21

C H A P T E R

I

N T R O D U C T I O N T O

M

A C R O E C O N O M I C S

:

U

N E M P L O Y M E N T

, I

N F L A T I O N

,

A N D

E

C O N O M I C

F

L U C T U A T I O N S

I

N T R O D U C T I O N T O

M

A C R O E C O N O M I C S

:

U

N E M P L O Y M E N T

, I

N F L A T I O N

,

A N D

E

C O N O M I C

F

L U C T U A T I O N S

21.1

Macroeconomic Goals

21.2

Employment and Unemployment

21.3

Types of Unemployment

21.4

Reasons for Unemployment

21.5

Inflation

21.6

Economic Fluctuations

ow we focus our attention on macroeconom-

ics and, in particular, on two key concepts that

are at the heart of macroeconomics and

economic policymaking—unemployment and

inflation. To those who have just lost a job, unem-

ployment ranks high on the stress meter. To an

elderly person who is living on a fixed income,

inflation and the loss of purchasing power may be

just as threatening.

In this chapter, we see how economists define

unemployment and inflation and consider the prob-

lems associated with each. In the last section of the

chapter, we examine the short-run fluctuations in

the economy—the so-called business cycle.

■

N

95469_21_Ch21_p561-602.qxd 4/1/07 3:30 PM Page 563

564

M O D U L E 6

Macroeconomic Foundations

THREE MAJOR MACROECONOMIC GOALS

Recall from Chapter 1 that macroeconomics is the

study of the whole economy—the study of the

forest, not the trees. Nearly every society has been

interested in three major macroeconomic goals:

(1) maintaining employment of human resources at

relatively high levels, meaning that jobs are rela-

tively plentiful and financial suffering from lack of

work and income is relatively uncommon; (2) main-

taining prices at a relatively stable level so that con-

sumers and producers can make better decisions;

and (3) achieving a high rate of economic growth,

meaning a growth in output per person over time.

We use the term

real

gross domestic product

(RGDP)

to measure

output or production.

The term real is used

to indicate that the

output is adjusted for

the general increase in

prices over time.

Technically, gross domestic product (GDP) is

defined as the total value of all final goods and serv-

ices produced in a given period of time, such as a

year or a quarter.

WHAT OTHER GOALS ARE IMPORTANT?

In addition to these primary goals, most societies are

concerned, at various times, with other economic

issues, some of which are essentially microeconomic

in character. For example, “quality of life” issues have

prompted some societies to try to reduce “bads,” such

as pollution and crime, and increase goods and serv-

ices, such as education and health services. Another

goal has been “fairness” in the distribution of income

or wealth. Still another goal pursued in many nations

at one time or another has been self-sufficiency in the

production of certain goods and services. For exam-

ple, in the 1970s, the United States implemented

policies that reduced U.S. reliance on other nations

for supplies of oil, partly for reasons of national

security.

HOW DO VALUE JUDGMENTS AFFECT

ECONOMIC GOALS?

In stating that nations have economic goals, we must

acknowledge that nations are made up of individu-

als. Individuals within a society may differ consider-

ably in how they evaluate the relative importance of

certain issues, or even in whether they consider cer-

tain “problems” to really be problems after all. For

example, most people view economic growth posi-

tively, but others consider it less favorably. Some cit-

izens may think the income distribution is just about

right, but others may think it provides insufficient

incomes to the poorer members of society; still

others may think it involves taking too much income

from the relatively well-to-do, thereby reducing

incentives to carry out productive, income-producing

activities.

ACKNOWLEDGING OUR GOALS:

THE EMPLOYMENT ACT OF 1946

Many economic problems—particularly those

involving unemployment, price instability, and eco-

nomic stagnation—are pressing concerns for the

U.S. government. The

Employment Act of 1946

and

the Full Employment and Balanced Growth Act of

1978 (the Humphrey–Hawkins Act) commit the

U.S. government to pur-

suing unemployment

policies that are also

consistent with price

stability. This legisla-

tion was the first

formal acknowledg-

ment of these primary

macroeconomic goals.

S E C T I O N

21.1

M a c r o e c o n o m i c G o a l s

■

What are the most important macroeco-

nomic goals in the United States?

■

Are these goals universal?

■

How has the United States shown its

commitment to these goals?

real gross domestic

product (RGDP)

the total value of all final goods and

services produced in a given period,

such as a year or a quarter, adjusted

for inflation

Employment Act

of 1946

a commitment by the federal gov-

ernment to hold itself accountable

for short-run economic fluctuations

95469_21_Ch21_p561-602.qxd 4/1/07 3:30 PM Page 564

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

565

THE CONSEQUENCES OF HIGH UNEMPLOYMENT

Unemployment figures are reported by the U.S.

Department of Labor on a monthly basis. The news of

lower unemployment usually sends stock prices higher;

and the news of higher unemployment usually sends

stock prices lower. Politicians are also concerned about

the unemployment figures because elections often hinge

precariously on whether unemployment has been rising

or falling.

Nearly everyone agrees that it is unfortunate when

a person who wants a job cannot find one. A loss of a

job can mean financial insecurity and a great deal of

anxiety. High rates of unemployment in a society can

increase tensions and despair. A family without income

from work undergoes great suffering; as a family’s sav-

ings fade, family members wonder where they are

going to obtain the means to survive. Society loses

some potential output of goods when some of its pro-

ductive resources—human or nonhuman—remain idle,

and potential consumption is reduced. Clearly, then, a

loss in efficiency occurs when people willing to work

and equipment able to produce remain idle. That is,

other things being equal, relatively high rates of unem-

ployment are viewed almost universally as undesirable.

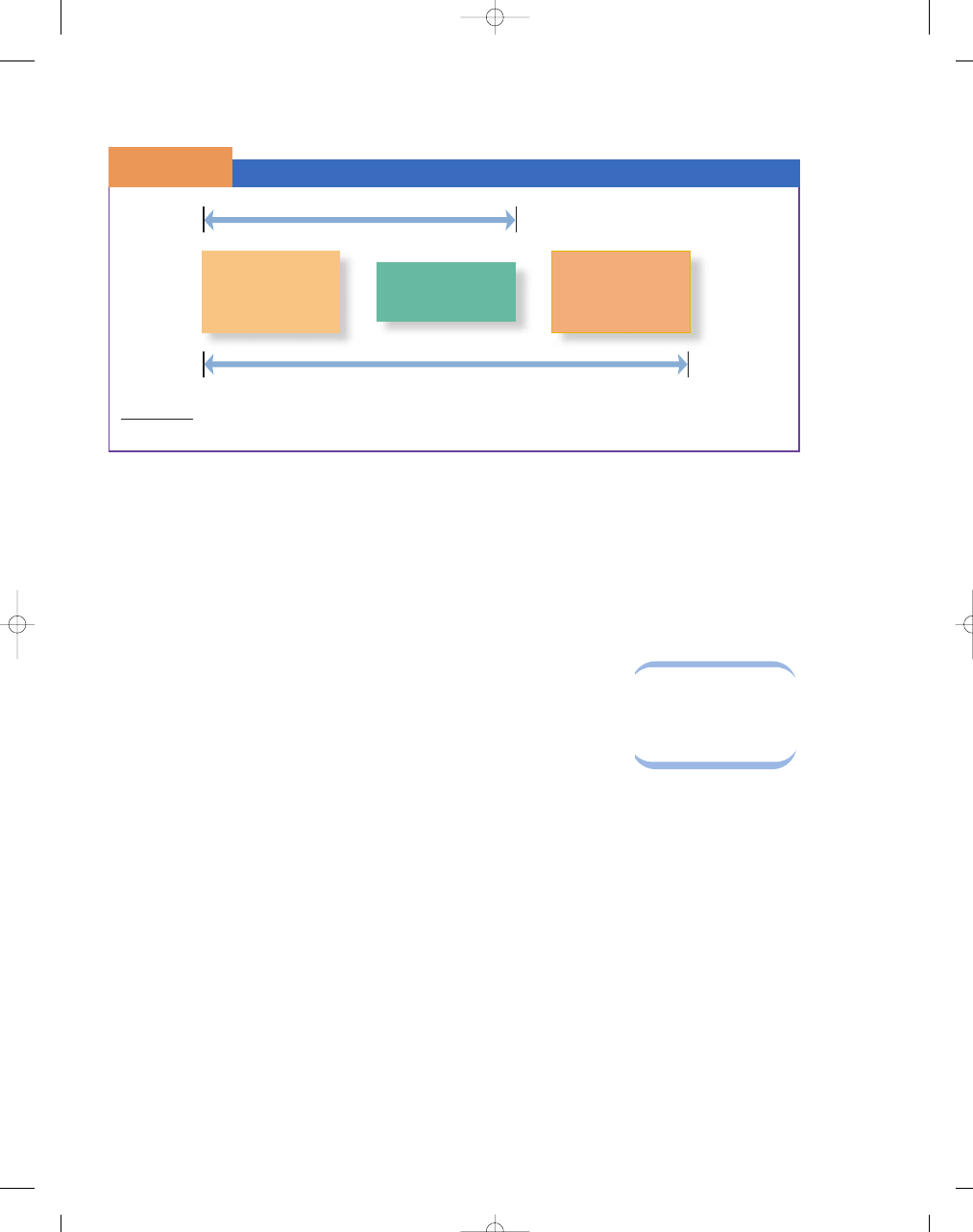

WHAT IS THE UNEMPLOYMENT RATE?

When discussing unemployment, economists and politi-

cians refer to the

unemployment rate.

To calculate

the unemployment rate,

you must first under-

stand another impor-

tant concept—the

labor

force.

The labor force

is the number of people

over the age of 16 who

are available for employ-

ment, as shown in

Exhibit 1. The civilian

labor force figure

excludes people in the

armed services and those in prisons or mental hospi-

tals. Other people regarded as outside the labor force

include homemakers, retirees, and full-time students.

These groups are excluded from the labor force

because they are not considered currently available

for employment.

When we say that the unemployment rate is

5 percent, we mean that 5 percent of the population

over the age of 16 who are willing and able to work

are unable to get jobs. This 5 percent means that 5 out

of 100 people in the total labor force are unemployed.

To calculate the unemployment rate, we simply divide

the number of unemployed by the number in the civil-

ian labor force:

Unemployment rate

=

Number of unemployed

Civilian labor force

S E C T I O N

*

C H E C K

1.

The most important U.S. macroeconomic goals are full employment, price stability, and economic growth.

2.

Individuals all have their own reasons for valuing certain goals more than others.

3.

The United States showed its commitment to the major macroeconomic goals with the Employment Act of 1946

and the Full Employment and Balanced Growth Act of 1978 (the Humphrey–Hawkins Act).

1.

What are the three major economic goals of most societies?

2.

What is the Employment Act of 1946? Why was it significant?

S E C T I O N

21.2

E m p l o y m e n t a n d U n e m p l o y m e n t

■

What are the consequences of

unemployment?

■

What is the unemployment rate?

■

Does unemployment affect everyone equally?

■

What causes unemployment?

■

How long are people typically

unemployed?

unemployment rate

the percentage of the population

aged 16 and older who are willing

and able to work but are unable to

obtain a job

labor force

the number of people aged 16 and

over who are available for

employment

95469_21_Ch21_p561-602.qxd 4/1/07 3:30 PM Page 565

566

M O D U L E 6

Macroeconomic Foundations

In August 2006, the number of civilians unemployed

in the United States was 7.12 million, and the civilian

labor force totaled 151.7 million. Using these data,

we can calculate that the unemployment rate in

August 2006 was 4.7 percent:

Unemployment rate

= 7.12 million/151.7 million

= .047 × 100 = 4.7 percent

THE WORST CASE OF U.S. UNEMPLOYMENT

By far, the worst employment downturn in U.S. his-

tory occurred during the Great Depression, which

began in late 1929 and continued until 1941.

Unemployment rose from only 3.2 percent of the

labor force in 1929 to more than 20 percent in the

early 1930s, and double-digit unemployment per-

sisted through 1941. The debilitating impact of

having millions of productive people out of work led

Americans (and people in other countries as well) to

say, “Never again.” Some economists would argue

that modern macroeconomics, with its emphasis on

the determinants of unemployment and its elimina-

tion, truly began in the 1930s.

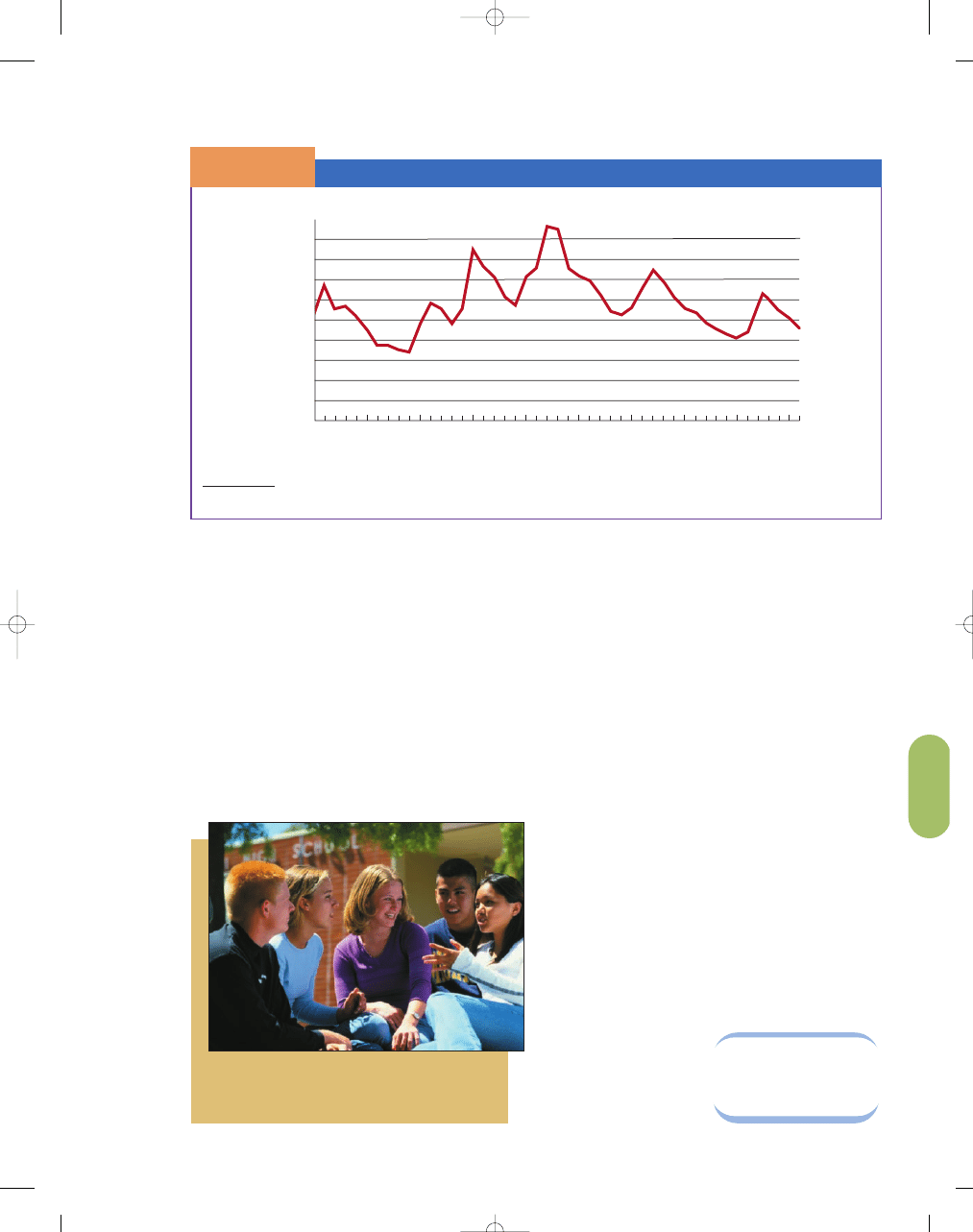

VARIATIONS IN THE UNEMPLOYMENT RATE

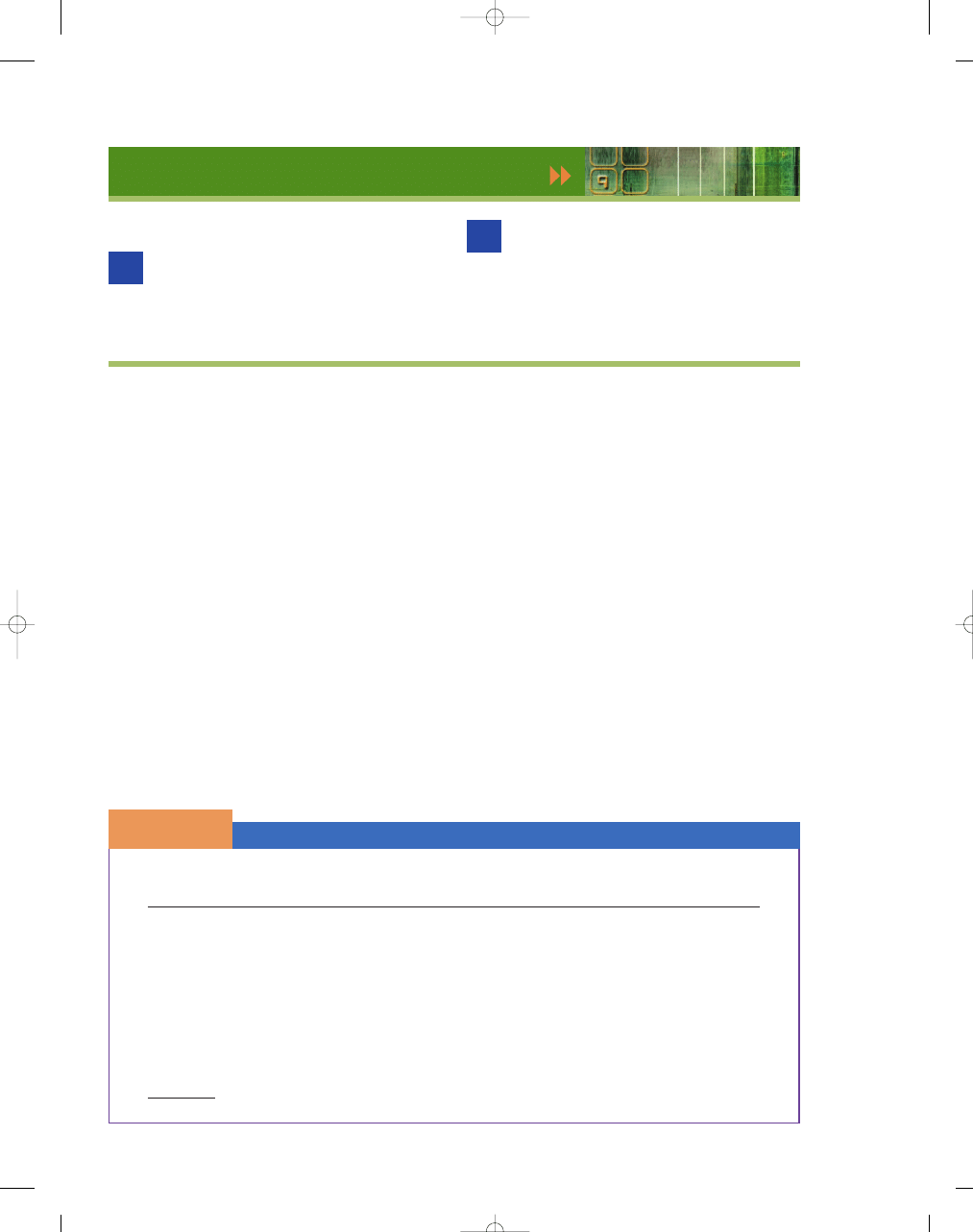

Exhibit 2 shows U.S. unemployment rates over the

last 46 years. Unemployment since 1960 ranged from

a low of 3.5 percent in 1969 to a high of 9.7 percent

in 1982. Unemployment in the worst years is two or

more times what it is in good years. Before 1960,

variations in unemployment were more pronounced.

ARE UNEMPLOYMENT STATISTICS ACCURATE

REFLECTIONS OF THE LABOR MARKET?

In periods of prolonged recession, some individuals

think that the chances of landing a job are so bleak

that they quit looking. These people are called

dis-

couraged workers.

Individuals who have not

actively sought work

for four weeks are not

counted as unemployed;

instead, they fall out

of the labor force. Also,

people looking for full-

time work who grudg-

ingly settle for part-time

jobs are counted as “fully” employed, even though

they are only “partly” employed. At least partially

balancing these two biases in government employ-

ment statistics, however, is the number of people who

are overemployed—that is, working overtime or at

more than one job. Also, a number of jobs in the

underground economy (e.g., drug dealing, prostitu-

tion, gambling, and so on) are not reported. In addi-

tion, many people may claim they are seeking work

when, in fact, they may just be going through the

motions so they can continue to collect unemploy-

ment compensation or receive other government

benefits.

WHO ARE THE UNEMPLOYED?

Unemployment usually varies greatly across different

segments of the population and over time.

SOURCE: Bureau of Labor Statistics, August 2006.

Civilians

Employed

(144.58 million)

Unemployed

(7.12 million)

Out of

Labor Force

(77.47 million)

(229.2 million)

Total Adult Population

(151.7 million)

Labor Force (Employed + Unemployed)

The U.S. Labor Force, 2006

S E C T I O N

2 1 . 2

E

X H I B I T

1

discouraged worker

an individual who has left the labor

force because he or she could not

find a job

95469_21_Ch21_p561-602.qxd 4/1/07 3:30 PM Page 566

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

567

Education as a Factor in Unemployment

According to the Bureau of Labor Statistics, the

unemployment rate across the sexes and races

among college graduates is significantly lower than

for those who do not complete high school. In June

2006, the unemployment rate for individuals with-

out high school diplomas was 6.5 percent, compared

with 2.1 percent for those with bachelor degrees and

higher. Further, college graduates have lower unem-

ployment rates than people who have some college

education but did not complete their bachelor’s

degrees (3.6 percent).

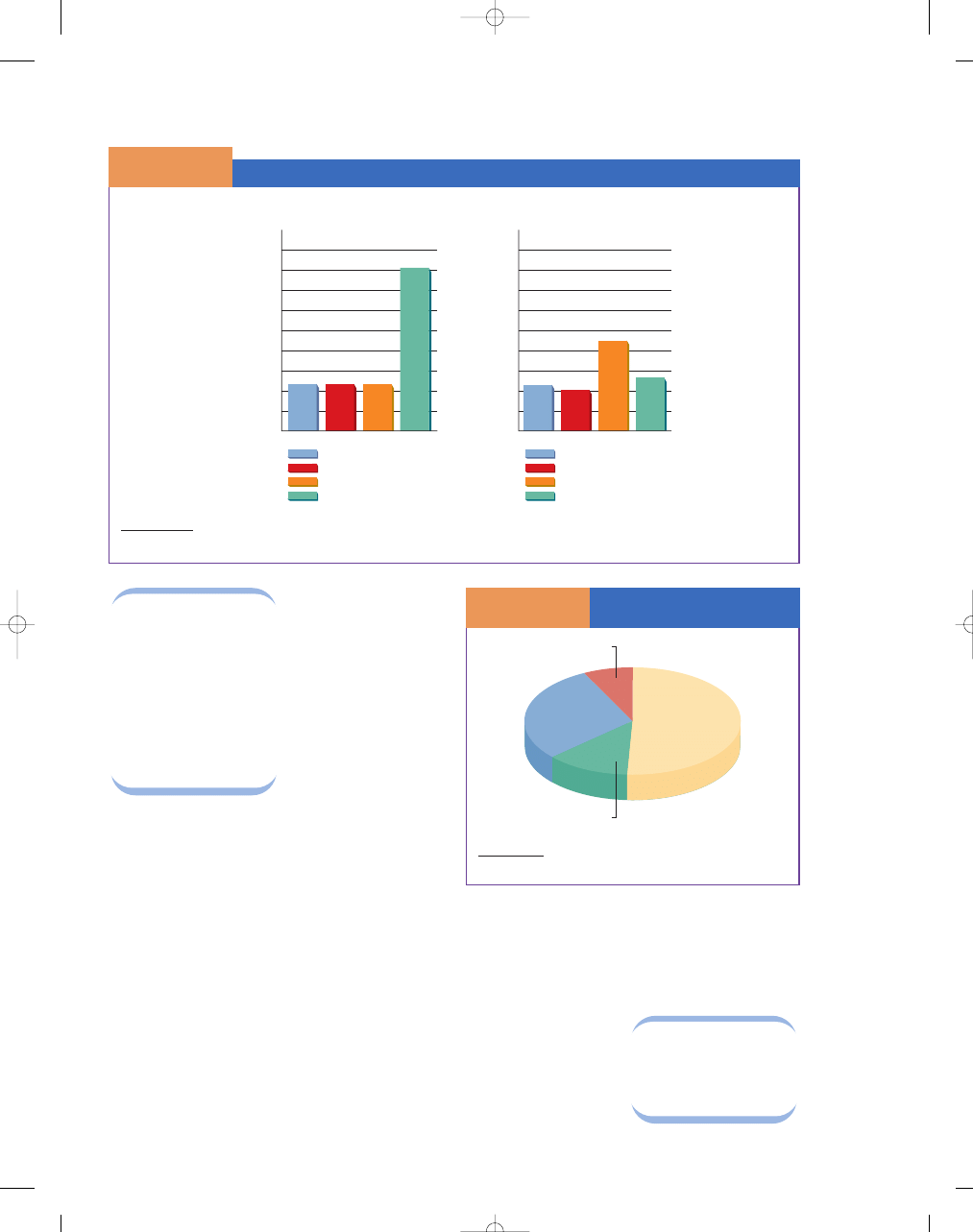

Age, Sex, and Race as Factors in Unemployment

The incidence of unemployment varies widely among

the population. Unemployment tends to be greater

among the very young, among blacks and other

minorities, and among workers with few skills. The

unemployment rate for adult females tends to be

higher than that for adult males.

Considering the great variations in unemploy-

ment for different groups in the population, we cal-

culate separate unemployment rates for groups

classified by sex, age, race, family status, and type of

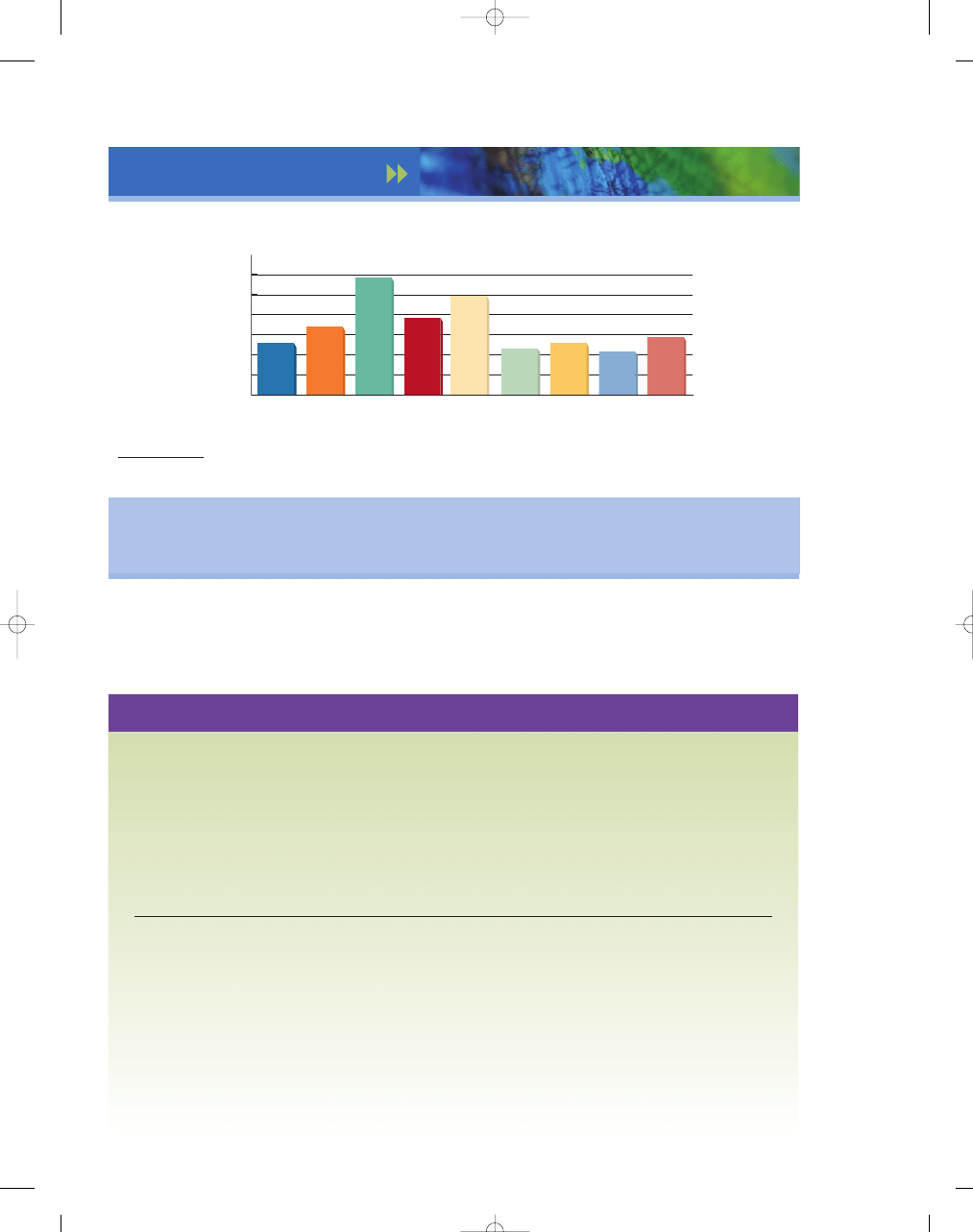

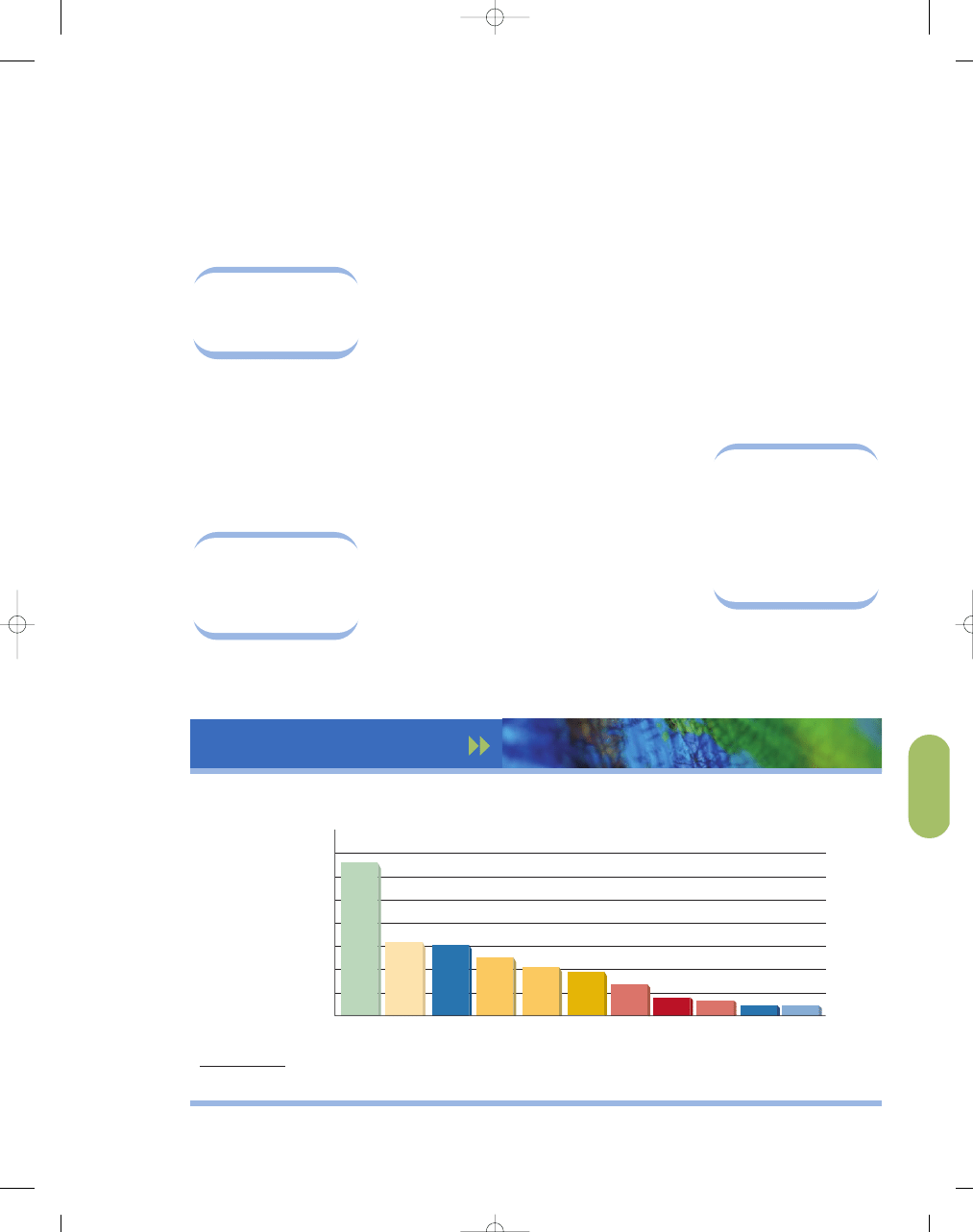

occupation. Exhibit 3 shows unemployment rates for

various groups. Note that the variation around the

average unemployment rate for the total population

of 4.7 percent was considerable. The unemployment

rate for blacks was much higher than the rate for

whites, a phenomenon that has persisted throughout

the post–World War II period. Unemployment among

teenagers was much higher than adult unemployment,

at 16.2 percent. Some would regard teenage unem-

ployment a lesser evil than unemployment among

adults, because most teenagers have parents or

guardians on whom they can rely for subsistence.

CATEGORIES OF UNEMPLOYED WORKERS

According to the Bureau

of Labor Statistics, the

four main categories of

unemployed workers

are

job losers

(those who

have been temporarily

SOURCE: Bureau of Labor Statistics, August 2006.

10%

9

8

7

6

5

4

3

2

1

0

1960

1965

1970

1975

1980

Year

1990

1985

1995

2000

2005

U.S. Unemployment Rate

P

er

cent

Unemployment Rates, 1960–2006

S E C T I O N

2 1 . 2

E

X H I B I T

2

Teenagers have the highest rates of unemployment. Do you

think it would be easier for them to find jobs if they had more

experience and higher skill levels?

©

Photodisc Green/Getty Images

job loser

an individual who has been tem-

porarily laid off or fired

95469_21_Ch21_p561-602.qxd 4/1/07 3:30 PM Page 567

568

M O D U L E 6

Macroeconomic Foundations

laid off or fired),

job

leavers

(those who

have quit their jobs),

reentrants

(those who

worked before and are

reentering the labor

force), and

new entrants

(those entering the labor

force for the first time—

primarily teenagers). It

is a common misconcep-

tion that most workers

are unemployed because

they have lost their jobs. Although job losers may typi-

cally account for 50 to 60 percent of the unemployed, a

sizable fraction is due to job leavers, new entrants, and

reentrants, as seen in Exhibit 4.

HOW MUCH UNEMPLOYMENT?

Even though unemployment is painful to those who

have no source of income, reducing unemployment is

not costless. In the short run, a reduction in unemploy-

ment may come at the expense of a higher rate of

inflation, especially if the economy is close to full

capacity, where resources are almost fully employed.

Moreover, trying to match employees with jobs can

quickly lead to significant inefficiencies, because of mis-

matches between a worker’s skill level and the level of

skill required for a job. For example, the economy would

be wasting resources subsidizing education if people

with Ph.D.s in biochemistry were driving taxis or tend-

ing bar. That is, the skills of the employee may be

higher than those neces-

sary for the job, result-

ing in what economists

call

underemploy-

ment.

Another source

of inefficiencies is plac-

ing employees in jobs

beyond their abilities.

job leaver

a person who quits his or her job

reentrant

an individual who worked before and

is now reentering the labor force

new entrant

an individual who has not held a

job before but is now seeking

employment

SOURCE: Bureau of Labor Statistics, August 2006.

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

Total Population

Men

Women

Teenagers

(16–19 years)

Total Population

White

Black

Hispanic

Unemplo

yment Rate

Unemplo

yment Rate

4.7%

4.7%

4.7%

16.2%

4.6%

4.1%

8.8%

5.3%

Unemployment in the United States by Age, Sex, and Race

S E C T I O N

2 1 . 2

E

X H I B I T

3

a. U.S. Unemployment, by Sex and Age

b. U.S. Unemployment, by Race or Ethnic Group

Reasons for

Unemployment

S E C T I O N

2 1 . 2

E

X H I B I T

4

Job losers

49%

Reentrants

30%

Job leavers

12%

New entrants

9%

SOURCE: Bureau of Labor Statistics, August 2006.

underemployment

a situation in which a worker’s

skill level is higher than necessary

for a job

95469_21_Ch21_p561-602.qxd 16/1/07 3:17 PM Page 568

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

569

HOW LONG ARE PEOPLE USUALLY UNEMPLOYED?

The duration of unemployment is equally as impor-

tant as the amount of unemployment. The financial

consequences of a head of household’s being unem-

ployed for four or five weeks are usually not extremely

serious, particularly if the individual is covered by an

unemployment compensation system. The impact

becomes much more serious if that person is unemployed

for several months. Therefore, it is useful to look at

the average duration of unemployment to discover

what percentage of the labor force is unemployed

longer than a certain period, say 15 weeks. Exhibit 5

presents data on the duration of unemployment. As

you can see in this table, roughly 39 percent of the

unemployed were out of work less than five weeks,

and 16 percent of the total unemployed were out of

work for more than six months. The duration of

unemployment tends to be greater when the amount

of unemployment is high and smaller when the

amount of unemployment is low. Unemployment of

any duration, of course, means a potential loss of

output. This loss of current output is permanent; it is

not made up when unemployment starts falling again.

LABOR FORCE PARTICIPATION RATE

The percentage of the population that is in the labor

force is what economists call the

labor force partici-

pation rate.

Since 1950, the labor force participation

rate increased from 59.2

percent to 67.1 percent.

Most of that change

occurred between 1970

and 1990. The increase

in the labor force partic-

ipation rate can be

attributed in large part

to the entry of the baby

boomers into the labor force together with a 14.2 per-

centage point increase in the women’s labor force partic-

ipation rate.

Over the last several decades, the number of

women working shifted dramatically, reflecting the

changing role of women in the workforce. In Exhibit 6,

we see that in 1950, less than 34 percent of women

were working or looking for work. Today that figure

is roughly 60 percent. In 1950, more than 85 percent

of men were working or looking for work. Today the

labor force participation rate for men has fallen to

roughly 73 percent, as many men stay in school

longer and opt to retire earlier.

Duration of

Unemployment

S E C T I O N

2 1 . 2

E

X H I B I T

5

SOURCE: Bureau of Labor Statistics, August 2006.

Duration

Percent Unemployed

Less than 5 weeks

39%

5 to 14 weeks

30

15 to 26 weeks

15

27 weeks and over

16

i n t h e n e w s

A Growing Number of Men Are Not Working,

So What Are They Doing?

B Y A L A N B . K R U E G E R

A growing number of men in their prime working years are pursuing what

might be called the Kramer lifestyle, after the enigmatic “Seinfeld” character:

neither working nor attending school. In 1967, 2.2 percent of noninstitutional-

ized men age 25 to 54 spent the entire year without working for pay or attend-

ing school. That figure climbed to 8 percent in 2002, the latest year available

from the Bureau of Labor Statistics. . . .

(continued)

labor force

participation rate

the percentage of the population in

the labor force

SOURCE: Bureau of Labor Statistics, September 2006.

Labor Force Participation Rates for Men and Women

S E C T I O N

2 1 . 2

E

X H I B I T

6

1950

1960

1970

1980

1990

2000

2006

Total

59.2%

59.4%

60.4%

63.8%

66.5%

67.1%

66.0%

Men

86.4

83.3

79.7

77.4

76.4

64.8

73.4

Women

33.9

37.7

43.3

51.5

57.5

59.9

59.3

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 569

570

M O D U L E 6

Macroeconomic Foundations

S E C T I O N

*

C H E C K

1.

The consequences of unemployment for society include a reduction in potential output and consumption—a

decrease in efficiency.

2.

The unemployment rate is found by taking the number of people officially unemployed and dividing by the

number in the civilian labor force.

3.

Unemployment rates are highest for minorities, the young, and less-skilled workers.

4.

The four main categories of unemployed workers are job losers, job leavers, reentrants, and new entrants.

5.

The duration of unemployment tends to be greater (smaller) when the amount of unemployment is high (low).

1.

What happens to the unemployment rate when the number of unemployed people increases, ceteris paribus?

When the labor force grows, ceteris paribus?

2.

How might the official unemployment rate understate the “true” degree of unemployment? How might it

overstate it?

3.

Why might the fraction of the unemployed who are job leavers be higher in a period of strong labor demand?

4.

Suppose you live in a community of 100 people. If 80 people are over 16 years old and 72 people are willing and

able to work, what is the unemployment rate in this community?

5.

What would happen to the unemployment rate if a substantial group of unemployed people started going to

school full time? What would happen to the size of the labor force?

6.

What happens to the unemployment rate when officially unemployed people become discouraged workers? Does

anything happen to employment in this case?

i n t h e n e w s ( c o n t . )

The problem is much more severe for some groups than others. Nearly

one in five men age 25 to 54 with less than a high school degree did not work

even one week in 2002. The nonworking rate for college graduates was only

3.3 percent. In central cities, 10.8 percent of men spent the year without work,

compared with 7.1 percent elsewhere. . . .

Long-term joblessness among mature men has become a much more

important phenomenon than unemployment. Many jobless men do not

actively search for work, so they are not counted as unemployed. Yet they still

represent a significant loss of productive human resources for the economy.

The conventional wisdom is that joblessness has grown since the early

1980s because the demand for less-skilled workers has dropped, causing their

pay to fall. The decline in unions and erosion of the real value of the minimum

wage have also caused their pay to fall. Rather than toil at low pay, more and

more men have withdrawn from the job market. . . .

Comparing workers and nonworkers over a full week, nonworkers spent

about a quarter of their extra time in “home production,” which includes

household chores, cleaning, and repairs. The bulk of their extra time went into

leisure and recreation, particularly watching television, socializing, and play-

ing sports and games. Nonworkers also slept 10 percent more (44 minutes)

a night than workers. Both groups devoted relatively little time to child care,

at least as a primary activity.

By contrast, nonworking women spend half their extra time engaged in

household work and child care.

Supporting a Kramer lifestyle is not easy, especially if your neighbors are

less magnanimous than Jerry Seinfeld. Nearly two-thirds of nonworking men

age 25 to 24 received income from some source in 2002. Among those with

unearned income, the average amount was $11,551, with the largest sums

coming from Social Security and disability payments. . . .

Not surprisingly, wives are also an important source of financial support

for nonworking men, but only 42 percent of male nonworkers between age 25

and 54 are married, compared with 68 percent of their employed counterparts.

Twenty-nine percent of nonworkers live with their parents or other relatives,

substantially higher than the 9 percent of workers in such a living arrangement.

More than 40 percent of nonworkers who live with their spouse or parents also

have other relatives present who contribute income to their household. Thus,

financial support for nonworkers seems to be a family affair.

The experiences of nonworking adult men are quite varied, and many

have severe disabilities. Although these statistics paint a picture of nonwork-

ing men struggling to get by financially, many manage to live as if every day

were Sunday. As one man from Brooklyn who has not worked since 1998 told

me this week, he thinks of the Off-Track Betting parlor in Midtown Manhattan

as his “club,” and he sees many of the same men there day after day.

SOURCE: Alan B. Krueger, “A Growing Number of Men Are Not Working, So What

Are They Doing?” New York Times, 29 April 2004. Copyright © 2004 by the New

York Times Co. Reprinted with permission.

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 570

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

571

In examining the status of and changes in the unem-

ployment rate, it is important to recognize that unem-

ployment can take several forms. In this section, we will

examine the three types of unemployment—frictional,

structural, and cyclical—and evaluate the relative effects

of each on the overall unemployment rate.

FRICTIONAL UNEMPLOYMENT

In a dynamic economy where people are constantly

losing or leaving their jobs, some frictional unemploy-

ment is always present.

Frictional unemployment

is

the temporary unemployment that results from the

search time that occurs

when people are search-

ing for suitable jobs and

firms are looking for

suitable workers. People

seeking work do not

usually take the first job

offered to them. Like-

wise, firms do not usu-

ally take the first person

they interview. People and firms engage in a search to

match up skills and interests. While the unemployed

are looking, they are frictionally unemployed.

For example, consider an advertising executive

who was fired in Chicago on March 1 and is now

actively looking for similar work in San Francisco. Of

course, not all unemployed workers were fired; some

may have voluntarily quit their jobs. In either case,

frictional unemployment is short term and results

from normal turnover in the labor market, as when

people change from one job to another.

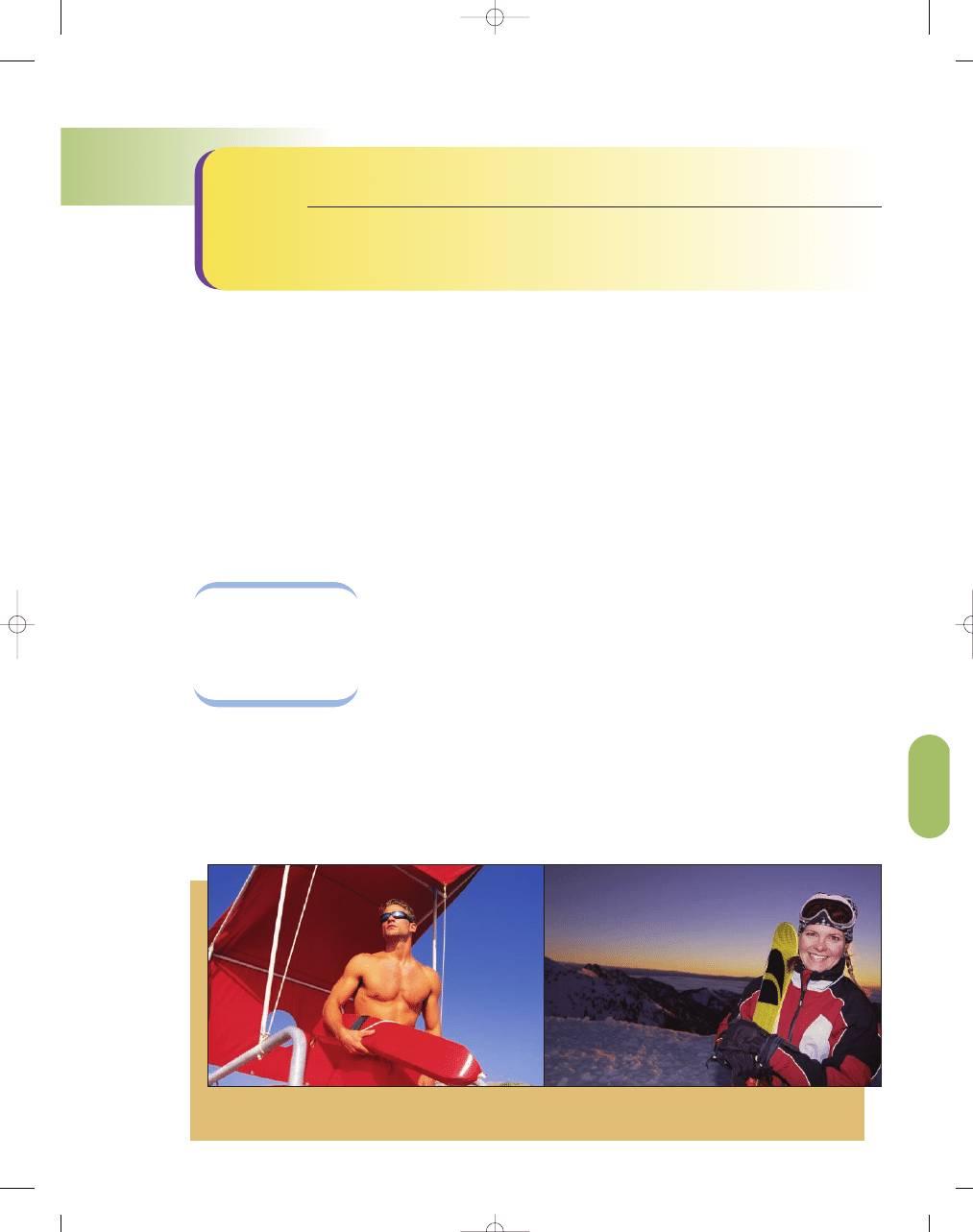

Some unemployment occurs because certain types

of jobs are seasonal in nature. This type of unemploy-

ment is called seasonal unemployment. For example, a

ski instructor in Aspen might become seasonally

unemployed at the end of April when ski season is

over. Or a roofer in Minnesota may become seasonally

unemployed during the harsh winter months. In agri-

cultural areas, employment increases during harvest

season and falls after the season is over. Even a forest

firefighter in a national park might only be employed

during the summer and fall, when forest fires peak.

Occupations that experience either sharp seasonal

shifts in demand or are subject to changing weather

conditions may lead to seasonal unemployment—like

in agriculture where employment increases during har-

vest season. Because this type of unemployment can

make the unemployment rate higher in the off-season

and lower during the in-season, the Bureau of Labor

Statistics (BLS) publishes a seasonally adjusted unem-

ployment rate as well. These figures are more accurate

because they take into account the effects of seasonal

unemployment.

S E C T I O N

21.3

Ty p e s o f U n e m p l o y m e n t

■

What are the three types of unemployment?

■

What is frictional unemployment?

■

What is structural unemployment?

■

What is cyclical unemployment?

■

What is the natural rate of

unemployment?

frictional

unemployment

the unemployment that results from

workers searching for suitable jobs

and firms looking for suitable workers

What will this ski instructor do this summer? What will the lifeguard do this winter? Will they find other jobs? Or will they be seasonally

unemployed?

©

Rob Gage/T

axi/Getty Images

©

Br

and X Pictures/J

upiter Images

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 571

572

M O D U L E 6

Macroeconomic Foundations

SHOULD WE WORRY ABOUT FRICTIONAL

UNEMPLOYMENT?

Geographic and occupational mobility are considered

good for the economy because they generally lead

human resources to go from activities of relatively low

productivity or value to areas of higher productivity,

increasing output in society as well as the wage income

of the mover. Indeed, some of this frictional unem-

ployment involving searches by firms and workers to

find more suitable matchups, is obviously beneficial to

the economy. Even though the amount of frictional

unemployment varies somewhat over time, it is unusual

for it to be much less than 2 percent of the labor force.

Actually, frictional unemployment tends to be some-

what greater in periods of low unemployment, when

job opportunities are plentiful. This high level of job

opportunity stimulates mobility, which, in turn, creates

some frictional unemployment.

STRUCTURAL UNEMPLOYMENT

A second type of unemployment is structural unem-

ployment. Like frictional unemployment, structural

unemployment is related to occupational movement or

mobility—in this case, to a lack of mobility. Structural

unemployment occurs

when workers lack the

necessary skills for jobs

that are available or

have particular skills

that are no longer in

demand. For example,

if a machine operator in

a manufacturing plant loses his job, he could still

remain unemployed despite the openings for computer

programmers in his community. The quantity of unem-

ployed workers conceivably could equal the number of

job vacancies, with the unemployment persisting

because the unemployed lack the appropriate skills.

Given the existence of structural unemployment, it is

wise to look at both unemployment and job vacancy

statistics in assessing labor market conditions.

Structural unemployment, like frictional unemploy-

ment, reflects the dynamic dimension of a changing

economy. Over time, new jobs open up that require new

skills, while old jobs that required different skills disap-

pear. It is not surprising, then, that many people advo-

cate government-subsidized retraining programs as a

means of reducing structural unemployment.

Another reason for structural unemployment is

that low-skilled workers are frequently unable to find

desirable long-term employment. Some of these low-

skilled jobs do not last long and involve little job train-

ing, so a worker may soon be looking for a new job.

Because they acquired no new skill from the old job,

they may be stuck without long-term secure work.

That is, structural workers cannot be said to be “in-

between jobs” like those who are frictionally unem-

ployed. Structural unemployment is more long term

and serious than frictional unemployment because

these workers do not have marketable skills.

The dimensions of structural unemployment are

debatable, in part because of the difficulty in precisely

defining the term in an operational sense. Structural

unemployment varies considerably—sometimes it is

low and at other times, as in the 1970s and early

1980s, it is high. To some extent, in the latter period,

jobs in the traditional sectors such as automobile

manufacturing and oil production were giving way to

jobs in the computer and biotechnology sectors.

Consequently, structural unemployment was higher.

SOME UNEMPLOYMENT IS UNAVOIDABLE

Some unemployment is actually normal and important

to the economy. Frictional and structural unemploy-

ment are simply unavoidable in a vibrant economy. To

a considerable extent, we can view both frictional and

structural unemployment as phenomena resulting

from imperfections in the labor market. For example,

if individuals seeking jobs and employers seeking

workers had better information about each other, the

amount of frictional unemployment would be consid-

erably lower. It takes time for suppliers of labor to find

the demanders of labor services, and it takes time and

money for labor resources to acquire the necessary

skills. But because information and job search are

costly, bringing together demanders and suppliers of

labor services does not occur instantaneously.

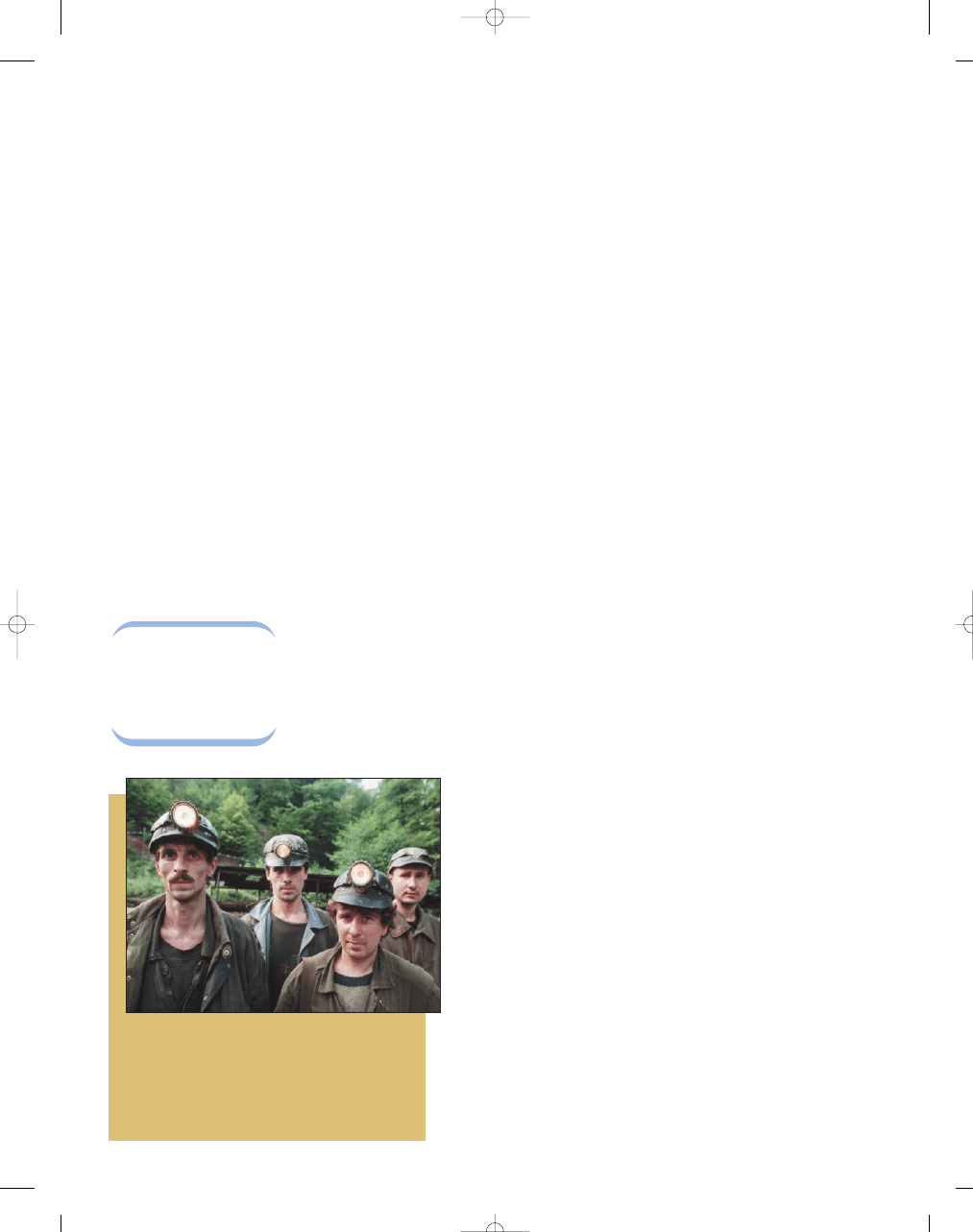

What type of unemployment would occur if these coal miners

lost their jobs as a result of a permanent reduction in demand for

coal and needed retraining to find other employment? Usually,

structural unemployment occurs because of workers’ lack of

skills or long-term changes in demand. Consequently, it generally

lasts for a longer period than does frictional unemployment.

©

Barr

y Le

wis/CORBIS

structural

unemployment

the unemployment that results from

workers not having the skills to obtain

long-term employment

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 572

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

573

CYCLICAL UNEMPLOYMENT

Often, unemployment is composed of more than just

frictional and structural unemployment. In years of rel-

atively high unemployment, some joblessness may result

from short-term cyclical fluctuations in the economy.

We call this type

cyclical unemployment.

Whenever

the unemployment rate is greater than normal, such as

during a recession, it is

due to cyclical unem-

ployment. Most attempts

to solve the cyclical

unemployment problem

emphasized increasing

aggregate demand to

counter recession.

The Cost of Cyclical Unemployment

When the unemployment rate is high, numerous eco-

nomic and social hardships result. The economic costs

are the forgone output when the economy is not pro-

ducing at its potential level. According to Okun’s Law

(really, a rule of thumb), a 1 percent increase in cycli-

cal unemployment reduces output by 2 percentage

points. Thus, we can actually estimate the economic

costs of not producing at our potential output. The

costs are particularly high for those groups with the

least skills—the poorly educated and teenagers with

little work experience.

THE NATURAL RATE OF UNEMPLOYMENT

It is interesting to observe that over the period in which

annual unemployment data are available, the median,

or “typical,” annual unemployment rate has been at or

slightly above 5 percent.

Some economists call

this typical unemploy-

ment rate the

natural

rate of unemploy-

ment.

When unem-

ployment rises well

above 5 percent, we

have abnormally high

unemployment; when it

falls well below 5 percent, we have abnormally low

unemployment. The natural rate of unemployment of

approximately 5 percent roughly equals the sum of

frictional and structural unemployment when they are

at their maximums. Thus, we can view unemploy-

ment rates below the natural rate as reflecting the

existence of below-average levels of frictional and

structural unemployment. When unemployment rises

above the natural rate, however, it reflects the exis-

tence of cyclical unemployment. In short, the natural

rate of unemployment is the unemployment rate when

the economy is experiencing neither a recession nor a

boom. The natural rate of unemployment is also

called the full employment rate of unemployment.

The natural rate of unemployment can change over

time as technological, demographic, institutional, and

other conditions vary. For example, as baby boomers

age, the natural rate falls because middle-aged workers

generally experience lower unemployment rates than

do younger workers. In addition, the Internet and job

placement agencies have improved access to employ-

ment information and allowed workers to find jobs

more quickly. Also, the new work requirements of the

welfare laws increased the number of people with jobs.

Thus, the natural rate is not fixed, because it can

change with demographic changes over time.

Full Employment and Potential Output

When all the resources of an economy—labor, land,

and capital—are fully employed, the economy is said to

be producing its

poten-

tial output.

Literally,

full employment of

labor means that the

economy is providing

employment for all who

are willing and able to

work with no cyclical

unemployment. It also

means that capital and land are fully employed. That is,

at the natural rate of unemployment, all resources are

fully employed, the economy is producing its potential

output, and no cyclical unemployment is present. It

does not mean the economy will always be producing

cyclical

unemployment

unemployment due to short-term

cyclical fluctuations in the economy

potential output

the amount of real output the economy

would produce if its labor and other

resources were fully employed, that is,

at the natural rate of unemployment

using what you’ve learned

Cyclical Unemployment

Are layoffs more prevalent during a recession than a recovery?

Do most resignations occur during a recovery?

Layoffs are more likely to occur during a recession. When times are

bad, employers are often forced to let workers go. Resignations are

relatively more prevalent during good economic times because more job

opportunities are available to those seeking new jobs.

Q

A

natural rate of

unemployment

the median, or “typical,” unemploy-

ment rate, equal to the sum of fric-

tional and structural unemployment

when they are at a maximum

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 573

574

M O D U L E 6

Macroeconomic Foundations

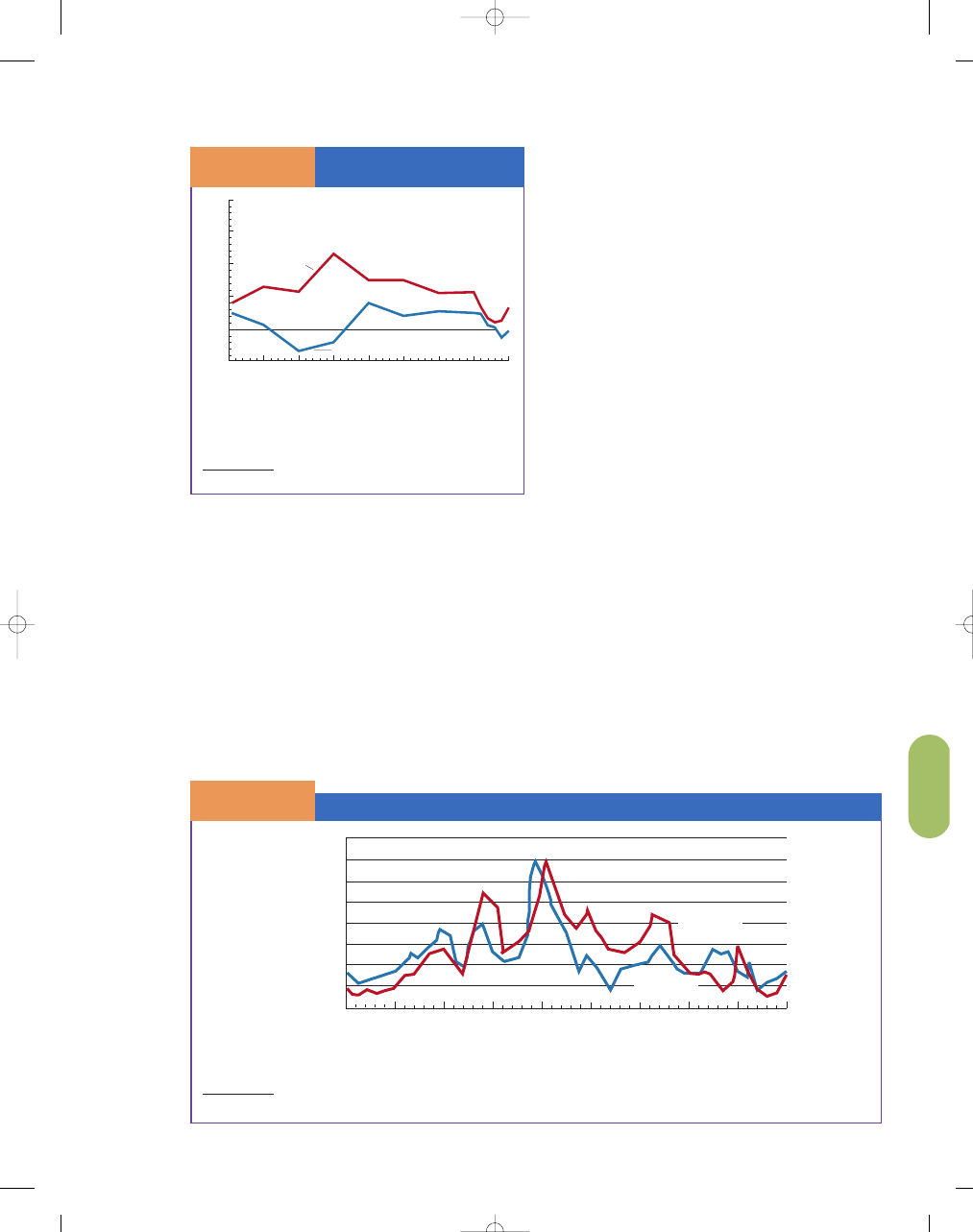

SOURCE: The World Factbook, 2006; http://www.cia.gov.

CONSIDER THIS:

Many developed countries had higher unemployment rates than the United States did in 2005. Generous unemployment benefits (particularly in France and

Germany) and sluggish economic growth in European countries helped cause the higher unemployment rates.

g l o b a l w a t c h

14%

12

10

8

6

4

2

0

Australia

5.1%

Canada

6.8%

Germany

11.7%

Italy

7.7%

France

9.9%

United

Kingdom

4.7%

U.S.

5.1%

Japan

4.4%

Sweden

5.8%

Unemployment Around the Globe, 2005

S E C T I O N

*

C H E C K

1.

The three types of unemployment are frictional unemployment, structural unemployment, and cyclical unemployment.

2.

Frictional unemployment results when a person moves from one job to another as workers search for suitable jobs

and firms look for suitable workers.

3.

Structural unemployment results when people who are looking for jobs lack the required skills for the jobs that are

available or a long-term change in demand occurs.

4.

Cyclical unemployment is caused by a recession.

5.

Imperfections in the labor market and institutional factors result in higher rates of unemployment.

6.

When cyclical unemployment is almost completely eliminated, our economy is said to be operating at full employ-

ment, or at a natural rate of unemployment.

1.

Why do we want some frictional unemployment?

2.

Why might a job retraining program be a more useful policy to address structural unemployment than to address

frictional unemployment?

3.

What is the traditional government policy “cure” for cyclical unemployment?

4.

What types of unemployment are present at full employment (at the natural rate of unemployment)?

5.

Why might frictional unemployment be higher in a period of plentiful jobs (low unemployment)?

6.

If the widespread introduction of the automobile caused a productive buggy whip maker to lose his job, would he

be structurally unemployed?

7.

If a fall in demand for domestic cars causes auto workers to lose their jobs in Michigan, while plenty of jobs are

available for lumberjacks in Montana, what kind of unemployment results?

at its potential output of resources. For example, when

the economy is experiencing cyclical unemployment,

the unemployment rate is greater than the natural rate.

It is also possible for the economy to temporarily

exceed the natural rate, as workers put in overtime or

moonlight by taking on extra employment.

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 574

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

575

In this section, we look at the causes of frictional and

structural unemployment. In later chapters, we dis-

cuss the causes of cyclical unemployment.

WHY DOES UNEMPLOYMENT EXIST?

In many markets, prices adjust to the market equi-

librium price and quantity, and no prolonged peri-

ods of shortage or surplus occur. However, in labor

markets, obstacles prevent wages from adjusting

and balancing the quantity of labor supplied and

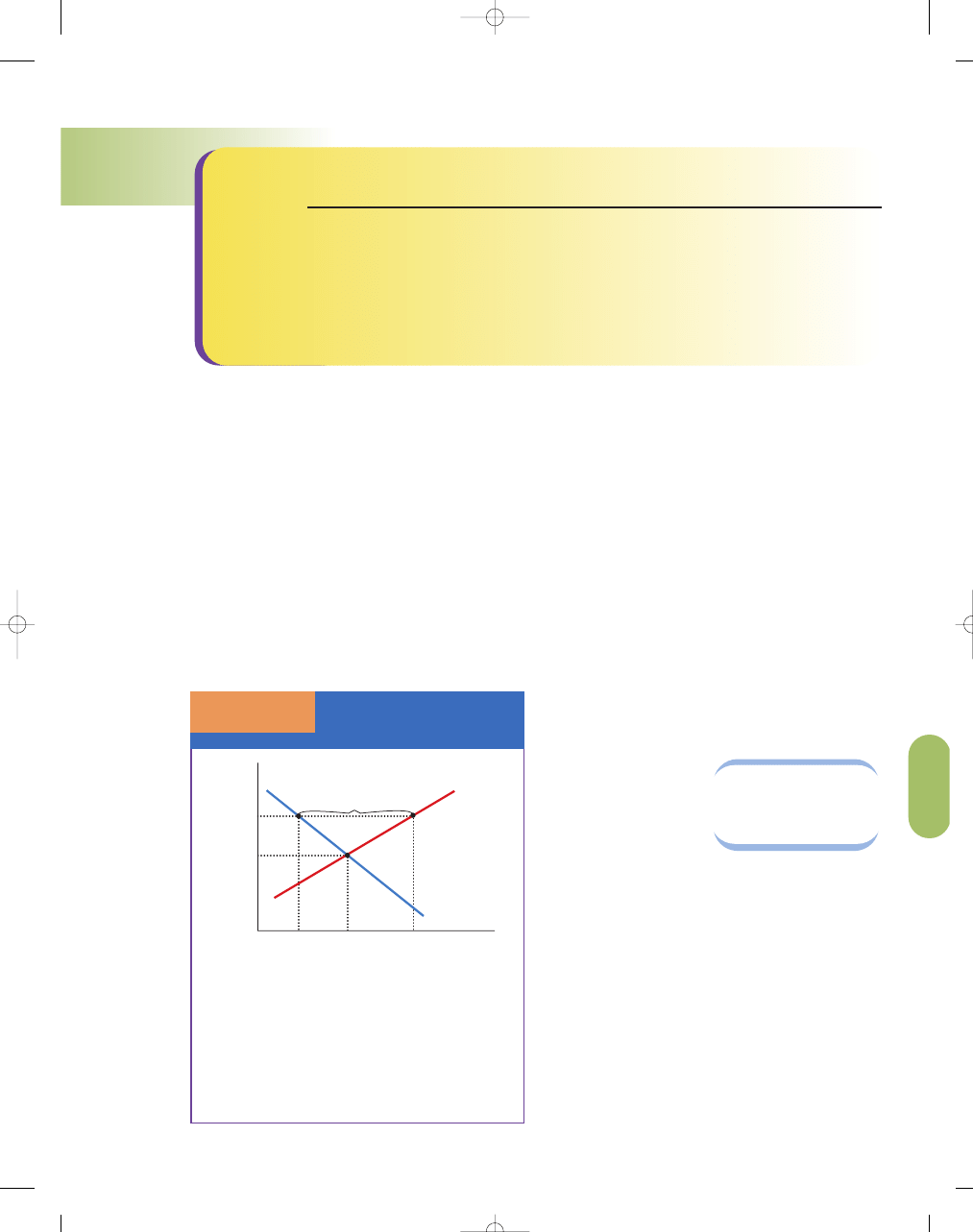

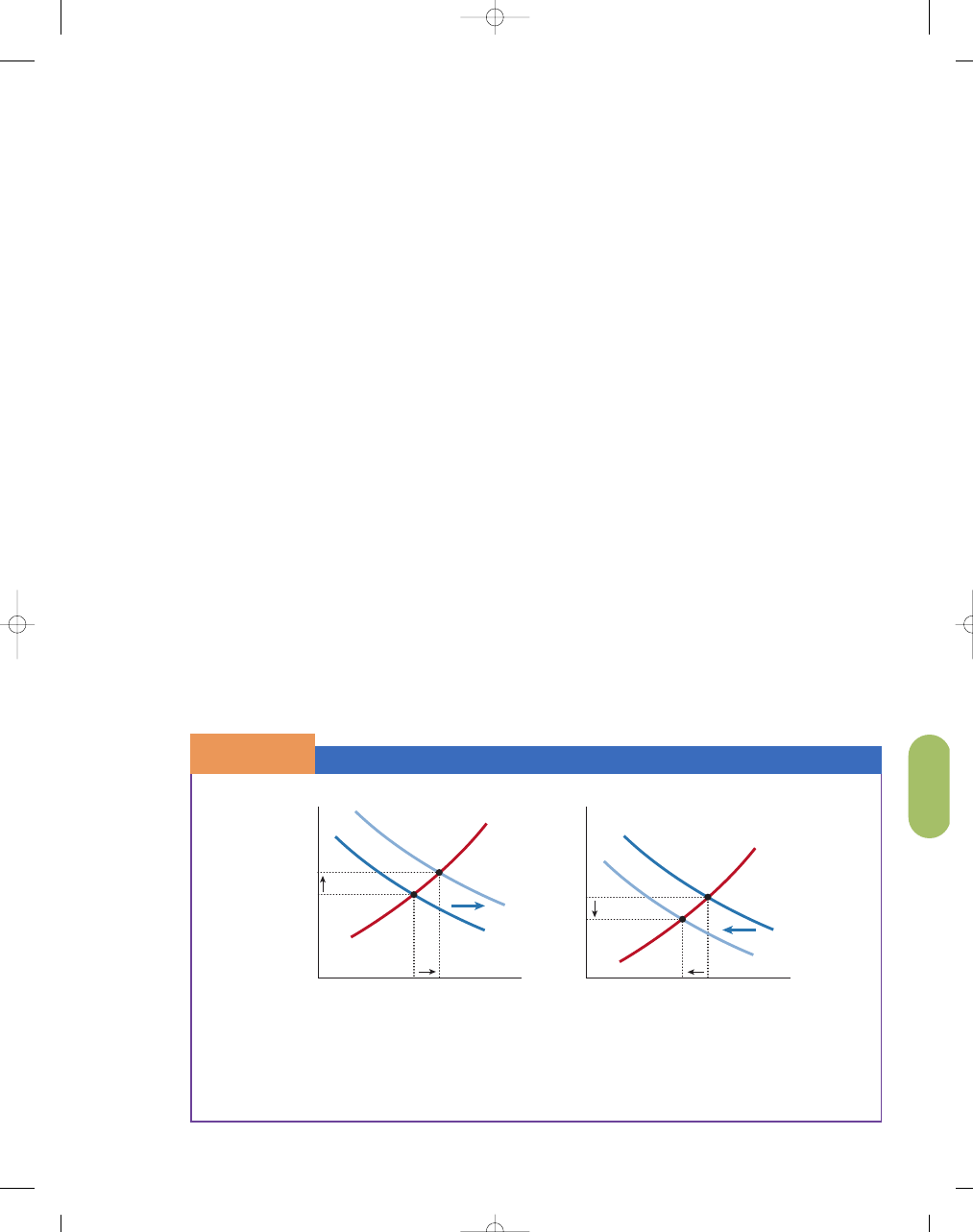

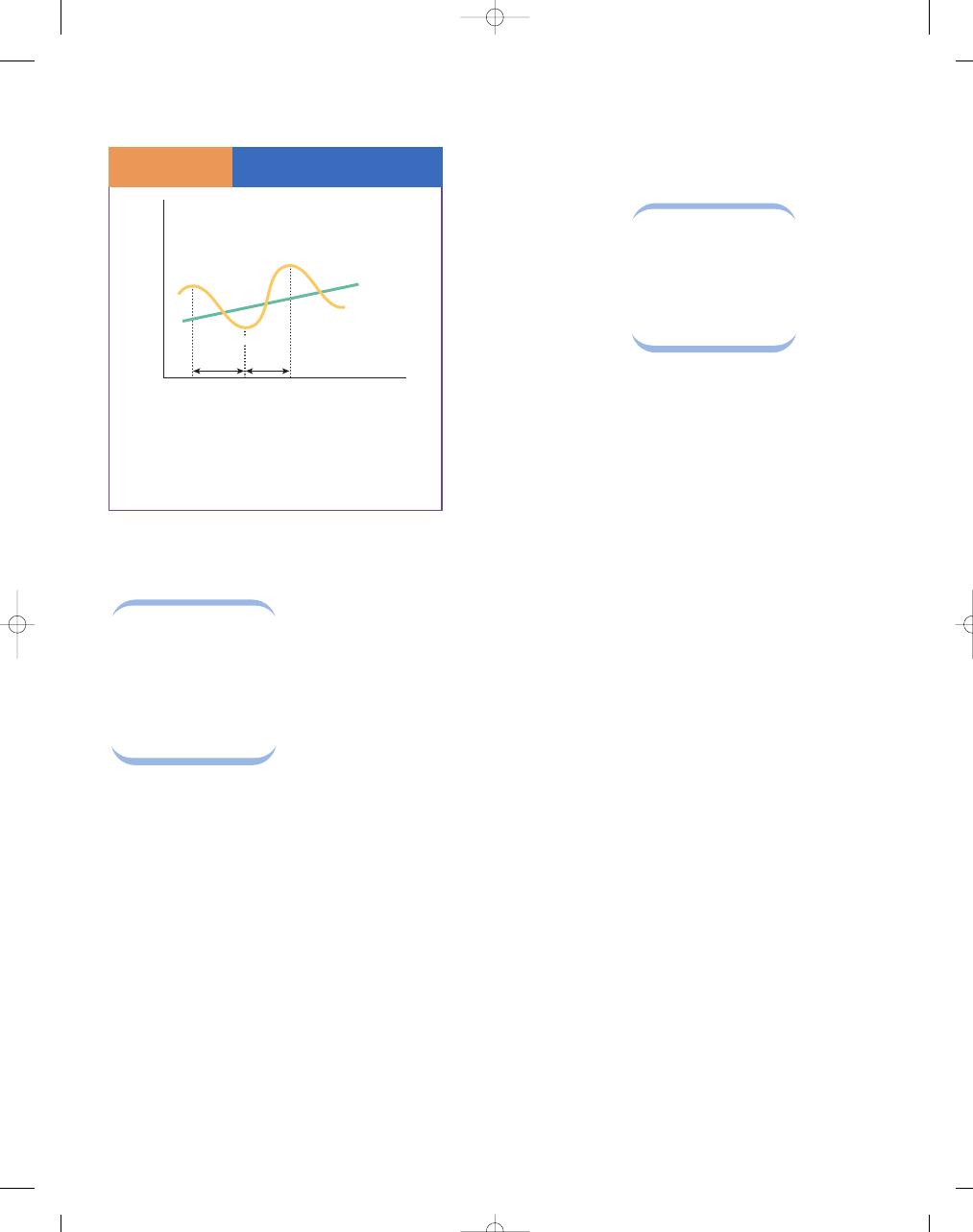

the quantity of labor demanded. In Exhibit 1, we see

that W

1

is higher than the market equilibrium wage

that equates the quantity demanded of labor with

the quantity supplied of labor. At W

1

, the quantity

of labor supplied is greater than quantity of labor

demanded, resulting in an excess quantity supplied

of labor—unemployment. That is, more people want

to work at the going (nonequilibrium) wage than

employers want to hire, and those who are not able

to find work are “unemployed.” Why? Economists

cite three reasons for the failure of wages to balance

the labor demand and labor supply equilibrium—

minimum wages, unions, and the efficiency wage

theory.

MINIMUM WAGES AND UNEMPLOYMENT

Many different types of labor markets exist for differ-

ent types of workers. The labor market for workers

with little experience

and job skills is called

the unskilled labor

market. Suppose the

government decided to

establish a

minimum

wage rate

(an hourly

wage floor) for unskilled

workers above the equilibrium wage, W

E

. At the

minimum wage, the quantity of labor supplied grows

because more people are willing to work at a higher

wage. However, the quantity of labor demanded falls

because some employers would find it unprofitable

to hire low-skilled workers at the higher wage. At

W

1

, a gap exists between the quantity of labor

demanded and the quantity supplied, representing a

surplus of unskilled workers—unemployment, as seen

in Exhibit 1.

Because minimum wage earners, a majority of

whom are 25 years or younger, are a small portion of the

labor force, most economists believe the effect of min-

imum wage on unemployment is small.

S E C T I O N

21.4

R e a s o n s f o r U n e m p l o y m e n t

■

How does a higher minimum wage lead to

greater unemployment among the young

and unskilled?

■

Can unions cause higher rates of

unemployment?

■

How does an efficiency wage cause a

higher rate of unemployment?

■

How do changes in job search costs affect

the unemployment rate?

■

Does unemployment insurance increase the

unemployment rate?

Wages Above Equilibrium

Lead to Greater

Unemployment

S E C T I O N

2 1 . 4

E

X H I B I T

1

0

W

1

W

E

Q

E

Q

D

Q

S

Labor Supply

Surplus of Labor

(Unemployment)

Labor Demand

Quantity of Labor

Real W

a

g

e

The labor market is in equilibrium where the quantity

demanded of labor is equal to the quantity supplied

of labor, at W

E

and Q

E

. If the wage persists above the

equilibrium wage, a surplus of labor or unemploy-

ment of Q

S

× Q

D

exists. That is, at W

1

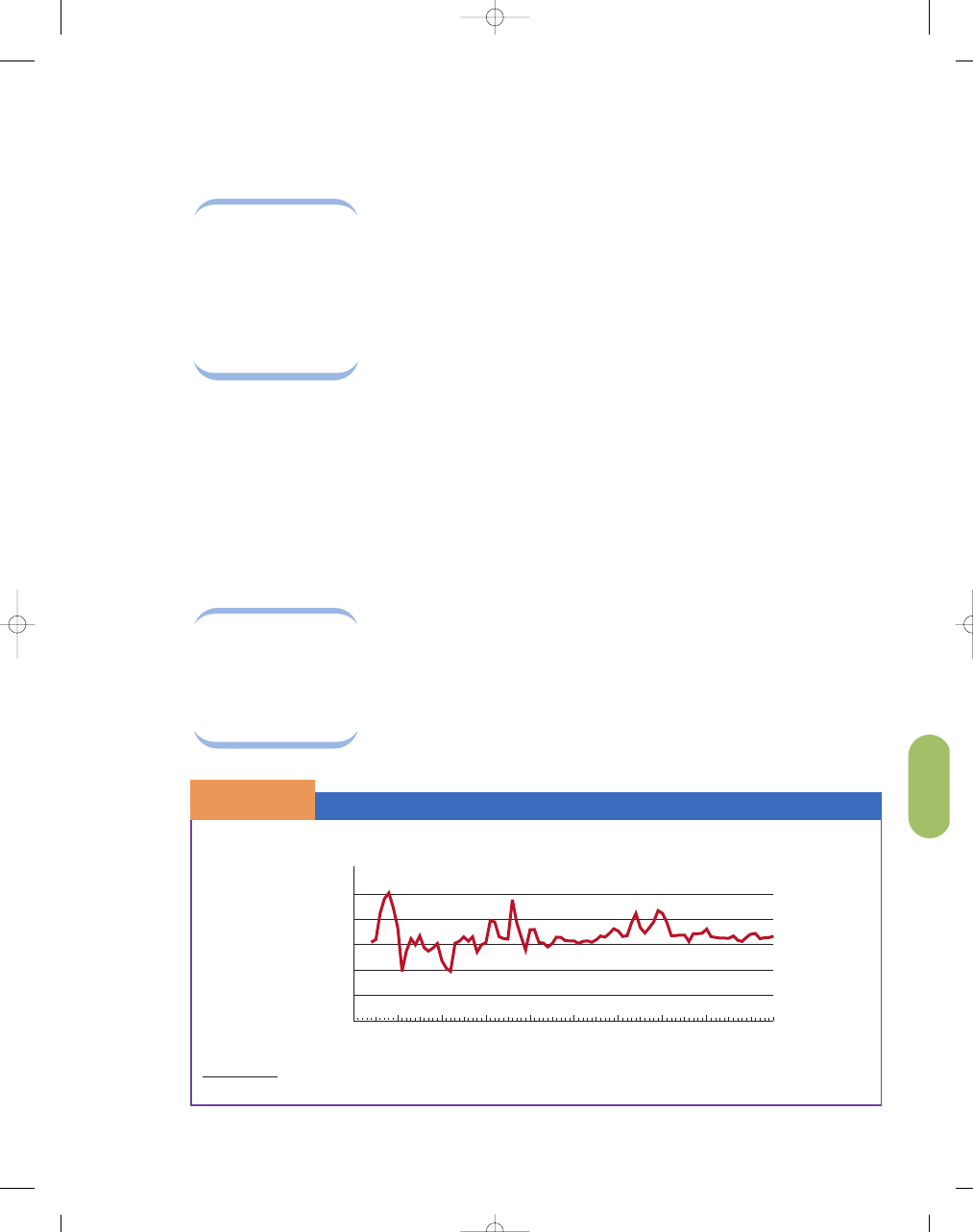

, the quantity of

labor supplied is greater than the quantity of labor

demanded; we can think of this surplus of labor as

unemployment.

minimum wage rate

an hourly wage floor set above the

equilibrium wage

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 575

576

M O D U L E 6

Macroeconomic Foundations

THE IMPACT OF UNIONS ON THE

UNEMPLOYMENT RATE

Unions negotiate their wages and benefits collectively

through their union officials, a process called collec-

tive bargaining. If, through this process of collective

bargaining, union officials are able to increase wages,

then unemployment will rise in the union sector. If the

bargaining raises the union wage above the equilib-

rium level, the quantity of union labor demanded will

decrease, and the quantity of union labor supplied

will increase—that is, union workers will be unem-

ployed. The union workers who still have their jobs will

be better off, but some who are equally skilled will be

unemployed and will either seek nonunion work or

wait to be recalled in the union sector. Many econo-

mists believe that is why wages are approximately

15 percent higher in union jobs, even when nonunion

workers have comparable skills. On the other hand,

even though wages in the union sector are typically

higher than the market wage, the presence of unions

does not necessarily lead to greater unemployment

because workers can find jobs in the nonunion

sector. Less than 10 percent of private sector jobs are

unionized.

EFFICIENCY WAGE

In economics, it is generally assumed that as produc-

tivity rises, wages rise, and workers can raise their

productivity through investments in human capital

like education and on-the-job training. However,

some economists follow

the

efficiency wage

model,

which is based

on the belief that higher

wages lead to greater

productivity.

In the efficiency

wage model, employers

pay their employees

more than the equilibrium wage to be more efficient.

Proponents of this theory suggest that it may lead to

attracting the most productive workers, fewer job

turnovers, and higher morale, which in turn can lead

to lower hiring and training costs. Because the effi-

ciency wage rate is greater than the equilibrium wage

rate, the quantity of labor supplied is greater than the

quantity of labor demanded, resulting in greater

amounts of unemployment.

In 1914, Henry Ford increased his workers’ wages

from $3 to $5 per day—roughly twice the going wage

rate for unskilled workers. This wage rate led to long

lines of workers seeking jobs at the Ford plant—that is,

quantity supplied greatly exceeded quantity demanded

at the efficiency wage rate. Ford knew that assembly

line work was boring, and to overcome the problem he

was having with morale and absenteeism, he decided to

increase daily wages to $5 a day. At the time, many

business leaders were skeptical because this put Ford’s

labor costs at nearly twice that of his rivals. However,

Ford profits continued to mount. Historical records

suggest that the efficiency wage led to lower turnovers,

less absenteeism, better hires, and less shirking—in

short, greater worker productivity. Even though the

higher wages led to higher labor costs, overall produc-

tion costs fell with the gains in labor productivity.

Some scholars have argued that the positive

effects of the efficiency wage are unique to assembly

line production and its high degree of worker interde-

pendence. However, it is costly for firms to pay an

efficiency wage. Consequently, firms must monitor

their workers’ efforts. If enough firms resort to paying

the efficiency wage rate, then the average real wage

rate will be greater than the equilibrium wage. This

equilibrium will lead to unemployment.

JOB SEARCH

Another reason for unemployment has to do with the

nature of labor markets. Because of frictional unem-

ployment, some unemployment would exist even if

labor supply and labor demand were balanced.

Different firms offer different compensation packages

(salary, fringe benefits, working conditions), and

workers are sometimes unaware of these packages

when they seek the “best” job available. It takes time

and money to locate the best available opportunities.

Also, not all job seekers are the same: They have dif-

ferent tastes and preferences about types of jobs and

job locations. Sometimes it is difficult to get the infor-

mation about particular jobs to the right job candi-

date. These search activities prolong the duration of

unemployment. However, the search goes on because

the job seeker hopes to find a better offer.

The labor demand and supply curves are con-

stantly shifting. That is, labor markets are constantly

in flux—people losing jobs, leaving jobs, reentering

jobs. In a growing and dynamic economy, jobs are

constantly being destroyed and created, leading to

temporary unemployment as workers search for the

best jobs for their skills.

UNEMPLOYMENT INSURANCE

Losing a job can lead to considerable hardships, and

unemployment insurance is designed to partially offset

the severity of the unemployment problem. The pro-

gram does not cover those who were fired or quit their

jobs. To qualify, recipients must have worked a certain

efficiency wage

model

theory stating that higher wages

lead to greater productivity

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 576

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

577

length of time and lost their jobs because the employer

no longer needed their skills. The typical compensation

is half salary for 26 weeks. Although the program is

intended to ease the pain of unemployment, it also leads

to prolonged periods of unemployment, as job seekers

stay unemployed for longer periods searching for new jobs.

For example, some unemployed people may

show little drive in seeking new employment, because

unemployment insurance lowers the opportunity cost

of being unemployed. Say a worker making $400 a

week when employed receives $220 in compensation

when unemployed; as a result, the cost of losing the

job is not $400 a week in forgone income but only

$180. It has been estimated that the existence of

unemployment compensation programs may raise

overall unemployment rates by as much as 1 percent.

Without unemployment insurance, a job seeker

would be more likely to take the first job offered, even

if the job did not match the job seeker’s preferences or

skill levels. A longer job search might mean a better

match, but it comes at the expense of lost production

and greater amounts of tax dollars.

DOES NEW TECHNOLOGY LEAD TO GREATER

UNEMPLOYMENT?

The widespread belief that technological advances

inevitably result in the displacement of workers is not

necessarily true. Generally, new inventions are cost

saving, and these cost savings usually generate higher

incomes for producers and lower prices and better prod-

ucts for consumers—benefits that ultimately result in

the growth of other industries. If the new equipment is

a substitute for labor, it might displace workers. For

example, many fast-food restaurants installed self-

service beverage bars to replace workers. However, new

capital equipment requires new workers to manufacture

and repair the new equipment. The most famous exam-

ple of this trade-off is the computer, which was sup-

posed to displace thousands of workers. Instead, the

computer generated a whole new growth industry that

created jobs. The problem is that it is easy to see only

the initial effect of technological advances (displaced

workers) but difficult to recognize the implications of

that invention throughout the whole economy over time.

Some economists believe that some of the real

wage differentials between skilled and unskilled work-

ers in the last couple of decades are due to technical

changes that are biased toward skilled workers. New

machines, with highly sophisticated computerization,

require highly skilled workers. Consequently, the new

machines make these workers more productive and

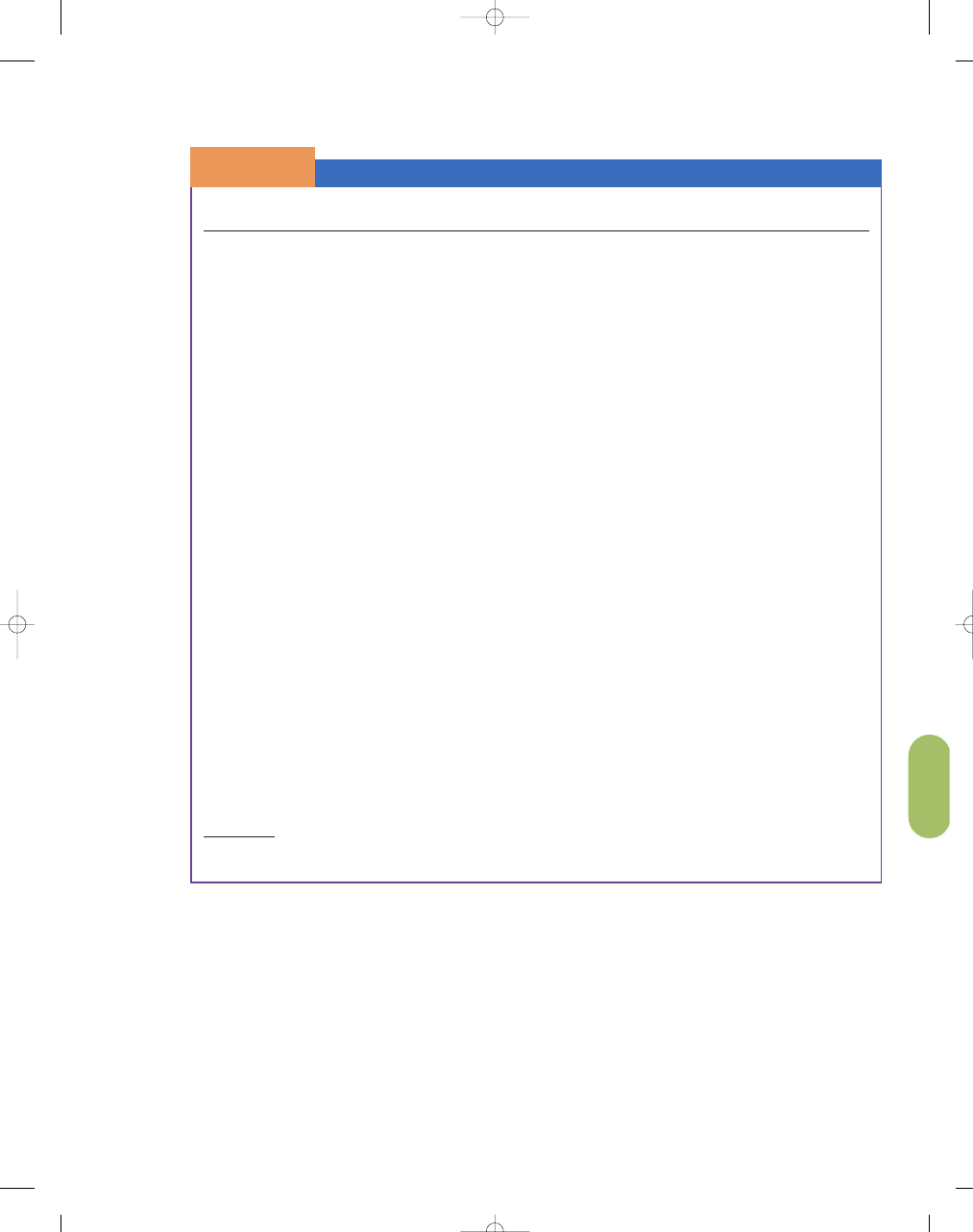

therefore they receive higher real wages. In Exhibit 2(a),

we graph the labor market for skilled workers. Because

of the increase in demand for skilled labor—skilled

workers can produce more with the new machines—

their real wages and employment are higher. At the

same time, the demand is lower for workers who do

not have the technical training to work with specialized

machinery, and the demand for unskilled workers falls

as seen in Exhibit 2(b). As a result of the decrease in

When a skill-biased technical change occurs, it increases the productivity of skilled workers. Consequently, the

increase in demand for skilled workers shifts the curve from D

1

to D

2

in (a). The increase in demand leads to higher

real wages from W

1

to W

2

and a greater quantity of skilled labor, Q

1

to Q

2

. In (b) we see a reduction in demand for

unskilled workers from D

1

to D

2

, because these workers cannot use the new technology that increases productivity.

The result is lower wages, W

1

to W

2

, and lower employment, Q

1

to Q

2

.

Real W

a

g

e

Quantity of Labor

0

Q

1

Q

2

W

1

W

2

S

D

1

D

2

Real W

a

g

e

Quantity of Labor

0

Q

2

Q

1

W

2

W

1

S

D

2

D

1

Skill-Biased Technical Change and Wage Inequality

S E C T I O N

2 1 . 4

E

X H I B I T

2

a. Skilled Workers

b. Unskilled Workers

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 577

578

M O D U L E 6

Macroeconomic Foundations

STABLE PRICE LEVEL AS A DESIRABLE GOAL

Just as full employment brings about one kind of eco-

nomic security, an overall stable

price level

increases

another form of economic security. Most prices in the

U.S. economy tend to rise over time. The continuing

rise in the overall price

level is called

inflation.

Even when the level of

prices is stable, some

prices will be rising

S E C T I O N

21.5

I n fl a t i o n

■

Why is the overall price level

important?

■

How did price level behave during the

previous century?

■

Who are the winners and losers during

inflation?

■

Can wage earners avoid the consequences

of inflation?

S E C T I O N

*

C H E C K

1.

Economists have cited three reasons why wages have failed to bring the quantity of labor demanded

into balance with the quantity of labor supplied—minimum wage, unions, and the efficiency wage

theory.

2.

At the minimum wage, the quantity of labor supplied grows because more people are willing to work

at a higher wage. However, the quantity of labor demanded falls because some employers would find it

unprofitable to hire low-skilled workers at the higher wage. That is, a higher minimum wage can lead to

higher rates of unemployment—particularly among unskilled teenagers.

3.

If the efficiency wage rate is greater than the equilibrium wage rate, the quantity of labor supplied is

greater than the quantity of labor demanded, resulting in greater amounts of unemployment.

4.

Sometimes it is difficult to get the information about particular jobs to the right job candidate. These

search activities prolong the duration of unemployment.

5.

Some unemployed persons may show little drive in seeking new employment, given the existence

of unemployment compensation. Unemployment compensation lowers the opportunity cost of being

unemployed.

1.

What are the three reasons for wages to fail to balance labor supply and labor demand?

2.

What is an efficiency wage?

3.

How do search costs lead to prolonged periods of unemployment?

4.

Why would higher unemployment compensation in a country like France lead to higher rates

of unemployment?

5.

Does new technology increase unemployment?

demand for unskilled workers, real wages and employ-

ment fall. Thus, skill-biased technical change tends to

create even greater disparities between the wages of

skilled and unskilled workers. The message: stay in

school (vocational or traditional).

price level

the average level of prices in the

economy

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 578

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

579

while others are falling. However, when inflation is

present, the goods and services with rising prices

will outweigh the goods

and services with lower

prices. Without stabil-

ity in the price level,

consumers and pro-

ducers will experience

more difficulty in coor-

dinating their plans

and decisions. When

the overall price level

is falling, it is called

deflation.

The aver-

age price level in the U.S. economy fell throughout

the late nineteenth century.

In general, the only thing that can cause a sus-

tained increase in the rate of inflation is a high rate of

growth in money, a topic we will discuss thoroughly

in upcoming chapters.

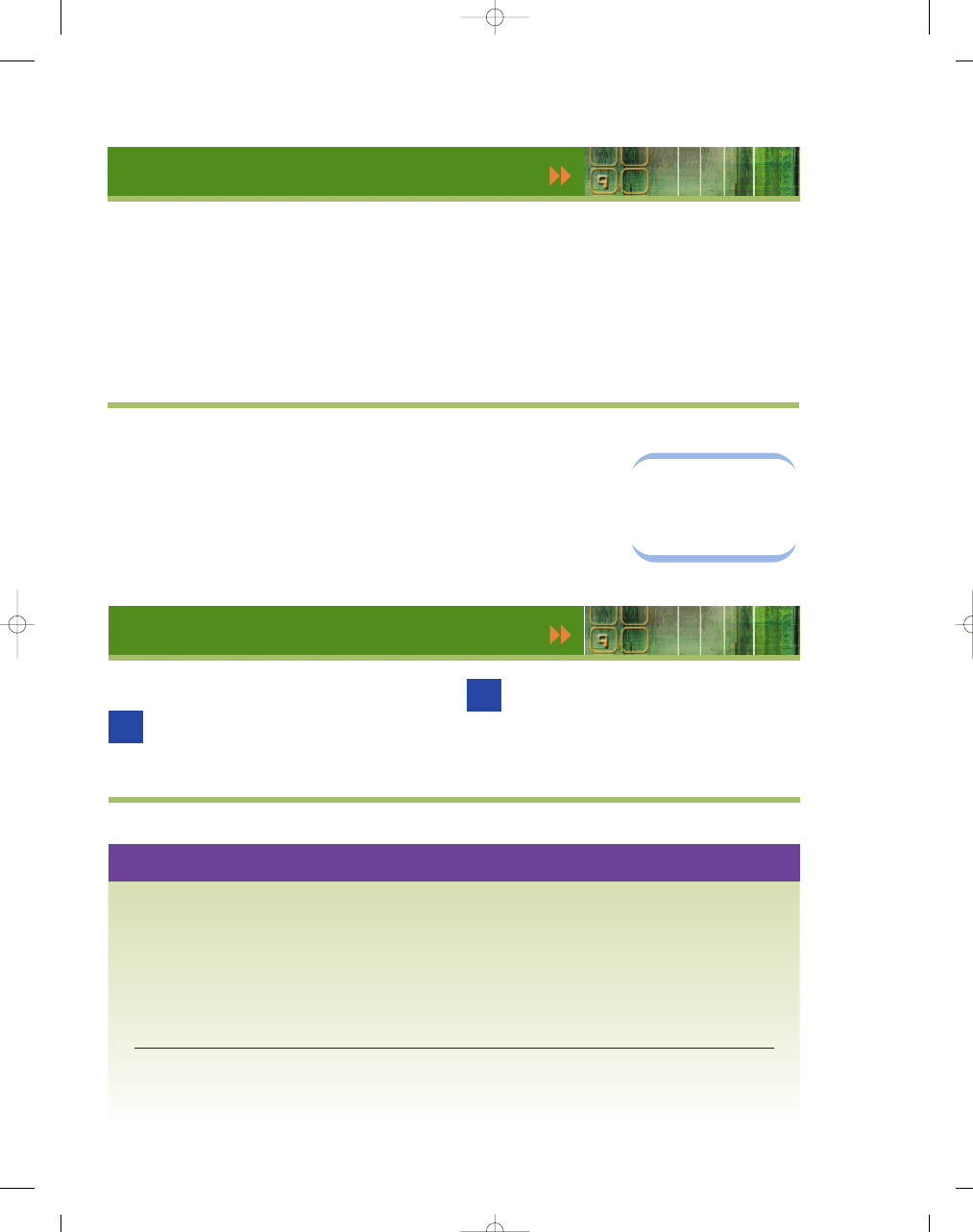

THE PRICE LEVEL OVER THE YEARS

Unanticipated and sharp changes in the price level are

almost universally considered to be “bad” and to

require a policy remedy.

What is the historical

record of changes in the

overall U.S. price level?

Exhibit 1 shows changes

in the

consumer price

index (CPI),

the stan-

dard measure of inflation,

from 1914 to 2005.

Can you believe that in 1940, stamps were 3 cents

per letter, postcards were a penny, the median price

of a house was $2,900, and the price of a new car

was $650? However, the problem with comparing

prices today with prices in the past is that it focuses

on the number of dollars it takes to buy something

rather than the purchasing power of the dollar. For

example, if prices and wages both doubled overnight,

raising the price of a quart of milk from $1 to $2,

you would be no worse off because you would still

work the same number of minutes to buy a quart

of milk.

WHO LOSES WITH INFLATION?

Inflation brings about changes in peoples’ purchasing

power, and these changes may be either desirable or

undesirable. Suppose you retire on a fixed pension of

$2,000 per month. Over time, that $2,000 will buy

less and less if prices generally rise. Your real income—

your income adjusted to reflect changes in purchasing

power—falls. Inflation lowers income in real terms for

people on fixed-dollar incomes. Likewise, inflation can

hurt creditors. For example, suppose a bank loaned

someone money for a house, at a 4 percent fixed rate

for 20 years, in the early 1960s (a period of low infla-

tion). However, the 1970s was a period of high infla-

tion rates (roughly 10% per year). Under this scenario,

because the lender did not correctly anticipate the

higher rate of inflation, the lender is the victim of

unanticipated inflation. That is, the borrower is

paying back with dollars that have much less purchas-

ing power than those dollars they borrowed in the

early 1960s. Another group that sometimes loses from

inflation

a rise in the overall price level,

which decreases the purchasing

power of money

deflation

a decrease in the overall price level,

which increases the purchasing

power of money

consumer price

index (CPI)

a measure of the trend in prices

of a basket of consumable goods

and services that serves to gauge

inflation

SOURCE: Bureau of Labor Statistics, 2006.

30%

20%

10%

0%

–10%

–20%

–30%

1910

1920

1930

1940

1950

Year

P

e

rcent

1970

1980

1960

1990

2000

Consumer Price Index

All Urban Consumers (CPI-U), Annual Percentage Change

The Price Level in the United States, 1914–2005

S E C T I O N

2 1 . 5

E

X H I B I T

1

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 579

580

M O D U L E 6

Macroeconomic Foundations

inflation, at least temporarily, comprises people whose

incomes are tied to long-term contracts. If inflation

begins shortly after a labor union signs a three-year

wage agreement, it may completely eat up the wage

gains provided by the contract. The same applies to

businesses that agree to sell quantities of one thing, say

coal, for a fixed price for a given number of years.

If some people lose because of changing prices,

others must gain. Debtors pay back dollars worth less

in purchasing power than those borrowed.

Corporations that can quickly raise the prices on their

goods may have revenue gains greater than their

increases in costs, providing additional profits. Wage

earners sometimes lose from inflation because wages

may rise at a slower rate than the price level. The

redistributional impact of inflation is not the result of

conscious public policy; it just happens.

The uncertainty that inflation creates can also

discourage investment and economic growth. When

inflation rates are high, they also tend to vary consid-

erably, which creates a lot of uncertainty. This uncer-

tainty complicates planning for businesses and

households, which is vital to capital formation, as

well as adding an inflation risk premium to long-term

interest rates.

Moreover, inflation can raise one nation’s price

level relative to price levels in other countries. In turn,

this shift can make financing the purchase of foreign

goods difficult, or it can decrease the value of the

national currency relative to that of other countries.

Costs of High Inflation

Predictably low rates of inflation, while still a prob-

lem, are considerably better than high and variable

inflation rates. A slow predictable rate of inflation

makes predicting future price increases relatively easy.

Consequently, setting interest rates will be an easier

task and the redistribution effects of inflation will be

minimized. In addition,

high and variable infla-

tion rates make it

almost impossible to

set long-term contracts

because prices and

interest rates may be

changing by the day, or

even by the hour in the case of

hyperinflation

—

extremely high rates of inflation for sustained periods

of time.

In its extreme form, inflation can lead to a com-

plete erosion of faith in the value of the pieces of

paper we commonly call money. In Germany, after

both world wars, prices rose so fast that people in

some cases finally refused to take paper money,

insisting instead on payment in goods or metals,

whose prices tend to move predictably with

inflation. Unchecked inflation can feed on itself and

may ultimately lead to hyperinflation of 300 percent

or more per year. We saw these rapid rates of

inflation in Argentina in the 1980s and Brazil in the

1990s. Most economists believe we can live quite

well in an environment of low, steady inflation, but

no economist believes we can prosper with high,

variable inflation.

UNANTICIPATED INFLATION

DISTORTS PRICE SIGNALS

High inflation also distorts economic decisions by

affecting after-tax income, because many aspects of

the tax system are not indexed for inflation, such as

the capital gains tax. (A capital gain is the difference

between the price at which an asset—for instance, a

stock—is sold and the price at which it is bought.)

Also, high inflation leads to people spending their

time and financial resources trying to find hedges

against inflation rather than engaging in productive

activities.

In periods of high

and variable inflation,

households and firms

have a difficult time

distinguishing between

changes in the

relative

price

of individual goods

and services (the price of a specific good compared to

the prices of other goods) and changes in the general

price level of all goods and services. Suppose the price

of milk rises by 5 percent between 2006 and 2007, but

the overall price level (inflation rate) increases by only

2 percent during that period. Then we could say that

between 2006 and 2007, the relative price of milk rose

only 3 percent (5% – 2%). The next year, the price of

milk might increase 5 percent again, but the general

inflation rate might be 6 percent. That is, between 2007

and 2008, the relative price of milk might actually fall

by 1 percent (5% – 6%). Remember, the relative price

is the price of a good relative to all other goods and

services. Because of this difficulty in establishing rela-

tive prices, inflation distorts the information that flows

from price signals. Does the good have a higher price

because it has become relatively more scarce and there-

fore more valuable relative to other goods, or did the

price rise along with all other prices because of

inflation? This muddying of price information under-

mines good decision making.

580

hyperinflation

extremely high rates of inflation

for sustained periods of time

relative price

the price of a specific good com-

pared to the price of other goods

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 580

C H A P T E R 2 1

Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

581

OTHER COSTS OF INFLATION

Another cost of inflation is the cost incurred by firms

as a result of being forced to change prices more

frequently. For example, a restaurant might have to

print new menus, or a department or mail-order

store may have to print

new catalogs to reflect

changing prices. These

costs are called

menu

costs;

they are the costs

of changing posted

prices. In some South

American economies in

the 1980s, inflation increased at more than 300

percent per year, with prices changing on a daily,

or even hourly, basis in some cases. Imagine how

large the menu costs could be in an economy such

as that!

The shoe-leather cost of inflation is the cost of

going to and from the bank to check on your assets

(so often that you wear

out the leather on your

shoes). Specifically, high

rates of inflation erode

the value of a cur-

rency, which means that

people will want to hold

less currency—perhaps

going to the ATM once a week rather than twice a

month. That is, the higher inflation rates lead to

higher nominal interest rates, which may induce

more individuals to put money in the bank rather

than allowing it to depreciate in their pockets. So,

the cost is really the time and convenience sacrificed

to keep less money on hand than you would if infla-

tion were not a factor. The effects of shoe-leather

costs of inflation, like those of menu costs, are

modest in countries with low inflation rates but

can be quite large in countries where inflation is

substantial.

INFLATION AND INTEREST RATES

The interest rate is usu-

ally reported as the

nominal interest rate,

which means it is not

adjusted for inflation.

We determine the

real

interest rate

by taking

the nominal rate of

interest and subtracting

the inflation rate:

Real interest rate

= Nominal interest rate

– Inflation rate

menu costs

the costs imposed on a firm from

changing listed prices

shoe-leather cost

the cost incurred when individuals

reduce their money holdings

because of inflation

SOURCES: The World Factbook, 2006; http://www.cia.gov.

g l o b a l w a t c h

40%

35%

30%

25%

20%

15%

10%

5%

0%

Jamaica

15.3%

Brazil

6.9%

Venezuela

16%

Indonesia

10.5%

Russia

12.7%

Mexico

4%

U.K.

2.1%

U.S.

3.2%

Canada

2.2%

Argentina

9.6%

Iraq

33%

Inflation Rate

(Ann

ual P

er

cent Chang

e)

Average Annual Inflation Rates, Selected Countries, 2005

nominal interest rate

the reported interest rate that

is not adjusted for inflation

real interest rate

the nominal interest rate minus the

inflation rate; also called the

inflation-adjusted interest rate

95469_21_Ch21_p561-602.qxd 4/1/07 3:31 PM Page 581

582

M O D U L E 6

Macroeconomic Foundations

For example, if the nominal interest rate was

5 percent, and the inflation rate was 3 percent, the

real interest rate would be 2 percent.

If people can correctly anticipate inflation, they

will behave in a manner that will largely protect them

against loss. However, if the inflation is not correctly

anticipated, (it is not an easy task to predict inflation)

inflation will still redistribute income. Consider the

creditor who believes that the overall price level will

rise 6 percent a year, based on experience in the imme-

diate past. Would that creditor lend money to some-

one at a 5 percent rate of interest? No. A 5 percent rate

of interest means that a person borrowing $1,000 now

will pay back $1,050 ($1,000 plus 5 percent of

$1,000) one year from now. But if prices go up 6 percent,

it will take $1,060 to buy what $1,000 does today

($1,060 is 6% more than $1,000). Thus, the creditor

lending at 5 percent will get paid back an amount

($1,050) less than the purchasing power of the origi-

nal loan ($1,060) at the time it was paid back. The real

interest rate would actually be negative. To protect

themselves, creditors will demand a rate of interest

large enough to compensate for the deteriorating value

of money.

Failure to understand the difference between

nominal and real interest rates is critical. In most eco-

nomic decisions, it is the real rate of interest that mat-

ters because it is this rate that shows how much

borrowers pay and lenders receive in terms of pur-

chasing power—goods and services money can buy.

Investors and lenders will do best when the real inter-