July 30, 2002

Dr. Edward Yardeni

(212) 778-2646

ed_yardeni@prusec.com

Amalia F. Quintana

(212) 778-3201

mali_quintana@prusec.com

Asset Valuation & Allocation

Models

R e s e a r c h

Page 2 / Ju

ly 30, 2002 / Prudential Securities Asset Valuation & Allocation Models

-

Introduction

-

I. Fed’s Stock Valuation Model

How can we judge whether stock prices are too high, too low, or just right? The purpose

of this weekly report is to track a stock valuation model that attempts to answer this

question. While the model is very simple, it has been quite accurate and can also be used

as a stocks-versus-bonds asset allocation tool. I started to study the model in 1997, after

reading that the folks at the Federal Reserve have been using it. If it is good enough for

them, it’s good enough for me. I dubbed it the Fed’s Stock Valuation Model (FSVM),

though no one at the Fed ever officially endorsed it.

On December 5, 1996, Alan Greenspan, Chairman of the Federal Reserve Board,

famously worried out loud for the first time about “irrational exuberance” in the stock

market. He didn’t actually say that stock prices were too high. Rather he asked the

question: “But how do we know when irrational exuberance has unduly escalated asset

values, which then become subject to unexpected and prolonged contractions….”

1

He did

it again on February 26, 1997.

2

2

He probably instructed his staff to devise a stock market

valuation model to help him evaluate the extent of the market’s exuberance. Apparently,

they did so and it was made public, though buried, in the Fed’s Monetary Policy Report

to the Congress, which accompanied Mr. Greenspan’s Humphrey-Hawkins testimony on

July 22, 1997.

3

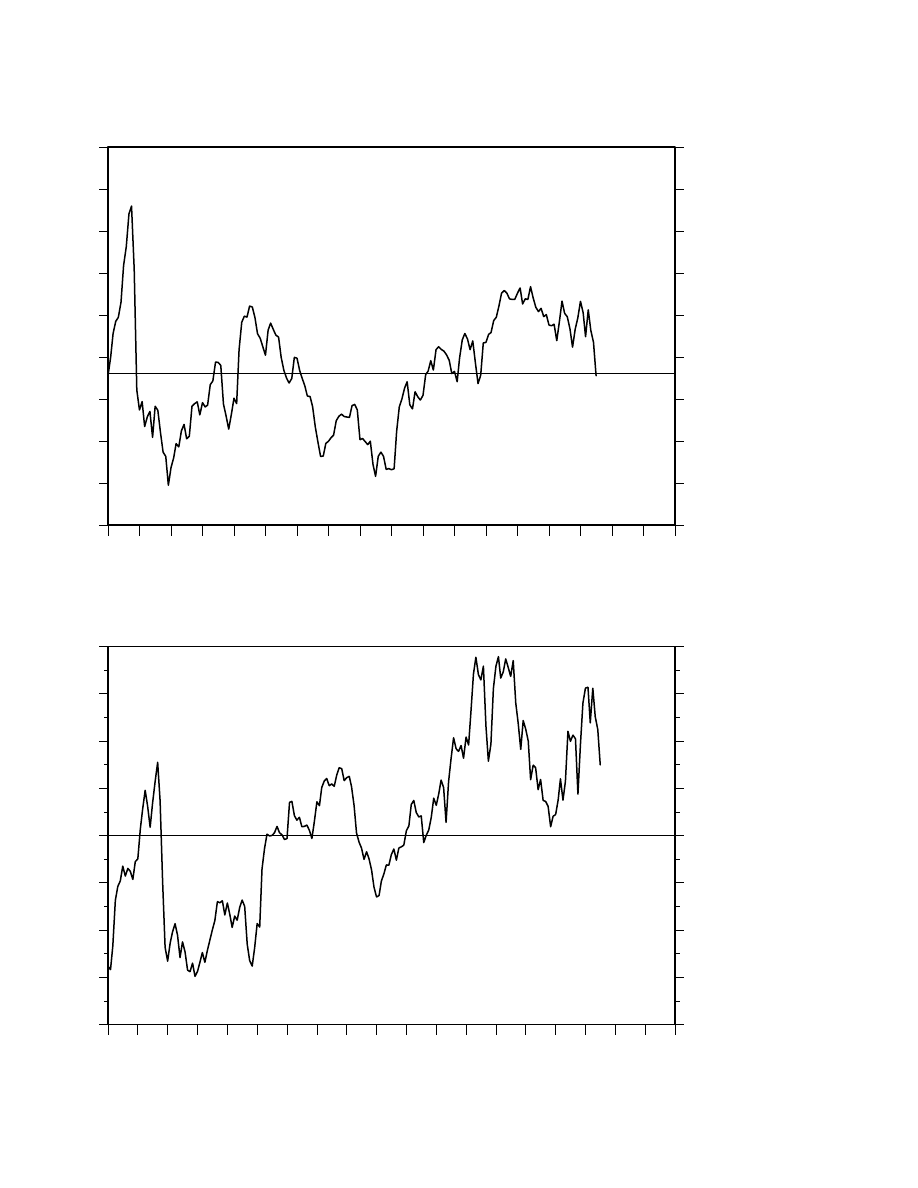

The Fed model was summed up in one paragraph and one chart on page 24 of the 25-

page document (see following table). The chart shows a strong correlation between the

S&P 500 forward earnings yield (FEY)—i.e., the ratio of expected operating earnings (E)

to the price index for the S&P 500 companies (P), using 12- month-ahead consensus

earnings estimates compiled by Thomson Financial First Call.—and the 10-year Treasury

bond yield (TBY). The average spread between the forward earnings yield and the

Treasury yield (i.e., FEY-TBY) is 29 basis points since 1979. This near-zero average

implies that the market is fairly valued when the two are identical:

1) FEY = TBY

Of course, in the investment community, we tend to follow the price-to-earnings ratio

more than the earnings yield. The ratio of the S&P 500 price index to expected earnings

(P/E) is highly correlated with the reciprocal of the 10-year bond yield, and on average

the two have been nearly identical. In other words, the “fair value” price for the S&P 500

(FVP) is equal to expected earnings divided by the bond yield in the Fed’s valuation

model:

2) FVP = E/TBY

1

http://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm

2

“We have not been able, as yet, to provide a satisfying answer to this question, but there are reasons in the

current environment to keep this question on the table.”

http://www.federalreserve.gov/boarddocs/hh/1997/february/testimony.htm

3

http://www.federalreserve.gov/boarddocs/hh/1997/july/ReportSection2.htm

Prudential Securities Asset Valuation & Allocation Models / Ju

ly 30, 2002 / Page 3

The ratio of the actual S&P 500 price index to the fair value price shows the degree of

overvaluation or undervaluation. History shows that markets can stay overvalued and

become even more overvalued for a while. But eventually, overvaluation is corrected in

three ways: 1) falling interest rates, 2) higher earnings expectations, and of course, 3)

falling stock prices—the old fashioned way to decrease values. Undervaluation can be

corrected by rising yields, lower earnings expectations, or higher stock prices.

The Fed’s Stock Valuation Model worked quite well in the past. It identified when stock

prices were excessively overvalued or undervalued, and likely to fall or rise:

1) The market was extremely undervalued from 1979 through 1982, setting the stage

for a powerful rally that lasted through the summer of 1987.

2) Stock prices crashed after the market rose to a record 34% overvaluation peak during

September 1987.

3) Then the market was undervalued in the late 1980s, and stock prices rose.

4) In the early 1990s, it was moderately overvalued and stock values advanced at a

lackluster pace.

5) Stock prices were mostly undervalued during the mid-1990s, and a great bull market

started in late 1994.

6) Ironically, the market was actually fairly valued during December 1996 when the

Fed Chairman worried out loud about irrational exuberance.

E

xcerpt from Fed’s July 1997 Monetary Policy Report:

The run-up in stock prices in the spring was bolstered by unexpectedly strong

corporate profits for the first quarter. Still, the ratio of prices in the S&P 500 to

consensus estimates of earnings over the coming twelve months has risen

further from levels that were already unusually high. Changes in this ratio have

often been inversely related to changes in long-term Treasury yields, but this

year’s stock price gains were not matched by a significant net decline in interest

rates. As a result, the yield on ten-year Treasury notes now exceeds the ratio of

twelve-month-ahead earnings to prices by the largest amount since 1991, when

earnings were depressed by the economic slowdown. One important factor

behind the increase in stock prices this year appears to be a further rise in

analysts’ reported expectations of earnings growth over the next three to five

years. The average of these expectations has risen fairly steadily since early

1995 and currently stands at a level not seen since the steep recession of the

early 1980s, when earnings were expected to bounce back from levels that were

quite low.

Page 4 / Ju

ly 30, 2002 / Prudential Securities Asset Valuation & Allocation Models

7) During both the summers of 1997 and 1998, overvaluation conditions were corrected

by a sharp drop in prices.

8) Then a two- month undervaluation condition during September and October 1998

was quickly reversed as stock prices soared to a remarkable record 70%

overvaluation reading during January 2000. This bubble was led by the Nasdaq and

technology stocks, which crashed over the rest of the year, bringing the market closer

to fair value

II. New Improved Model

The FSVM is missing a variable reflecting that the forward earnings yield is riskier than

the government bond yield. How should we measure risk in the model? An obvious

choice is to use the spread between corporate bond yields and Treasury bond yields. This

spread measures the market’s assessment of the risk that some corporations might be

forced to default on their bonds. Of course, such events are very unusual, especially for

companies included in the S&P 500. However, the spread is only likely to widen during

periods of economic distress, when bond investors tend to worry that profits won’t be

sufficient to meet the debt-servicing obligations of some companies. Most companies

won’t have this problem, but their earnings would most likely be depressed during such

periods. The FSVM is also missing a variable for long-term earnings growth. My New

Improved Model includes these variables as follows:

3) FEY = CBY – b · · LTEG

where CBY is Moody’s A-rated corporate bond yield. LTEG is long-term expected

earnings growth, which is measured using consensus five- year earnings growth

projections. I/B/E/S International compiles these monthly. The “b” coefficient is the

weight that the market gives to long-term earnings projections. It can be derived as -

[FEY-CBY]/LTEG. Since the start of the data in 1985, this “earnings growth coefficient”

averaged 0.1.

Equation 3 can be rearranged to produce the following:

4) FVP = E ¸ ¸ [CBY – b · · LTEG]

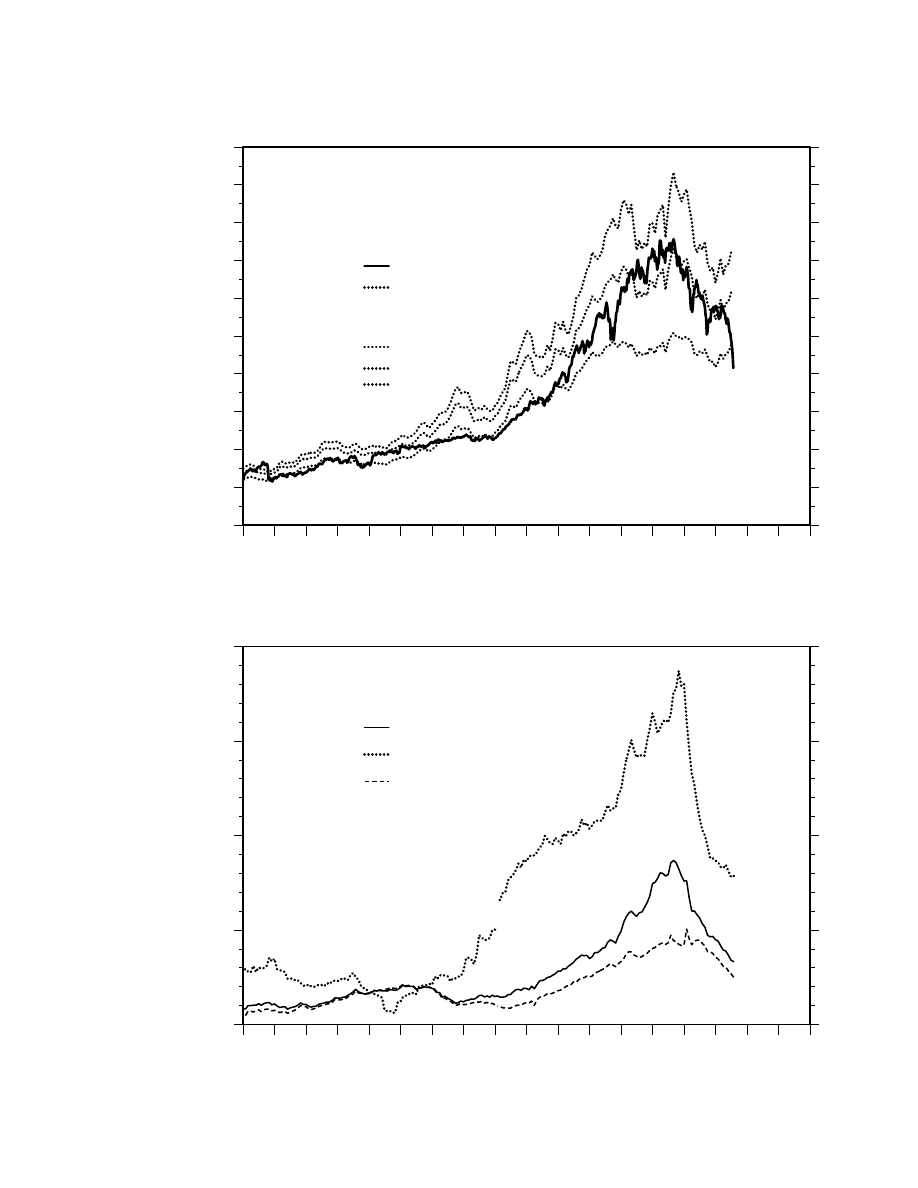

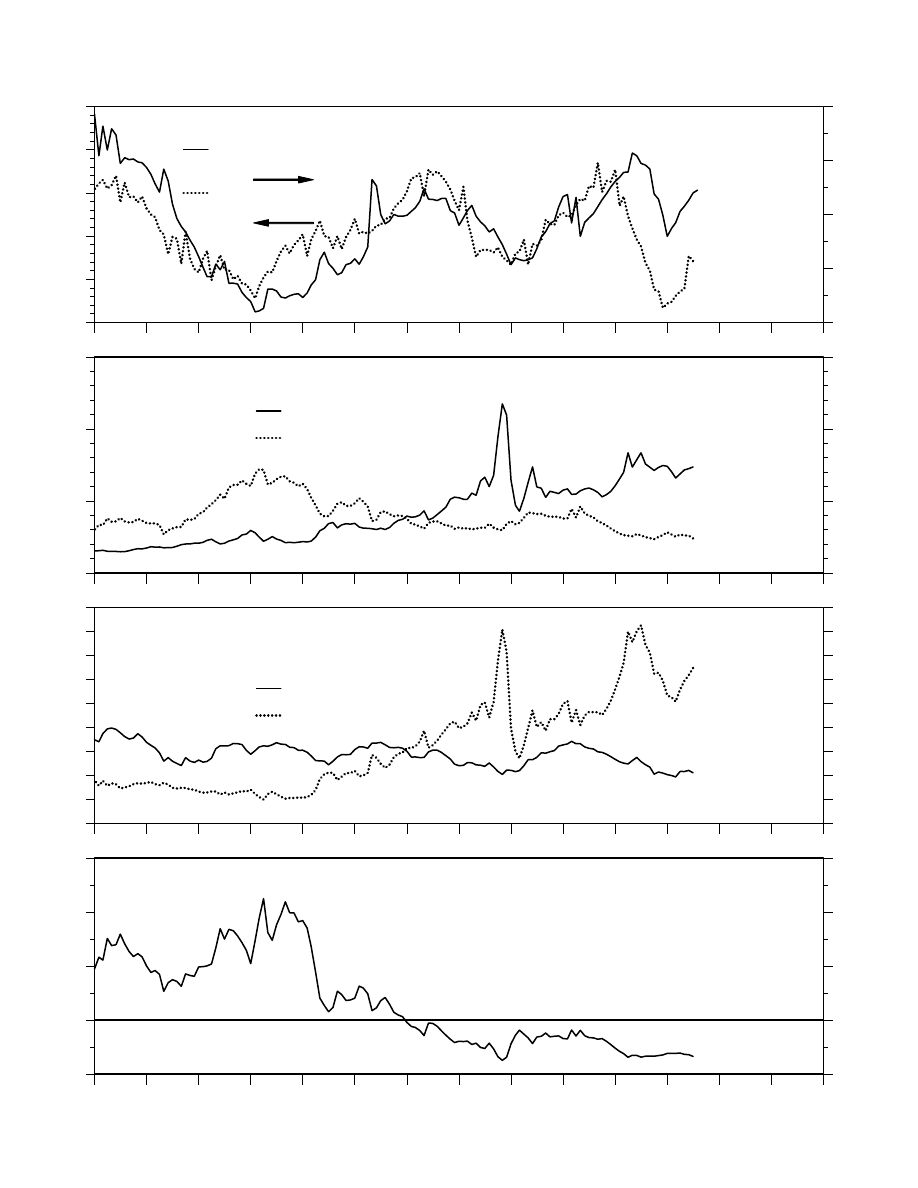

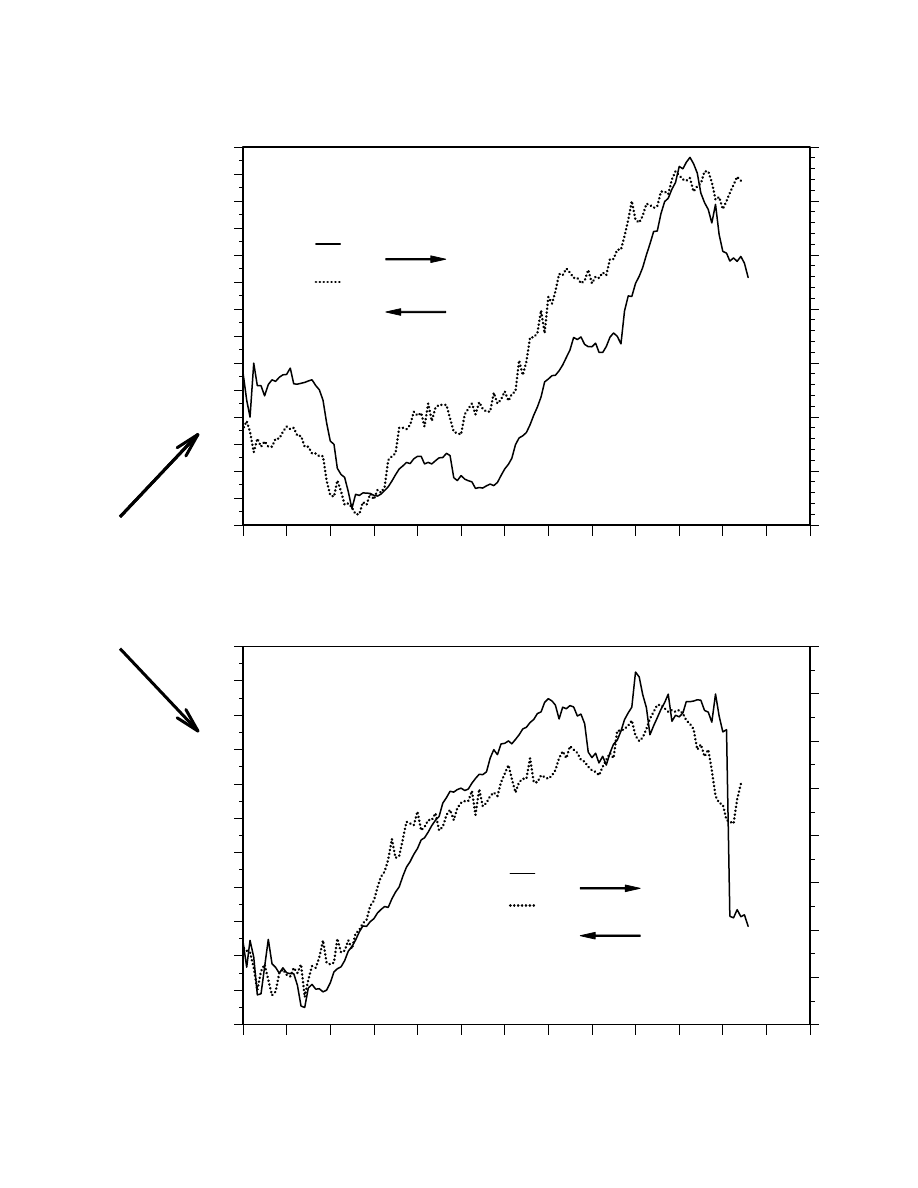

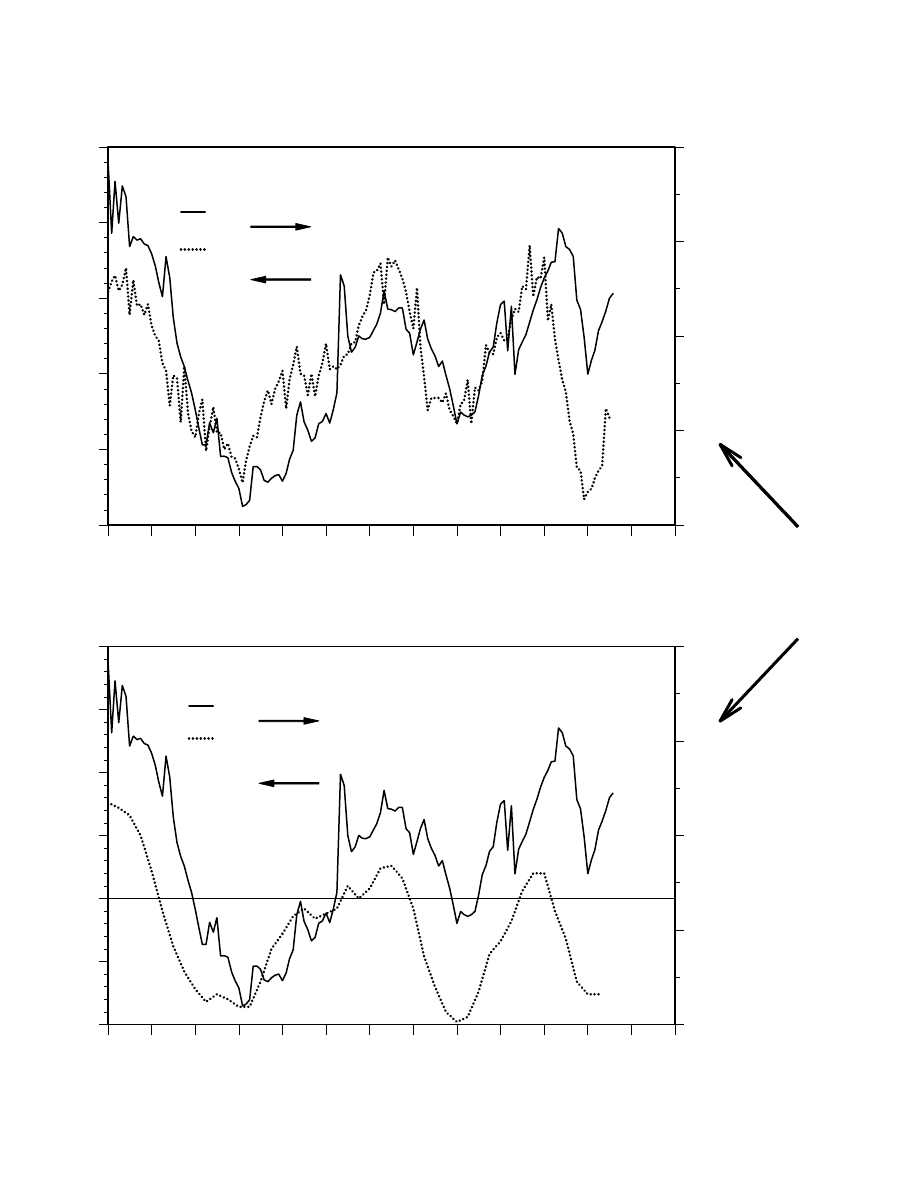

FVP is the fair value price of the S&P 500 index. Exhibit 10 shows three fair value price

series using the actual data for E, CBY, and LTEG with b = 0.1, b = 0.2, and b = 0.25.

The market was fairly valued during 1999 and the first half of 2000 based on the

consensus forecast that earnings could grow more than 16% per year over the next five

years and that this variable should be weighted by 0.25, or two and a half times more than

the average historical weight.

III. Back To Basics

With the benefit of hindsight, it seems that these assumptions were too optimistic. But,

Prudential Securities Asset Valuation & Allocation Models / Ju

ly 30, 2002 / Page 5

this is exactly the added value of the New Improved FSVM. It can be used to make

explicit the implicit assumptions in the stock market about the weight given to long-term

earnings growth. The simple version has worked so well historically because the long-

term growth component has been offset on average by the risk variable in the corporate

bond market.

IV. Stocks Versus Bonds

The FSVM is a very simple stock valuation model. It should be used along with other

stock valuation tools, including the New Improved version of the model. Of course, there

are numerous other more sophisticated and complex models. The Fed model is not a

market-timing tool. As noted above, an overvalued (undervalued) market can become

even more overvalued (undervalued). However, the Fed model does have a good track

record of showing whether stocks are cheap or expensive. Investors are likely to earn

below (above) average returns over the next 12-24 months when the market is overvalued

(undervalued).

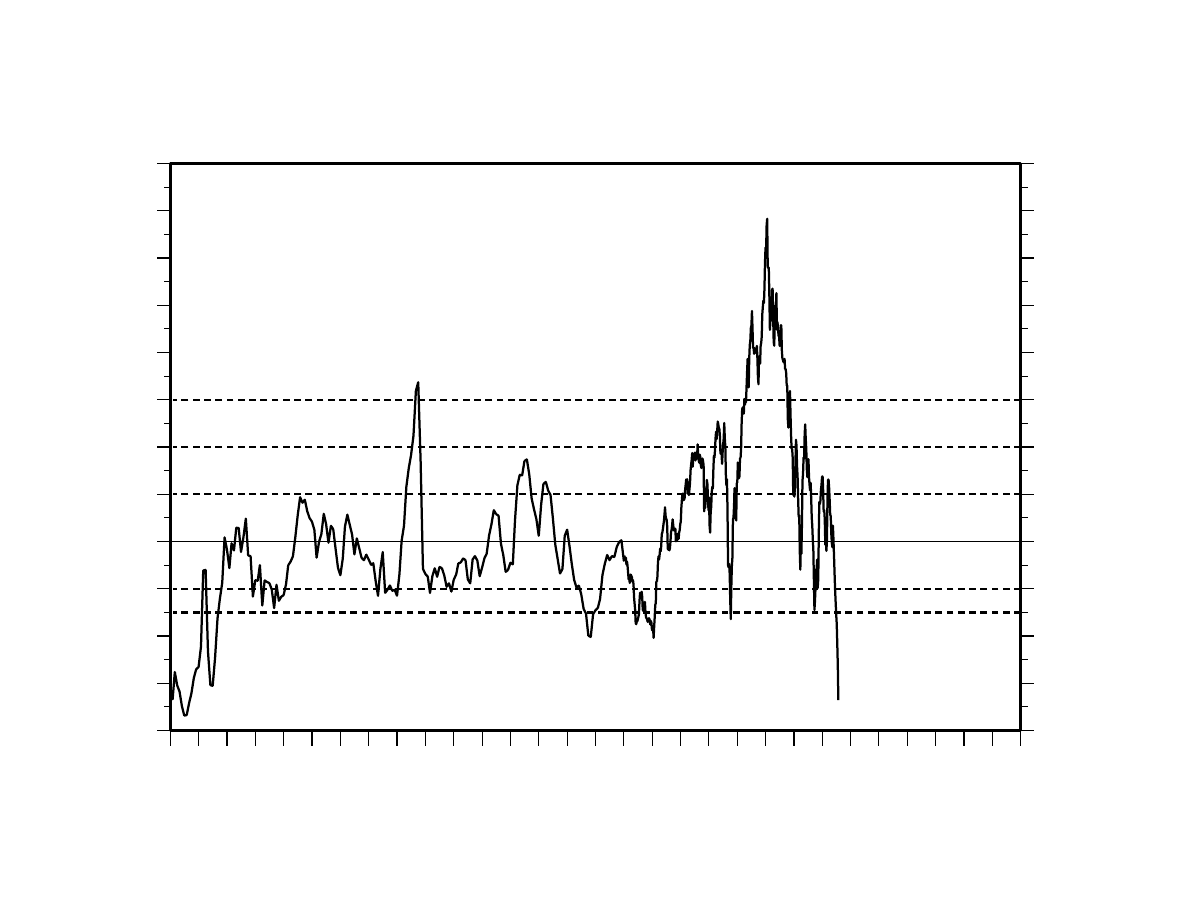

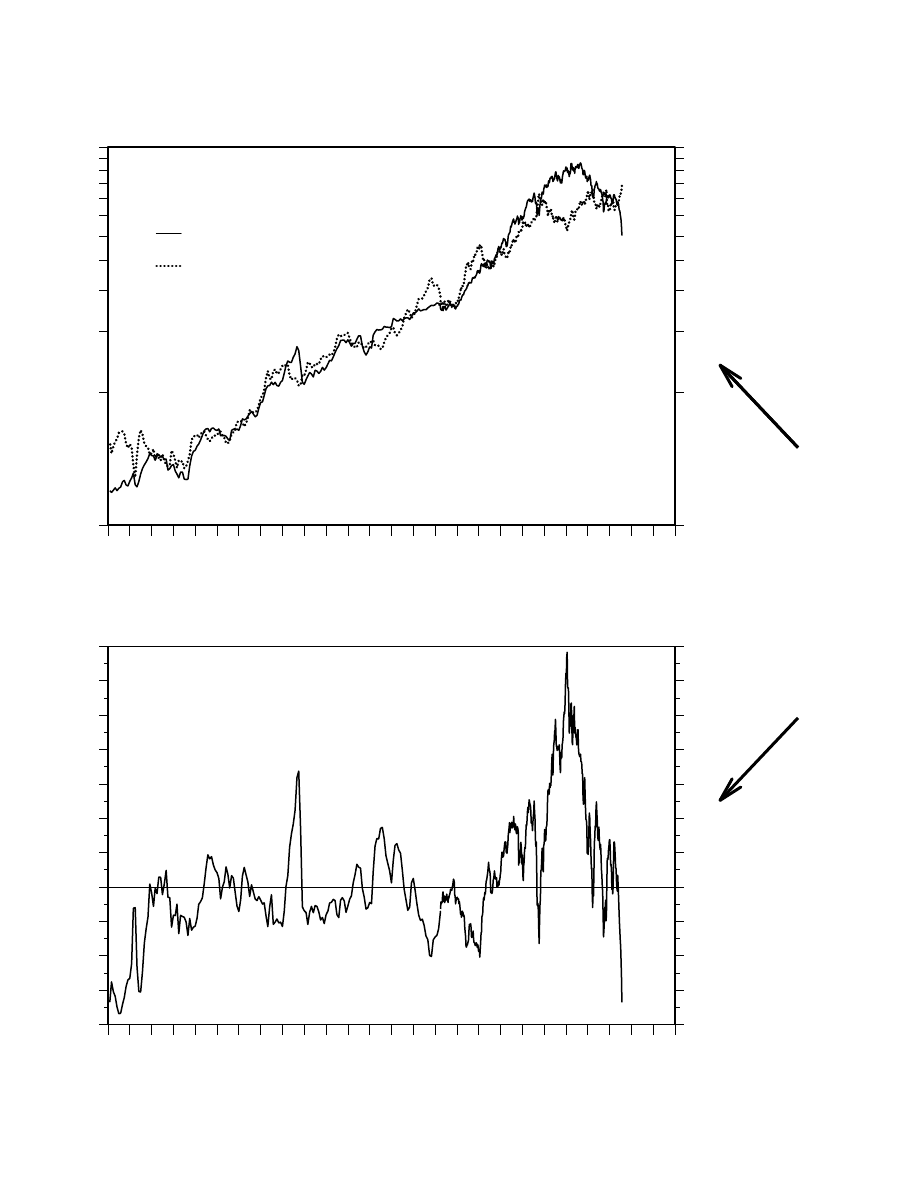

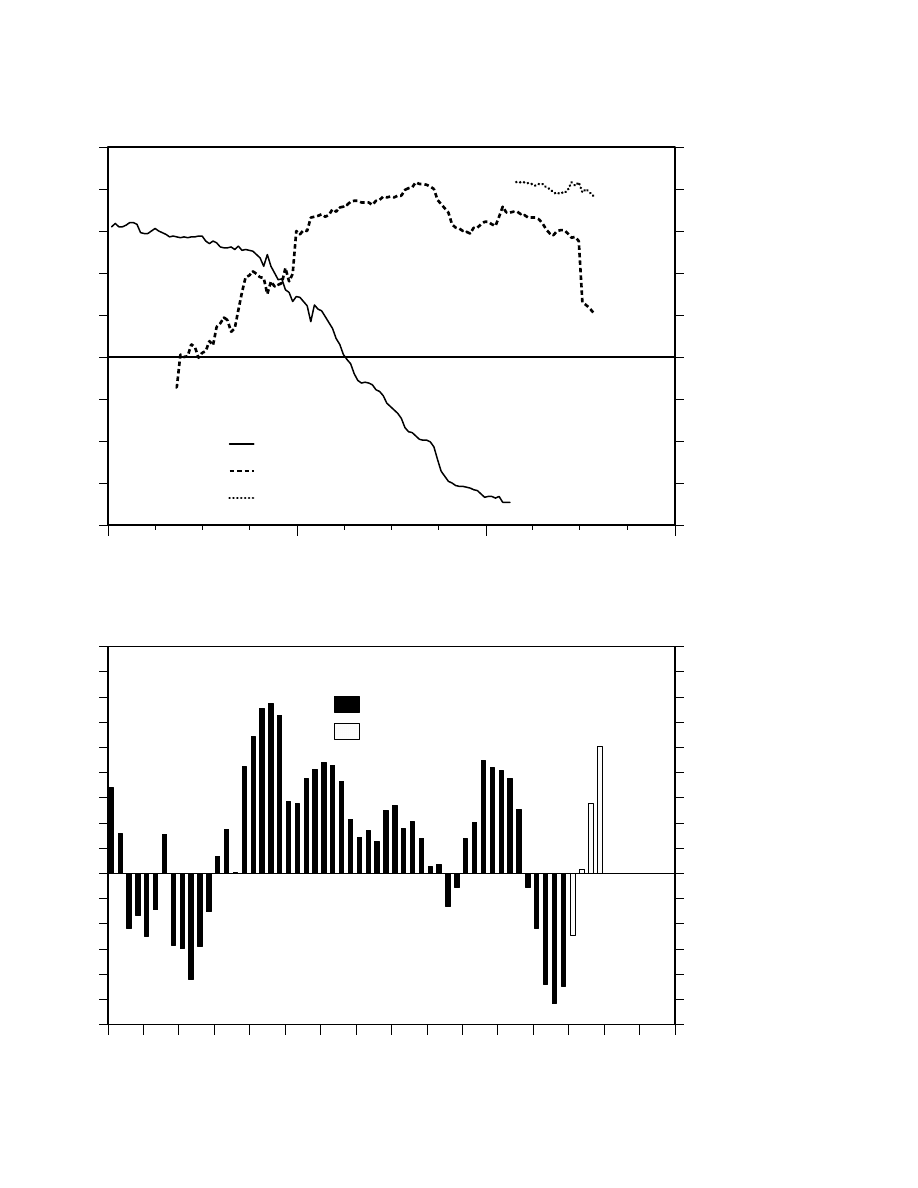

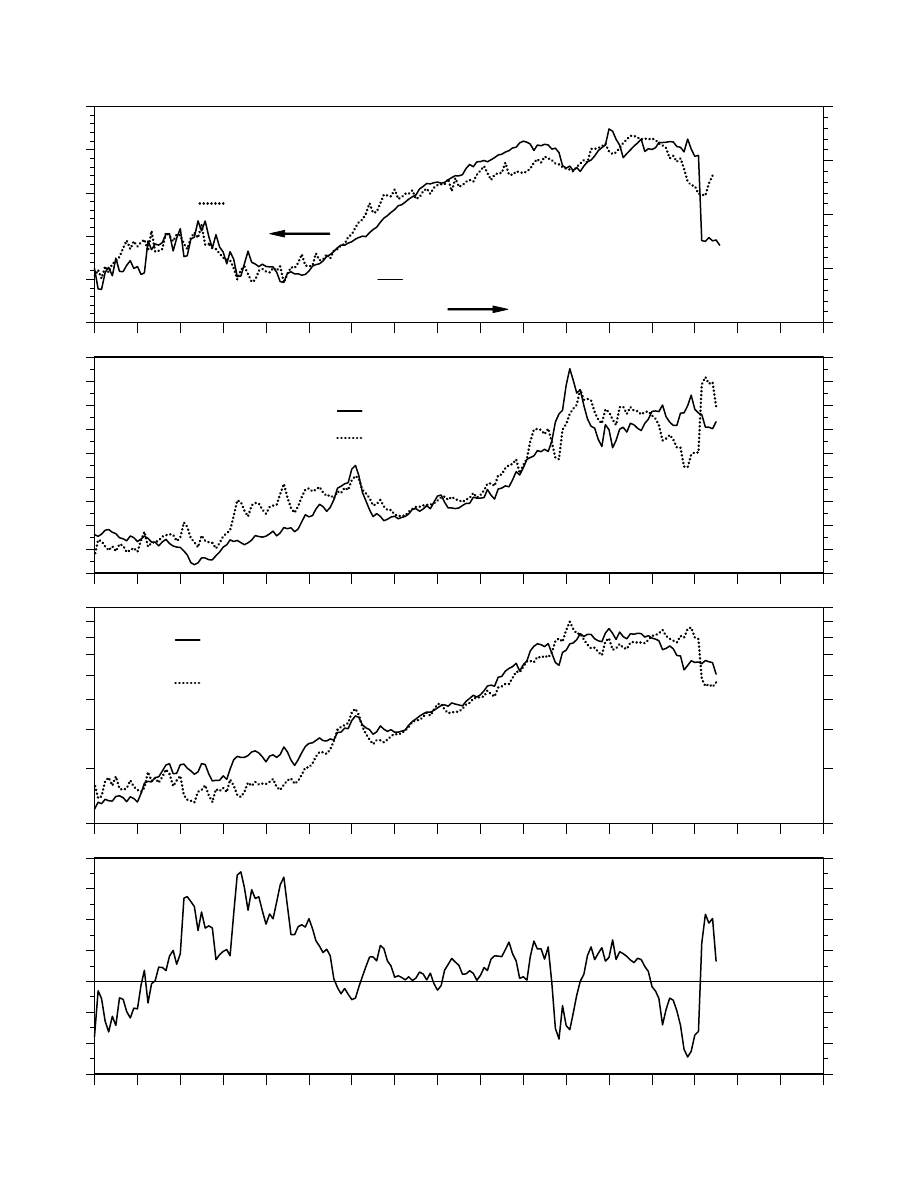

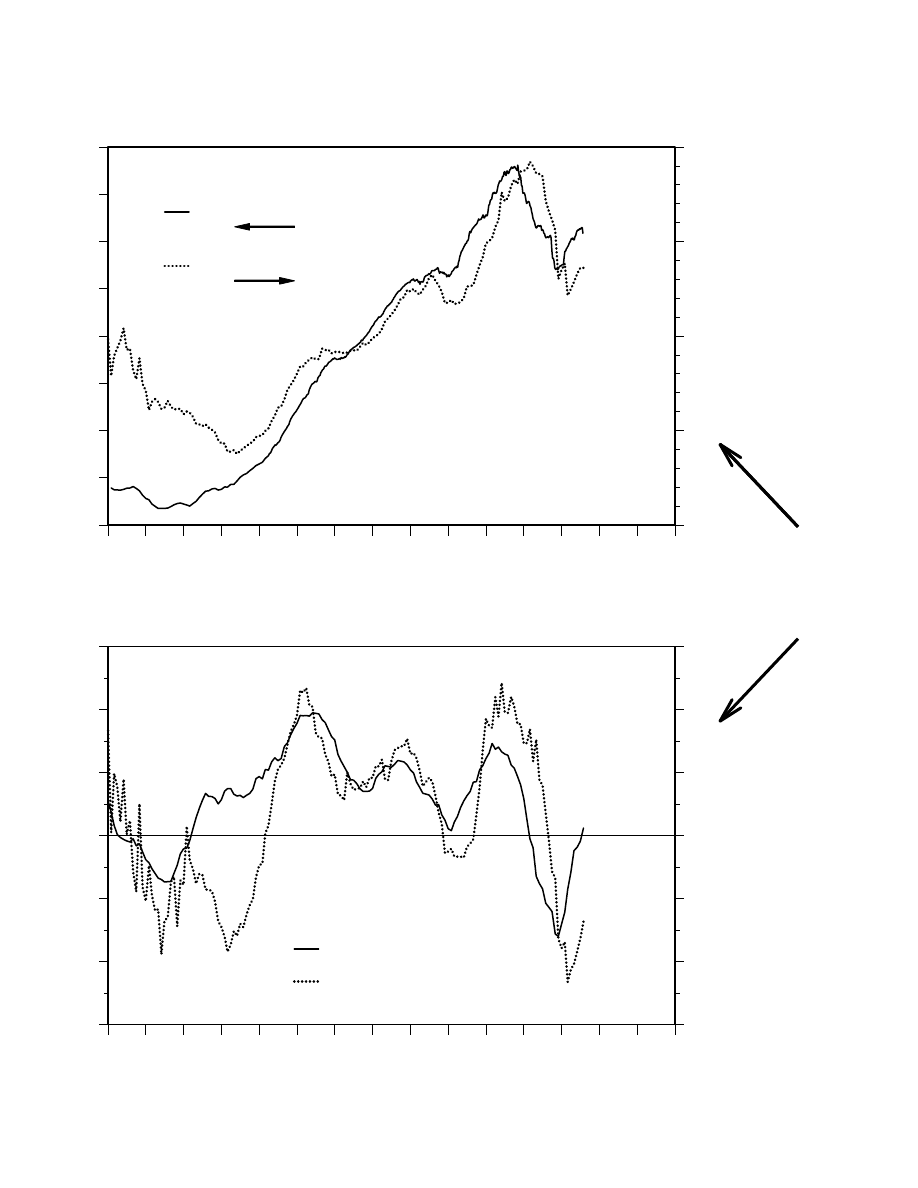

The next logical step is to convert the FSVM into a simple asset allocation model

(Exhibit 1). I’ve done so by subjectively associating the “right” stock/bond asset mixes

with the degree of over/under valuation as shown in the table below. For example,

whenever stocks are 10% to 20% overvalued, I would recommend that a moderately

aggressive investor should have a mix of 60% in stocks and 40% in bonds in their

portfolio.

Bonds/Stocks Asset Allocation Model

More than 30% overvalued

70% bonds, 30% stocks

20% to 30% overvalued

50% bonds, 50% stocks

10% to 20% overvalued

40% bonds, 60% stocks

10% undervalued to 10% overvalued

30% bonds, 70% stocks

10% to 15% undervalued

20% bonds, 80% stocks

More than 15% undervalued

10% bonds, 90% stocks

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08

-40

-30

-20

-10

0

10

20

30

40

50

60

70

80

-40

-30

-20

-10

0

10

20

30

40

50

60

70

80

7/26

ED YARDENI’S ASSET ALLOCATION MODEL: BONDS/STOCKS*

(for Moderately Aggressive Investor)

Stocks overvalued when greater than zero

Stocks undervalued when less than zero

70/30

50/50

40/60

30/70

30/70

20/80

10/90

* Ratio of S&P 500 index to its fair value (12-month forward consensus expected operating earnings per share

divided by the ten-year U.S. Treasury bond yield) minus 100. Monthly through March 1994, weekly after.

Source: Thomson Financial.

Yardeni

- Asset Allocation -

Page 6 /

July 30, 2002

/ Prudential Securities

Asset Valuation & Allocation Models

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

75

225

375

525

675

825

975

1125

1275

1425

1575

1725

75

225

375

525

675

825

975

1125

1275

1425

1575

1725

7/26

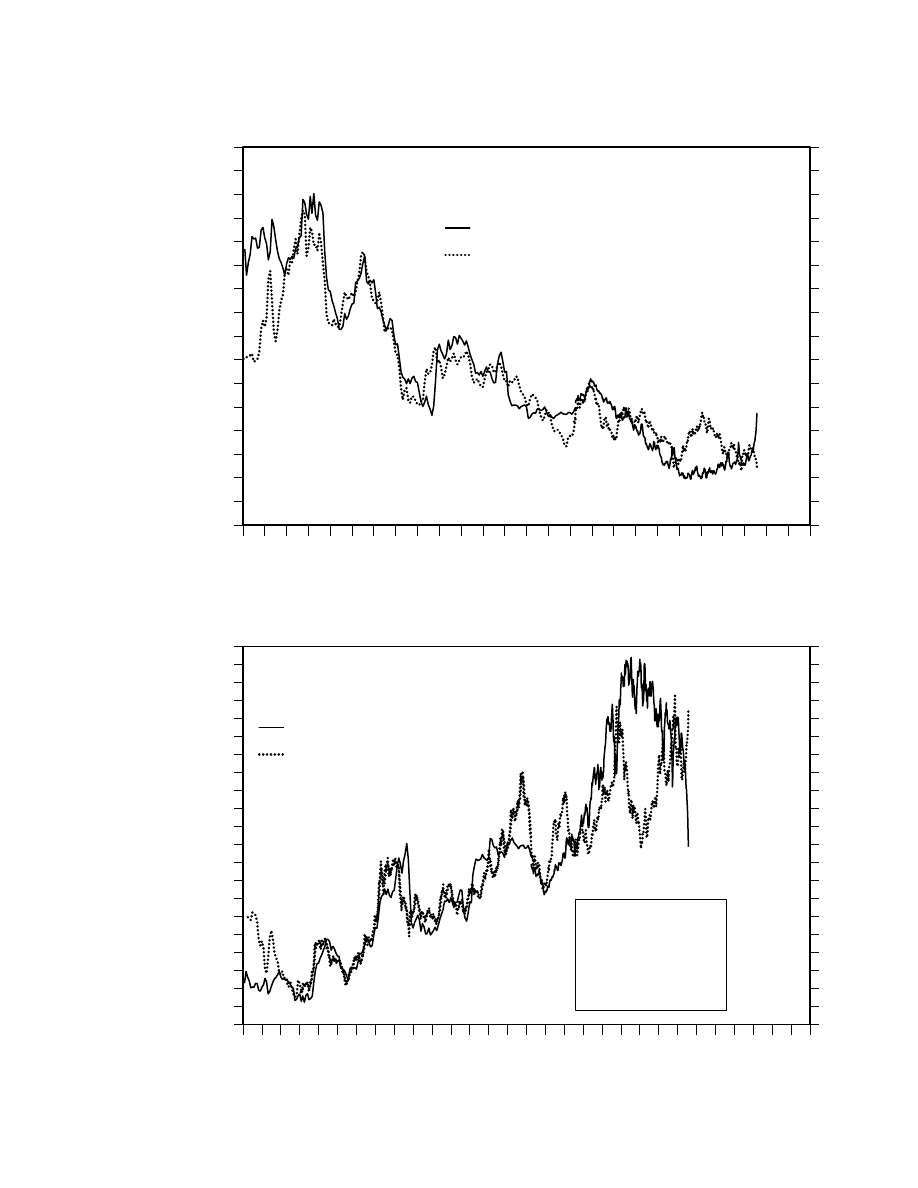

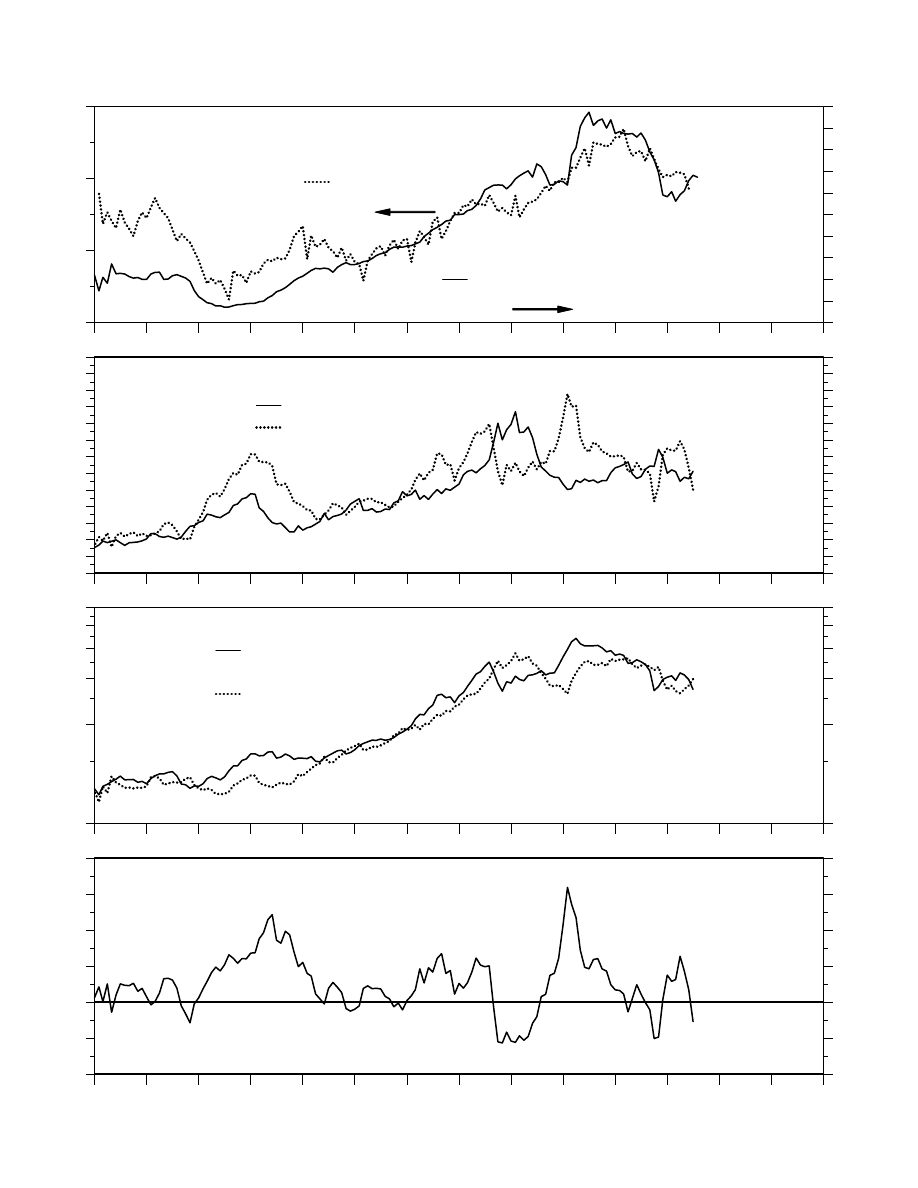

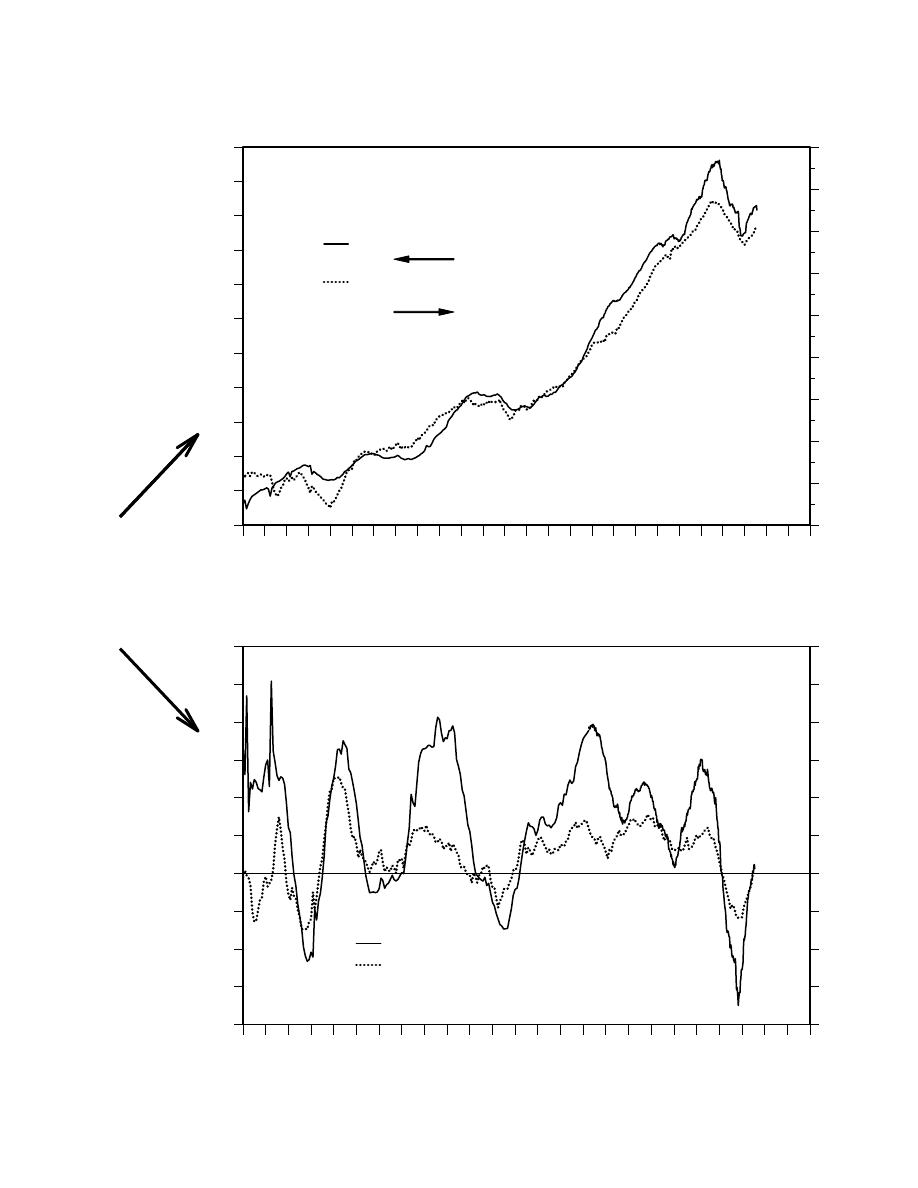

FED’S STOCK VALUATION MODEL (FSVM-1)

(ratio scale)

Fair-Value Price*

S&P 500 Price Index

* 52-week forward consensus expected S&P 500 operating earnings per share divided by 10-year US Treasury

bond yield. Monthly through March 1994, weekly after.

Source: Thomson Financial.

Yardeni

Figure 2.

According to the Fed

model, when stock

prices are overpriced,

returns from stocks

are likely to be subpar

over the next 12-24

months.

Better-than-average

returns tend to come

from underpriced

markets.

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

-40

-30

-20

-10

0

10

20

30

40

50

60

70

-40

-30

-20

-10

0

10

20

30

40

50

60

70

7/26

FED’S STOCK VALUATION MODEL (FSVM-1)*

(percent)

Overvalued

Undervalued

* Ratio of S&P 500 Index to its Fair-Value (52-week forward consensus expected S&P 500 operating earnings

per share divided by the 10-year US Treasury bond yield) minus 100. Monthly through April 1994, weekly

thereafter.

Source: Thomson Financial.

Yardeni

Figure 3.

Figure 3.

- Valuation Model -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 7

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

7/26

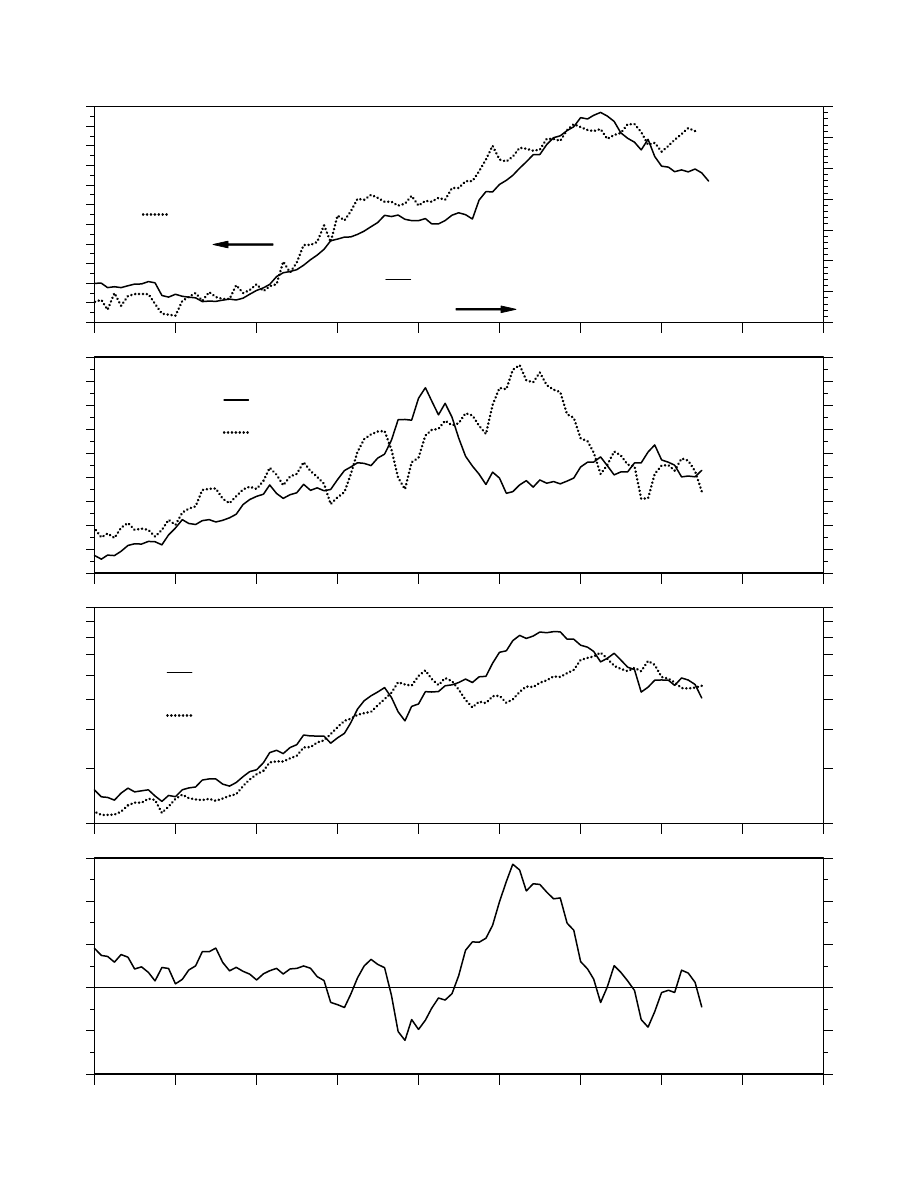

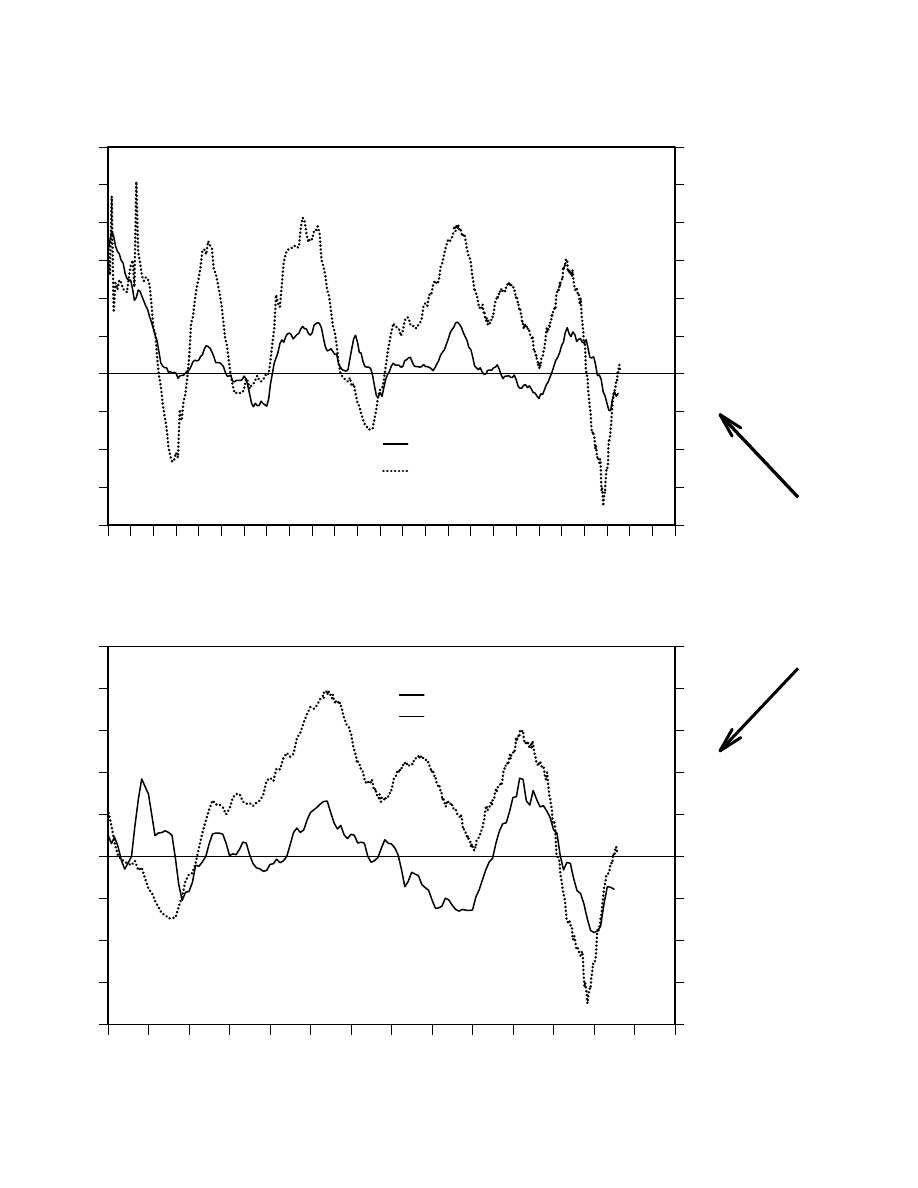

S&P 500 EARNINGS YIELD & BOND YIELD

10-Year US Treasury

Bond Yield

Forward Earnings Yield*

* 52-week forward consensus expected S&P 500 operating earnings per share divided by S&P 500 Index.

Monthly through March 1994, weekly after.

Source: Thomson Financial.

Yardeni

Figure 4.

This chart appeared in

the Fed’s July 1997

Monetary Policy

Report to the

Congress. It shows a

very close correlation

between the earnings

yield of the stock

market and the bond

yield. Another, more

familiar way to look at

it follows.

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

Actual Fair

Jun 14 18.1 20.1

Jun 21 18.1 20.7

Jun 28 17.5 20.7

Jul 5 17.1 20.7

Jul 12 16.6 21.2

Jul 19 15.8 21.4

Jul 26 14.9 22.4

7/26

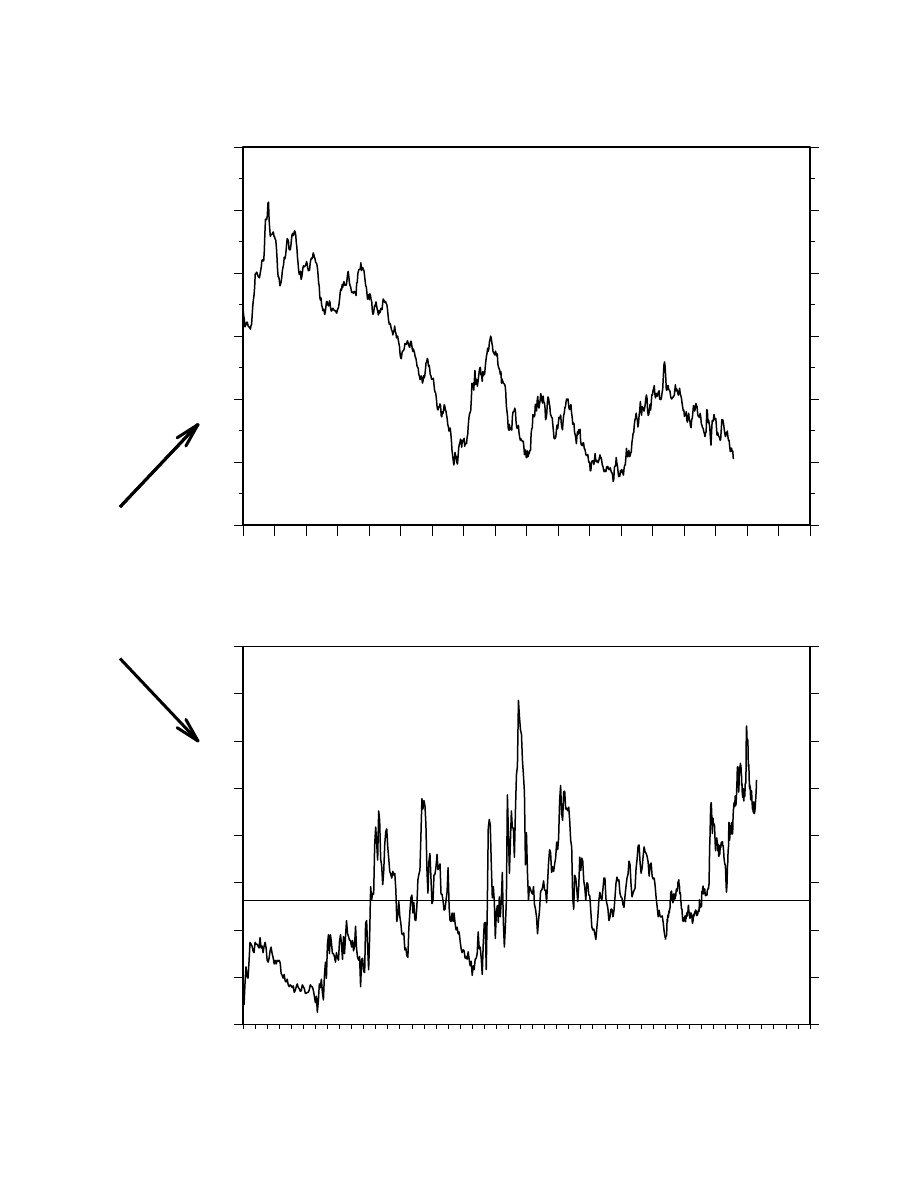

FORWARD P/E & BOND YIELD

Fair-Value P/E=Reciprocal Of

Ten-Year U.S. Treasury Bond Yield

Ratio Of S&P 500 Price To Expected Earnings*

* 52-week forward consensus expected S&P 500 operating earnings per share. Monthly through March 1994,

weekly after.

Source: Thomson Financial.

Yardeni

Figure 5.

The S&P 500 P/E

(using expected

earnings) is highly

correlated with

reciprocal of the bond

yield.

- Valuation Model -

Page 8 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

I

II

III

IV

I

II

III

IV

I

II

III

IV

2000

2001

2002

40

45

50

55

60

65

70

75

40

45

50

55

60

65

70

75

7/26

S&P 500 EARNINGS PER SHARE CONSENSUS FORECASTS

(analysts’ average forecasts)

For 2003

For 2002

For 2001

Forward

Earnings*

* 52-week forward consensus expected S&P 500 operating earnings per share. Time-weighted average of

current year and next year’s consensus forecasts.

Source: Thomson Financial.

Yardeni

Figure 6.

Expected forward

earnings is a

time-weighted

average of current and

the coming years’

consensus forecasts.

1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

10

15

20

25

30

35

40

45

50

55

60

65

10

15

20

25

30

35

40

45

50

55

60

65

Q1

7/25

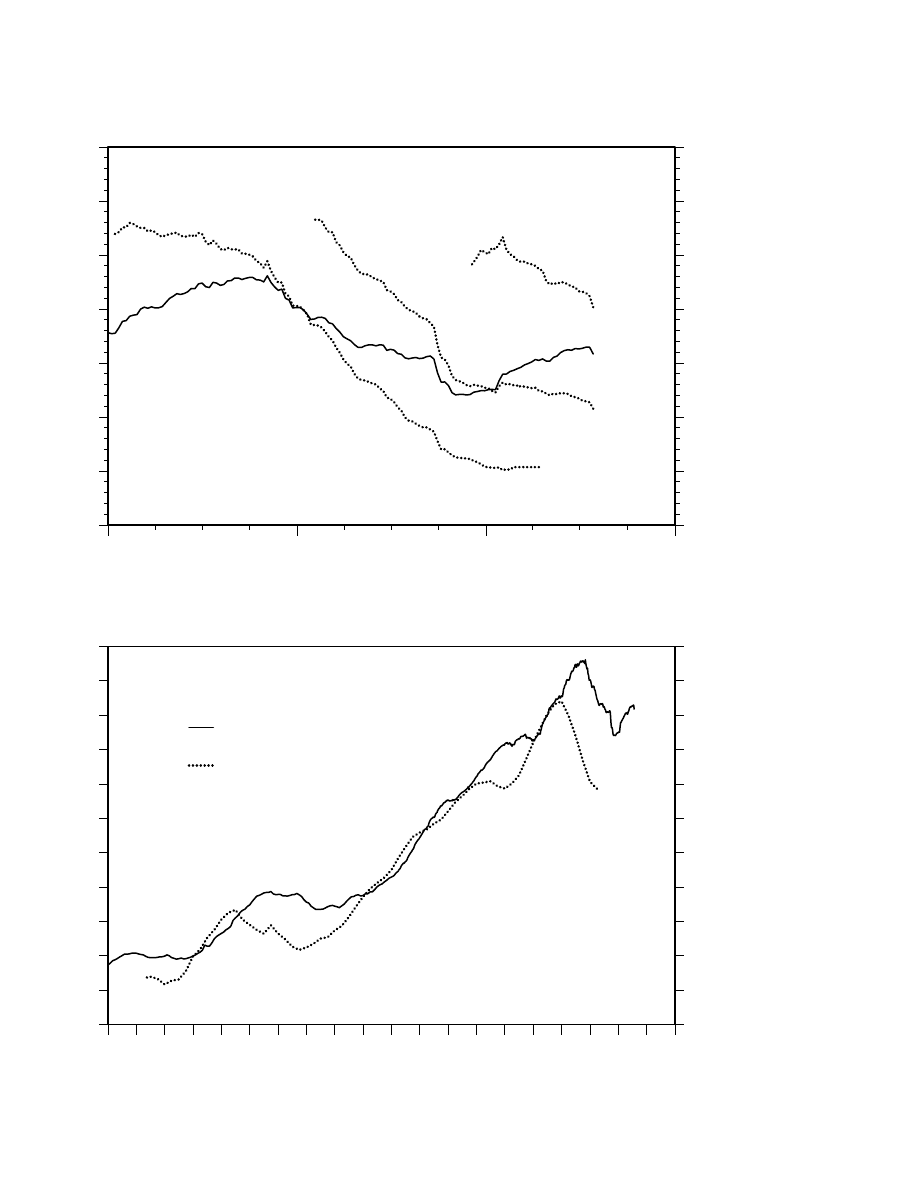

S&P 500 EARNINGS PER SHARE: ACTUAL & EXPECTED

S&P 500 Earnings Per Share

________________________

Operating Earnings

(4-quarter sum)

Forward Earnings*

(pushed 52-weeks ahead)

* 52-week forward consensus expected S&P 500 operating earnings per share. Monthly through March 1994,

weekly after.

Source: Thomson Financial.

Yardeni

Figure 7.

Bottom-up 52-week

forward expected

earnings tends to be a

good predicator of

actual earnings, with a

few significant misses.

- Earnings -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 9

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

20

25

30

35

40

45

50

55

60

65

70

75

20

25

30

35

40

45

50

55

60

65

70

75

Jul

S&P 500 CONSENSUS OPERATING EARNINGS PER SHARE

(analysts’ bottom-up forecasts)

Consensus Forecasts

__________________

Annual estimates

12-month forward

Actual 4Q sum

91

92

93

94

95

96

97

98

99

00

01

02

03

Source: Thomson Financial.

Yardeni

Figure 8.

Analysts always start

out too optimistic

about the prospects

for earnings.

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

10

15

20

25

30

35

10

15

20

25

30

35

S&P 500 CONSENSUS OPERATING EARNINGS PER SHARE

(analysts’ bottom-up forecasts, ratio scale)

Consensus Forecasts

_________________

Annual estimates

12-month forward

Actual 4Q sum

80

81

82

83

84

85

86

87

88

89

90

Source: Thomson Financial.

Yardeni

Figure 9.

Figure 9.

- Earnings -

Page 10 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

I

II

III

IV

I

II

III

IV

I

II

III

IV

2000

2001

2002

-20

-15

-10

-5

0

5

10

15

20

25

-20

-15

-10

-5

0

5

10

15

20

25

7/26

7/26

S&P 500 EARNINGS PER SHARE

Consensus Growth

Forecasts*

_______________

2001/2000

2002/2001

2003/2002

* Based on consensus expected S&P 500 operating earnings per share for years shown.

Source: Thomson Financial.

Yardeni

Figure 10.

The data on

consensus expected

earnings can be used

to derive consensus

earnings growth

forecasts.

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

-30

-25

-20

-15

-10

-5

0

5

10

15

20

25

30

35

40

45

-30

-25

-20

-15

-10

-5

0

5

10

15

20

25

30

35

40

45

Q4

S&P 500 OPERATING EARNINGS PER SHARE*

(yearly percent change)

Consensus Forecast

(Proforma)*

Actual

* S&P 500 composition is constantly changing. Actual data are not adjusted for these changes. Proforma

forecasts are same-company comparisions. Source: Thomson Financial.

Yardeni

Figure 11.

Earnings growth is

highly cyclical.

- Earnings -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 11

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

0

200

400

600

800

1000

1200

1400

1600

1800

2000

0

200

400

600

800

1000

1200

1400

1600

1800

2000

7/26

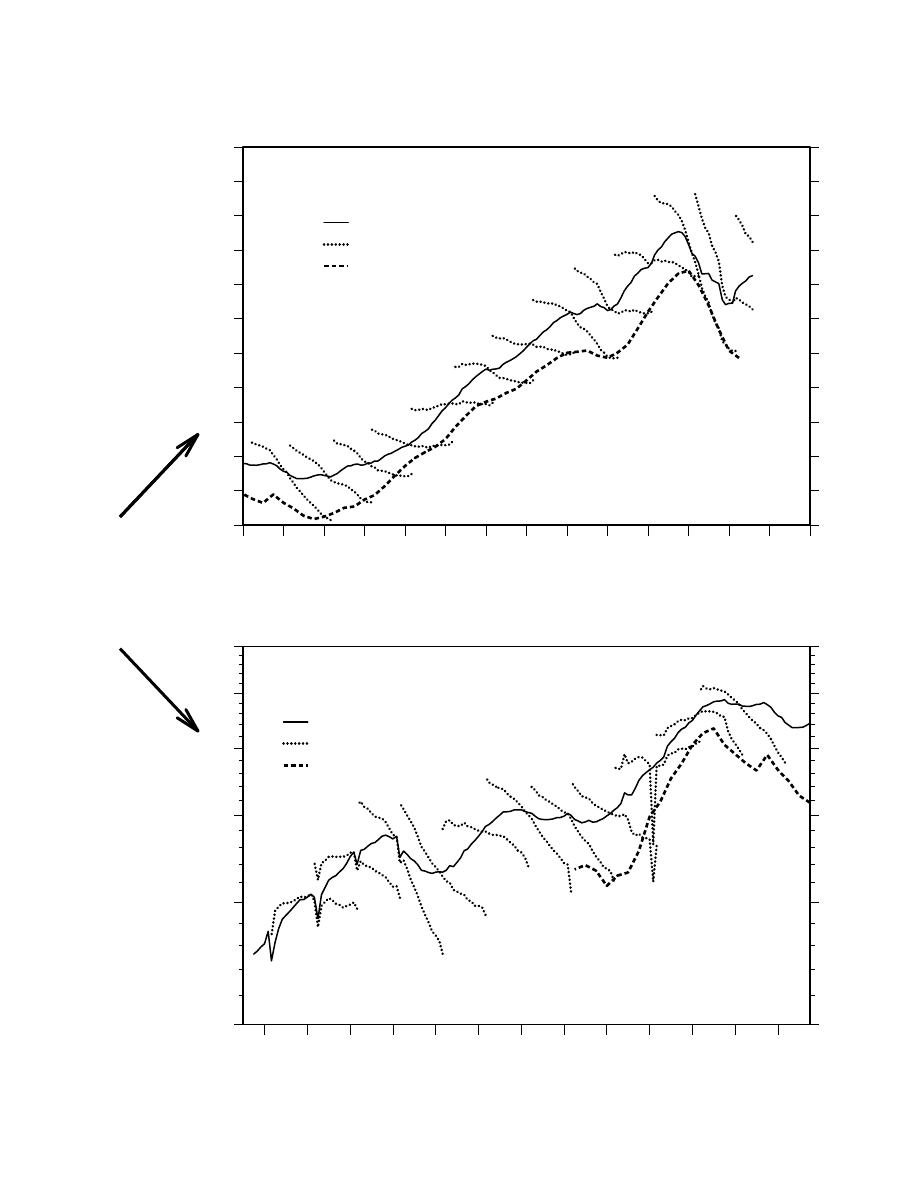

FED’S STOCK VALUATION MODEL (FSVM-2)

5-year earnings

growth weight

_____________

.25

.20

.10

.25

.20

.10

Actual S&P 500

Fair Value S&P 500*

* Fair Value is 12-month forward consensus expected S&P 500 operating earnings per share divided by

difference between Moody’s A-rated corporate bond yield less fraction (as shown above) of 5-year

consensus expected earnings growth.

Source: Thomson Financial

Yardeni

Figure 12.

This second version of

the Fed’s Stock

Valuation Model builds

on the simple one by

adding variables for

long-term expected

earnings growth and

risk.

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

10

15

20

25

30

10

15

20

25

30

Jul

LONG-TERM CONSENSUS EARNINGS GROWTH*

(annual rate, percent)

S&P 500

S&P 500 Information Technology

Ex Information Technology

* 5-year forward consensus expected S&P 500 earnings growth. Data from 1995 based on new Global Industry

Classification Standard.

Source: Thomson Financial.

Yardeni

Figure 13.

Long-term earnings

growth expectations

rose sharply during

1990s. They fell

sharply from

2000-2002.

- New Improved Model -

Page 12 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

-5

0

5

10

15

20

25

30

35

40

-5

0

5

10

15

20

25

30

35

40

Jun

MARKET’S WEIGHT FOR 5-YEAR CONSENSUS EXPECTED EARNINGS GROWTH*

(percent)

Average = 13%

Weight market gives to long-term earnings growth

________________________________________

value > 13% = more than average weight

value < 13% = less than average weight

* Moody’s A-rated corporate bond yield less earnings yield divided by 5-year consensus expected earnings

growth.

* Source: Standard and Poor’s Corporation, Thomson Financial and Moody’s Investors Service.

Yardeni

Figure 14.

Investors have on

average over time

subtracted 13% of

their long-term

earnings growth

expectations from the

corporate bond yield

to determine earnings

yield.

1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

.8

.9

1.0

1.1

1.2

1.3

1.4

1.5

1.6

.8

.9

1.0

1.1

1.2

1.3

1.4

1.5

1.6

Jun

S&P 500 PEG RATIO

P/E ratio for S&P 500

divided by 5-year consensus

expected earnings growth*

Average = 1.2

* P/E using 12-month forward consensus S&P 500 expected earnings and prices at mid-month.

Source: Thomson Financial.

Yardeni

Figure 15.

Historically, S&P 500

sold at P/E of 1.2 times

long-term expected

earnings growth, on

average, with quite a

bit of volatility.

- New Improved Model -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 13

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

6

7

8

9

10

11

12

6

7

8

9

10

11

12

7/26

CORPORATE BOND YIELD

(percent)

A-Rated

Source: Moody’s Investors Service.

Yardeni

Figure 16.

Corporate bond yield

variable in FSVM-2

captures risk that

earnings will be

weaker than expected.

60 62 64 66 68 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06

0

50

100

150

200

250

300

350

400

0

50

100

150

200

250

300

350

400

7/26

CORPORATE SPREAD*

(basis points)

Moody’s A-Rated Corporate Bond Yield

Minus 10-Year US Treasury Bond Yield

Average = 131

* Monthly through 1994, weekly thereafter.

Source: Board of Governors of the Federal Reserve System and Moody’s Investor Service.

Yardeni

Figure 17.

Figure 17.

- New Improved Model -

Page 14 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

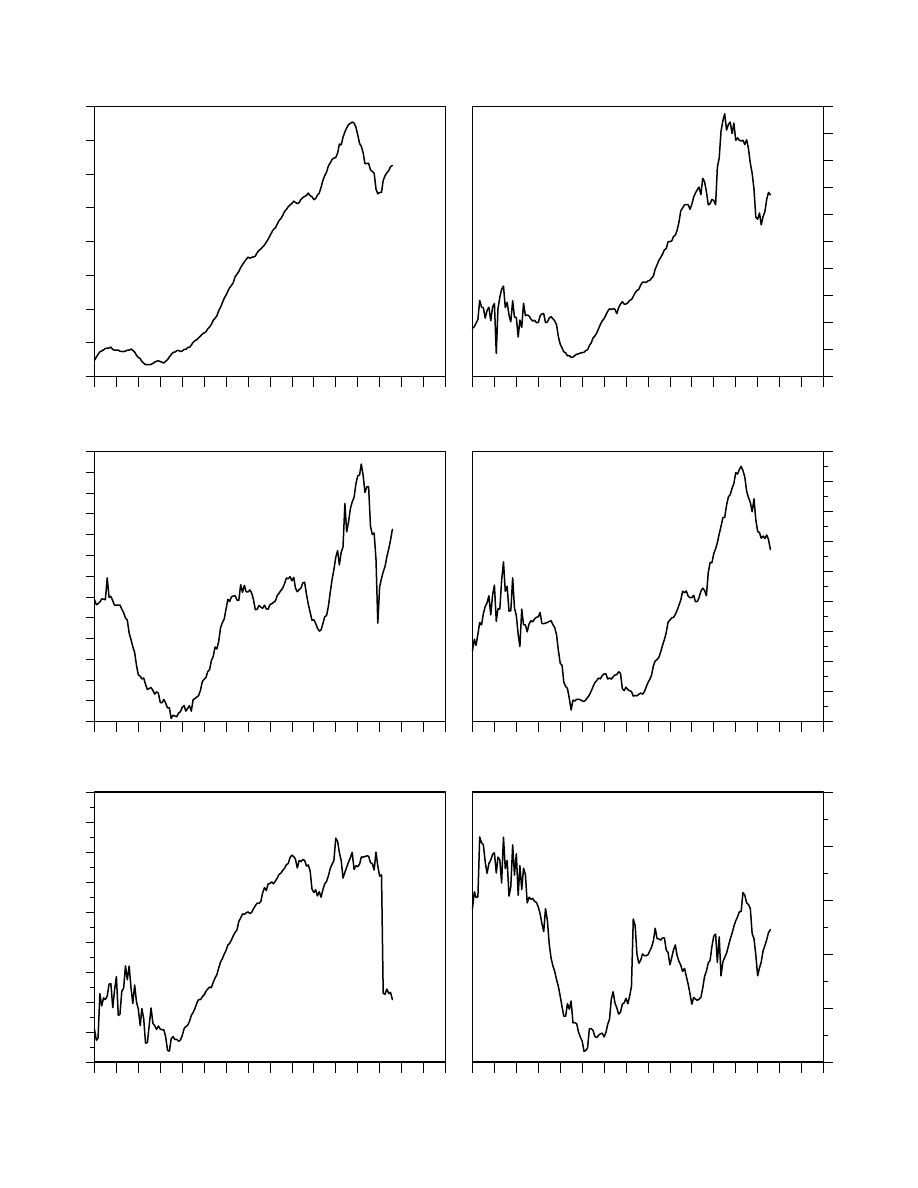

Figure 18.

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

25

30

35

40

45

50

55

60

65

Jul

UNITED STATES (S&P 500)

Expected EPS*

(dollars)

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

75

100

125

150

175

200

225

250

275

300

325

Jul

GERMANY (DAX)

Expected EPS

(euros)

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

225

250

275

300

325

350

375

400

425

450

475

500

525

550

Jul

CANADA (TSE 300)

Expected EPS

(Canadian dollars)

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

100

120

140

160

180

200

220

240

260

280

Jul

FRANCE (CAC 40)

Expected EPS

(euros)

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

180

200

220

240

260

280

300

320

340

360

Jul

UNITED KINGDOM (FT 100)

Expected EPS

(pounds)

* 12-month forward consensus expected operating earnings per share. Source: Thomson Financial.

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

20

30

40

50

60

70

Jul

JAPAN (TOPIX)

Expected EPS

(yen)

Yardeni

- Global: Expected Earnings* -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 15

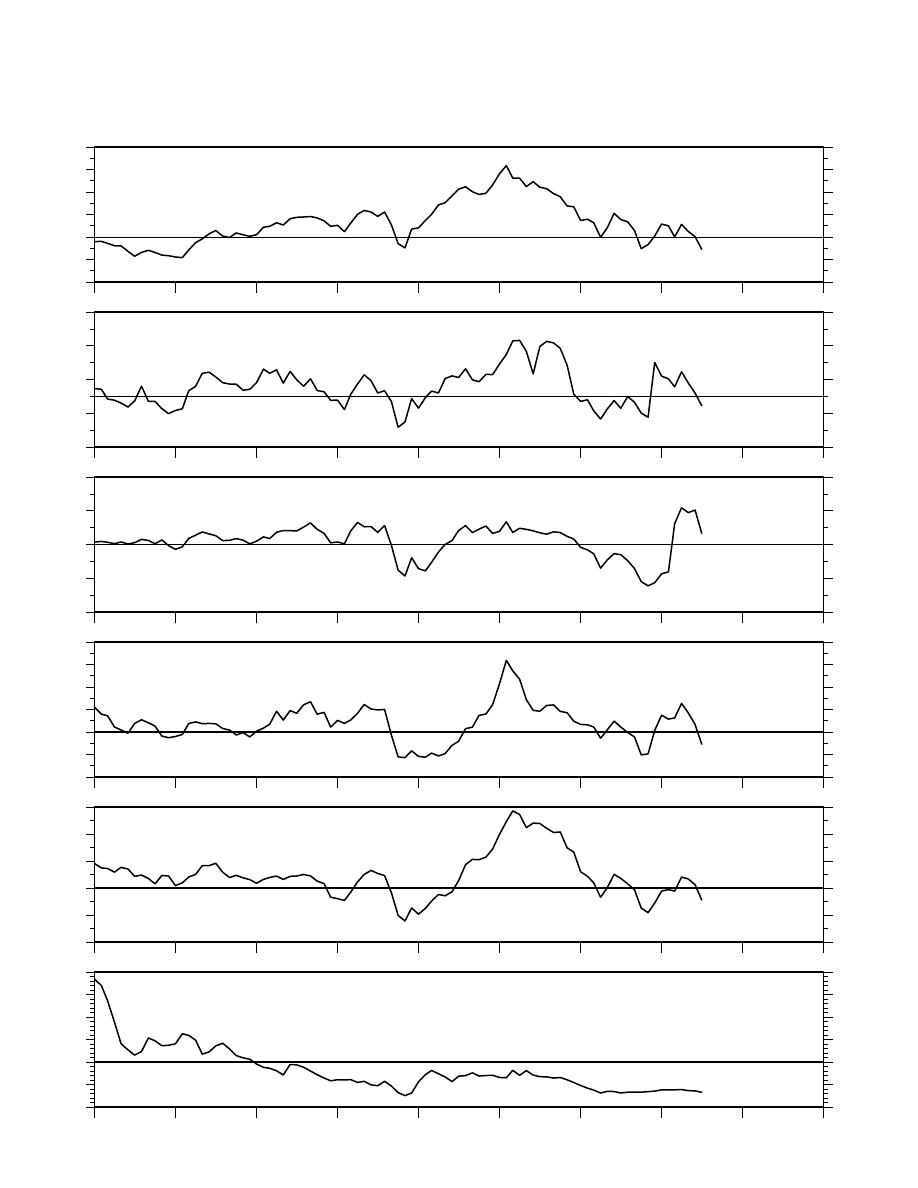

Figure 19.

1995

1996

1997

1998

1999

2000

2001

2002

2003

-40

-20

0

20

40

60

80

-40

-20

0

20

40

60

80

Jun

UNITED STATES

Overvalued

Undervalued

1995

1996

1997

1998

1999

2000

2001

2002

2003

-30

-10

10

30

50

-30

-10

10

30

50

Jun

CANADA

Overvalued

Undervalued

1995

1996

1997

1998

1999

2000

2001

2002

2003

-40

-20

0

20

40

-40

-20

0

20

40

Jun

UNITED KINGDOM

Overvalued

Undervalued

1995

1996

1997

1998

1999

2000

2001

2002

2003

-40

-20

0

20

40

60

80

-40

-20

0

20

40

60

80

Jun

GERMANY

Overvalued

Undervalued

1995

1996

1997

1998

1999

2000

2001

2002

2003

-40

-20

0

20

40

60

-40

-20

0

20

40

60

Jun

FRANCE

Overvalued

Undervalued

1995

1996

1997

1998

1999

2000

2001

2002

2003

-100

-50

0

50

100

150

200

-100

-50

0

50

100

150

200

Jun

JAPAN

Overvalued

Undervalued

Yardeni

Source: Thomson Financial.

- Global: Stock Valuation -

Page 16 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

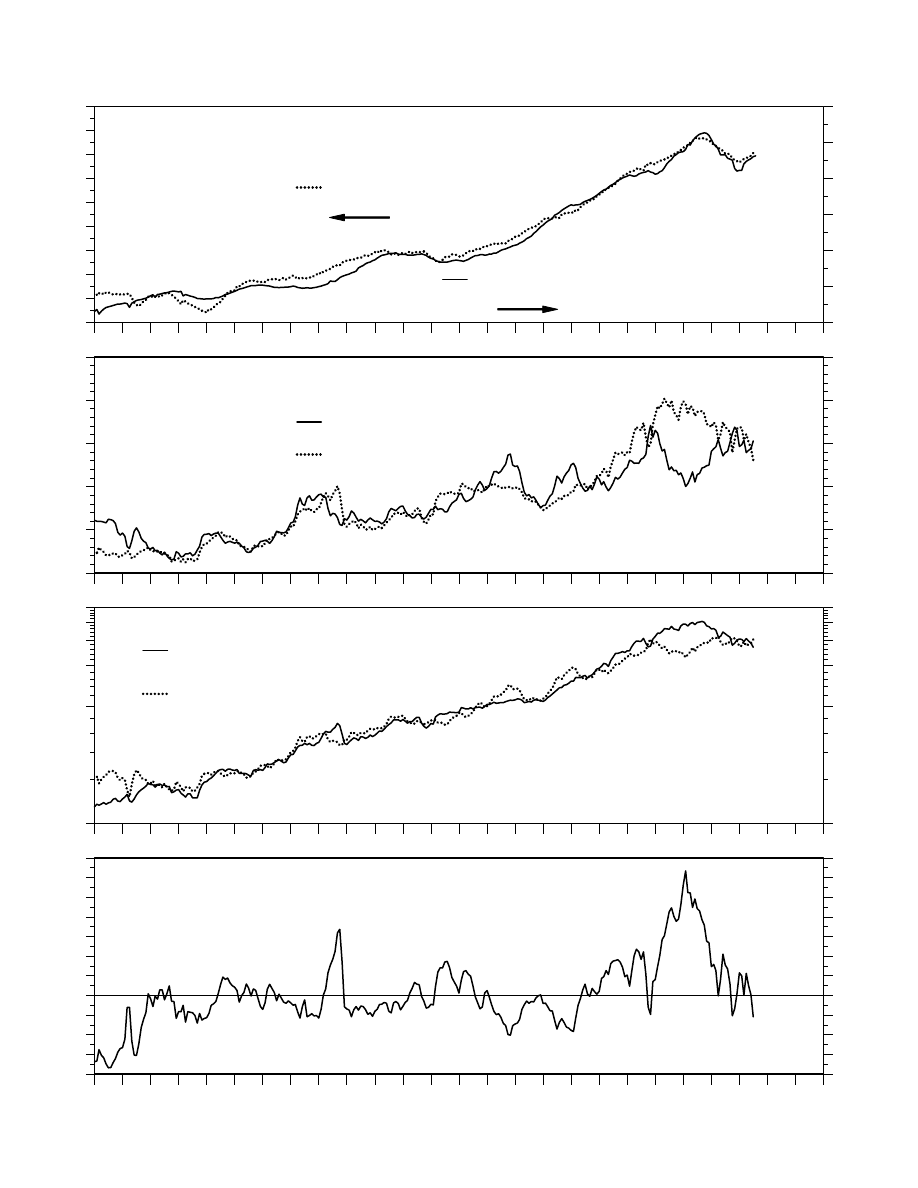

Figure 20.

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

04

10

20

30

40

50

60

70

70

80

90

100

110

120

130

140

150

160

Jul

STOCK VALUATION MODEL

Industrial Production

(1987=100)

Expected Earnings Per Share*

For S&P 500 (dollars)

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

04

5

10

15

20

25

30

5

10

15

20

25

30

Jun

Fair-Value P/E

Forward P/E

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

04

75

425

775

1125

1475

1825

75

425

775

1125

1475

1825

Jun

Fair-Value Price

(ratio scale)

Stock Price Index (S&P 500)

(ratio scale)

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

04

-40

-30

-20

-10

0

10

20

30

40

50

60

70

-40

-30

-20

-10

0

10

20

30

40

50

60

70

Jun

Overvalued

Undervalued

Source: Thomson Financial.

Yardeni

- Global: United States (S&P 500) -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 17

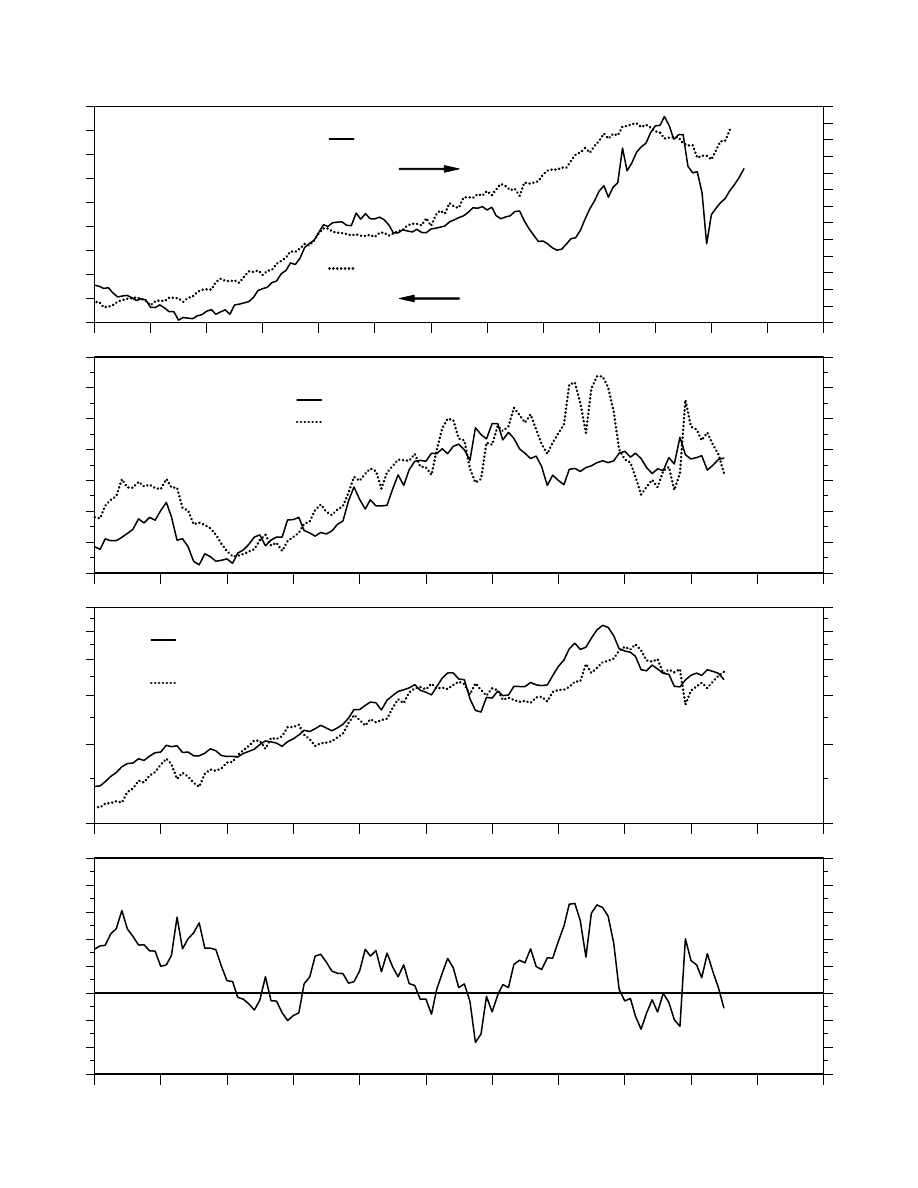

Figure 21.

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

225

250

275

300

325

350

375

400

425

450

475

500

525

550

75

80

85

90

95

100

105

110

115

120

Apr

Jul

STOCK VALUATION MODEL

Expected Earnings Per Share

for TSE 300 (Canadian dollars)

Industrial Production

(1997=100)

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

10

12

14

16

18

20

22

24

10

12

14

16

18

20

22

24

Jun

Fair-Value P/E

Forward P/E

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2500

4500

6500

8500

10500

12500

2500

4500

6500

8500

10500

12500

Jun

Stock Price Index (TSE 300)

(ratio scale)

Fair-Value

(ratio scale)

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

-30

-20

-10

0

10

20

30

40

50

-30

-20

-10

0

10

20

30

40

50

Jun

Overvalued

Undervalued

Yardeni

* Source: Thomson Financial.

- Global: Canada (TSE 300) -

Page 18 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

Figure 22.

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

150

200

250

300

350

85

90

95

100

105

110

Jul

STOCK VALUATION MODEL

Expected Earnings Per Share

for FT 100 (pounds)

Industrial Production

(1995=100)

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

7

9

11

13

15

17

19

21

23

25

7

9

11

13

15

17

19

21

23

25

Jun

Fair-Value P/E

Forward P/E

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

1500

2300

3100

3900

4700

5500

6300

7100

7900

1500

2300

3100

3900

4700

5500

6300

7100

7900

Jun

Stock Price Index (FT 100)

(ratio scale)

Fair-Value

(ratio scale)

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

-30

-20

-10

0

10

20

30

40

-30

-20

-10

0

10

20

30

40

Jun

Overvalued

Undervalued

Yardeni

Source: Thomson Financial.

- Global: United Kingdom (FT 100) -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 19

Figure 23.

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

75

100

125

150

175

200

225

250

275

300

325

90

100

110

120

Jul

STOCK VALUATION MODEL

Expected Earnings Per Share

for DAX (Euros)

Industrial Production

(1995=100)

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

8

10

12

14

16

18

20

22

24

26

28

30

32

34

8

10

12

14

16

18

20

22

24

26

28

30

32

34

Jun

Fair-Value P/E

Forward P/E

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

1000

3000

5000

7000

9000

11000

1000

3000

5000

7000

9000

11000

Jun

Stock Price Index (DAX)

(ratio scale)

Fair-Value

(ratio scale)

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

-40

-20

0

20

40

60

80

-40

-20

0

20

40

60

80

Jun

Overvalued

Undervalued

Yardeni

Source: Thomson Financial.

- Global: Germany (DAX) -

Page 20 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

Figure 24.

1995

1996

1997

1998

1999

2000

2001

2002

2003

100

125

150

175

200

225

250

275

98

100

102

104

106

108

110

112

114

116

118

120

Jul

STOCK VALUATION MODEL

Expected Earnings Per Share

for CAC 40 (Euros)

Industrial Production

(1995=100)

1995

1996

1997

1998

1999

2000

2001

2002

2003

11

13

15

17

19

21

23

25

27

29

11

13

15

17

19

21

23

25

27

29

Jun

Fair-Value P/E

Forward P/E

1995

1996

1997

1998

1999

2000

2001

2002

2003

1500

2300

3100

3900

4700

5500

6300

7100

7900

1500

2300

3100

3900

4700

5500

6300

7100

7900

Jun

Stock Price Index (CAC 40)

(ratio scale)

Fair-Value

(ratio scale)

1995

1996

1997

1998

1999

2000

2001

2002

2003

-40

-20

0

20

40

60

-40

-20

0

20

40

60

Jun

Overvalued

Undervalued

Yardeni

Source: Thomson Financial.

- Global: France (CAC 40) -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 21

Figure 25.

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

20

30

40

50

60

90

95

100

105

110

115

Jun

Jul

STOCK VALUATION MODEL

Expected Earnings Per Share

for TOPIX (yen)

Industrial Production

(1995=100)

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

0

50

100

150

0

50

100

150

Jun

Fair-Value P/E

Forward P/E

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

0

500

1000

1500

2000

2500

3000

3500

4000

4500

0

500

1000

1500

2000

2500

3000

3500

4000

4500

Jun

Stock Price Index (TOPIX)

Fair-Value

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

-100

0

100

200

300

-100

0

100

200

300

Jun

Overvalued

Undervalued

Yardeni

Source: Thomson Financial.

- Global: Japan (TOPIX) -

Page 22 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

100

150

200

250

300

25

30

35

40

45

50

55

60

65

7/26

Jul

S&P 500 & G5 FORWARD EARNINGS

G5 Forward Earnings**

S&P 500 Forward Earnings*

* 52-week forward consensus expected S&P 500 operating earnings per share. Monthly through March 1994,

weekly after.

** Unweighted average of the 12-month forward consensus expected operating earnings per share for Canada,

France, Germany, Japan and United Kingdom. Source: Thomson Financial.

Yardeni

Figure 26.

Close correlation

between US and G5

profits cycle.

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

-30

-20

-10

0

10

20

30

-30

-20

-10

0

10

20

30

Jul

Jul

S&P 500 & G5 FORWARD EARNINGS

(yearly percent change)

G5 Forward Earnings**

S&P 500 Forward Earnings*

* 12-month forward consensus expected operating earnings per share. Source: Thomson Financial.

** Unweighted average of the 12-month forward consensus expected operating earnings per share for Canada,

France, Germany, Japan and United Kingdom. Source: Thomson Financial.

Yardeni

Figure 27.

Figure 27.

- Earnings: US vs G5 -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 23

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

70

80

90

100

110

120

130

140

150

160

10

15

20

25

30

35

40

45

50

55

60

65

7/26

Jun

S&P 500 EARNINGS & INDUSTRIAL PRODUCTION

S&P 500 Forward Earnings*

Industrial Production

(1992=100)

* 52-week forward consensus expected S&P 500 operating earnings per share. Monthly through March 1994,

weekly after

Source: Thomson Financial.

Figure 28.

Strong correlation

between US industrial

production and S&P

500 forward earnings.

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

-20

-15

-10

-5

0

5

10

15

20

25

30

-20

-15

-10

-5

0

5

10

15

20

25

30

7/26

S&P 500 EARNINGS & PRODUCTION

(yearly percent change)

S&P 500 Forward Earnings*

Industrial Production

* 52-week forward consensus expected S&P 500 operating earnings per share. Monthly through March 1994,

weekly after

Source: Thomson Financial.

Figure 29.

Figure 29.

- Earnings & Output: US -

Page 24 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

-20

-15

-10

-5

0

5

10

15

20

25

30

-20

-15

-10

-5

0

5

10

15

20

25

30

7/26

Jun

S&P 500 EARNINGS & PRODUCER PRICE INDEX

(yearly percent change)

PPI: Intermediate Goods

S&P 500 Forward Earnings*

* 12-month forward consensus expected operating earnings per share. Source: Thomson Financial.

Yardeni

Figure 30.

Profits cycle is highly

correlated with pricing

cycles especially with

the intermediate

goods PPI and import

prices.

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

-20

-15

-10

-5

0

5

10

15

20

25

-20

-15

-10

-5

0

5

10

15

20

25

Jun

7/26

S&P 500 EARNINGS & US IMPORT PRICES

(yearly percent change)

Import Price Index

S&P 500 Forward Earnings*

* 12-month forward consensus expected operating earnings per share. Source: Thomson Financial, US

Department of Labor, Bureau of Labor Statistics.

Yardeni

Figure 31.

Figure 31.

- Earnings & Prices: US -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 25

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

100

125

150

175

200

225

250

275

92

94

96

98

100

102

104

106

108

110

112

114

116

118

120

May

Jul

FRANCE: EARNINGS & PRODUCTION

Forward Earnings*

Industrial Production

(1995=100)

* 12-month forward consensus expected earnings per share for CAC 40.

Source: Thomson Financial.

Yardeni

Figure 32.

Industrial production

is key variable driving

profits in France and

UK.

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

180

200

220

240

260

280

300

320

340

88

90

92

94

96

98

100

102

104

106

108

110

May

Jul

UNITED KINGDOM: EARNINGS & PRODUCTION

Forward Earnings*

Industrial Production

(1995=100)

* 12-month forward consensus expected earnings per share for FT 100.

Source: Thomson Financial.

Yardeni

Figure 33.

Figure 33.

- Earnings & Output: Europe -

Page 26 / July 30, 2002

/ Prudential Securities Asset Valuation & Allocation Models

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

20

30

40

50

60

90

95

100

105

110

115

Jun

Jul

JAPAN: EARNINGS & PRODUCTION

Forward Earnings*

Industrial Production

(1995=100)

* 12-month forward consensus expected operating earnings per share for TOPIX.

Source: Thomson Financial.

Yardeni

Figure 34.

Japan’s profits cycle

driven by

manufacturing.

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

20

30

40

50

60

-50

-25

0

25

50

75

100

Q1

Jul

JAPAN: EARNINGS & TANKAN BUSINESS CONDITIONS

Tankan Business Conditions:

Major Manufacturers

(diffusion index)

Forward Earnings*

* 12-month forward consensus expected earnings per share for TOPIX.

Source: Thomson Financial.

Yardeni

Figure 35.

Figure 35.

- Earnings & Output: Japan -

Prudential Securities Asset Valuation & Allocation Models / July 30, 2002 / Page 27

R E S E A R C H

The research analyst(s) or a member of the research analyst’s household does not have a financial interest in any of the tickers mentioned in this report.

The research analyst or a member of the team does not have a material conflict of interest relative to any stock mentioned in this report

The research analyst has not received compensation that is based upon (among other factors) the firm’s investment banking revenues as it related to any stock mentioned in this report

The research analyst, a member of the team, or a member of the household do not serve as an officer, director, or advisory board member of any stock mentioned in this report

Prudential Securities has no knowledge of any material conflict of interest involving the companies mentioned in this report and our firm

When we assign a Buy rating, we mean that we believe that a stock of average or below average risk offers the potential for total return of 15% or more over the next 12 to 18 months. For higher

risk stocks, we may require a higher potential return to assign a Buy rating. When we reiterate a Buy rating, we are stating our belief that our price target is achievable over the next 12 to 18

months.

When we assign a Sell rating, we mean that we believe that a stock of average or above average risk has the potential to decline 15% or more over the next 12 to 18 months. For lower risk

stocks, a lower potential decline may be sufficient to warrant a Sell rating. When we reiterate a Sell rating, we are stating our belief that our price target is achievable over the next 12 to 18

months.

A Hold rating signifies our belief that a stock does not present sufficient upside or downside potential to warrant a Buy or Sell rating, either because we view the stock as fairly valued or

because we believe that there is too much uncertainty with regard to key variables for us to rate the stock a Buy or Sell.

Rating distribution

Rating distribution

Rating distribution

Rating distribution

07/15/02

Firm

Firm

Firm

Firm

IBG Clients

IBG Clients

IBG Clients

IBG Clients

Buy

Buy

Buy

Buy

40.00%

4.00%

50.00%

Hold

Hold

Hold

Hold

56.00%

5.00%

50.00%

Sell

Sell

Sell

Sell

3.00%

1.00%

0.00%

Excludes Closed End Funds

Any OTC-traded securities or non-U.S. companies mentioned in this report may not be cleared for sale in all states.

02-XXXX

Securities products and services are offered through Prudential Securities Incorporated, a Prudential company.

©Prudential Securities Incorporated, 2002, all rights reserved. One Seaport Plaza, New York, NY 10292

Prudential Financial is a service mark of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. However, such

information has not been verified by us, and we do not make any representations as to its accuracy or completeness. Any statements nonfactual in nature constitute only current opinions,

which are subject to change. Prudential Securities Incorporated (or one of its affiliates or subsidiaries) or their officers, directors, analysts, employees, agents, independent contractors, or

consultants may have positions in securities or commodities referred to herein and may, as principal or agent, buy and sell such securities or commodities. An employee, analyst, officer, agent,

independent contractor, a director, or a consultant of Prudential Securities Incorporated, its affiliates, or its subsidiaries may serve as a director for companies mentioned in this report. Neither

the information nor any opinion expressed shall constitute an offer to sell or a solicitation of an offer to buy any securities or commodities mentioned herein. There may be instances when

fundamental, technical, and quantitative opinions may not be in concert. This firm (or one of its affiliates or subsidiaries) may from time to time perform investment banking or other services for,

or solicit investment banking or other business from, any company mentioned in this report.

There are risks inherent in international investments, which may make such investments unsuitable for certain clients. These include, for example, economic, political, currency exchange rate

fluctuations, and limited availability of information on international securities. Prudential Securities Incorporated, its affiliates, and its subsidiaries make no representation that the companies

which issue securities which are the subject of their research reports are in compliance with certain informational reporting requirements imposed by the Securities Exchange Act of 1934.

Sales of securities covered by this report may be made only in those jurisdictions where the security is qualified for sale. The contents of this publication have been approved for distribution by

Prudential-Bache International Limited, which is regulated by The Securities and Futures Authority Limited. We recommend that you obtain the advice of your Financial Advisor regarding this or

other investments.

Additional information on the securities discussed herein is available upon request.

Document Outline

- - Introduction -

- - Asset Allocation -

- - Valuation Model -

- - Valuation Model -

- - Earnings -

- - Earnings -

- - Earnings -

- - New Improved Model -

- - New Improved Model -

- - New Improved Model -

- - Global: Expected Earnings* -

- - Global: Stock Valuation -

- - Global: United States (S&P 500) -

- - Global: Canada (TSE 300) -

- - Global: United Kingdom (FT 100) -

- - Global: Germany (DAX) -

- - Global: France (CAC 40) -

- - Global: Japan (TOPIX) -

- - Earnings: US vs G5 -

- - Earnings & Output: US -

- - Earnings & Prices: US -

- - Earnings & Output: Europe -

- - Earnings & Output: Japan -

Wyszukiwarka

Podobne podstrony:

anal deutsche bank polska

Pewnego dnia pewna starsza dama przyszła do Deutsche Bank z torbą pełną pieniędzy, pliki

anal deutsche bank polska

anal deutsche bank polska

Digital Card Models 2002 Samolot B 25B Michell

WOTRSCHATZ Bank, Deutsch, Wortschatz und Grammatik

Prudential Financial Research Stock Valuation Models

2002 all models

BANK CENTRALNY I JEGO FUNKCJE

Bank centralny 5

Europejski Bank Centralny

Bank centralny

Ustawa z 30 10 2002 r o ubezp społ z tyt wyp przy pracy i chor zawod

Die Baudenkmale in Deutschland

ecdl 2002

5 Bank Swiatowy

ei 03 2002 s 62

więcej podobnych podstron