9.!12%E$ 3;&%129.%,D9$ ,D$ 4(+D9.12!$ /3$

!5!)'(413<92$&(1)F4$;2!+/34(9B

a

@$c3$2#$8342!#$4 6&.!4%H%,D9!,$#2!&.!$63<427931!$-D$

Q$

]%)$-'42!&/.%,D$m@$K&%B%#$2$_@n@$_3//E$8%&/.3$#3H"24!E$H!$*/%$1%#$-27$39!12=E$9.($)382!'%$,!-'$4(-'%&9.%:

,D93$/3&3-+%E$%8($#F9$;+3-34%=E$63#2#3$H!$12!$.1%#($,!,$42!)*E$9.($'!HE$H!$/%1($#7H9.(.1%$,!-'$927H-.($12H$8(=$

634212!1E$8!.$63.1%12%$,!;3$/3)+%/1!,$4%;2@

l$

C279!,$2153&#%9,2$1%$'!1$'!#%'$.1%"!P=$#3H1%$4Y$T2)3+%,!429.$>R`\`?@

a$

_.2!,!$ -27$ '%)E$ 6312!4%H$ &(1!)$ ;2!+/34($ 63-2%/%$ 9B%&%)'!&(-'()2E$ )'F&!$ -6&.(,%,D$ 3-2D;%12*$ !5!)'(413<92$

2153&#%9(,1!,@$b%"29.(=$/3$129B$#3H1%Y$4(-'7634%12!$/*H!,$"29.8($6&35!-,31%"1(9B$*9.!-'12)F4E$B3#3;!129.13<=$

6&3/*)'F4$>93$*#3H"242%$63&F41%12%$3&%.$3;&%129.%$46+(4$21/(42/*%"1(9B$;*-'F4$2$6&!5!&!19,2?E$-63-F8$3&;%12:

.%9,2$&(1)*$>&!;*"%9,!E$38342D.)2$2153&#%9(,1!$2'6@?$3&%.$"3-34($1%6+(4$134(9B$42%/3#3<92@

QQ`

;2<!)'2<#%*0'=+>!6*?<

8%/%12%@$L1%"2.%$5*1/%#!1'%"1%E$4 '(#$)319!69,%$-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%E$

.%9B79%$,!/1%)$/3$-.!&-.!,$&!5"!)-,2@$b 6*1)'*$42/.!12%$9%+!,$;3-63/%&)2$2 6&39!-F4$4 12!,$

.%9B3/.D9(9B$>4 '(#$4+%<924!,$4(9!1($6&.!/-27823&-'4$2 %"3)%9,2$)%62'%+*?$2-'3'1!$,!-'E$

%8($/!9(.,!$63/!,#34%1!$6&.!.$*9.!-'12)F4$-.!&3)3$63,7'!;3$&(1)*E$% '%)H!$#!9B%12.#($

1%$12#$5*1)9,31*,D9!E$9B%&%)'!&(.34%+($-27$#3H"24!$/*HD$!5!)'(413<92D$12!.%"!H12!$3/$

#2!,-9%E$1%$,%)2#$'&%1-%)9,!$-D$.%42!&%1!$>&(1!)$6*8"29.1(E$;2!+/34($9.($6&(4%'1(?$2 ,%:

)2!;3$B3&(.31'*$214!-'(9(,1!;3$/3'(9.D@$N3#2#3$8%&/.3$/*H!;3$.%21'!&!-34%12%$214!:

-'3&F4E$%1%"2'()F4E$#!/2F4$!'9@$;2!+/D$2 13'34%1(#2$1%$12!,$-6F+)%#2E$-'%1342$31%$'(")3$

6!42!1$12!42!")2$4(921!)$&.!9.(42-'3<92$;3-63/%&9.!,E$&(1)*$521%1-34!;3E$4 63&F41%12*$

/3$-5!&($%)'(413<92$63.%;2!+/34!,@

A>$$B0+3+#$-391:!#$0!"@$%&'(#)*'+#,'*9

N3#2#3$H!$63,792!$-2+($5*1/%#!1'%"1!,$.1%,/*,!$-27$4 92D;+(#$*H(92*E$12!$/39.!)%+3$-27$

313$/3'(9B9.%-$,!/13"2'!,$2 634-.!9B12!$38342D.*,D9!,$/!52129,2$4 "2'!&%'*&.!@$c%)E$,%)$9.7:

-'!$,!-'$,!;3$*H(92!E$'%)$'!H$42!"!$.1%9.!G$,!-'$#*$6&.(62-(4%1(9BE$1%$3;F+$4 38&782!$63,7=$

639B3/.D9(9B$. .%)&!-*$%1%"2.($521%1-34!,@$C 6&.!4%H%,D9!,$427)-.3<92$6&.(6%/)F4$'!&:

#21$'!1$12!$,!-'$4(,%<12%1($4 3;F"!

g

@

B9D9$ ./!521234%=$ -2+7$ 5*1/%#!1'%"1D$ 6&.!/-27823&-'4%E$ 1%"!H($ /3)31%=$ %1%"2.($ -!:

#%1'(9.1!,$ '!;3$ '!*@$ O2+%$ '3$ #2%&%$ 3//.2%+(4%12%$ 92%+$ #%'!&2%"1(9B$ >eXN$ R``l?@$

W *)+%/%9B$92%+$&3.&FH12=$#3H1%$-2+($4!417'&.1!E$.42D.%1!$. 4.%,!#1(#$3//.2%+(4%:

12!#$63-.9.!;F"1(9B$9.7<92$*)+%/F4$3&%.$-2+($.!417'&.1!E$639B3/.D9!$3/$92%+$.!417'&.:

1(9B@$ O2+%$ '3$ '%)H!$ ./3"13<=$ /3$ /.2%+%12%E$ #3H13<=$ 63/3+%12%$ 9.!#*<E$ #39$ >O]N$ \^^^?@$

Z )3"!2$5*1/%#!1'%"1(E$'3$-'%1342D9($63/-'%47$9.!;3<E$.%-%/129.(E$63/-'%434(E$;+F41($

>O]N$ R`\l?@$ N&.!)+%/%,D9$ '3$ 1%$ 4%&*1)2$ 5*1)9,3134%12%$ 6&.!/-27823&-'4%$ #3H1%$ 6342!:

/.2!=E$H!$-2+%$5*1/%#!1'%"1%$6&.!/-27823&-'4%$4(6+(4%$. 63'!19,%+*$4!417'&.1!;3$>;!:

1!&34%1(9B$6&.!6+(4F4E$63-2%/%1(9B$%)'(4F4$I$#%'!&2%"1(9B$2 12!#%'!&2%"1(9BE$29B$3&:

;%12.%9,2$3&%.$4.%,!#1!;3$3//.2%+(4%12%?$3&%.$63'!19,%+*$.!417'&.1!;3$>4(-'76*,D9(9B$

w 3'39.!12*$-.%1-d.%;&3H!G$2 *#2!,7'13<92$29B$4()3&.(-'%12%d#212#%"2.34%12%?$2 38,%42%$

-27$4 ./3"13<92$63/#23'*$/3$5*1)9,3134%12%$2 &3.43,*@$m23&D9$63/$*4%;7E$H!$63,792!$'3$

#%$8"2-)2$.42D.!)$. %1%"2.D$5*1/%#!1'%"1DE$6342113$&3.6%'&(4%=$-27$,!$4 )31'!)<92!$

4%&'3<92$4!417'&.1!,$63/#23'*@$

g$

N&.()+%/343$C@$c%&9.(G-)2$>R``RY$^RE$\`RE$\`^?$*H(4%$'!*$-2+%$5*1/%#!1'%"1%E$,!/1%)H!$.%62-*,!$;3$

12!)2!/($4$9*/.(-+342!$3&%.$6&.(&F41*,!$/3$63,792%$-2+($!)313#29.13:01%1-34!,@$C(,D')2!#$,!-'$'*$6&%9%$T@$c%&:

9.(G-)2!,:f*12!4-)2!,$ >R`\QY$ lQ?E$ ;/.2!$ -2+%$ 5*1/%#!1'%"1%$ /!01234%1%$ ,!-'$ 46&3-'$ ,%)3$ -*#%&(9.1%$ )%'!;3&2%$

39!1($ 63/#23'*$ /3)31%1%$ 6&.!.$ 6&(.#%'$ -5!&$ 2$ !'%6F4$ %1%"2.($ 5*1/%#!1'%"1!,$ >4$ -.!&-.(#$ *,792*$ 38!,#*,D9%$

'%)H!$6&39!-$4(9!1($2$4%&'3<=$4!417'&.1D$6&.!/-27823&-'4%?$"*8$'!H$,%)3$)%'!;3&2%$*'3H-%#2%1%$.$39!1D$)31/(9,2$

!)313#29.13:01%1-34!,$63/#23'*@$C(/%,!$-27E$H!$/!0129,%$'%$8%&/.2!,$12H$2-'3'7$-2+($5*1/%#!1'%"1!,E$%)9!1'*,!$

-%#$6&39!-$,!,$%1%"2.($>',@$!'%6($%1%"2.($5*1/%#!1'%"1!,?$"*8E$93$.&3.*#2%+!$.!$4.;"7/F4$36!&%9(,1(9BE$.%47H%$'3$

63,792!$/3$39!1($!)313#29.13:01%1-34!,$63/#23'*@

QQ\

F*=+#@8-(+:!-&+"-+#D2<!(9*G,*'29&6+#+ strategie value investing i growth investing

O2+7$5*1/%#!1'%"1D$6&.!/-27823&-'4%$1%"!H($.%'!#$./!521234%=$,%)3$63'!19,%+$6&.!/-27:

823&-'4%$/3$'43&.!12%$2 39B&31($,!;3$4%&'3<92$4!417'&.1!,@

W /!52129,2$'!,$)"*9.34!$,!-'$63/)&!<"!12!$4%;2Y

I 4%&'3<92$4!417'&.1!,E$,%)3$*124!&-%"1!,$)%'!;3&22$4%&'3<92E$4(12)%,D9!,$8!.63<&!/:

nio z &.!9.(42-'!,$./3"13<92$4(9!12%1(9B$%)'(4F4$/3$;!1!&34%12%$/39B3/F4E$8%.*:

,D9!,$1%$29B$9B%&%)'!&(-'()%9B$4!417'&.1(9B$2 63'!19,%"!$/3$4.&3-'*E$%8-'&%B*,D9!,$3/$

46+(4*$3)&!<"31!;3$214!-'3&%$9.($'!H$82!HD9(9B$4%&*1)F4$1%$&(1)*$)%62'%+34(#E

I 63'!19,%+*$/3$'43&.!12%$4%&'3<92$4!417'&.1!,E$)'F&($634212!1$6&.!+3H(=$-27$4 /+*;2#$

3)&!-2!$1%$4.&3-'$4%&'3<92$&(1)34!,$6&.!/-27823&-'4%E

I )312!9.13<92$ 39B&31($ 4%&'3<92E$ % 4279$ %1%"2.34%12%$ '%)H!$ )4!-'22$ 8!.62!9.!G-'4%$

5*1)9,3134%12%$63/#23'*E$,!;3$4(6+%9%"13<92E$-'%82"13<92$01%1-34!,E$./3"13<92$%/%:

6'%9,2$/3$.#2!12%,D9(9B$-27$4%&*1)F4$4 3'39.!12*$!'9@

b%)+%/%$ -27$ 6&.($ '(#E$ H!$ '3$ 4%&'3<=$ 4!417'&.1%$ ,!-'$ 62!&43'1%$ 4 -'3-*1)*$ /3$ 9!1($

&(1)34!,$%)9,2$I$'3$4%&'3<=$4!417'&.1%$)-.'%+'*,!$8342!#$9!1($&(1)34!E$% 12!$1%$3/4&F'@$

]!<"2$4(-'76*,!$-6&.7H!12!$.4&3'1!$#27/.($4%&'3<92D$4!417'&.1D$% 4%&'3<92D$&(1)34DE$'3$

#%$313$9B%&%)'!&$4'F&1(@$C%&'3<=$4!417'&.1%$2-'12!,!$8!.$4.;"7/*$1%$5%)'$9.($4 /%1!,$

)"%-2!$%)'(4F4$#3H1%$#F42=$3 2-'12!12*$4%&'3<92$&(1)34(9BE$9.($'!H$12!@$N31%/'3$4-.!":

)2!$/+*;3'&4%+!$2 -2"1!$3/!&4%12!$4%&'3<92$&(1)34!,$3/$4%&'3<92$4!417'&.1!,$6&34%/.2$

49.!<12!,$"*8$6FP12!,$/3$)3&!)'($2 634&3'*$4 3)3"29!$'!,$/&*;2!,@$c(#$-%#(#E$-2+%$5*1/%:

#!1'%"1%$12!$634211%$8(=$.%-%/129.3$&3.6%'&(4%1%$6&.!.$6&(.#%'$9!1($&(1)34!,$%)9,2E$

'(#$8%&/.2!,E$H!$1%$'7$3-'%'12D$46+(4%,D$'%)H!$211!$9.(112)2$12H$5*1/%#!1'%"1!@

N3,792%$9!1%$2 4%&'3<=$12!$#*-.D$8(=$-382!$'3H-%#!E$#2#3$2H$9.7-'3$8(4%,D$*H(4%1!$

,%)3$-(1312#($>]%)2$R``[Y$RaIRg?Y

I 9!1%$)-.'%+'*,!$-27$8342!#$4 4(12)*$1!;39,%9,2$#27/.($)*6*,D9(#$2 -6&.!/%,D9(#E$

a 4279$ ,!-'$ 9.7-'3$ 4(12)2!#$ )3#6&3#2-*E$ )'F&($ 3//%"%$ ,D$ 3/$ 4%&'3<92$ "!HD9!,$ * ,!,$

63/-'%4(E

I 4%&*1)2$ '&%1-%)9,2$ 38!,#*,D$ '%)H!$ 42!"!$ 9.(112)F4$ 12!.42D.%1(9B$ 8!.63<&!/123$

z 4%&'3<92D$%)'(4F4$>16@$.38342D.%12%$1%8(49F4?E

I 9!1%$3/13-2$-27$8!.63<&!/123$/3$-('*%9,2$.#2%1($-'3-*1)F4$4+%-13<9234(9BE$63/9.%-$

;/($4%&'3<=$#%$-.!&-.($.%)&!-$>3)&!<"%$-27$,D$. 42!"*$211(9B$4.;"7/F4E$16@$1%$63'&.!:

8($.%&.D/.%12%?E

I 1%$ 9!17$ 4(42!&%,D$ 46+(4$ '%)H!$ '%)2!$ 9.(112)2E$ ,%)Y$ &!"%9,%$ 636('*$ /3$ 63/%H(E$ -2+%$

6&.!'%&;34%$-'&31$3&%.$6&.(,7'%$6&.!.$12!$-'&%'!;2%$214!-'(9(,1%@

N3/381!$&3.&FH12!12!$#3H1%$.1%"!P=$&F412!H$4 T27/.(1%&3/34(9B$O'%1/%&/%9B$C(:

9!1($>TOC$R`\\Y$R[E$6)'$S?E$',Y$i !1%E$'3$'!$3.1%9.%,D9($)43'7$HD/%1DE$35!&34%1D$"*8$

6+%931D$4 .%#2%1$.%$-)+%/12)$%)'(4F4@$b 6343/*$#3H"243<92$521%1-34(9BE$#3'(4%9,2$

"*8$-.9.!;F"1!;3$.%21'!&!-34%12%$)31)&!'1!;3$)*6*,D9!;3$2d"*8$-6&.!/%49(E$9!1%$6+%93:

1%$.%$%)'(4%$#3H!E$%"!$12!$#*-2E$3/.42!&92!/"%=$4%&'3<=E$)'F&%$#3;+%8($8(=$6&.(62-%1%$

-)+%/12)342$%)'(4F4$6&.!.$211(9Bj@

QQR

;2<!)'2<#%*0'=+>!6*?<

Z '(9B$ '!H$ 6343/F4$ 39!1%$ -2+($ 5*1/%#!1'%"1!,$ 634211%$ 3/8(4%=$ -27$ 4+%<12!$ 6&.!.$

6&(.#%'$4%&'3<92$4!417'&.1!,@$N&.(,792!$6!&-6!)'(4($4%&'3<92$4!417'&.1!,$#%$'%)H!$'7$

.%"!'7E$H!$12!$*)2!&*1)34*,!$&3.4%H%G$'(")3$1%$-6F+)2$13'34%1!$1%$;2!+/.2!E$%"!$63.4%"%$1%$

&3.-.!&.!12!$&!5"!)-,2$'%)H!$1%$-6F+)2$2 '&%1-%)9,!$63.%$.3&;%12.34%1(#$38&3'!#@

U319!69,%$ -2+($ 5*1/%#!1'%"1!,$ 6&.!/-27823&-'4%$ '43&.($ )31'21**#$ >63&@$ &(-@$ \?$ 63:

6&.!.

S

Y

I 2/!1'(0)%9,7$P&F/!+$2 9.(112)F4$4%&'3<92$4!417'&.1!,$6&.!/-27823&-'4%E

I 39!17$'43&.!12%$4%&'3<92$2 63'!19,%+*$/3$4.&3-'*E

I %1%"2.7$)4!-'22$39B&31($4%&'3<92@

C43./*'!*$

!"#$%&'$

D:E.3'#$

!"#$%&'$

B(*'+@%!8#:9#$

(")*+,-'-&./00'1) -

4#.#$%&'$

F@0&'*8$=>$

c&.($%-6!)'($-2+($5*1/%#!1'%"1!,$6&.!/-27823&-'4%$I$)31'21**#

p&F/+3Y$36&%934%12!$4+%-1!@

V%)'$4('43&.!12%$2 *'&.(#%12%$4%&'3<92$6&.!.$6&.!/-27823&-'43$12!$6&.!-D/.%$,!-.9.!$

o '(#E$2H$214!-'3&.($3/123-D$. '!;3$'('*+*$)3&.(<92@$m($'%)$-27$-'%+3E$63'&.!81%$,!-'$,!-.9.!$

4+%<924%$)3#*12)%9,%$6&.!/-27823&-'4%$. &(1)2!#E$%8($#F;+$31$'7$4%&'3<=$4+%<9242!$&3.:

63.1%=@

Z '!;3$6*1)'*$42/.!12%$#3H1%$4(&FH12=$/4%$4(#2%&($-2+($5*1/%#!1'%"1!,Y

I 382!)'(41(E$ &.!9.(42-'(E$ 4(12)%,D9($ . 63'!19,%+*$ 6&.!/-27823&-'4%$ /3$ '43&.!12%$

i 39B&31($4%&'3<92$4!417'&.1!,E

I %1'(9(634%1($6&.!.$&(1!)E$87/D9!,$38&%.!#$-6F+)2$4 39.%9B$214!-'3&F4$2 %1%"2'(:

)F4E$3892DH31!,$12!6!413<92D$>9.7-'3$8&%)$#3H"243<92$.4!&(0)34%12%$/%1(9B?$3&%.$

3;&%129.!12%#2$>)4!-'2%$63.1%49.%E$6!&9!69,%$214!-'3&F4E$/3-'7613<=$/%1(9BE$-.*#$

2153&#%9(,1(E$%-(#!'&2%$2153&#%9,2?@

S$

N3/381!$63/!,<92!$6&.!/-'%42%,D$'%)H!$L@$m"%9)E$N@$C&2;B'E$]@X@$m%9B#%1

$>R```Y$[QI[S?

@$

C(&FH12%,D$312$'&.($5%.($4$.%&.D/.%12*$4%&'3<92DY$,!,$'43&.!12!$>%$4279$3-2D;%12!$.4&3'*$.$

.%214!-'34%1!;3$)%62'%+*$634(H!,$,!;3$)3-.'*?E$*'&.(#(4%12!$>62"134%12!

E

$8($4('43&.31%$

4%&'3<=$ 12!$ .3-'%+%$ *'&%931%E$ .#12!,-.31%$ 6&.!.$ .+!$ ;3-63/%&34%12!E$ 16@$ .%&.D/.%12!$ &(.(:

)2!#E$)%62'%+!#$21'!"!)'*%"1(#$2'6@?$3&%.$&!%"2.%9,7$>4.&3-'$4%&'3<92$%)9,2$2$.42D.%1!$.$'(#$

.(-)2$)%62'%+34!$"*8$4(6+%'($/(42/!1/(?@$U4!-'2%$&!%"2.%9,2$4%&'3<92$12!$,!-'$382!)'!#$.%:

21'!&!-34%12%$ .$ 6*1)'*$ 42/.!12%$ )319!69,2$ -2+($ 5*1/%#!1'%"1!,@$ c%$ 3-'%'12%$ .%'&.(#*,!$ -27$

8342!#$1%$)4!-'22$'43&.!12%$2$*'&.(#(4%12%$4%&'3<92E$)+%/D9$;+F41($1%92-)$1%$2/!1'(0)%9,7$

)"*9.34(9B$9.(112)F4$4%&'3<92$4!417'&.1!,$6&.!/-27823&-'4%@

QQQ

F*=+#@8-(+:!-&+"-+#D2<!(9*G,*'29&6+#+ strategie value investing i growth investing

G>$$H3':*-:9#$0!"@$%&'(#)*'+#,'*9$'#$+,*$0+.#+*5!!$!'4*0+34#'!#$$

4$4#.+3IJ$Kvalue investingL$!$!'4*0+34#'!#$4*$4/.30+$Kgrowth investingL

U319!69,7$ -2+($ 5*1/%#!1'%"1!,$ 6&.!/-27823&-'4%$ 4%&'3$ '%)H!$ &3.6%'&.(=$ 6&.!.$ 6&(.#%'$

/4F9B$63/-'%434(9B$-'&%'!;22$214!-'34%12%E$',@$214!-'34%12%$4 -6F+)2$4.&3-'34!$>growth

9&'?09E$growth investing?$3&%.$214!-'34%12%$4 -6F+)2$3 63'!19,%"!$4%&'3<92$>7+"8!#9&'?09E$

value investing?@

b%$-6F+)2$4.&3-'34!$*4%H%$-27$1%$3;F+$-6F+)2$>m!&1-'!21$R``l8o$]2%1;E$U3""!&$R``So$

k1J!-'36!/2%$R`\l9o$O'39)-$R`\l?Y

I o 4(H-.(#$12H$6&.!927'1!$'!#62!$4.&3-'*$6&.(9B3/F4$2 .(-)F4

8

E$3-2D;%,D9!$9.7-'3$

4(12)2$"!6-.!$3/$39.!)24%1(9B

^

E

I o &!"%'(412!$4(-3)29B$4-)%P12)%9B$NdXE$Ndmq$!'9@E

I w 8&%1H%9B$&3.42,%,D9(9B$-27E$)'F&!$-D$4 5%.2!$9()"*$!)313#29.1!;3E$/!#3;&%09.1!;3E

I 12!$4(6+%9%,D9!$/(42/!1/(@

Z )3"!2$ -6F+)2$ 3 63'!19,%"!$ 4%&'3<92E$ '3$ -6F+)2E$ )'F&!$ >m!&1-'!21$ R``l8o$ ]2%1;E$ U3""!&$

R``So$k1J!-'36!/2%$R`\l8o$O'39)-$R`\l?Y

I 9B%&%)'!&(.*,D$-27$4(H-.(#$12H$<&!/12%$63.23#!#$.(-)F4$1%$%)9,7E

I 4(6+%9%,D$4(-3)2!$/(42/!1/(E

I 5*1)9,31*,D$4 /3,&.%+(9B$8&%1H%9BE$%"!$12!)312!9.12!$#3/1(9BE

I -D$ "2/!&%#2$ 4 8&%1H(E$ %"!$ 12!$ -)*62%,D$ 1%$ -382!$ .%21'!&!-34%12%$ 214!-'3&F4E$ -6F+)2$

6&.!9B3/.D9!$ 6&.!,<9234!$ 6&38"!#($ >-6F+)2$ 4(9!12%1!$ 6312H!,$ 29B$ 4%&'3<92$ 5*1/%:

#!1'%"1!,E$12!/34%&'3<9234%1!?E

I 9B%&%)'!&(.*,D$-27$&!"%'(412!$12-)2#2$4-)%P12)%#2$NdXE$Ndmq$!'9@

U"*9.34(#$6('%12!#$3/13-.D9(#$-27$/3$-6F+!)$. 62!&4-.!,$;&*6($,!-'$6('%12!$3 9.%-E$

w ,%)2#$*/%$-27$*'&.(#%=$4(-3)2!$'!#63$4.&3-'*@$]%)$63)%.*,D$8%/%12%$>r%*;!1$\^^^Y$R\E$

l^Ia\o$m!&1-'!21$R``l8Y$[I^o$K&%B%#E$_3//$R``^Y$[Q?E$4 /+*H-.(#$3)&!-2!$8%&/.3$'&*/13$

*'&.(#%=$,!-'$631%/6&.!927'1!$4(12)2@$C ./!9(/34%1!,$427)-.3<92$6&.(6%/)F4$1%-'76*,!$

634&F'$/3$<&!/12!,@$_"%$-6F+!)$. /&*;2!,$;&*6($)"*9.34!$6('%12!$8&.#2Y$,%)$-.(8)3$2 czy

w 3;F"!$/3,/.2!$/3$636&%4($2 3/&!%;34%12%$9!1$1%$&(1)*s

e2!$4(6&%934%13$,!/1!,$*124!&-%"1!,$9B%&%)'!&(-'()2$4(H!,$4(#2!1231(9B$&3/.%,F4$

-6F+!)E$% 6&3-'!$&3.&FH12!12!$#27/.($12#2$,!-'$9.7-'3$12!#3H"24!$>#3;D$4(-'7634%=$!"!:

#!1'($4-6F"1!?@$C(/%,!$-27$,!/1%)E$H!$12!$1%"!H($6&.(62-(4%=$6&.!-%/1!,$4%;2$/3$)&('!:

&2F4$;&*634%12%@$T3H1%$8342!#$.;3/.2=$-27$. ]2%1;$2 U3""!&$>R``SY

\RE$

\a

?E$H!$6&.!/-27823&:

-'4%$2 214!-'3&.($3/12!<"28($427)-.D$)3&.(<=E$;/(8($-)*62"2$-27$1%$!5!)'(413<92$2 4%&'3<92$

5*1/%#!1'%"1!,$63/#23'F4E$% 12!$1%$/3)31(4%12*$*#341(9B$)"%-(52)%9,2@

8

]%)$4-)%.*,!$L@$M%66%63&'$>\^^^Y$R`QIR`l?E$6&.!/-27823&-'4%E$)'F&!$*.(-)*,D$4(12)2$"!6-.!$3/$39.!)24%G$

#3H1%$1%$3;F+$.%"29.(=$/3$,!/1!,$.$-.!<92*$12H!,$4(#2!1231(9B$;&*6E$',@$6&.!/-27823&-'4E$)'F&!Y$/(-631*,D$6&.!4%;D$

#%&)2E$.#2!12+($&!;*+($;&($4$8&%1H(E$-.(8)3$2$%/!)4%'12!$&!%;*,D$1%$.#2%1(E$63-2%/%,D$6&.!4%;7$'!9B13"3;29.1DE$

6&.!-.+($-)*'!9.1D$&!-'&*)'*&(.%9,7$3&%.$*#2!,7'12!$/3)31*,D$6&.!,7=@

^$

C-.(-')3$'3$'+*#%9.(=$#%$4(-3)2!$9!1($&(1)34!$%)9,2$'(9B$-6F+!)E$6&34%/.2$'!H$,!/1%)$9.7-'3$/3$29B$6&.!:

4%&'3<9234%12%@

QQl

;2<!)'2<#%*0'=+>!6*?<

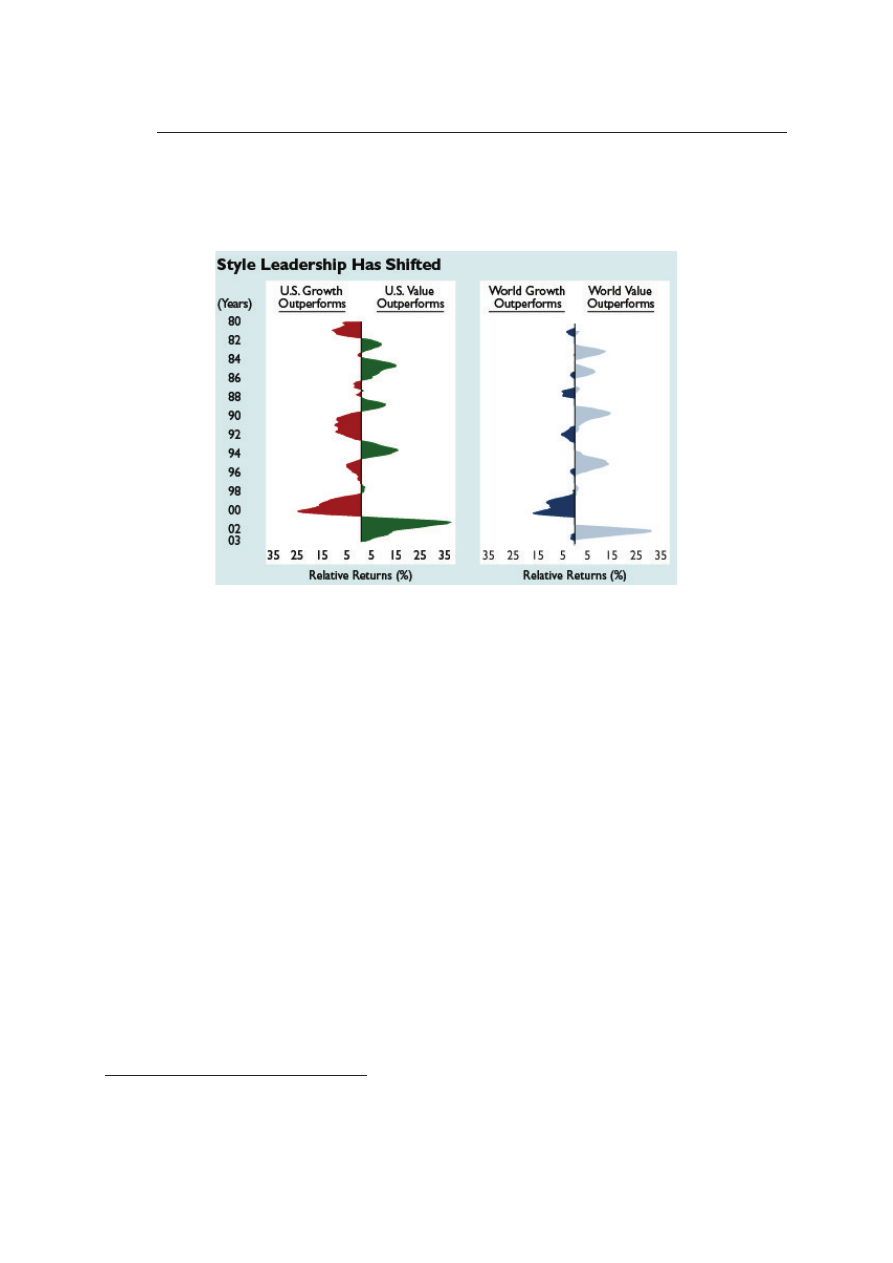

O)*'!9.13<=$ 38*$ 4(H!,$ 4(#2!1231(9B$ -'&%'!;22$ ,!-'$ .&FH12934%1%$ 4 .%"!H13<92$ 3/$

6&.(,7'!;3$9.%-*$%1%"2.($I$3)&!-($-)*'!9.13<92$-'3-34%12%$-'&%'!;22$growth i value inveE

sting$6&.!6"%'%,D$-27E$93$.3-'%+3$6&.!/-'%4231!$1%$&(-*1)*$R@

F@0&'*8$A>$

k14!-'34%12!$4$4%&'3<=$J-@$214!-'34%12!$4!$4.&3-'

\`

p&F/+3Y$m!&1-'!21$>R``l%?@

k-'12!,D$.%'!#$-2"1!$6&.!-+%1)2$/3$3)&!-34!,$.#2%1($-'3-34%1!,$6&.!.$214!-'3&F4$-'&%:

'!;22$"*8$4()3&.(-'%12%$63/!,<92%$8%&/.2!,$.&F4134%H31!;3E$,%)2#$#3;+%8($8(=$9B392%H8($

-'&%'!;2%$)2'6&H#+!+9'-+,"!#D2*?!$>KLMN?$>k1J!-'36!/2%$R`\l%?@$ B3/.2$4 12!,$3 -.*)%:

12!$-6F+!)$4.&3-'34(9B$3 631%/6&.!927'1(9B$4(12)%9BE$. ,!/139.!-1D$!"2#21%9,D$-6F+!)$

o -)&%,1(9B$&(1)34(9B$4%&'3<92%9B$>'(9B$4(9!12%1(9B$8%&/.3$12-)3$"*8$8%&/.3$4(-3)3?@

U319!69,%$ -2+($ 5*1/%#!1'%"1!,$ ,!-'$ *124!&-%"1%$ 2E$ 9B3=$ 62!&43'12!$ 8"2H-.%$ -'&%'!;22$

value investingE$ #3H!$ .1%"!P=$ .%-'3-34%12!$ '%)H!$ 4 -'&%'!;22$ growth investingE$ % 6&.!/!$

4-.(-')2#$4 -'&%'!;22$KLMN@$L1%"2.%$-2+($5*1/%#!1'%"1!,$634211%$.%6!412=$3/6342!/12D$

39B&317$4%&'3<92$214!-'(9,2E$% z /&*;2!,$-'&31($4-)%.%=$63/#23'($3 1%,427)-.(#$63'!19,%:

"!$4.&3-'*@$e%"!H($6%#27'%=$,!/1%)$2H$5%)'E$H!$6&.!/-27823&-'43$9B%&%)'!&(.*,!$-27$631%/:

6&.!927'1D$-2+D$5*1/%#!1'%"1D$12!$#*-2$3.1%9.%=$%*'3#%'(9.12!E$H!$4 /%1(9B$4%&*1)%9B$

6%1*,D9(9B$1%$&(1)*$)%62'%+34(#$87/.2!$*/%1D$214!-'(9,D@$c&.!8%$8342!#$3/&FH12=$/38&D$

-6F+)7$3/$/38&!,$214!-'(9,2@$T3H!$-27$3)%.%=E$H!$4%&'3<=$63/#23'*$,!-'$6&.!-.%934%1%$2 nie

-'%1342$31$4 /%1(#$9.%-2!$3)%.,2$214!-'(9(,1!,@$O.9.!;F"12!$2-'3'1!$,!-'$*.(-)%12!$6&.!.$

214!-'3&%$ #3H"242!$ -.!&3)2!;3$ #%&;21!-*$ 8!.62!9.!G-'4%$ 4 63-'%92$ 1%/4(H)2$ 4%&'3<92$

\`$

k1/!)-$4$6&.(6%/)*$J%"*!$-'39)-$&!6&!.!1'34%1($,!-'$6&.!.

W@O@$M*--!""$\```$q%"*!$k1/!t$2$TO k$C3&"/$

q%"*!$k1/!tE$%$/"%$;&34'B$-'39)-$6&.!.$W@O@$M*--!""$\```$K&34'B$k1/!t$2$TO k$C3&"/$K&34'B$k1/!t@

O'36($.4&3'*$

38"29.31!$.3-'%+($,%)3$&FH129%$63#27/.($.4&3'%#2$.$J%"*!$2$;&34'B$-'39)-$4$36%&92*$3$4(;+%/.31!$\R:#2!-279.1!$

<&!/12!$)&39.D9!

@

QQa

F*=+#@8-(+:!-&+"-+#D2<!(9*G,*'29&6+#+ strategie value investing i growth investing

4!417'&.1!,$1%/$9!17$&(1)34D$3&%.$#3H"243<92$&!%"2.%9,2$/.27)2$'!#*$631%/6&.!927'1(9B$

-'F6$.4&3'*E$,%)$2 39B&31($4%&'3<92$214!-'(9,2@$C '(#$)31'!)<92!$.%-%/1!$4(/%,!$-27$63/!,:

<92!$KLMNE$4 )'F&(#$3;&%129.!12*$87/D$63/"!;%+($93$6&%4/%$63'!19,%"1!$.(-)2E$%"!$'%)H!$

63'!19,%"1!$&(.()3$214!-'(9,2@

e%"!H($63/)&!<"2=E$H!$)"*9.34(#$!"!#!1'!#$4 %1%"2.2!$-2+($5*1/%#!1'%"1!,$63.3-'%,!$

&3"%$9.(112)F4$. #%)&3:E$#2)&33'39.!12%$2 417'&.%$-6F+)2$3&%.$'&%)'34%12!$9!1$&(1)3:

4(9B$'(")3$,%)3$6*1)'*$3/12!-2!12%$/"%$4%&'3<92$4!417'&.1!,$6&.($63/!,#34%12*$/!9(.,2$

214!-'(9(,1(9B@$]%)$-'42!&/.%$m@$K&%B%#$>R``SY$\^RI\^Q?Y$ib%-%/129.3E$/"%$6&%4/.24!;3$

214!-'3&%E$4%B%12%$9!1$#%,D$'(")3$,!/13$.1%9.!12!$I$/%,D$#*$-.%1-7$1%$.%)*6$63$&3.-D/1!,$

9!12!$ 63/9.%-$ -6%/)F4$ 2 1%$ -6&.!/%H$ 63/9.%-$ .1%9.1!;3$ 4.&3-'*@$ U2!/($ 21/.2!,$ "!62!,E$

;/(8($.%63#12%+$3 ;2!+/.2!$2 .4&F92+$*4%;7$1%$.(-)2$. /(42/!1/$3&%.$4(12)2$63-2%/%1(9B$

-6F+!)j@

O'3-34%12!$)319!69,2$-2+($5*1/%#!1'%"1!,$4 6&%)'(9!$-'%42%$6&.!/$214!-'3&%#2$6!41!$

4(#3;2@$ b%)+%/%$ 31%$ 8342!#E$ H!$ -D$ 312$ &%9,31%"12

\\

E$ 63'&%52D$ 36&.!=$ -27$ '+*#342$ 2 ,!;3$

6-(9B3"3;22E$9B%&%)'!&(.*,D$-27$92!&6"243<92D$>6&!5!&*,D$<&!/123:$2 /+*;3'!ࡖ($B3&(:

.31'$214!-'(9(,1(?E$/(-9(6"21D$3&%.$%4!&-,D$/3$&(.()%@$N3-2%/%,D$'%)H!$*#2!,7'13<=$4%&'3:

<9234%12%$%)'(4F4$1%$63/-'%42!$4-.(-')29B$/3-'761(9B$2153&#%9,2E$% w -4329B$/!9(.,%9B$

214!-'(9(,1(9B$)2!&*,D$-27$%1%"2.D$4%&'3<92$4!417'&.1!,@

_!9(.,!$ 214!-'(9(,1!$ #3H1%$ . )3"!2$ &3.6%'&(4%=$ . 6!&-6!)'(4($ /!52129,2$ .%6&!.!1:

'34%1!,$6&.!.$m@$K&%B%#%$2 _@n@$_3//%$>R``^Y$\`gI\`S?@$ B3/.2$3 '3E$%8($'%)%$/!9(.,%E$

/.27)2$6&.!6&34%/.31!#*$6&39!-342$%1%"2'(9.1!#*E$35!&34%+%$8!.62!9.!G-'43$2 -%'(-5%):

9,31*,D9($214!-'3&%$.4&3'@$k14!-'34%12!$4(#%;%$4279$6&.!6&34%/.!12%$-.!&3)29B$%1%"2.$

36%&'(9B$1%$5%)'%9B$2 )319!1'&*,D9(9B$-27$1%$8!.62!9.!G-'42!$2 4%&'3<92@$U4!-'22$8!.62!:

9.!G-'4%$12!$1%"!H($6&.($'(#$63,#34%=$4 -!1-2!$%8-3"*'1(#E$)3#6"!'1(#E$% &%9.!,$,%)3$

39B&317$6&.!/$-'&%'%#2$4 13&#%"1(9B$2 /%,D9(9B$-27$6&.!42/.2!=$4%&*1)%9B$&(1)34(9B@$

O%'(-5%)9,31*,D9($/39BF/$,!-'$39.(42<92!$63,792!#$-*82!)'(41(#$2 3.1%9.%$/39BF/E$,%)2$

214!-'3&$,!-'$;3'34($.%%)9!6'34%=E$63/$4%&*1)2!#E$H!$/.2%+%$&%9,31%"12!@

M4#5!$83N:34*

M3-1D9%$&3"%$%1%"2.($5*1/%#!1'%"1!,$4 6&39!-%9B$214!-'(9(,1(9BE$%"!$2 '!H$.%&.D/9.(9B$

>I+"8!#J+9!(#%+-+)!:!-&?$-6&%42%E$H!$-.9.!;F"1!;3$.1%9.!12%$1%82!&%$6&38"!#$./!52123:

4%12%$ 63,792%$ -2+($ 5*1/%#!1'%"1!,$ 6&.!/-27823&-'4%@$ _!52129,%$ '%$ -'%1342$ 8342!#$ 6*1)'$

4(,<92%$/"%$2/!1'(52)%9,2$9.(112)F4$,D$)-.'%+'*,D9(9B$3&%.$4(.1%9.%12%$-63-38F4$,!,$63:

#2%&*@

A82!$4(#2!1231!$634(H!,$)4!-'2!$-6&%42%,D$42!"!$6&38"!#F4$2 -D$9.7-'3$8%;%'!"2.3:

4%1!$6&.!.$214!-'3&F4E$)'F&.($-)*62%,D$-27$1%$#2!&.!12*$4%&'3<92$6&.!/-27823&-'4%$>9.7-'3$

'(")3$6&.!.$6&(.#%'$4%&'3<92$&(1)34!,$63/#23'*?E$,!;3$!5!)'(413<92$3&%.$)&!34%12*$6&.!.$

\\$

C279!,$2153&#%9,2$1%$'!#%'$)4!-'22$&%9,31%"13<92$.1%"!P=$#3H1%$16@$4Y$]*&!)$>R``lY$\SSI\[^?@$

QQg

;2<!)'2<#%*0'=+>!6*?<

12!$ 4%&'3<92$ /3/%1!,E$ .%63#21%,D9$ ,!/139.!<12!$ 3 63<4279!12*$ 427)-.!,$ *4%;2$ %1%"2.2!$

P&F/!+$2 9.(112)F4$'!,$4%&'3<92$3&%.$63'!19,%+342$6&.!/-27823&-'4%$4 .%)&!-2!$,!,$'43&.!:

nia i 39B&31(@

b%6&!.!1'34%1%$4 1212!,-.(#$%&'()*"!$/!52129,%E$,%)$2 -.!&-.!$-63,&.!12!$1%$-2+7$5*1/%:

#!1'%"1D$6&.!/-27823&-'4%E$4 '(#$3/12!-2!12!$,!,$/3$*.1%1(9B$)319!69,2$214!-'(9(,1(9BE$

#3H!$6&.(-+*H(=$-27$/3$4(6!+12!12%$'!,$"*)2$2 /%"-.!;3$&3.43,*$%1%"2.($5*1/%#!1'%"1!,@

O!+*.#+&.#

m!&1-'!21$>R``l%?E$F'#K'8L7!#;'&#F&/"!M#%+-+)!#B&NE$B''6Ydd'21(*&"@93#d1!6B)S.$>R^@`Q@R`\l?@

m!&1-'!21$>R``l8?E$OH!#?H+""!-)!#*-#D*?0*-)#)2'6&H#+-(#7+"8!#9&'?09E$icB!$m!&1-'!21$]3*&1%"Y$N!&-6!9'2J!-$31$k1J!:

-'21;$u$C!%"'B$T%1%;!#!1'jE$L*'*#1@

m"%9)$L@E$C&2;B'$N@E$m%9B#%1$]@X@$>R```?E$W D'9<80*6+-*8#6+2&'3?*#("+#+0?>'-+2*89</E$_3#$C(/%4129.($Lm E$

C%&-.%4%@

3-'%$e@L@$>R```?E$OH!#D2',"!:9#6*&H#@8-(+:!-&+"#+-+"/9*9E$icB!$X9313#2-'jE$L*;*-'$\^

'B

@

K&%B%#$m@$>R``S?E$B-&!"*)!-&-/#*-6!9&'2E$C(/%4129'43$O'*/23$XTULE$C%&-.%4%@

K&%B%#$m@E$_3//$_@n@$>R``^?E$F!?82*&/#+-+"/9*9C#9*P&H#!(*&*'-E$T9K&%4r2""@

r%*;!1$M@L@$>\^^^?E$Q'6+#-+80+#' R-+-9+?HS#T2<!?*6#!@!0&/6-'3?*#2/-08E$CkK$N&!--E$C%&-.%4%@

k1J!-'36!/2%$>R`\l%?E$444@21J!-'36!/2%@93#d'!&#-d;d;%&6@%-6$>R^@`Q@R`\l?@

k1J!-'36!/2%$>R`\l8?E$444@21J!-'36!/2%@93#d'!&#-dJdJ%"*!-'39)@%-6$>R^@`Q@R`\l?@

k1J!-'36!/2%$>R`\l9?E$444@21J!-'36!/2%@93#d'!&#-d;d;&34'B-'39)@%-6$>R^@`Q@R`\l?@

]%)2$L@$>R``[?E$./?!-+#* 09<&+=&'6+-*!#6+2&'3?*#D2<!(9*G,*'29&6+E$C3"'!&-$U"*4!&E$U&%)F4@

]2%1;$m@E$U3""!&$c@$>R``S?E$OH!#&28&H#+,'8&#)2'6&H#+-(#7+"8!#9&'?09E$T9U21-!($31$V21%19!E$C21'!&@

]*&!)$C@

$>R``l?E$U31-'&*)9,%$2 %1%"2.%$63&'5!"%$6%62!&F4$4%&'3<9234(9B$3 .#2!11(#$/39B3/.2!E$C(/%4129'43$LX$

w N3.1%12*E$N3.1%G@

T2)3+%,!429.$K@$>R`\`?E$.+2&'34#6!6-G&2<-+#+ 6+2&'34#2/-0'6+#+0?>*E$4Y$U*!28-0*#<:*+-#6 R-+-9+?H#D2<!(9*GE

biorstwaE$&!/@$]@$O382!9BE$b!-.('($e%*)34!$W124!&-('!'*$X)313#29.1!;3$4 N3.1%12*E$C(/%4129'43$WXNE$

N3.1%GE$-@$S``IS\R@

TOC$>R`\\?E$%*G(</-+2'('6!#9&+-(+2(/#6/?!-/E$kqO E$n31/(1E$6)'$SE$-@$R[@

eXN$>R``l?E$Q'6+#A-?/0"'D!(*+#T'69<!?H-+E$C(/%4129'43$e%*)34!$NCeE$C%&-.%4%E

'@$SE$-@$all@

M%66%63&'$L@$>\^^^?E$.+2&'34#("+#+0?>'-+2*89</S#T'2+(-*0#:!-!(V!2+#* inwestoraE$CkK:N&!--E$C%&-.%4%@

M2'9B2!$]@ @$>\^^S?E$W-+"*<+#@8-(+:!-&+"-+E$CkK:N&!--E$C%&-.%4%@

O]N$>\^^^?E$F='6-*0#XG</0+#T'"90*!)'E$C(/%4129'43$e%*)34!$NCeE$C%&-.%4%E$'@$QE$-@$R`Q@

O]N$>R`\l?E$F='6-*0#XG</0+#T'"90*!)'E$B''6Ydd-,6@641@6"$>R^@`Q@R`\l?@

O'39)-$>R`\l?E$B''6Ydd-'39)-@%83*'@93#d3/d'&%/21;8%-29-d%d`SRS`Sm*(\@B'#$>R^@`Q@R`\l?@

c%&9.(G-)%:f*12!4-)%$T@$>R`\Q?E$%!&'('"')*+#'?!-/#9*=/#@8-(+:!-&+"-!>#9DY=!0#Z)*!=('6/?H#* D'<+)*!=('6/?H[E$

bLNAnE$O.9.!921@

c%&9.(G-)2$C@$>R``R?E$\8-(+:!-&+"-/#D'2&@!"#D+D*!2Y6#6+2&'3?*'6/?HE$NCXE$C%&-.%4%@

PMQRS7TQCSO$ CFTQ6CU$DP$CUT$VD7?SQW$SQR$XSOMT$BQXT CBQ6Y$$

6FD<CU$BQXT CBQ6$ CFSCT6BT

S20+.#:+;$Purpose Z$cB!$6*&63-!$35$'B!$%&'29"!$2-$'3$/!01!$'B!$5*1/%#!1'%"$-'&!1;'B$35$'B!$93#6%1($%1/$'3$

63-2'231$2'$21$'!&#-$35$J%"*!$21J!-'21;$%1/$;&34'B$21J!-'21;$-'&%'!;2!-@

]!9*)-5%!&H'('"')/5+DD2'+?H$Z$cB!$-'*/($B%-$% #!'B3/29%"$%-6!9'$%1/$539*-!-$31$6&36!&$*1/!&-'%1/21;$35$

'B!$93#6%1(v-$5*1/%#!1'%"$-'&!1;'B$!--!19!@$cB!$%&'29"!$2-$8%-!/$31$9&2'29%"$%1%"(-2-$35$'B!$"2'!&%'*&!$%-$4!""$

%-$31$&!-!%&9B$#!'B3/-$-*9B$%-Y$%1%"(-2-$E$-(1'B!-2-E$93#6%&2-31$%1/$&!%-3121;$8($%1%"3;(@

QQS

F*=+#@8-(+:!-&+"-+#D2<!(9*G,*'29&6+#+ strategie value investing i growth investing

\*-(*-)9#$$cB!$&!-*"'$35$'B!$%&'29"!$2-$'B!$/!012'231$35$'B!$5*1/%#!1'%"$-'&!1;'B$35$'B!$93#6%1($%1/$2'-$6"%9!$

21$'B!$931'!t'$35$'B!$J%"*!$21J!-'21;$%1/$;&34'B$21J!-'21;$-'&%'!;2!-@

12*)*-+"*&/57+"8!#$$cB!$3&2;21%"2'($35$'B!$%&'29"!$#%125!-'-$2'-!"5$21$'B!$%*'B3&v-$/!012'231$35$'B!$5*1/%#!1'%"$

-'&!1;'B$35$'B!$93#6%1($%1/$2'-$&3"!$21$'B!$21J!-'#!1'$6&39!--@

H*@43.(0;$5*1/%#!1'%"$-'&!1;'B$35$'B!$93#6%1(E$21'&21-29$J%"*!E$J%"*!$21J!-'21;E$;&34'B$21J!-'21;E$;&34'B$

%'$&!%-31%8"!$6&29!$>KLMN?

V@+34#'!*

T2)3+%,!429.$K@$>R`\l?E$F*=+#@8-(+:!-&+"-+#D2<!(9*G,*'29&6+#+ strategie value investing i growth investingE$b!-.(:

'($e%*)34!$W124!&-('!'*$O.9.!92G-)2!;3$1&$[`lE$iV21%1-!E$M(1)2$V21%1-34!E$W8!.62!9.!12%j$1&$gSE$C(/%4:

129'43$e%*)34!$W124!&-('!'*$O.9.!92G-)2!;3E$O.9.!921E$-@$QRSIQQSo$444@41!2.@6"d5&5*@$

Wyszukiwarka

Podobne podstrony:

strategie przedsiębiorcze, strategie sciaga

zarządzanie strategiczne przedsiębiorstwem i strategia marke, Zarządzanie(1)

Wspieranie rozwoju małych i średnich przedsiębiorstw w strategicznych dokumentach programowych Lubel

zarządzanie strtegiczne przedsiębiorstwem i strategia market, Zarządzanie(1)

zarządzanie strtegiczne przedsiębiorstwem i strategia market

Podstawy analizy fundamentalnej Podejscie strategiczne

skonieczny, przedsiębiorczość strategiczna, Przedsiębiorczość strategiczna w tworzeniu przewagi konk

Strategia Value raise z drawem na flopie

Miliband przedstawia strategię ws Afganistanu (17 11 2009)

Przedsiebiorczosc strategie i metody zarzadzania przedsiebiorstwem

skonieczny, przedsiębiorczość strategiczna, Model przedsiębiorczości strategicznej

Investment Strategies

więcej podobnych podstron