Biodegradable

Polymers

Market Report

David K. Platt

A Smithers Group Company

©PlasBio Inc. (www.plasbio.com)

©PlasBio Inc. (www.plasbio.com)

Biodegradable Polymers

Market Report

David K. Platt

Smithers Rapra Limited

A wholly owned subsidiary of The Smithers Group

Shawbury, Shrewsbury, Shropshire, SY4 4NR, United Kingdom

Telephone: +44 (0)1939 250383 Fax: +44 (0)1939 251118

http://www.rapra.net

Published in 2006 by

Smithers Rapra Limited

Shawbury, Shrewsbury, Shropshire, SY4 4NR, UK

©2006, Smithers Rapra Limited

All rights reserved. Except as permitted under current legislation no part

of this publication may be photocopied, reproduced or distributed in any

form or by any means or stored in a database or retrieval system, without

the prior permission from the copyright holder.

A catalogue record for this book is available from the British Library.

Every effort has been made to contact copyright holders of any material reproduced within

the text and the authors and publishers apologise if

any have been overlooked.

ISBN: 1-85957-519-6

Typeset by Smithers Rapra Limited

Cover printed by Telford Reprographics Limited, Telford, UK

Printed and bound by Smithers Rapra Limited, Shrewsbury, UK

i

Contents

1.1 Background

................................................................................................................... 1

1.2 The

Report

.................................................................................................................... 2

1.3 Methodology ................................................................................................................. 3

1.4 About the Author .......................................................................................................... 3

2.1 Global Market Forecasts ............................................................................................... 5

2.2 Material Trends ............................................................................................................. 6

2.3 Regional Trends ............................................................................................................ 7

2.4 Market Trends ............................................................................................................... 8

2.5 Competitive Trends ....................................................................................................... 9

3.1 Introduction ................................................................................................................ 11

3.2 Defi nitions of Biodegradable Polymers ........................................................................ 11

3.3 Mechanisms of Polymer Degradation .......................................................................... 11

3.4 Measuring Biodegradability of Polymers ..................................................................... 12

3.5 Factors Affecting Biodegradability ............................................................................... 13

3.6 Biodegradable Polymer Classes .................................................................................... 14

3.6.1 Naturally Biodegradable Polymers .................................................................. 15

3.6.2 Synthetic Biodegradable Polymers ................................................................... 15

3.6.3 Modifi ed Naturally Biodegradable Polymers ................................................... 15

3.7 Starch-Based Biodegradable Polymers ......................................................................... 16

3.8 Polyhydroxyalkanoates ............................................................................................... 18

3.9 Polylactic Acid Polyesters ............................................................................................ 20

3.10 Synthetic Biodegradable Polymers ............................................................................... 22

3.10.1 Polycaprolactone (PCL) ................................................................................... 22

3.10.2 Polyglycolide (PGA) ........................................................................................ 23

3.10.3 Poly(dioxanone) (a polyether-ester) ................................................................. 23

3.10.4 Poly(lactide-co-glycolide) ................................................................................. 23

ii

Biodegradable Polymers

3.11 Processing Biodegradable Polymers ............................................................................. 25

3.11.1 Introduction .................................................................................................... 25

3.11.2 Film Blowing and Casting ............................................................................... 25

3.11.3 Injection Moulding .......................................................................................... 27

3.11.4 Blow Moulding ............................................................................................... 27

3.11.5 Injection Stretch Blow Moulding ..................................................................... 28

3.11.6 Thermoforming ............................................................................................... 29

3.11.7 Fibre Spinning ................................................................................................. 30

4.1 Introduction

................................................................................................................ 31

4.2 Market

Drivers

............................................................................................................ 31

4.2.1 Development of Framework Conditions .......................................................... 31

4.2.2 Development of a Composting Infrastructure .................................................. 35

4.2.3 Pricing Trends ................................................................................................. 37

4.2.4 Growth in Pre-Packaged Food Sales ................................................................ 38

4.2.5 Consumer Preference for Sustainable Packaging .............................................. 38

4.2.6 Product and Technology Development ............................................................ 39

4.3 Market Development and Structure ............................................................................. 39

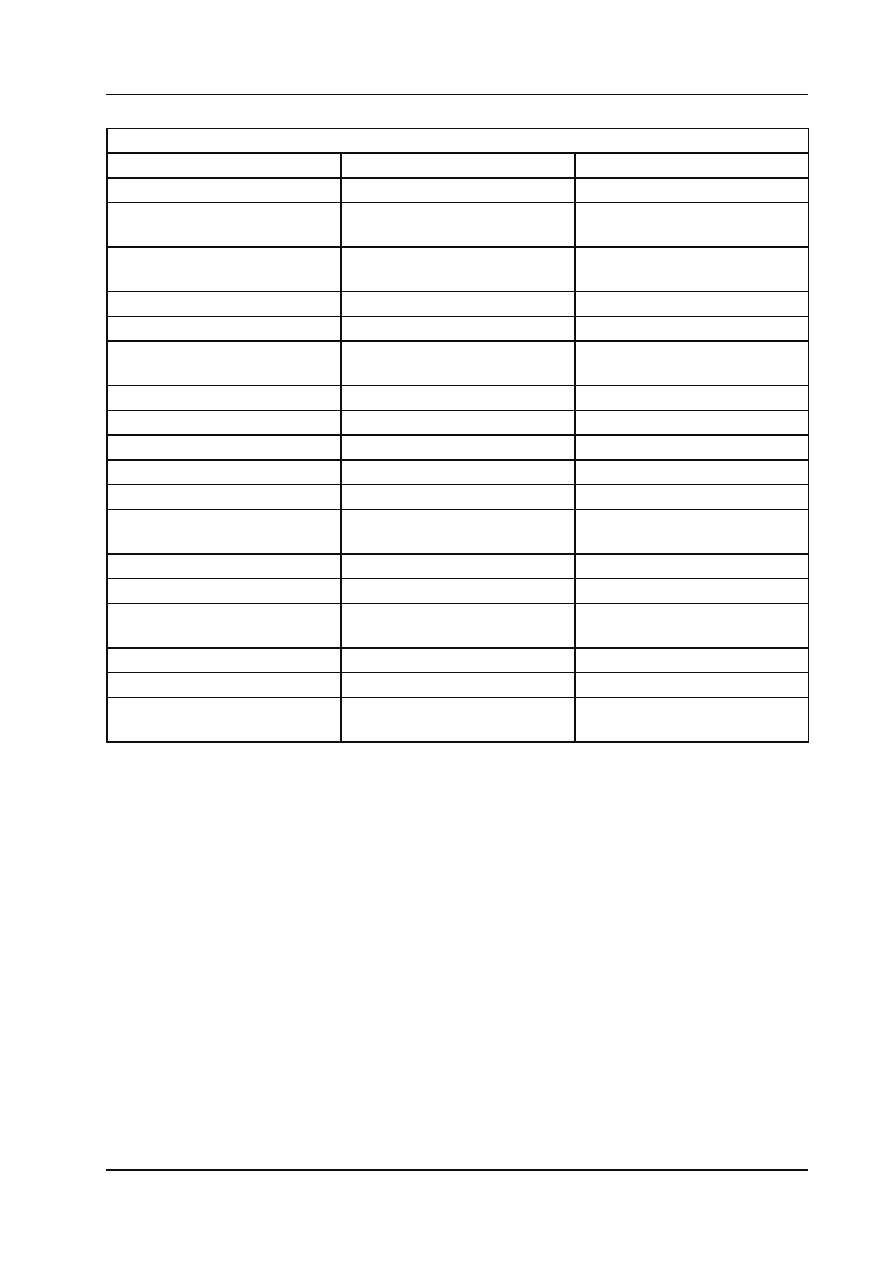

4.4 The Global Biodegradable Polymers Market Forecast ................................................. 41

4.4.1 Western European Biodegradable Polymers Market Forecast .......................... 44

4.4.2 North American Biodegradable Polymers Market Forecast ............................. 46

4.4.3 Asia Pacifi c Biodegradable Polymers Market Forecast ..................................... 48

5.1 Introduction ................................................................................................................ 57

5.2 Applications Development ........................................................................................... 57

5.3 Market Drivers ............................................................................................................ 59

5.4 Market Size and Forecast ............................................................................................ 60

5.5 Major Suppliers and their Products ............................................................................. 61

5.5.1 Novamont ....................................................................................................... 61

5.5.2 Rodenburg Biopolymers, BV ........................................................................... 63

5.5.3 EarthShell Corporation ................................................................................... 63

5.5.4 Stanelco Group ................................................................................................ 64

5.5.5 Grenidea Technologies .................................................................................... 65

5.5.6 Biopolymer Technologies ................................................................................. 65

5.5.7 NNZ BV ......................................................................................................... 65

5.5.8 Plantic Technologies ........................................................................................ 66

iii

Contents

6.1 Introduction ................................................................................................................ 67

6.2 Applications Development ........................................................................................... 67

6.2.1 Rigid Packaging ............................................................................................... 68

6.2.2 Flexible Packaging ........................................................................................... 69

6.2.3 Blow Moulded Bottles ..................................................................................... 70

6.2.4 High Performance Applications ....................................................................... 70

6.3 Market Drivers ............................................................................................................ 70

6.3.1 Better Environmental Credentials .................................................................... 71

6.3.2 Stable Supply and More Competitive Prices .................................................... 71

6.3.3 World’s First Greenhouse-Gas-Neutral Polymer .............................................. 71

6.3.4 Replacement of Traditional Packaging Materials ............................................. 72

6.3.5 Speciality Cards ............................................................................................... 72

6.3.6 Source Options ................................................................................................ 72

6.3.7 New Applications ............................................................................................ 73

6.3.8 Better Processing ............................................................................................. 73

6.4 Market Size and Forecast ............................................................................................ 74

6.5 Major Suppliers and their Products ............................................................................. 75

7.1 Introduction ................................................................................................................ 79

7.2 Applications Development ........................................................................................... 81

7.2.1 Films ............................................................................................................... 82

7.2.2 Flexible Packaging ........................................................................................... 82

7.2.3 Thermoformed Articles ................................................................................... 82

7.2.4 Coated/Corrugated Paper ................................................................................ 82

7.2.5 Synthetic Papers .............................................................................................. 83

7.2.6 Bioresorbable Medical Devices ........................................................................ 83

7.2.7 Polymer Blends ................................................................................................ 83

7.3 Market Drivers ............................................................................................................ 83

7.4 Market Size and Forecast ............................................................................................ 84

7.5 Suppliers and their Products ........................................................................................ 84

8.1 Introduction ................................................................................................................ 87

8.2 Applications Development ........................................................................................... 88

iv

Biodegradable Polymers

8.3 Market Drivers ............................................................................................................ 89

8.4 Market Size and Forecast ............................................................................................ 89

8.5 Suppliers and their Products ........................................................................................ 90

9.1 Introduction ................................................................................................................ 93

9.2 Packaging .................................................................................................................... 93

9.2.1 Flexible Packaging ........................................................................................... 93

9.2.2 Rigid Packaging ............................................................................................... 94

9.2.3 Paper Coating .................................................................................................. 96

9.2.4 Loose-Fill Packaging ........................................................................................ 97

9.3 Bags and Sacks ............................................................................................................ 97

9.4 Disposable Serviceware ............................................................................................... 97

9.5 Agriculture and Horticulture ....................................................................................... 98

9.6 Medical Devices .......................................................................................................... 98

9.6.1 Sutures ............................................................................................................ 98

9.6.2 Dental Devices ................................................................................................. 99

9.6.3 Orthopaedic Fixation Devices ......................................................................... 99

9.6.4 Other Applications .......................................................................................... 99

9.7 Consumer Electronics Products ................................................................................. 100

9.8 Automotive ............................................................................................................... 100

9.9 Speciality Cards ......................................................................................................... 101

9.10 Fibres ........................................................................................................................ 101

10.1 Alpha Packaging ........................................................................................................ 103

10.2 Arkhe Planning Co. ................................................................................................... 103

10.3 Arthur Blank & Company ......................................................................................... 104

10.4 Autobar Group Ltd. .................................................................................................. 105

10.5 Bartling GmbH & Co. KG Kunststoffe ..................................................................... 106

10.6 Bi-Ax International .................................................................................................... 106

10.7 BioBag International AS ............................................................................................ 107

10.8 Biosphere Industries Corporation .............................................................................. 108

10.9 BIOTA Brands of America Inc. .................................................................................. 108

v

10.10 Bomatic

Inc.

........................................................................................................... 109

10.11 Brenmar

Company

................................................................................................. 109

10.12 Carolex

SAS

........................................................................................................... 110

10.13 Chien Fua Bio-Tech Industry Co., Ltd. ................................................................... 111

10.14 Coopbox

Europe

.................................................................................................... 111

10.15 Cortec

Corporation

................................................................................................ 112

10.16 Earthcycle Packaging Ltd. ....................................................................................... 113

10.17 Europackaging

plc

.................................................................................................. 114

10.18 Ex-Tech Plastics, Inc. .............................................................................................. 114

10.19 Fabri-Kal

................................................................................................................ 115

10.20 Faerch Plast A/S ...................................................................................................... 115

10.21 Farnell

Packaging

Ltd.

............................................................................................ 116

10.22 Fortune

Plastics

...................................................................................................... 116

10.23 Good Flag Biotechnology Corporation ................................................................... 117

10.24 Grenidea Technologies Pte Ltd. ............................................................................... 118

10.25 The Heritage Bag Company .................................................................................... 118

10.26 Huhtamäki

Oy

....................................................................................................... 119

10.27 IBEK Verpackungshandel GmbH ............................................................................ 120

10.28 ILIP

........................................................................................................................ 121

10.29 Innovia

Films

BVBA

............................................................................................... 122

10.30 Liquid

Container/Plaxicon

...................................................................................... 123

10.31 NNZ

bv

.................................................................................................................. 123

10.32 Natura

Verpackungs

GmbH

................................................................................... 124

10.33 NVYRO

................................................................................................................. 125

10.34 Plastic

Suppliers

Inc.

............................................................................................... 126

10.35 RPC Group plc ....................................................................................................... 127

10.36 Siamp-Cedap

.......................................................................................................... 128

10.37 Sidaplax

.................................................................................................................. 129

10.38 Signum

NZ

Ltd.

..................................................................................................... 129

10.39 Spartech

Corp.

........................................................................................................ 130

10.40 Sunway Household Ltd. ......................................................................................... 131

Contents

vi

Biodegradable Polymers

10.41 Toray

Industries

Inc.

............................................................................................... 131

10.42 Toray

Saehan

Inc.

................................................................................................... 132

10.43 Treofan

Group

........................................................................................................ 133

10.44 Vertex

Pacifi c Limited ............................................................................................. 134

10.45 Wei Mon Industry Co. Ltd. .................................................................................... 135

10.46 Wentus Kunststoff GmbH ...................................................................................... 136

10.47 Wilkinson

Industries

Inc.

........................................................................................ 137

1

1

Introduction

1.1 Background

Biodegradable polymers have been around for almost a decade, but it has only been in the last two

to three years that they have started to be produced on a commercial scale. Biodegradable polymers

have already found acceptance in application areas such as food packaging, bags and sacks, loose-

fi ll packaging agricultural fi lm and many niche market applications. However, while they remain

very much a niche product at the moment, there are signs that biodegradable polymers are ready to

attack mass markets with a number of major suppliers such as NatureWorks LLC, Novamont and

BASF, gearing up for large-scale production.

Biodegradable polymer demand is being driven by a number of important trends. In developed

countries of the Western world, particularly in Western Europe, governments have implemented

legislation to reduce the amount of municipal waste packaging being sent to landfi ll. Other options

being pursued include mechanical recycling, incineration with energy recovery and composting. As

these trends gather momentum, more favourable framework conditions for biodegradable plastics

market development are slowly coming into place.

There is also a growing trend for brand owners and retailers to recognise the potential marketing

benefi ts of ‘green’ or ‘sustainable’ packaging as consumers become more concerned about the

development of sustainable technologies, reduction in CO

2

emissions and the conservation of the

earth’s fossil resources. Several major world brands including Wal-Mart have been persuaded to

switch from petrochemical-based plastics to biodegradable plastics in recent years.

Demand for biodegradable polymers is also benefi ting from a narrowing in the price differential

between biopolymers and petrochemical-based plastics over the last two years. Petrochemical-

based plastic prices have gone up sharply due to a surge in crude oil prices and look like remaining

at historically high levels for some time to come. At the same time, biopolymer prices have come

down signifi cantly in recent years due to better production techniques, better material sourcing by

suppliers and higher production volumes. In 2006, certain starch-based and PLA biopolymers were

competitive with standard thermoplastics such as PET.

This report uses the American Society for Testing and Materials (ASTM) defi nitions of biodegradable

and compostable plastics.

• Biodegradable plastic: a biodegradable plastic is a degradable plastic in which the degradation

results from the action of naturally occurring microorganisms such as bacteria, fungi and algae.

• Composting: composting is a managed process that controls the biological decomposition of

biodegradable materials into a humus-like substance called compost; the aerobic and mesophilic

and thermophilic degradation of organic matter to make compost; the transformation of

biologically decomposable materials through a controlled process of bio-oxidation that proceeds

through mesophilic and thermophilic phases and results in the production of carbon dioxide,

water, minerals and stabilised organic matter (compost or humus).

2

Biodegradable Polymers

Biodegradable polymers and biopolymers can be produced by a wide variety of technologies, both

from renewable resources of animal or plant origin, and from fossil resources. A number of different

types are already available on the market.

Biodegradable polymers that are based on renewable resources include polyesters such as polylactic

acid (PLA) and polyhydroxyalkanoate (PHA). Biodegradable polymers can also be made from extracts

from plants and vegetables such as corn, maize, palm oil, soya and potatoes.

Biodegradable polymers can also be made from mineral oil based resources such as the aliphatic-

aromatic co-polyester types. Mixtures of synthetic degradable polyesters and pure plant starch,

known as starch blends, are also well-established products on the market.

Biodegradable polymers are similar in terms of their chemical structure to conventional thermoplastics

such as polyethylene, polypropylene and polystyrene. They can be processed using standard polymer

processing methods such as fi lm extrusion, injection moulding and blow moulding.

While biodegradable polymers may be similar to petrochemical-based thermoplastics in terms of their

structure, their chemical structure imbues them with technical properties that make them perform in

different ways. For example, starch blends can produce fi lm with better moisture barrier protection

and higher clarity than some conventional plastics. PLA has a high water vapour transmission rate,

which is benefi cial for fresh food applications where it is important that the water vapour escapes

quickly from the packaging. PLA also reduces fogging on the lid of the packaging.

1.2 The Report

The report starts with an overview of biodegradable polymers including an examination of the

processes of biodegradation, classifi cation of biodegradable polymers including their chemical

structure, properties, and processing performance.

Section 4 examines the global market for biodegradable polymers by major geographic region, covering

Western Europe, North America and Asia Pacifi c. Biodegradable polymer consumption by polymer

type and end use market is presented for each region for the years 2000, 2005 and forecast for 2010.

The main body of the study (Chapters 5-8) is divided into four core sections based on biodegradable

polymer types.

• Starch-based

• Polylactic acid (PLA)

• Polyhydroxyalkanoates

(PHA)

• Synthetic biodegradable polymers such as aliphatic-aromatic co-polyesters

Each section contains an overview of key market drivers, analysis of world consumption by geographic

region for the years 2000, 2005 and forecast for 2010, application developments and an analysis of

the major suppliers and their products.

Chapter 9 examines the market opportunities for biodegradable plastics by end use market covering

packaging, bags and sacks, disposable serviceware, agriculture and horticulture, medical devices,

consumer electronics products, automotive, speciality cards and fi bres.

3

Introduction

Finally, Chapter 10 examines around fi fty major processors of biodegradable plastics and their

products, including: BioBag International, Biosphere Industries, Bomatic, Coopbox, Cortec,

Europackaging, Ex-Tech Plastics, The Heritage Bag Company, Huhtamäki, IBEK, Innovia Films,

NNZ, natura Verpackungs, Plastic Suppliers, RPC Group, Toray and Treofan.

1.3 Methodology

The research for the report is based on various information sources including: the Rapra Polymer

Library, trade press, Internet/company web sites, and interviews with some of the leading suppliers.

The opinions expressed and the data presented are those of the author.

1.4 About the Author

David Platt graduated from the University of Nottingham with an Economics degree before completing

an MBA at the University of Bradford. He joined a leading international market consultancy where

he specialised in plastics sector research. He conducted a wide range of multi-client and single-client

studies covering a wide range of materials, from standard thermoplastics, engineering and high

performance polymers to conductive polymers and thermoplastic elastomers.

Now operating as a freelance consultant, he makes regular contributions to the European plastics

trade press, and also works with leading plastics industry consultants.

4

Biodegradable Polymers

5

2

Executive Summary

2.1 Global Market Forecasts

The market for biodegradable polymers has shown strong growth during the last fi ve years, albeit from

a very small base. However, there are still only a handful of producers operating truly commercial

scale production plants. The situation is slowly changing with a number of major plant expansions

planned over the next few years.

The major classes of biopolymer, starch and starch blends, polylactic acid (PLA) and aliphatic-

aromatic co-polyesters, are now being used in a wide variety of niche applications, particularly for

manufacture of rigid and fl exible packaging, bags and sacks and foodservice products. However,

market volumes for biopolymers remain extremely low compared with standard petrochemical-

based plastics. For example, in 2005, biopolymer consumption accounted for just 0.14% of total

thermoplastics consumption in Western Europe.

In 2005, the global biodegradable plastics market tonnage is estimated at 94,800 tonnes (including

loose-fi ll packaging) compared with 28,000 tonnes in 2000. In 2010, market tonnage is forecast to

reach 214,400 tonnes, which represents a compound annual growth rate of 17.7% during the period

2005-2010. Excluding loose-fi ll packaging, which is a relatively more mature sector for biodegradable

polymers, global market tonnage in 2005 is 71,700 tonnes and the compound annual growth rate

for the period 2005-2010 is 20.3%.

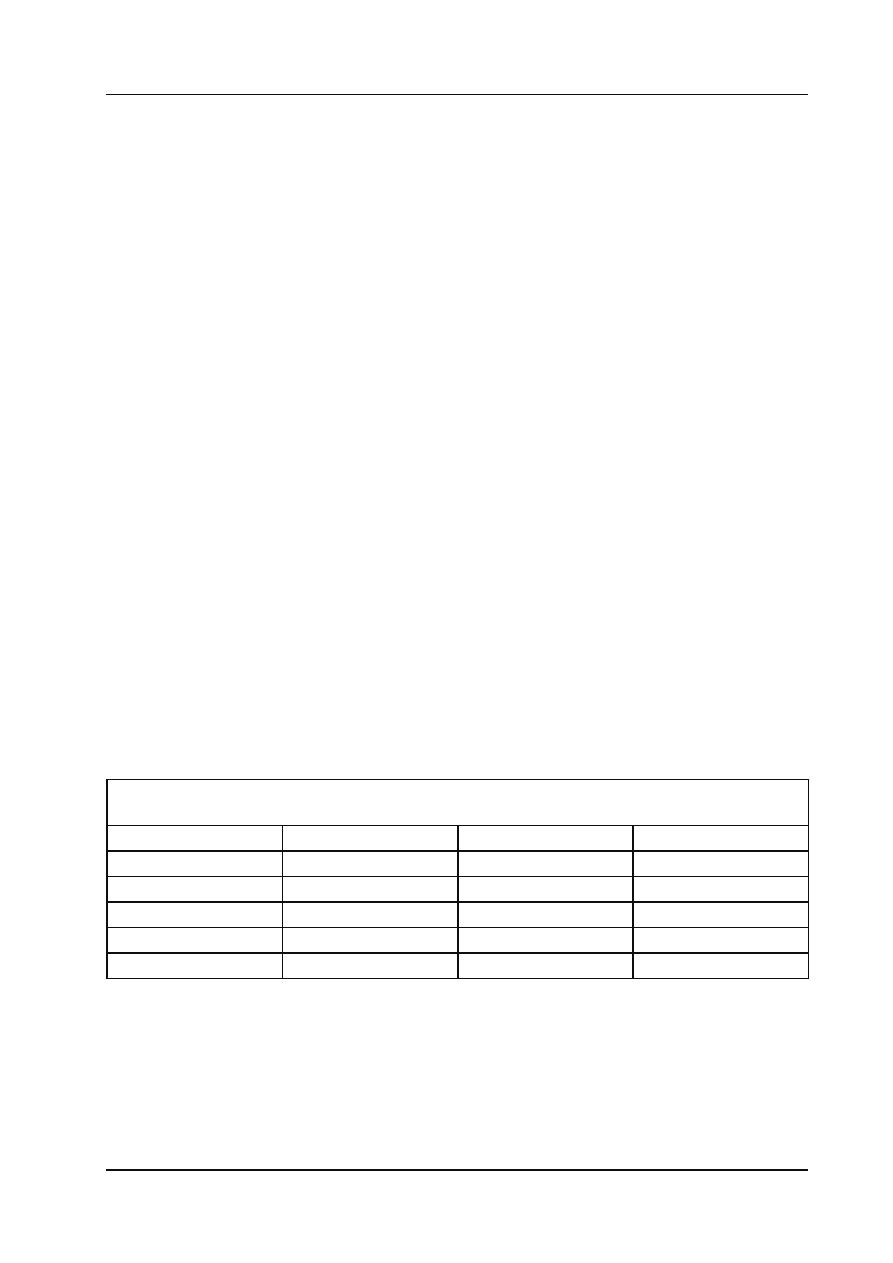

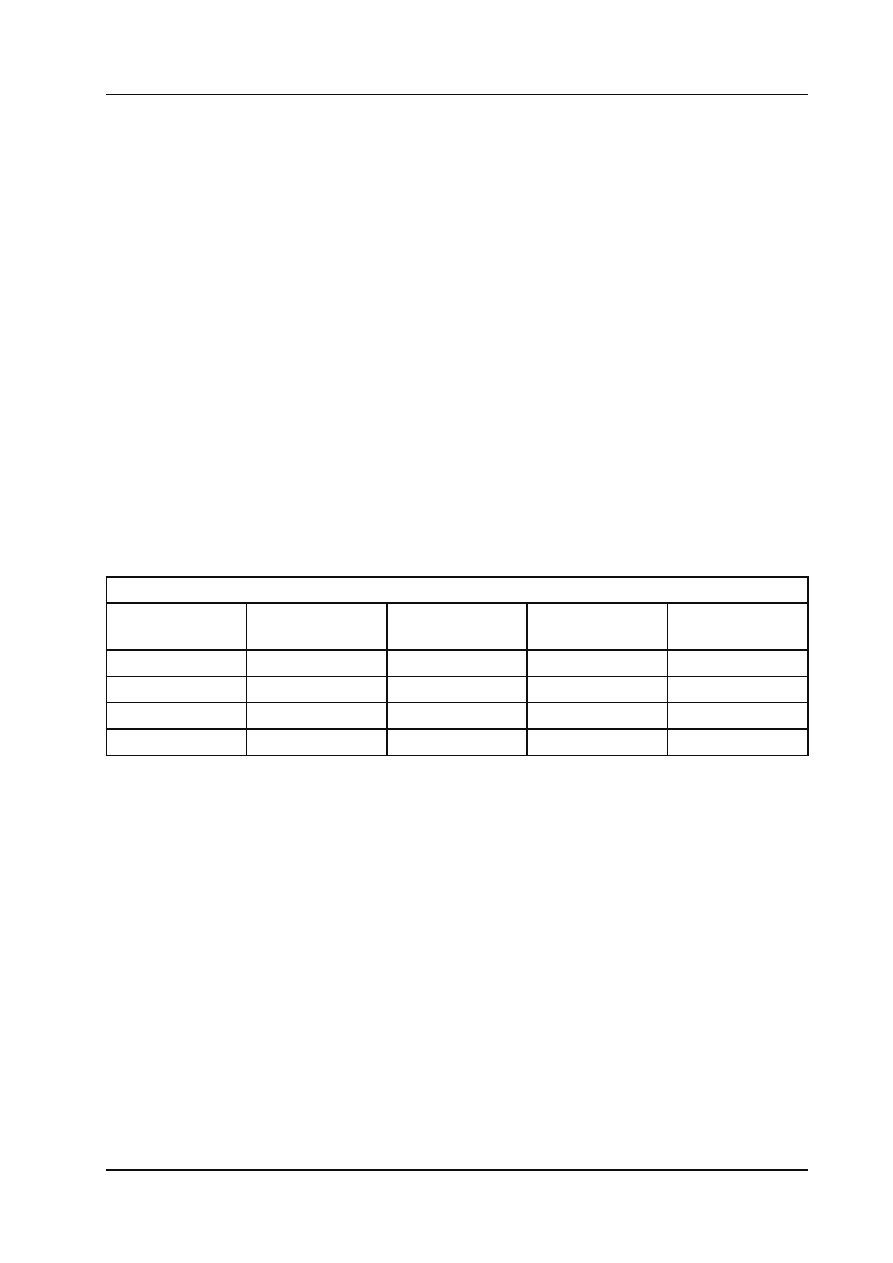

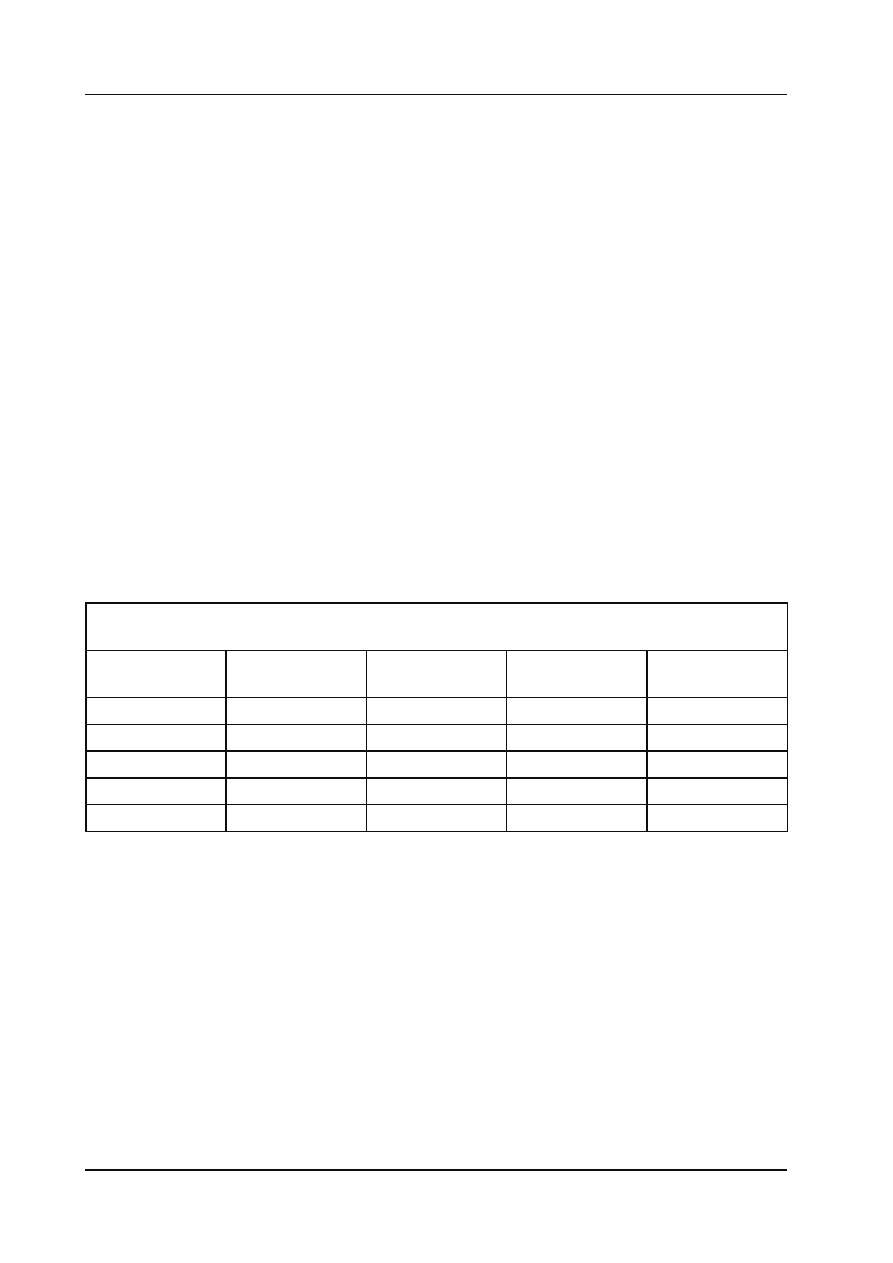

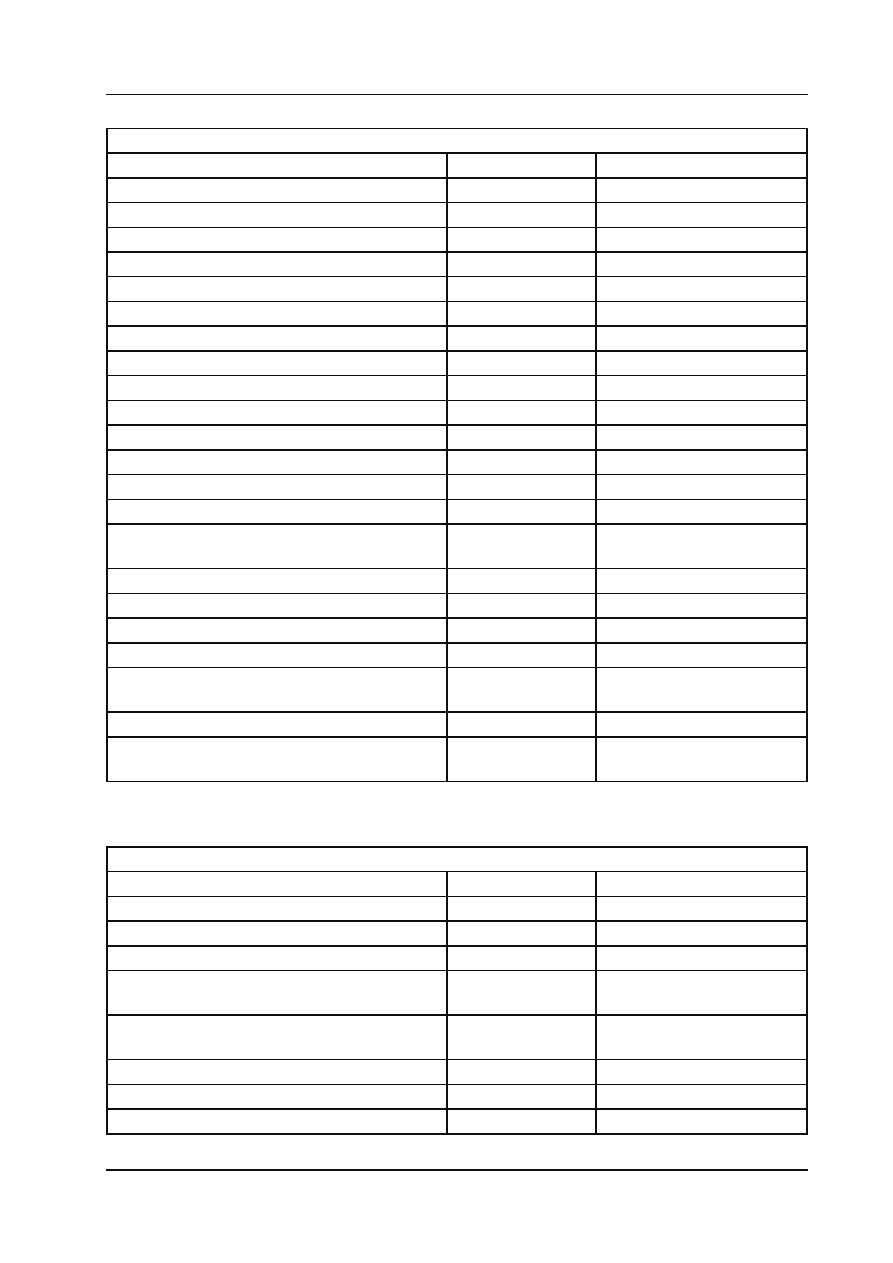

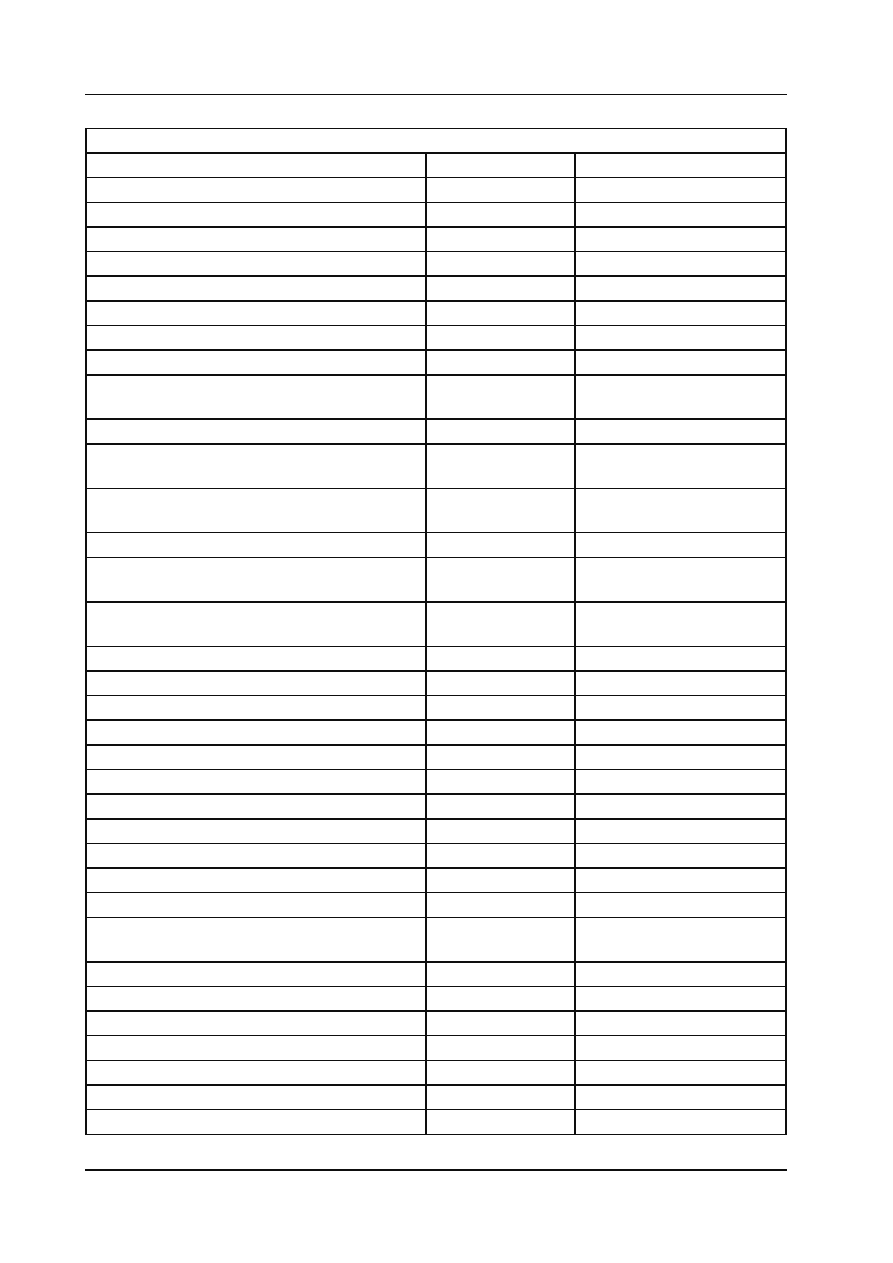

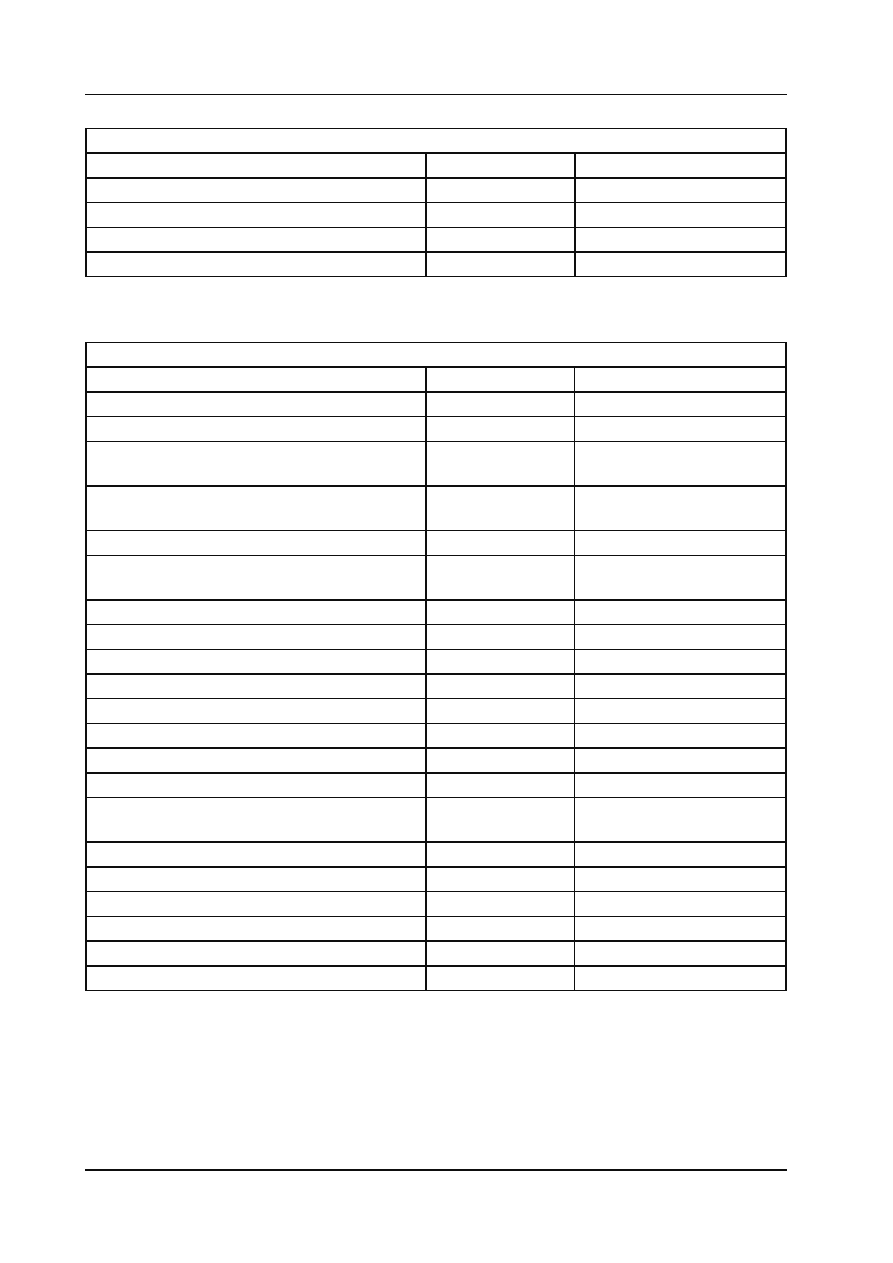

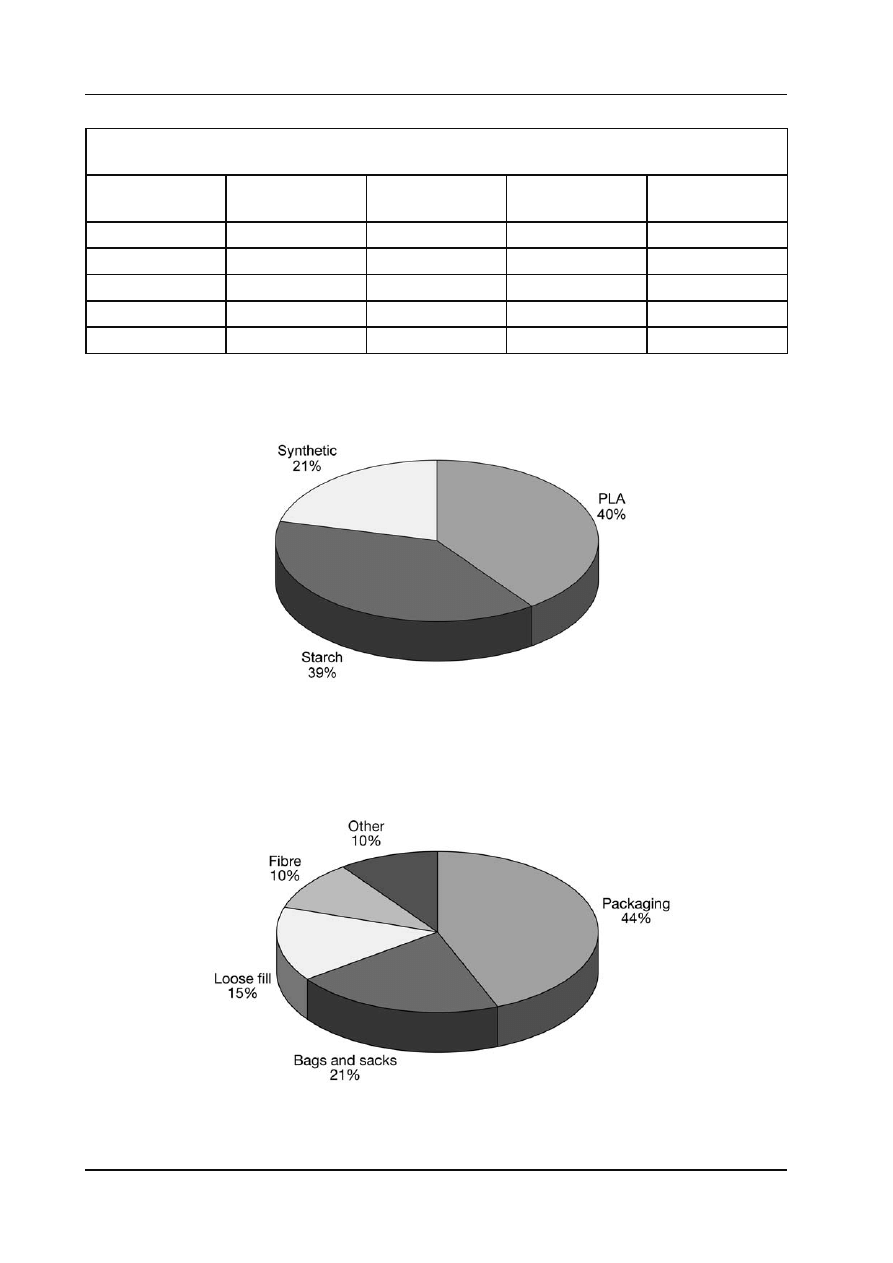

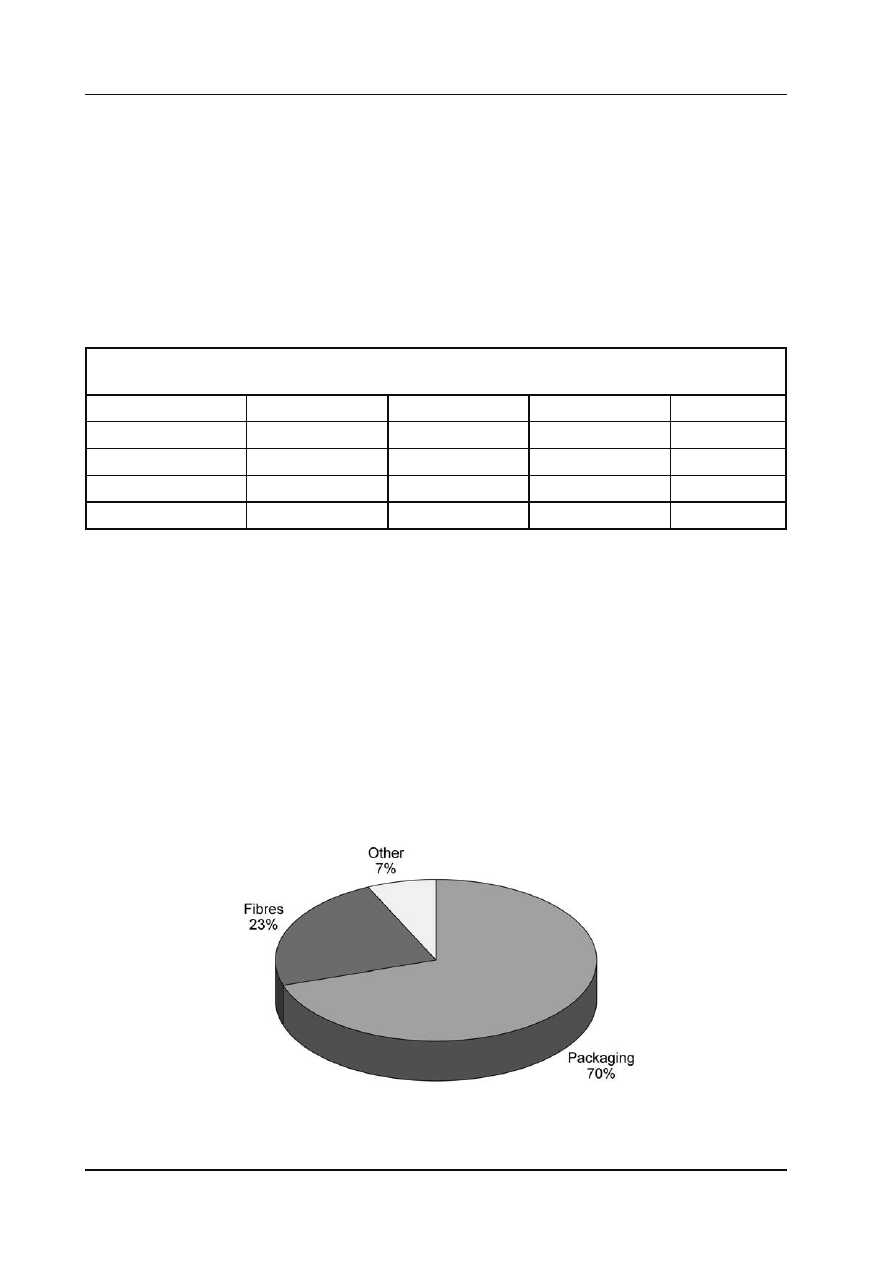

Table 2.1 shows global consumption of biodegradable polymers by polymer type for the years 2000,

2005 and forecast for 2010.

Table 2.1 Global consumption of biodegradable polymers by polymer type, 2000, 2005 and

forecast for 2010 (’000 tonnes)

2000

2005

2010

Starch

15.5

44.8

89.2

PLA

8.7

35.8

89.5

PHA

0

0.2

2.9

Synthetic

3.9

14.0

32.8

28.1

94.8

214.4

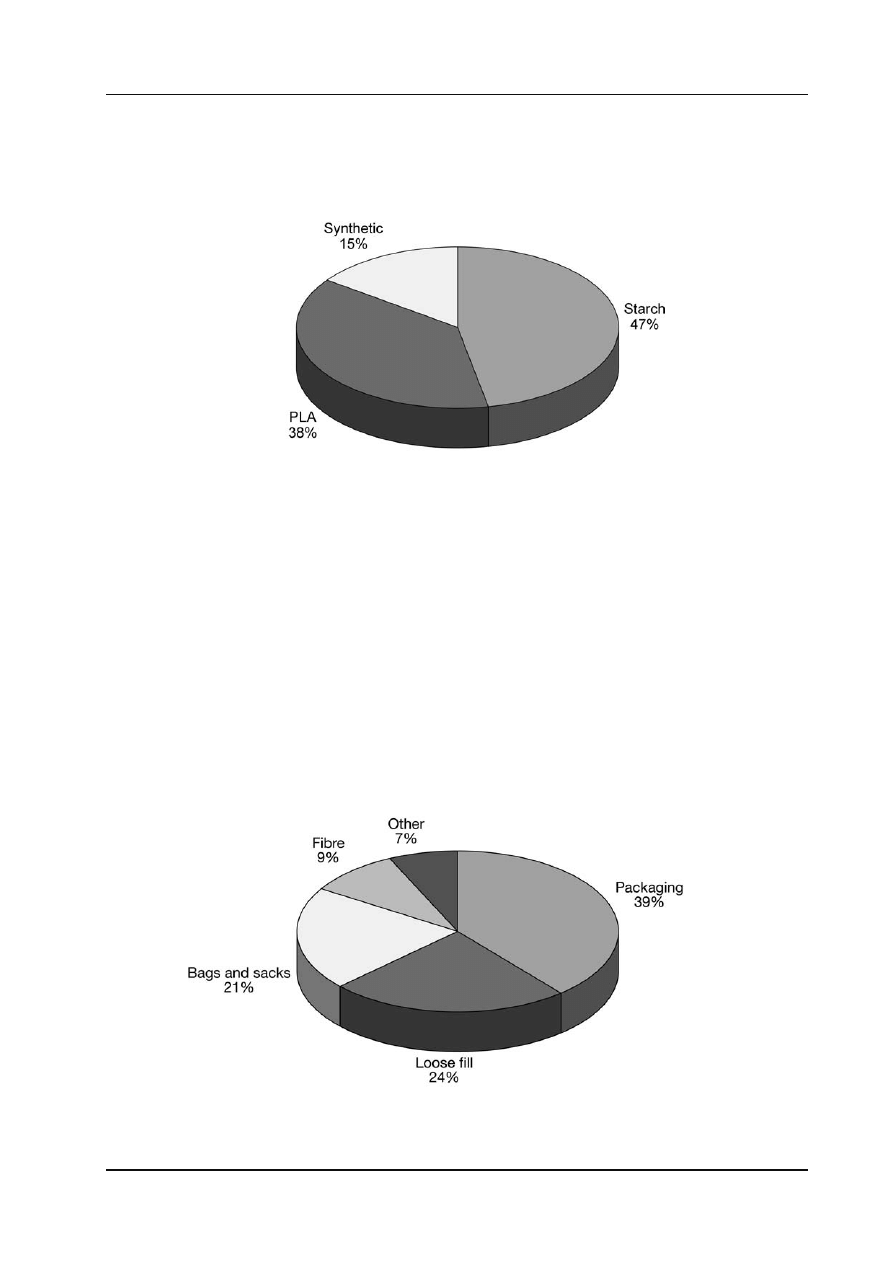

In 2005, starch-based materials were the largest class of biodegradable polymer with just over 47% of

total market volumes. Loose-fi ll foam packaging accounts for more than a half of starch biopolymer

volumes. Polylactic acid (PLA) is the second largest material class followed by synthetic aliphatic-

aromatic co-polyesters. The PHA category is at an embryonic stage of market development with

very low market tonnage at the moment.

6

Biodegradable Polymers

All classes of biodegradable polymers are projected to experience substantial growth during the next

fi ve years. Of the material classes with existing commercial applications, PLA will grow the fastest

with a compound annual growth rate of 20.1% for the period 2005-2010. PLA demand is being

driven by strong product and applications development by major suppliers such as NatureWorks

LLC. Synthetic types will also experience growth approaching 20% per annum over the forecast

period. Starch-based polymers are projected to grow at slightly lower rates. This is mainly due to

the presence of loose-fi ll packaging, which is a relatively more mature applications sector. PHA,

which started from virtually a zero base in 2005, is projected to grow at close to 60% per annum as

commercial scale plants come on stream and better products and processes are introduced.

Demand for biodegradable polymers is being driven by a number of important trends, including:

• Development of supporting framework conditions such as more favourable government regulations

to reduce waste packaging and landfi ll in favour of recycling and composting. Political support

is also slowly gaining ground with biodegradable packaging receiving special treatment in some

countries such as Germany.

• The world biodegradable plastics industry has agreed a set of standards and certifi cation procedures

for biodegradable packaging materials, which will continue to encourage growth and possibly

deter imitation.

• Composting infrastructures are being developed by local councils in major towns and cities

around the world in response to the problem of packaging waste and over-reliance on landfi ll in

some countries.

• The price differential between biodegradable polymers and petrochemical-based plastics has

narrowed during the last two years.

• Growing consumer awareness and preference for sustainable packaging.

• Brand owners are also recognising the benefi ts of promoting sustainable or ‘green’ packaging.

• There has been a stream of new product and technology development by leading biodegradable

polymer suppliers that have opened up new markets and potential applications.

2.2 Material Trends

Product development and improvement has a crucial role to play in the further development of the

biodegradable polymers market. These include development of more reliable and lower cost raw

materials for manufacture of biodegradable polymers, improvement in performance properties vis-

à-vis standard thermoplastics, improvement in processing performance and development of new

polymers and blends.

Some of the most interesting material developments covered in the report are as follows.

• New types of renewable feedstock such as palm oil for manufacture of starch-based

biodegradable polymers.

• A new generation of PLA materials that can withstand high temperatures and are suitable for

microwavable food packaging.

7

Executive Summary

• New blends of synthetic biopolymers and PLA with better properties and processing performance.

• Plasticiser-free

fl exible PLA fi lm.

• Development of markets for PLA injection stretch blow moulding applications.

• PLA bottles with higher barrier for oxygen sensitive food and beverages.

• Improvements to biodegradable polymer additive formulations helping to improve processing

effi ciencies.

• Development of biodegradable polymers with fl ame retardant properties that can be used for

consumer electronics product housing.

• Development of synthetic biodegradable polymers such as polybutylene succinates (PBS) with

improved stiffness and thermal properties.

• Progress in fermentation processes and identifi cation of lower cost feedstock for manufacture of

PHA products to provide lower material costs.

2.3 Regional Trends

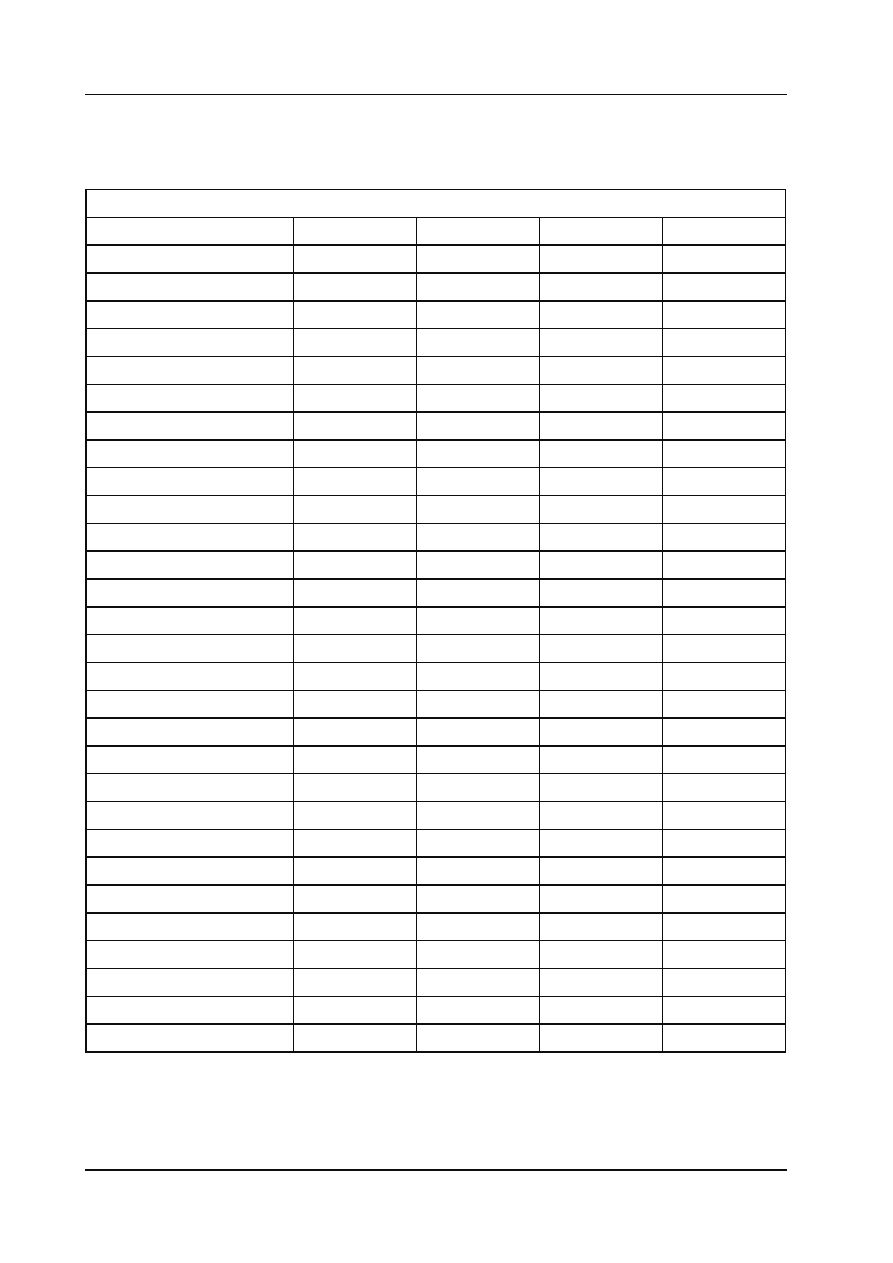

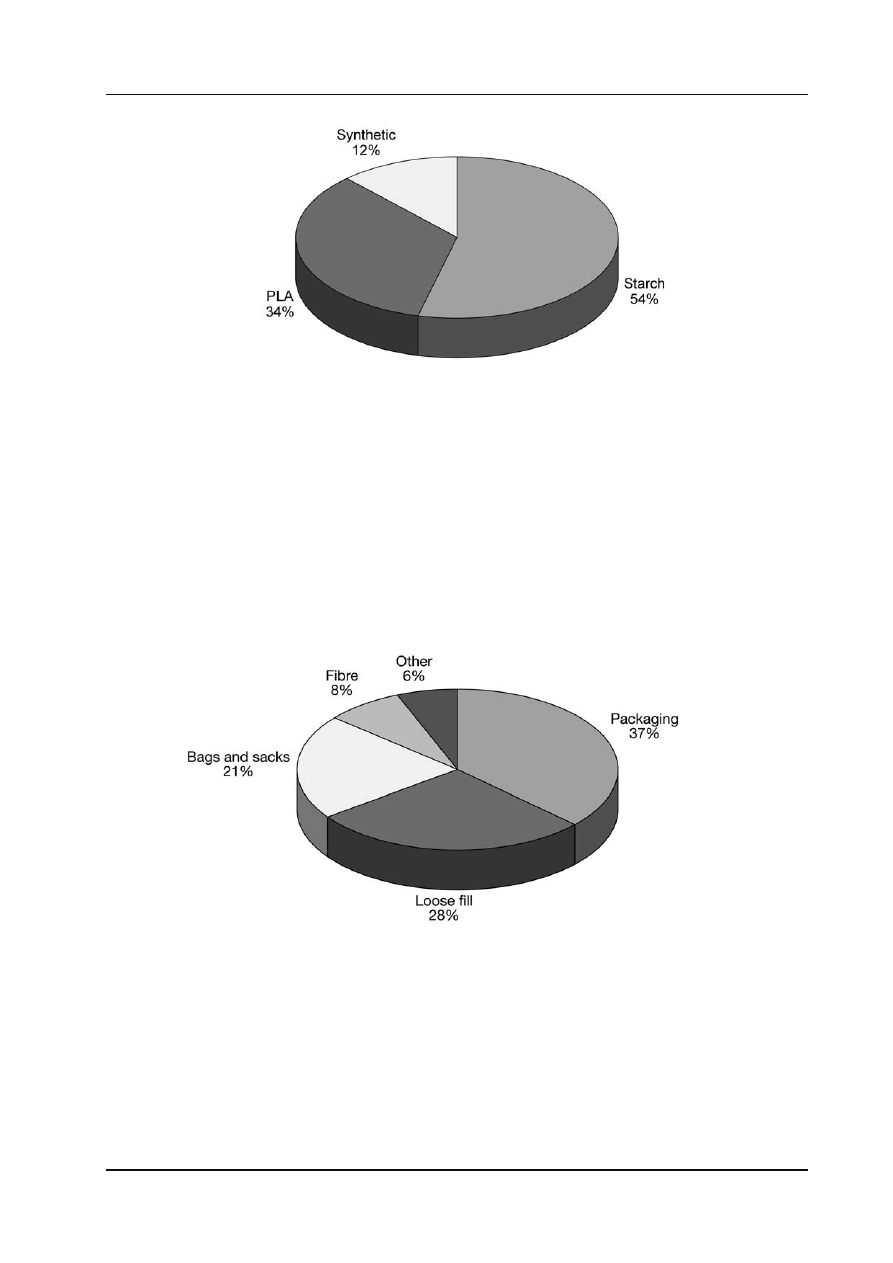

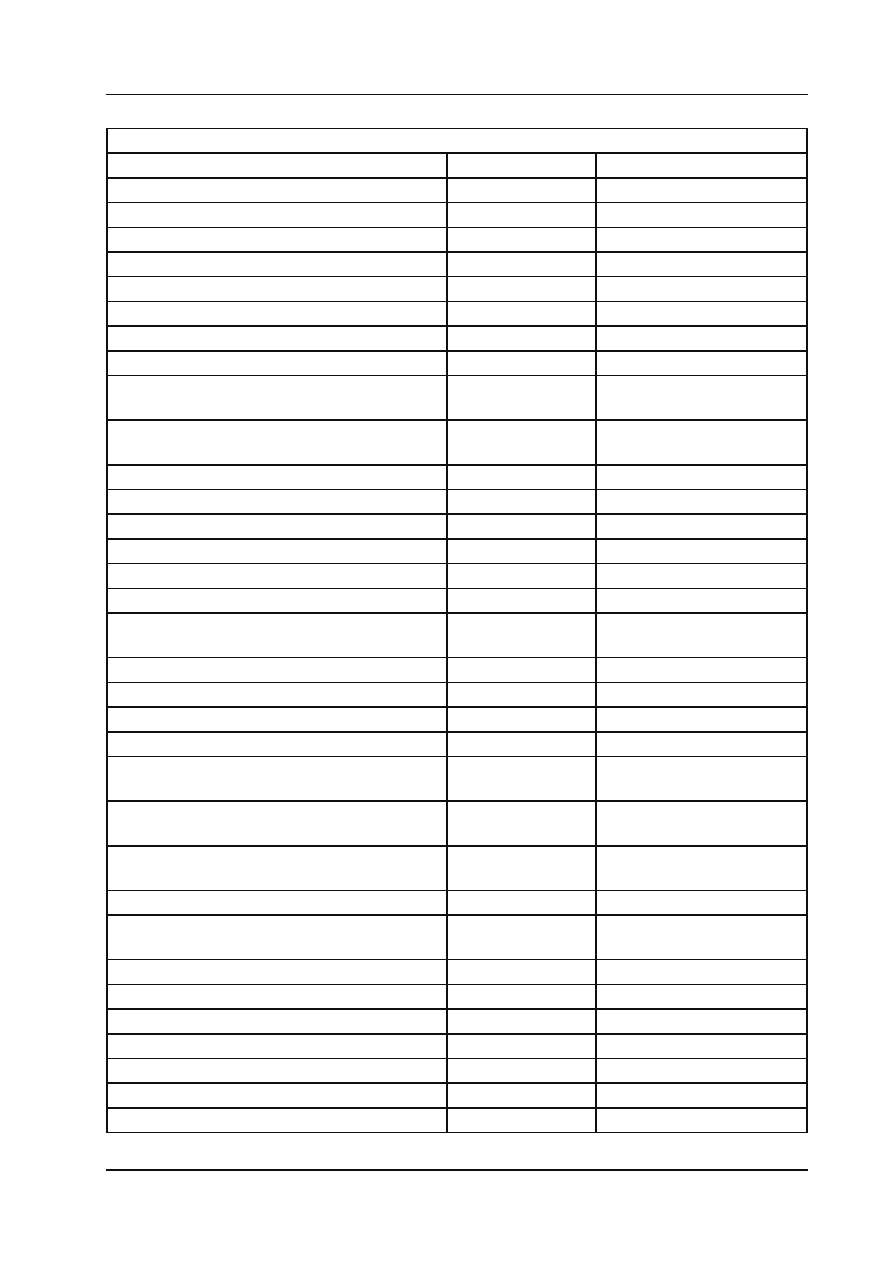

Figure 2.1 shows percentage share of global biodegradable polymer consumption by major world

region for 2005.

Figure 2.1

Percentage share of global biodegradable polymer consumption by major world region, 2005

Western Europe is the leading market for biodegradable polymers with 59% of market volumes in

2005. The Western European market has been driven more by regulation than other world regions such

as the USA and Japan. These include the European Union directives on packaging waste and landfi ll

which aim to divert a growing amount of packaging waste towards recycling and composting. Europe

has also benefi ted from some of the world’s leading biodegradable producers such as Novamont,

Rodenburg Biopolymers and BASF being based in the region.

8

Biodegradable Polymers

North America has lagged well behind Western Europe in terms of biodegradable polymer market

development. Traditionally, there has not been the same degree of urgency to address the issue of

waste disposal through landfi ll in North America because of its enormous landmass. Government

and consumer attitudes towards recycling of packaging waste and environmental protection have

also militated against market development of sustainable materials.

However, attitudes are slowly changing. During the last few years there have been a number of

positive trends that are encouraging biodegradable polymer development including, growth of the

composting infrastructure, more institutions looking at food waste diversion from landfi ll, rising

tipping fees for landfi ll and a better understanding among foodservice suppliers that there is a market

for compostable materials.

Japan is the largest consumer of biodegradable polymers in the Asia Pacifi c region, followed by

Australia and New Zealand, with Taiwan, South Korea, Singapore and China, some way behind in

terms of market development.

2.4 Market Trends

Biodegradable polymers can be found in a wide range of end use markets although these materials

still remain very much niche products. Continued progress in terms of product development and

cost reduction will be required before they can effectively compete with conventional plastics for

mainstream applications.

Starch-based biodegradable plastics are used for manufacture of various types of bags and sacks,

rigid packaging such as thermoformed trays and containers, and loose-fi ll packaging foam as an

alternative to polystyrene and polyethylene. They are also used in agriculture and horticulture for

applications such as mulching fi lm, covering fi lm and plant pots. Injection moulding applications

include pencil sharpeners, rulers, cartridges, combs and toys.

The main markets for PLA are thermoformed trays and containers for food packaging and food

service applications. Other developing areas include fi lms and labels, injection stretch blow moulded

bottles and jars, specialty cards and fi bres.

Synthetic biodegradable polyesters are used mainly as specialty materials for paper coating, fi bres,

and garbage bags and sacks. They are also showing up in thermoformed packaging as functional

adjuncts to lower-cost biodegradable materials.

Potential applications for PHA include feminine hygiene products, packaging, appliances, electrical

and electronics, consumer durables, agriculture and soil stabilisation, nonwovens, biomedical device

adhesives, and automotive parts.

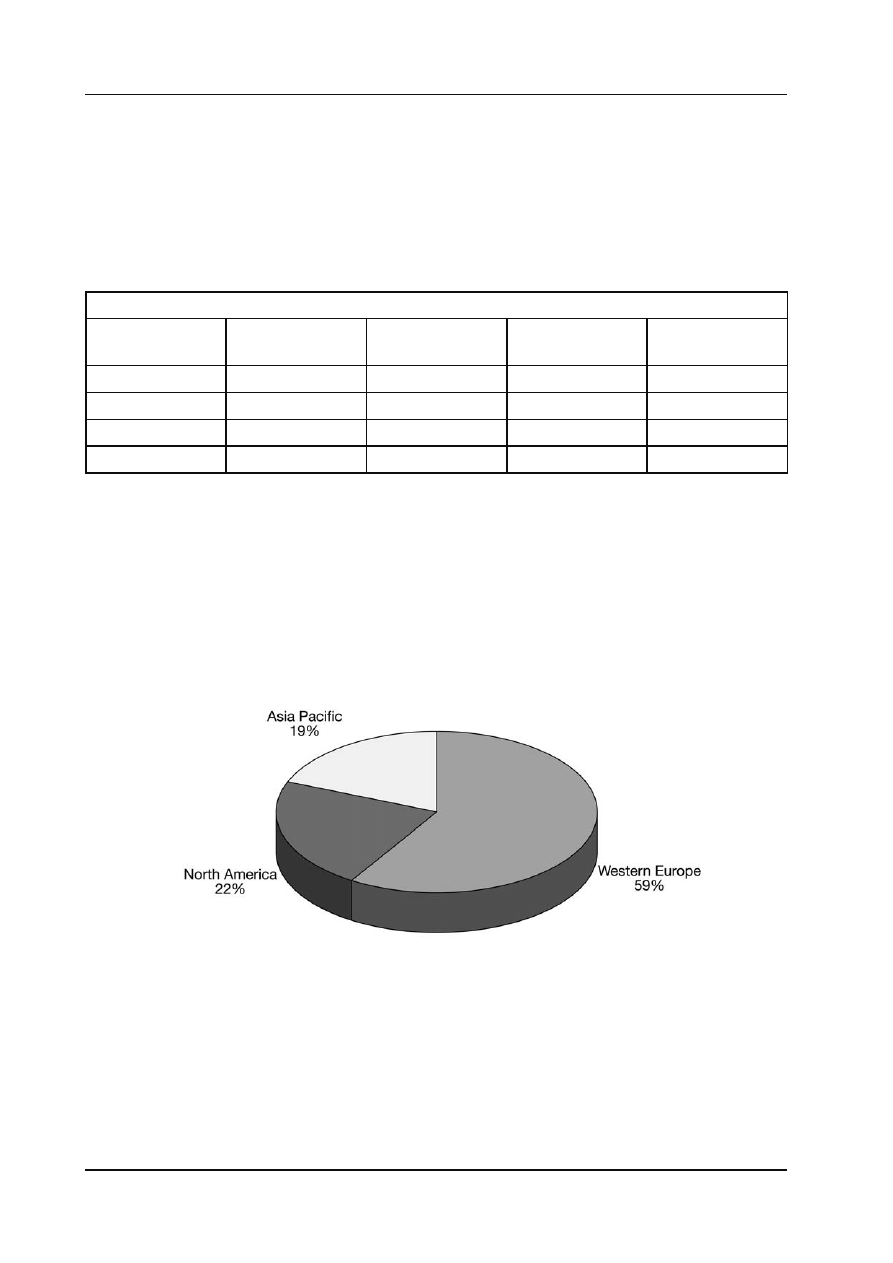

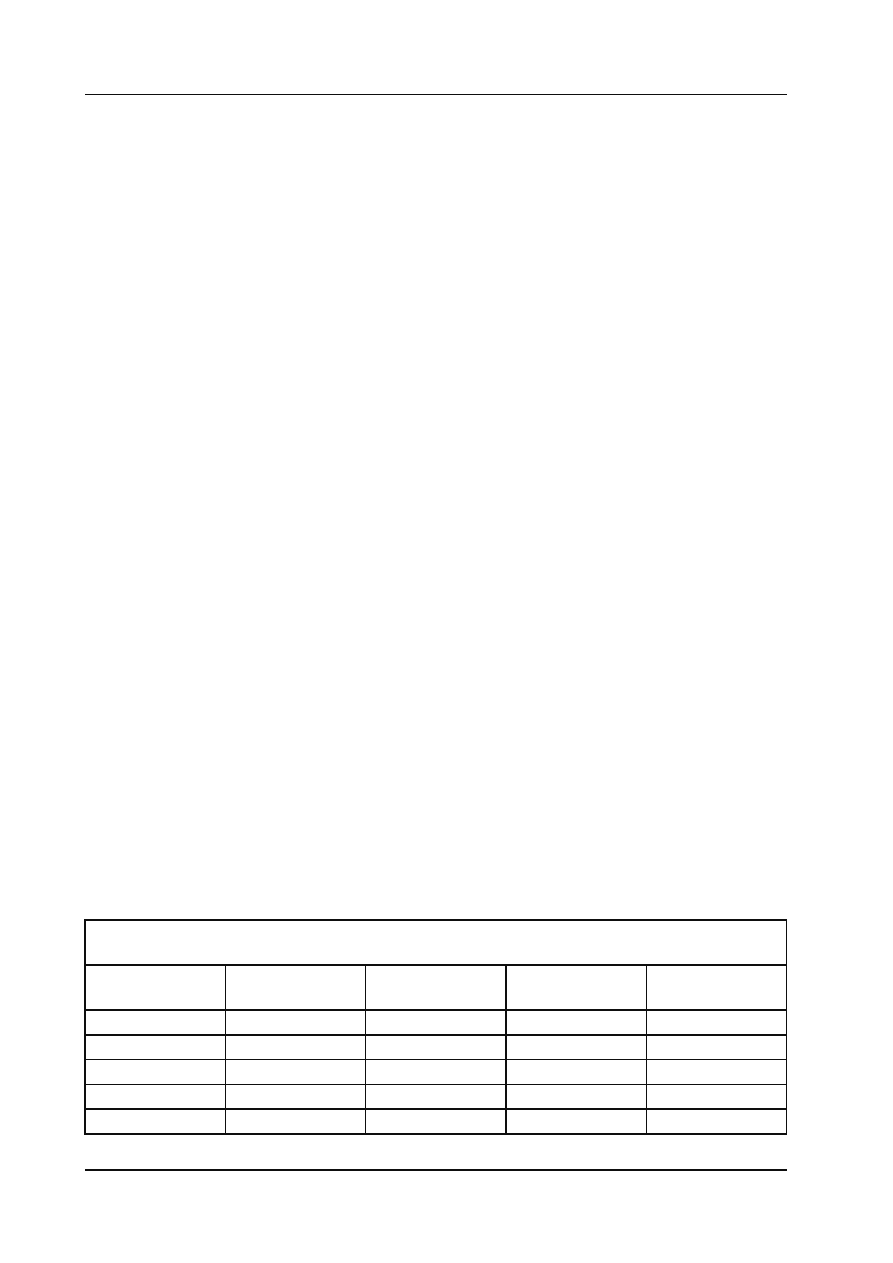

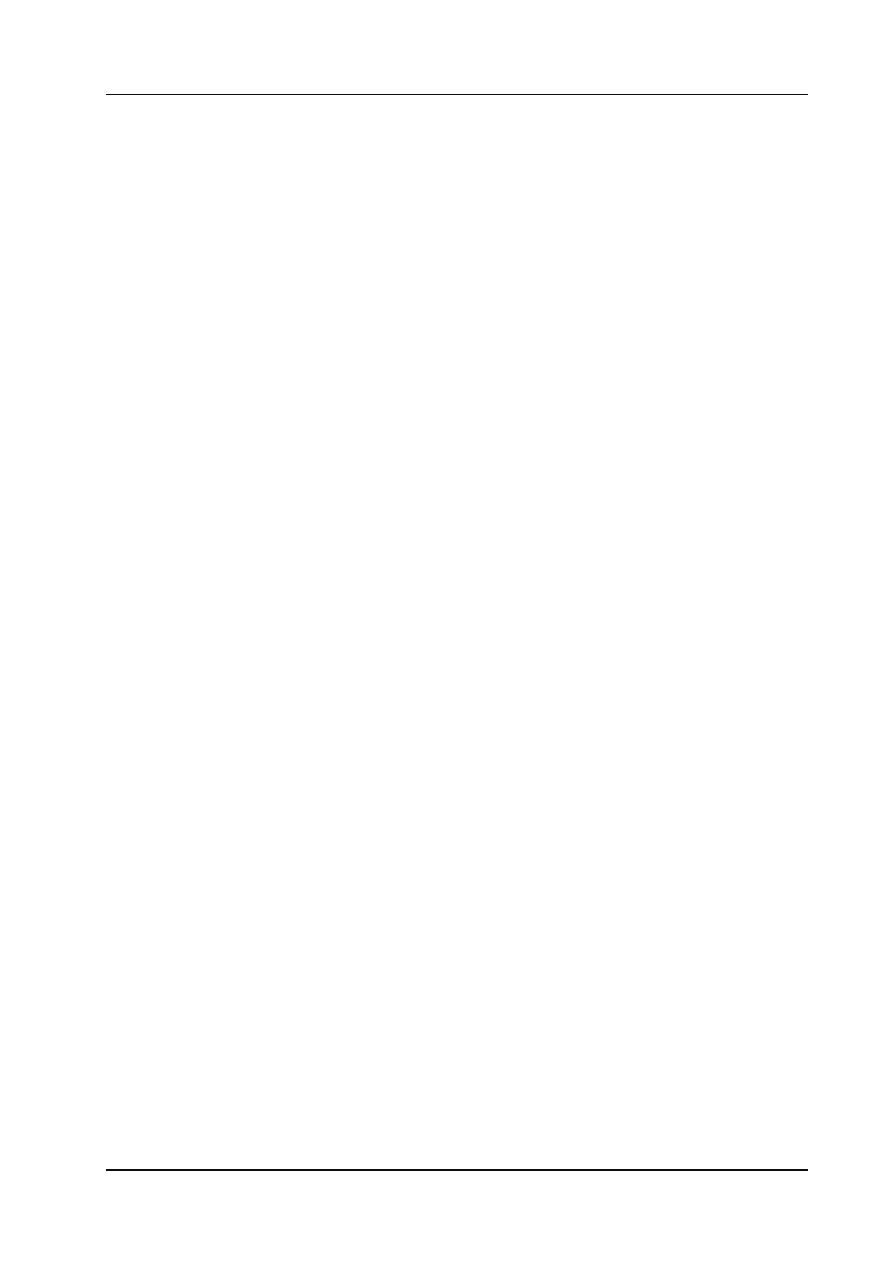

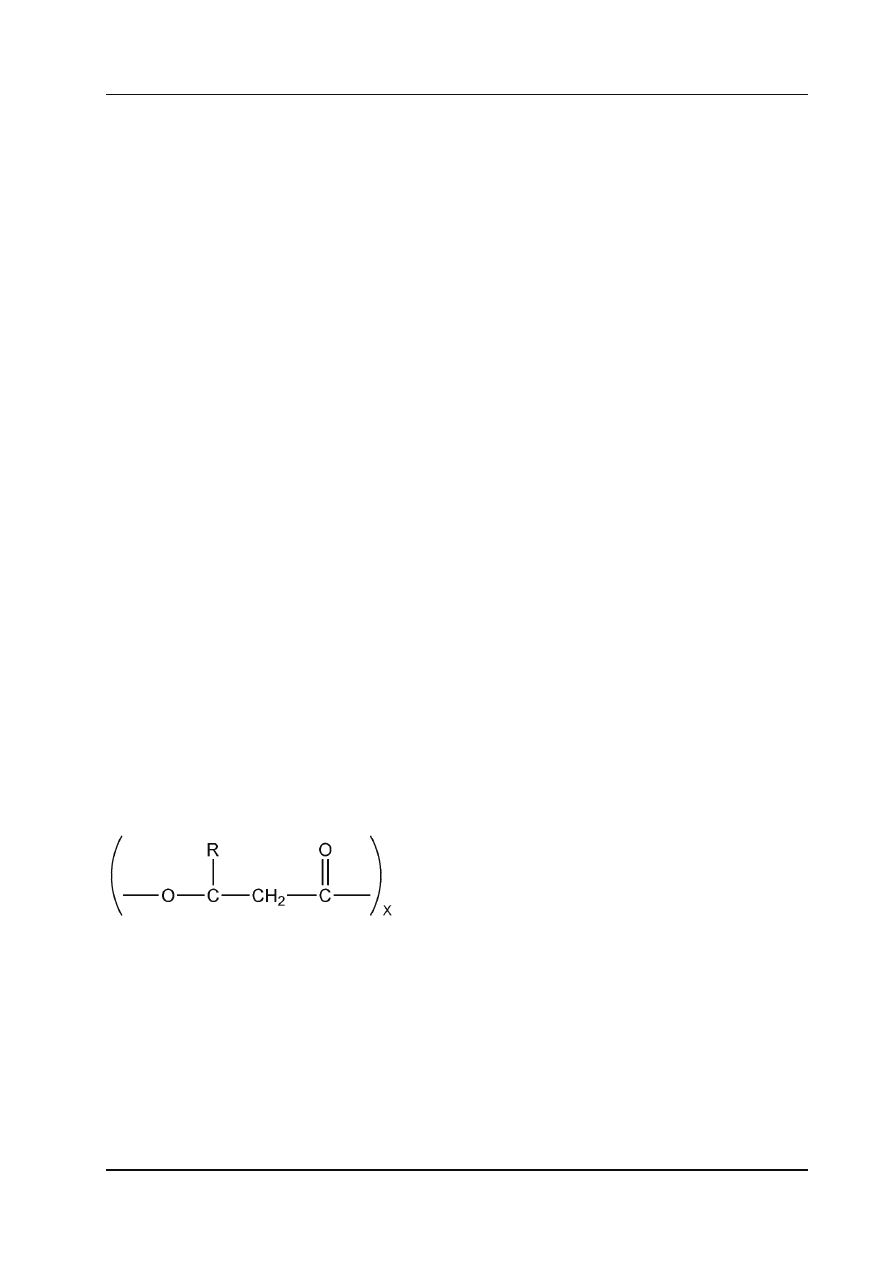

Figure 2.2 shows percentage share of global biodegradable polymer consumption by end use market

for 2005.

In 2005, packaging (including rigid and fl exible packaging, paper coating and foodservice) is the

largest sector with 39% of total biodegradable polymer market volumes. Loose-fi ll packaging is the

second largest sector, followed by bags and sacks. Fibres or textiles is an important sector for PLA,

and accounts for 9% of total market volumes. Others include a wide range of very small application

areas, the most important of which are agriculture and fi shing, medical devices, consumer products

and hygiene products.

9

Executive Summary

2.5 Competitive Trends

There are around thirty suppliers actively involved in the world biodegradable polymers market in

2005. The synthetic biopolymers market is dominated by large, global and vertically integrated chemical

companies such as BASF, DuPont, and Mitsubishi Gas Chemicals. The starch and PLA sectors contain

mainly specialist biopolymer companies such as Novamont, NatureWorks LLC, Rodenburg Biopolymers

and Biotec, which were specifi cally established purely to develop biodegradable polymers.

The leading suppliers are Novamont, NatureWorks, BASF and Rodenburg Biopolymers, which

together represent over 90% of the European market for biodegradable plastics.

Global production capacity for biodegradable polymers has grown dramatically since the mid 1990s.

In 1995, production was mainly on a pilot-plant basis with total worldwide capacity amounting to

no more than 25-30,000 tonnes. In 2005, global capacity for biodegradable polymers was around

360,000 tonnes. Based on announced projects, total production capacity is set to almost reach

600,000 tonnes by 2008.

At the moment, there are a growing number of biodegradable polymers performing well in niche

applications. Many of these materials can be even more cost competitive in the future compared to

petroleum-based resins including PET, polyethylene (PE), and polypropylene (PP) as suppliers develop

better material properties that can lead to thinner fi lms or lower processing costs.

Historically, pricing had been the biggest barrier to biodegradable polymer market development.

However, the competitive position of biodegradable polymers has been improved during the last two

years by the sharp upswing in the cost and declining availability of standard petroleum-based resins.

Commodity resin prices have climbed steadily since 2003 as oil and natural gas prices have surged.

During the period 2003-2005, the average price for competing materials such as polypropylene,

general-purpose polystyrene and low density polyethylene (LDPE) have increased between 30-35%.

Bottle-grade PET prices have increased by nearly 18%.

At the same time, prices for the three major types of bio-based resins, starch-based biopolymers,

polylactic acid (PLA) and aliphatic aromatic co-polyester, have dropped considerably over the last

Figure 2.2

Percentage share of global biodegradable polymer consumption by end use market for 2005

10

Biodegradable Polymers

three years as production volumes have increased, more effi cient production processes have been

deployed and lower cost raw materials have been found.

In 2003, the average price of starch blends was around €3.0-5.0 per kg. In 2005, the average price

range of starch blends was down to €1.5-3.5 per kg. PLA is now being sold at prices between €1.37-

2.75 per kg compared to a price range of €3.0-3.5 per kg three years ago, and is now almost price

competitive with PET. The average cost of an aliphatic aromatic co-polyester has fallen from €3.5-4.0

per kg in 2003 to €2.75-3.65 per kg in 2005. Prices are expected to fall further for all biodegradable

polymer types over time as production volumes increase and unit costs fall.

In terms of the product life cycle, the biodegradable plastics industry has now reached the market

introduction stage, having spent the last ten years or so developing their products and processes.

The main focus of suppliers was on improving the technology and the products in readiness for

full commercialisation. Now, a signifi cant number of products are commercially available and the

emphasis has switched to the end user and developing markets and applications.

Brand owners and consumer will have a key role to play in the growth of this industry over the

next fi ve to ten years. Buyers are indeed beginning to recognise the marketing value of sustainable

materials and are starting to endorse this biopolymers movement. It is education and awareness

along with the cost and performance improvements that will take sustainable materials out of niche

market status.

While the cost of some biodegradable plastics are high compared with conventional polymers, from

a marketing perspective, it is important not only to consider the material cost, but also all associated

costs, including the costs of handling and disposal, which are of course lower for biodegradable

plastics. Hence, marketing of biodegradable plastics products is most successful when their cost

savings and material advantages are exploited to the full. Also, users of biodegradable plastics can

differentiate themselves from the competition by demonstrating how innovative and proactive they

are for the benefi t of the environment.

Applications development to achieve higher production volumes will be crucial for continued

market expansion. Production costs for biopolymers still remain high because of low volumes, and

profi tability of biodegradable plastics products is still too low. Hence, volumes must be increased if

unit costs are to fall and profi tability is to improve.

11

3

Overview of Biodegradable Polymers

3.1 Introduction

This chapter begins with an examination of the mechanisms of polymer biodegradation, how

biodegradation mechanisms are measured and the factors affecting biodegradation. This is followed

by a review of the different classes of biodegradable polymers, their chemical composition, properties,

performance characteristics and processing technologies.

3.2 Defi nitions of Biodegradable Polymers

Biodegradability and compostability are clearly defi ned by the scientifi c community and were legally

incorporated into a Standard by the American Society for Testing and Materials (ASTM), under

reference ASTM D 6400 - 99, in July 1999. Similar defi nitions have been recognised in several countries

around the world, the most signifi cant being DIN CERTCO 54900 in Germany. Harmonisation of

the defi nitions was carried out through the International Biodegradable Products Institute (BPI),

which signed a memorandum of understanding with the Japanese Biodegradable Plastics Society

and the German DIN CERTCO.

The ASTM defi nes a biodegradable plastic as a degradable plastic in which the degradation results

from the action of naturally occurring microorganisms such as bacteria, fungi and algae.

Composting is defined as a managed process that controls the biological decomposition of

biodegradable materials into a humus-like substance called compost; the aerobic and mesophilic and

thermophilic degradation of organic matter to make compost; the transformation of biologically

decomposable materials through a controlled process of bio-oxidation that proceeds through

mesophilic and thermophilic phases and results in the production of carbon dioxide, water, minerals

and stabilised organic matter (compost or humus).

Following the international agreement on defi nitions for biodegradable plastics, specifi ed periods

of time, disposal pathways and standard test methodologies were incorporated into the defi nitions.

Standardisation organisations such as CEN, International Standards Organisation (ISO) and American

Society for Testing and Materials (ASTM) were consequently encouraged to develop standard

biodegradation tests so these could be determined. Society further demanded non-debatable criteria

for the evaluation of the suitability of polymeric materials for disposal in specifi c waste streams such

as composting or anaerobic digestion. Biodegradability is usually just one of the essential criteria,

besides ecotoxicity and effects on waste treatment processes.

3.3 Mechanisms of Polymer Degradation

Biodegradation is usually defi ned as degradation caused by biological activity, it will usually

occur simultaneously with, and is sometimes initiated by, non-biological degradation such as

photodegradation and hydrolysis.

12

Biodegradable Polymers

Many different polymers are subject to hydrolysis. Different mechanisms of hydrolysis are usually

present in most environments. In contrast to enzymic degradation, where a material is degraded

gradually from the surface inwards, chemical hydrolysis of a solid material can take place throughout

its cross-section, except for very hydrophobic polymers.

Biological degradation takes place through the actions of enzymes or by products (such as acids and

peroxides) secreted by microorganisms (bacteria, yeasts, fungi). Also, microorganisms can eat, and

sometimes digest polymers, and cause mechanical, chemical and enzymic ageing.

Two steps occur in the microbial polymer degradation process, fi rst, a depolymerisation or chain

cleavage step, and second, mineralisation. The fi rst step normally occurs outside the organism due

to the size of the polymer chain and the insoluble nature of many of the polymers. Extracellular

enzymes are responsible for this step, acting either endo (random cleavage of the internal linkages of

the polymer chains) or exo (sequential cleavage of the terminal monomer units in the main chain).

Once suffi ciently small size oligomeric or monomeric fragments are formed, they are transported into

the cells where they are mineralised. At this stage the cell usually derives metabolic energy from the

mineralisation process. The products of this process are gases, water, salts, minerals and biomass.

Many variations of this general view of the biodegradation process can occur, depending on the

polymer, the organisms and the environment. Nevertheless, there will always be at some stage the

involvement of enzymes.

Enzymes are the biological catalysts that can induce massive increases in reaction rates in an

environment that is otherwise unfavourable for chemical reactions. All enzymes are proteins with a

complex three-dimensional structure ranging in molecular weight from several thousands to several

million g/mol. The enzyme activity is closely related to the conformational structure, which creates

certain regions at the surface forming an active site. At the active site the interaction between enzyme

and substrate takes place, leading to the chemical reaction, eventually giving a particular product.

Some enzymes contain regions with absolute specifi city for a given substrate while others can recognise

a series of substrates. For optimal activity most enzymes must associate with cofactors, which can

be of inorganic (such as metal ions) or organic origin (such as coenzymes A, ATP, and vitamins like

ribofl avin and biotin).

There are an enormous number of different enzymes each catalysing its own unique reaction on

groups of substrates or on very specifi c chemical bonds, in some cases acting complimentarily and

in others synergistically. Different enzymes can also have different mechanisms of catalysis. Some

enzymes change the substrate through some free radical mechanism while others follow alternative

chemical routes (1).

3.4 Measuring Biodegradability of Polymers

Given the various mechanisms available for the biodegradation of a polymer, it will be appreciated

that biodegradation does not only depend on the polymer chemistry, but also on the presence of the

biological systems involved in the process. When investigating the biodegradability of a material,

the effect of the environment cannot be neglected. Microbial activity and hence biodegradability is

infl uenced by the:

• Presence of microorganisms

• Availability of oxygen

13

Overview of Biodegradable Polymers

• Amount of available water

• Temperature

• Chemical environment (pH, electrolytes etc.)

In order to simplify the overall picture, the environments in which biodegradation occurs are divided

into two environments, aerobic, where oxygen is available, and anaerobic, where no oxygen is present.

These two can in turn be subdivided into aquatic and high solids environments.

The high solids environment is the most relevant for measuring the biodegradation of polymeric

materials, since they represent the conditions during biological municipal solid waste treatment such

as composting. However, possible applications of biodegradable materials other than in packaging and

consumer products (such as fi shing nets at sea) explain the necessity of aquatic biodegradation tests.

Numerous methods to measure the biodegradability of polymers have been developed. Because of

slightly different defi nitions or interpretation of the term ‘biodegradability’, the different approaches

are therefore not equivalent in terms of information they provide or the practical signifi cance. Since

the typical exposure environment involves incubation of a polymer substrate with microorganisms

or enzymes, only a limited number of measurements are possible. These include those pertaining to

the substrates, to the microorganisms, or to the reactive products.

Four common approaches available for studying biodegradation processes are used.

• Monitoring microbial growth

• Monitoring the depletion of substrates

• Monitoring reaction products

• Monitoring changes in substrate properties

Measurements for testing the biodegradability of polymers are usually based on one or more of these

four basic approaches (2).

3.5 Factors Affecting Biodegradability

The environment is an important factor affecting the rate and degree of biodegradation of polymer

substrates. The other key aspects determining biodegradability are related to the chemical composition

of the polymer. The polymer chemistry governs the chemical and physical properties of the material

and its interaction with the physical environment, which in turn affects the material’s compostability

with particular degradation mechanisms.

Many attempts have been made to correlate polymer structure to biodegradability. However,

this proved to be challenging and so far only few general relationships between structure and

biodegradability have been formulated. In many cases complex interplay between some of the different

factors occur simultaneously, often causing diffi culty in sorting out primary effects and correlations.

Some of the general factors affecting biodegradability are listed below, but it should be considered

that many exceptions to the norm have also been reported.

The accessibility of the polymer to water-borne enzymes is vitally important because the fi rst step in

the degradation of plastics usually involves the actions of extracellular enzymes, which break down

14

Biodegradable Polymers

the polymer into products small enough to be assimilated. Therefore, the physical state of the plastic

and the surface offered for attack, are important factors. Biodegradability is usually also affected by

the hydrophilic nature (wettability) and the crystallinity of the polymer. A semi-crystalline nature

tends to limit the accessibility, essentially confi ning the degradation to the amorphous region of the

polymer. However, contradictory results have been reported. For example, highly crystalline starch

materials and bacterial polyesters, are rapidly hydrolysed.

The chemical properties that are important include the:

• Chemical linkage in the polymer backbone.

• Pendant groups, their position and their chemical activity.

• End-groups and their chemical activity.

Linkage involving hetero atoms, such as ester and amide bonds, are considered susceptible to

enzymic degradation. However, this is not the case for polyamides, aromatic polyesters and many

other polymers containing hetero atoms in the main chain. The stereo-chemistry of the monomer

units along the polymer chain also infl uences biodegradation rates, since an inherent property of

many enzymes is their stereo-chemical selectivity. The stereo-chemistry may nevertheless not be

observed when a broad spectrum of microorganisms are used instead of enzyme solutions with

high stereo-specifi city.

The molecular weight distribution of the polymer can have a dramatic effect on rates of

depolymerisation. This effect has been demonstrated for a number of polymers, where a critical

lower limit must be present before the process will start. The molecular origin for this effect is

still subject to speculation, and has been attributed to a range of causes such as changes in enzyme

accessibility, chain fl exibility, fi ts with active sites, crystallinity or other aspects of morphology.

Interaction with other polymers (blends) also affects the biodegradation properties. These additional

materials may act as barriers to prevent migration of microorganisms, enzymes, moisture or oxygen

into the polymer domain of interest. The susceptibility of a biodegradable polymer to microbial

attack is sometimes decreased by grafting it onto a non-biodegradable polymer, or by crosslinking.

On the other hand, it has sometimes been suggested that combining a non-biodegradable polymer

with one that is biodegradable, or grafting a biodegradable polymer onto a non-biodegradable

backbone polymer may result in a biodegradable system. Whether the non-biodegradable component

is in fact mineralised, however, is usually disregarded (3).

3.6 Biodegradable Polymer Classes

There are broadly three classes of commercially available biodegradable polymers in existence.

1. Unmodifi ed polymers that are naturally susceptible to microbial-enzyme attack.

2. Synthetic polymers, primarily polyesters.

3. Naturally biodegradable polymers that have been modifi ed with additives and fi llers.

Naturally biodegradable polymers produced in nature are renewable. Some synthetic polymers are

also renewable because they are made from renewable feedstock, for example polylactic acid is

derived from agricultural feedstock.

15

Overview of Biodegradable Polymers

3.6.1 Naturally Biodegradable Polymers

Natural polymers are produced in nature by all living organisms. Biodegradation reactions are

typically enzyme-catalysed and occur in aqueous media. Natural macromolecules containing

hydrolysable linkages, such as protein, cellulose, and starch, are generally susceptible to

biodegradation by the hydrolytic enzymes of microorganisms. Thus the hydrophilic/hydrophobic

character of polymers greatly affects their biodegradability. It also has a great impact on their

performance and durability in humid conditions.

Polysacharides such as starch are the most prevalent naturally biodegradable polymer in commercial

use. Aliphatic polyesters such as polyhydroxyalkanoates (PHA) are also a family of easily

biodegradable polymers found in nature that are beginning to fi nd commercial use.

3.6.2 Synthetic Biodegradable Polymers

While natural polymers are produced by living organisms, synthetic biodegradable polymers

are only produced by mankind. Biodegradation reactions are the same for both, i.e., typically

enzyme-catalysed and produced in aqueous media. The major category of synthetic biodegradable

polymers consists of aliphatic polyesters with a hydrolysable linkage along the polymer chain

such as polylactic acid (PLA). Other widely available synthetic types include aliphatic/aromatic

co-polyesters.

3.6.3 Modifi ed Naturally Biodegradable Polymers

Over the last thirty years or so, many attempts have been made to improve the biodegradability

of synthetic polymers by incorporating polysaccharide-derived materials. The most prominent

modifi ed naturally biodegradable polymer in commercial use is produced by Novamont under

the Mater-Bi trade name. This starch-based technology is unique because the modifi cation goes

beyond conventional compounding. The starch is destructurised by applying suffi cient work and

heat to almost completely destroy the crystallinity of amylose and amylopectine in the presence

of macromolecules able to form a complex with amylose. Novamont produces several different

classes of Mater-Bi, all containing starch with different classes of synthetic components such as

polycaprolactone (PCL). The material obtained is suitable for producing fi lm and sheet, foams

and injection moulding.

For the purpose of this report, four classes of commercially available biodegradable polymers

are examined.

1. Starch based biodegradable polymers (including modifi ed starch blends)

2. Polyhydroxyalkanoates (PHA)

3. Polylactic acid (PLA)

4. Synthetic biodegradable polymers such as aliphatic-aromatic co-polyesters.

The following sections discuss the chemical composition, properties and production of each

biodegradable polymer type in more detail.

16

Biodegradable Polymers

3.7 Starch-Based Biodegradable Polymers

In nature, the availability of starch is just second to cellulose. The most important industrial sources of

starch are corn, wheat, potato, tapioca and rice. In the last decade, there has been a signifi cant reduction

in the price of corn and potato starch, both in Europe and the USA. The lower price and greater

availability of starch associated with its very favourable environmental profi le aroused a renewed interest

in development of starch-based polymers as an alternative to polymers based on petrochemicals.

Starch is totally biodegradable in a variety of environments and thus permits the development of

totally degradable products for specifi c market demands. Degradation or incineration of starch-

based products recycles atmospheric carbon dioxides trapped by starch-producing plants and does

not increase potential global warming.

The most relevant achievements in this sector are related to thermoplastic starch polymers

resulting from the processing of native starch by chemical, thermal and mechanical means, and to

its complexation to other co-polymers. The resulting materials show properties ranging from the

fl exibility of polyethylene to the rigidity of polystyrene, and can be soluble or insoluble in water as

well as insensitive to humidity. Such properties explain the leading position of starch-based materials

in the biodegradable polymer fi eld.

Starch is unique among carbohydrates because it occurs naturally as discrete granules. This is because

the short-branched amylopectin chains are able to form helical structures, which crystallise. Starch

granules exhibit hydrophilic properties and strong intermolecular association via hydrogen bonding

due to the hydroxyl groups on the granule surface. The melting point of native starch is higher than

the thermal decomposition temperature: hence the poor thermal stability of native starch and the

need for conversion to starch-based materials with a much-improved property profi le.

In nature, starch is based on crystalline beads of about 15-100 microns in diameter. Crystalline

starch beads in plastics can be used as fi llers or can be transformed into thermoplastic starch, which

can either be processed alone or in combination with specifi c synthetic polymers. To make starch

thermoplastic, its crystalline structure has to be destroyed by pressure, heat, mechanical work or

use of plasticisers. Three main families of starch polymer can be used: pure starch, modifi ed starch

and fermented starch polymers.

The production of starch polymers begins with the extraction of starch. Taking as an example corn;

starch is extracted from the kernel by wet milling. The kernel is fi rst softened by steeping it in a dilute

acid solution, then ground coarsely to split the kernel and remove the oil-containing germ. The starch

slurry is then washed in a centrifuge, dewatered and dried. Either prior, or subsequent to the drying

step, the starch may be processed in a number of ways to improve its properties.

The addition of chemicals leading to alteration of the structure of starch is generally described as

‘chemical modifi cation’. Modifi ed starch is starch that has been treated with chemicals so that some

hydroxyl groups have been replaced by for example ester or ether groups. High starch content plastics

are highly hydrophilic and readily disintegrate when in contact with water. Very low levels of chemical

modifi cation can signifi cantly improve hydrophilicity, as well as change other rheological, physical

and chemical properties of starch.

Crosslinking, in which two hydroxyl groups or neighbouring starch molecules are linked chemically

is also a form of chemical modifi cation. Crosslinking inhibits granule swelling or gelatinisation and

gives increased stability to acid, heat treatment and shear forces. Chemically modifi ed starch may

be used directly or palletised or otherwise dried for conversion to a fi nal product.

17

Overview of Biodegradable Polymers

Starch can also be modifi ed by fermentation as used in the Rodenburg process. In this case the raw

material is a potato waste slurry originating from the food industry. The slurry mainly consists of

starch, the rest being proteins, fats and oils, inorganic components and cellulose. The slurry is held

in storage silos for about two weeks to allow for stabilisation and partial fermentation. The most

important fermentation process that occurs is the conversion of a small fraction of starch to lactic

acid by mans of the lactic acid bacteria that are naturally present in the feedstock. The product is

subsequently dried to a fi nal water content of 10% and then extruded.

Starch-based polymers have been the most studied class of biodegradable polymer for their extrusion

characteristics. Extrusion processing plays a large role in establishing the polymer properties. Starch

can be made thermoplastic by using technology very similar to extrusion cooking. Starch exists as

granular beads of about 15-100 microns in diameter that can be compounded with another synthetic

polymer as a fi ller. However, under special heat and shear conditions during extrusion it can be

transformed into an amorphous thermoplastic by a process known as destructurising.

Starch can be destructured in the presence of more hydrophobic polymers such as aliphatic polyesters.

Aliphatic polyesters with low melting points are diffi cult to process by conventional techniques such

as fi lm blowing and blow moulding. Films such as polycaprolactones (PCL) are tacky as extruded

and have a low melt strength (over 130 °C). Also, the slow crystallisation of the polymer causes the

properties to change with time. Blending starch with aliphatic polyesters improves processability

and biodegradability.

Addition of starch has a nucleating effect, which increases the rate of crystallisation. The rheology

of starch/PCL blends depends on the extent of starch granule destruction and the formation of

thermoplastic starch during extrusion. Increasing the heat and shear intensities can reduce the melt

viscosity, but enhance the extrudate-swell properties of the polymer.

Starch/aliphatic polyester compositions are prepared by blending a starch-based component and an

aliphatic polyester in a co-rotating, intermeshing twin-screw extruder. The co-rotating, self-cleaning

screw on these machines prevents caking and churning of cooked starch. Temperature and pressure

conditions are such that the starch is destructurised and the composition forms a thermoplastic melt.

The resulting material has an interpenetrated or partially interpenetrated structure.

Novamont is easily market leader for starch-based biodegradable plastics. Under the Mater-Bi trade

name, Novamont offers a wide range of materials divided into fi ve product families by processing

technology. These are fi lm, extrusion/thermoforming, injection moulding, foaming and tyre technology.

Mater-Bi products are mainly used in specifi c applications where biodegradability is required. Examples

include composting bags and sacks, foodservice products such as single serve cups, containers and

plates, foam for industrial packaging, fi lm wrapping, laminated paper, agricultural fi lm products,

slow release devices and hygiene products.

Mater-Bi is characterised by the following properties.

• Use performance similar to traditional plastics

• Processing performance similar or better than traditional plastics

• Wide range of mechanical properties from soft and tough material to rigid

• Antistatic

behaviour

• Compostability in a wide range of composting conditions

18

Biodegradable Polymers

Other leading starch-based biodegradable polymer manufacturers are Biotec and BIOP

Biopolymers.

Following the sale of the fi lm business to Novamont in 2000, Biotec offers starch-based materials

for foodservice products and pharmaceutical applications.

BIOP Biopolymer Technologies offers a starch-based material comprising an additive consisting of

a vinyl alcohol/vinyl acetate copolymer, sold under the Biopar trade name (4).

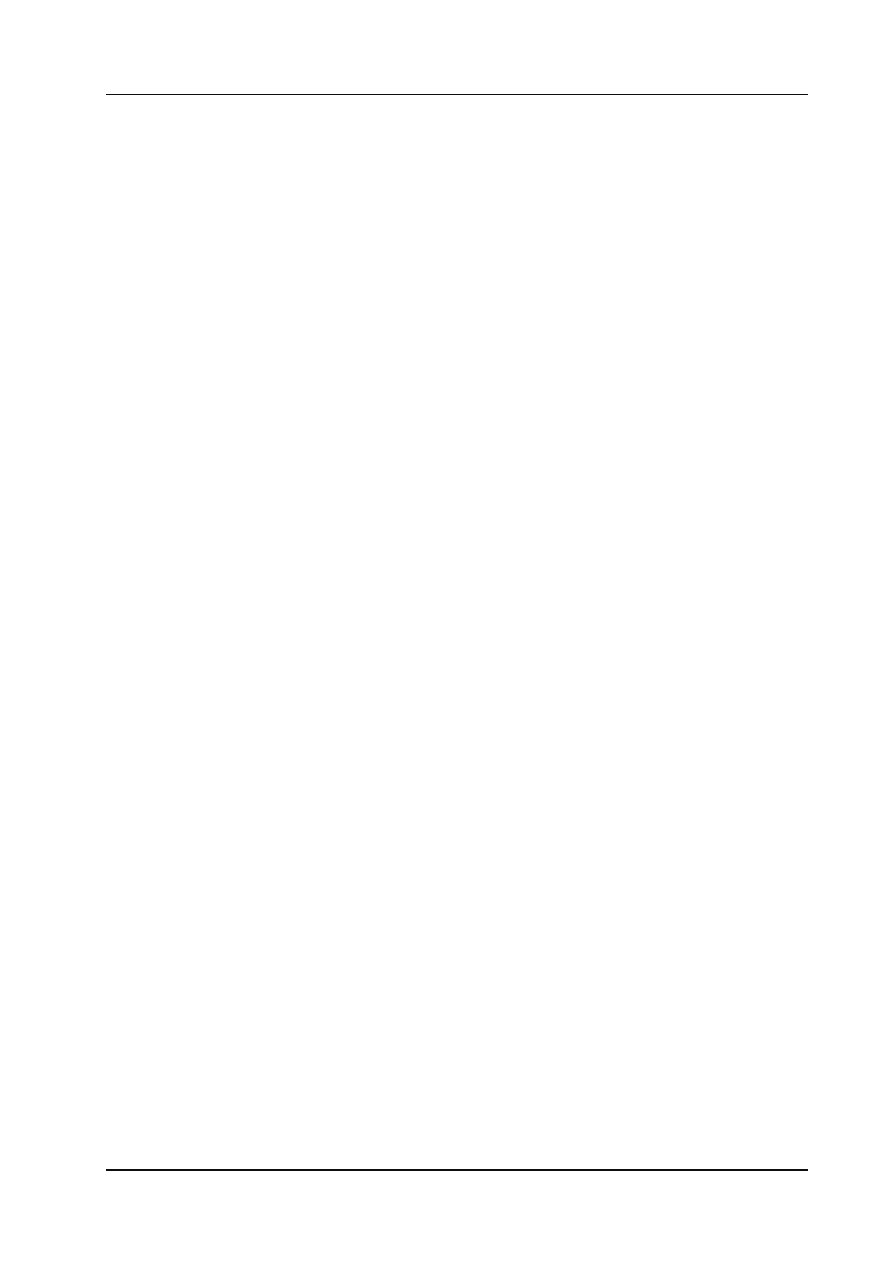

3.8 Polyhydroxyalkanoates

Polyhydroxyalkonates (PHA) is a term given to a family of aliphatic polyesters produced by

microorganisms that are fully biodegradable. They offer a wide array of physical properties that can

range from stiff and brittle plastics to elastomers.

An attractive feature of PHAs is the ability to produce them using renewable carbon resources.

PHA can be produced using renewable carbon sources such as sugars and plant oils. Various waste

materials are also being considered for potential carbon sources for PHA production, including whey,

molasses and starch. The carbon source available to a microorganism is one of the factors (others

being the PHA synthase substrate specifi city and the types of biochemical pathways available) that

determine the type of PHA produced. For industrial scale production, the carbon source signifi cantly

contributes to the fi nal cost. This makes the carbon source one of the most important components

in the production of PHA and is therefore a prime target for potential cost reduction.

PHAs are mainly composed of R-(-)-3-hydroxyalkanoic acid monomers. These can be broadly

subdivided into two groups:

Short chain length PHAs

• consist of 3 carbon - 5 carbon monomers (C3-C5)

• produced by bacterium Alcaligenes eutrophus (plus others)

Long chain length PHAs

• consist of 6 carbon - 14 carbon monomers (C6-C14)

• produced

by

Pseudomonas oleovorans (plus others)

Each type of PHA generally consists of 1000-10000 monomers, but most are synthesised by short

chain length monomers.

There are many different types of PHA, distinctly characterised by chain length, type of functional

group and degree of unsaturated bonds. A higher degree of unsaturation increases the rubber

qualities of a polymer, and different functional groups change the physical and chemical properties

of a polymer.

PHB (or poly-3-hydroxybutyrate (P(3HB))) is the most common type of PHA produced and is an

example of a short chain length homopolymer produced by A. eutrophus. PHB has poor physical

properties for commercial use, as it is stiff, brittle and hard to process. This has led to an increased

interest to produce heteropolymers with improved qualities.

19

Overview of Biodegradable Polymers

Biopol, produced by Metabolix, is a leading example of an improved poly(3-hydroxybutyrate-co-

3-hydroxyvalerate), P(3HB-3HV), heteropolymer. Compared to PHB, P(3HB-3HV) is less stiff,

tougher, and easier to process, making it more suitable for commercial production. It is also water

resistant and impermeable to oxygen, increasing its value.

PHB is a completely biodegradable polymer and degrades through various types of bacteria and

fungi to carbon dioxide and water through secreting enzymes. It can also be degraded through non-

enzymatic hydrolysis. Degradation appears to be the fastest under conditions of high temperatures

and mechanical disruption. PHB is also biocompatible, meaning it is a metabolite normally present

in blood.

The production of biodegradable polymers using carbon as the starting material can be carried

out using a 3-stage or a 2-stage process.

The 3-stage process involves utilisation of plant sugars derived from photosynthetically fi xed CO

2

as carbon sources in the fermentation of organic acids, alcohols and amino acids. These substances

are then used as building blocks for the chemical synthesis of polymers. Examples of polymers

using the 3-stage process include polylactic acid and polybutylene succinate.

On the other hand, the 2-stage process involves the direct conversion of plant sugars and plant

oils into polymer by microorganisms. At present, the biosynthesis of PHA is largely carried out

through the 2-stage process. Compared to the 3-stage process of polymer production, the 2-stage

process can be more cost effective provided that excellent producers of PHA are identifi ed and the

fermentation process is highly optimised. Inexpensive plant oils have been found to be an excellent

carbon source for the effi cient production of PHA.

There were a number of efforts to commercialise PHA, notably by ICI in the 1980s and early 1990s,

and by Monsanto in the mid 1990s. However, these attempts were largely unsuccessful due to the

high cost and very limited processability and properties. In recent years, these defi ciencies have

been largely overcome most notably by Metabolix and by Procter & Gamble’s Nodax business

unit, which both specialise in PHA materials development.

The broad range of properties offered by PHA make them useful for a wide variety of applications,

including:

Food packaging

Single-serve cups and other disposable foodservice items

Houseware

Appliances

Electrical and electronics

Consumer durables

Agriculture and soil stabilisation

Adhesives, paints and coatings

Automotive

Medical (bone plates and surgical sutures)

20

Biodegradable Polymers

3.9 Polylactic Acid Polyesters

Polylactic acid (PLA) is a biodegradable polymer derived from lactic acid. It is a highly versatile

material and is made from 100% renewable resources like corn, sugar beet, wheat and other starch-

rich products. Polylactic acid exhibits many properties that are equivalent to or better than many

petroleum-based plastics, which makes it suitable for a variety of applications.

The starting material for polylactic acid is starch from a renewable resource such as corn. Corn is

milled, which separates starch from the raw material. Unrefi ned dextrose is then processed from

the starch. Dextrose is turned into lactic acid using fermentation, similar to that used by beer and

wine producers.

Polylactide (PLA) polymer chemistry stems from lactide, which is the cyclic dimer of lactic acid that

exists as two optical isomers, d and l. l-lactide is the naturally occurring isomer, and dl-lactide is the

synthetic blend of d-lactide and l-lactide. The homopolymer of l-lactide (LPLA) is a semicrystalline

polymer. Poly(dl-lactide) (DLPLA) is an amorphous polymer exhibiting a random distribution of both

isomeric forms of lactic acid, and accordingly is unable to arrange into an organised crystalline structure.

This material has lower tensile strength, higher elongation, and a much more rapid degradation time.

PLA is about 37% crystalline, with a melting point of 175-178 °C and a glass-transition temperature of

60-65 °C. The degradation time of LPLA is much slower than that of DLPLA, requiring more than two

years to be completely absorbed. Copolymers of l-lactide and dl-lactide have been developed prepared

to disrupt the crystallinity of l-lactide and accelerate the degradation process.

Turning the lactic acid into a polymer involves a chemical process called condensation, whereby two

lactic acid molecules are converted into one cyclic molecule called a lactide. This lactide is purifi ed

through vacuum distillation. A solvent-free melt process causes the ring-shaped lactide polymers

to open and join end-to-end to form long chain polymers. A wide range of products that vary in

molecular weight and crystallinity can be produced, allowing the PLA to be modifi ed for a variety

of applications.

PLA compares well with petrochemical-based plastics used for packaging. It is clear and naturally

glossy like polystyrene, it is resistant to moisture and grease, it has fl avour and odour barrier

characteristics similar to polyethylene terephthalate (PET). The tensile strength and modulus of

elasticity of PLA is also comparable to PET.

PLA can be formulated to be either rigid or fl exible and can be co-polymerised with other materials.

Polylactic acid can be made with different mechanical properties suitable for specifi c manufacturing