Podatki w

USA

Katarzyna Wal

1

AGENDA

Prawo podatkowe w USA

Rodzaje podatkow w USA

Podatki dochodowe

Podatek od sprzedaży i

własności

Nietypowe podatki

2

TYPES OF RULES OF TAX

LAW

Branch

Name

Type of

Rule

Legislative

Congress

Statutory

Executive

Treasury

Department /

IRS

Regulatory

Judicial

•US Tax Courts

•Federal Courts

–District

–Appeals

–Supreme

Judicial

3

STATUTORY SOURCES:

STATUTES AND LAWS

Congress makes the laws, or statutes.

Statutes are organized - or codified - by

subject matter into the United States Code

Title 26 (the 26

th

“book”) of the U.S.C. is

the Internal Revenue Code

4

Administrative Sources

Federal Register

Code of Federal Regulations

Internal Revenue Bulletin

Cumulative Bulletin

Judicial Sources

Tax Court of the United States

Report

Court Reporters, e.g. Federal

Supplement Series

Tax Reporters, e.g. Tax Court

Memorandum Decisions

5

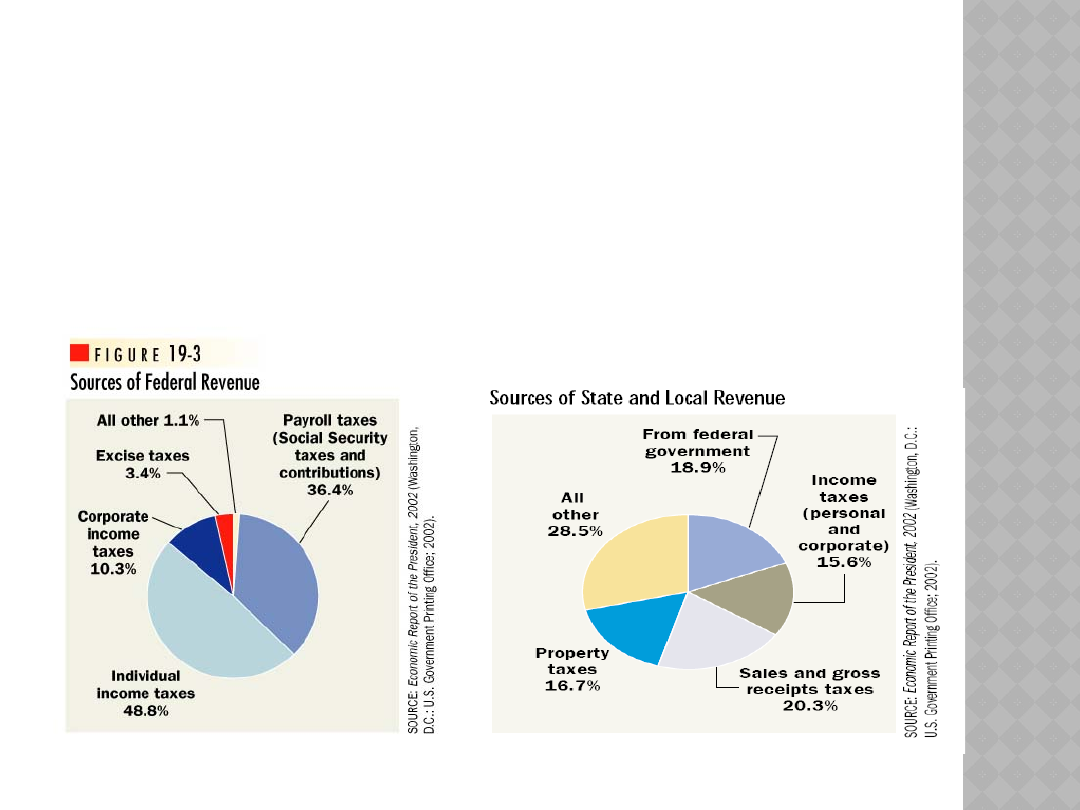

U.S. TAXES: FEDERAL,

STATE AND LOCAL

1. Income Taxes Taxes on earned income “Pay Check”

Taxes on unearned income “Interest and dividends”

2. Excise Taxes Specific Tax on products and services

“Luxury and Sin Tax”

3. Sales Taxes % sales of retail goods and services

4. Payroll Taxes Paid by employers and employees to

finance specific programs

5. Corporate Income TaxAbout 35% of profits

6. Property Taxes

-On property

-Real estate, boats, cars and inventories.

7. Estate taxes and gift taxes.

6

INDIVIDUAL INCOME

TAX

nr 1 wśród podatków

43 stany

7

TROCHĘ HISTORII

Constitution (1787) included the option to tax, but not to tax

individuals directly

Excise taxes and customs duties produced enough revenue at

the time

No income taxes against citizens, but also no services for

them either

Revolutionary War financed by other countries

War of 1812 was first temporary income tax

When war debts were paid, income tax was dropped

Civil War

1862-President Lincoln signed a law providing for

progressive income tax on wages

When the war ended the tax expired

16

th

Amendment (introduced 1909, ratified 1913)

1

st

permanent income tax

8

WWI (1917) was paid for by income taxes

After WWI government was not providing

many services for citizens

Great Depression (1929)

President Roosevelt’s “New Deal” provided for

government services for citizens through tax

revenue

Social Security Act (1935)

Internal Revenue Service (IRS) created

Money withheld from wages deposited with the

Dept. of Treasury

During WWII taxes were increased to

finance the war

This increase set precedent for changing tax rates

of today

Rates are increased to pay for growing services

and needs of the government

9

I STANOWE…

Predates federal history

1911—Wisconsin enacts first real state

income tax

Earlier unsuccessful experiments in other states

Administrative problems

Wisconsin introduced source documentation,

central state-level administration

Adoption in other states quickly followed

By 1919 – 9 additional states

By 1940, 33 state personal income taxes

(Alaska repealed their income tax in 1979)

Philadelphia enacted first local income tax in

1939 to combat real estate property

devaluation

10

IRS

1935

Administrative agency of the

Dept. Of Treasury

Headquarters in DC, 7 regional offices

Main functions are to collect income taxes

and enforce tax laws

Other functions include:

Assist taxpayers in finding information and forms

Assist taxpayers in preparing tax returns

11

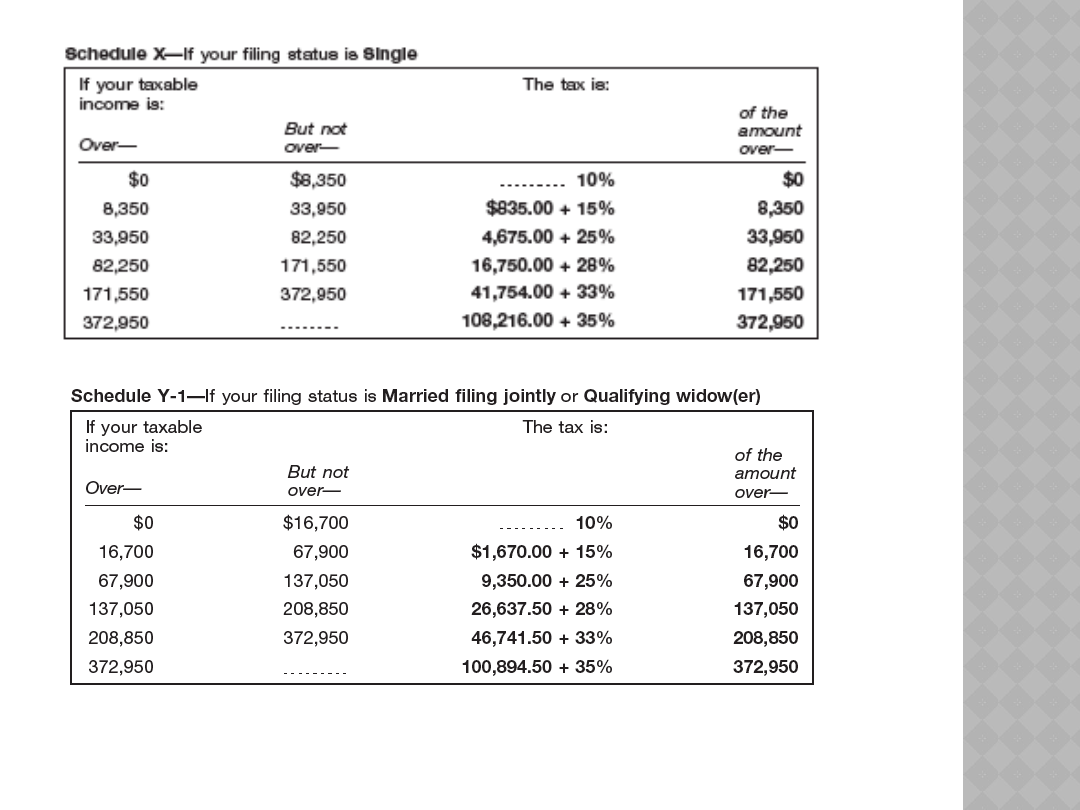

TAX FORM TERMS

Filing Status

Single (not married)

Married filing jointly

Married filing separately

Head of Household (must meet

certain conditions)

Qualifying widow(er) w/ dependent

child

12

13

14

Exemption(s)

An allowance(s) a taxpayer claims for

each person dependent on taxpayer’s

income

Automatically allowed 1 for yourself

Dependent

A person who lives w/ you and receives >

½ of living expenses from you (including

baby born at any time during the tax

year)

Each exemption claimed excludes a

certain amount of gross income ($3,100

in 2004)

15

TAX FORM TERMS

CONT’D

Qualifications for being a dependent

Must be a relative

Citizen or resident of the United States

If married, cannot file a joint return w/

spouse

Person’s income must be less than the

amount of exemption (does not include

child <19 or student <24)

Must provide > ½ of the person’s support

during the year

Itemized Deduction:

Medical and dental expenses (exceeding

7.5% of AGI)

State and local income, real estate, and

personal property tax

Home mortgage interest

Charitable contributions

Casualty and theft losses (exceeding $100

+ 10% of AGI)

Job expenses and certain miscellaneous

deductions (some categories must exceed

2% of AGI)

Standard Deduction:

Single taxpayers, $5350

Married taxpayers filing jointly, $10,700

17

Gross Income

All the taxable income received, including wages,

tips, salaries, interest, dividends, unemployment

compensation, alimony, workers’ compensation, etc

Adjusted Gross Income

Income after allowed adjustments are made (i.e. IRA

contributions)

Taxable Income

Income used for determining tax amount

AGI less legal expenses that are allowed to be

deducted (state and local taxes, mortgage interest,

child care expenses, casualty and theft losses, job

and miscellaneous expenses)

TAXABLE INCOME OF

INDIVIDUALS

- Personal Exemption (s)

- Itemized or Std.

Deduction

Wages, salary, etc

Interest Income

Dividends

Capital Gains

Unemployment

Compensation

+ Other Incomes

Gross Income

Gross Income

- Retirement Contribution

- Other adjustments

Adjusted Gross Income

(AGI)

Taxable

Income

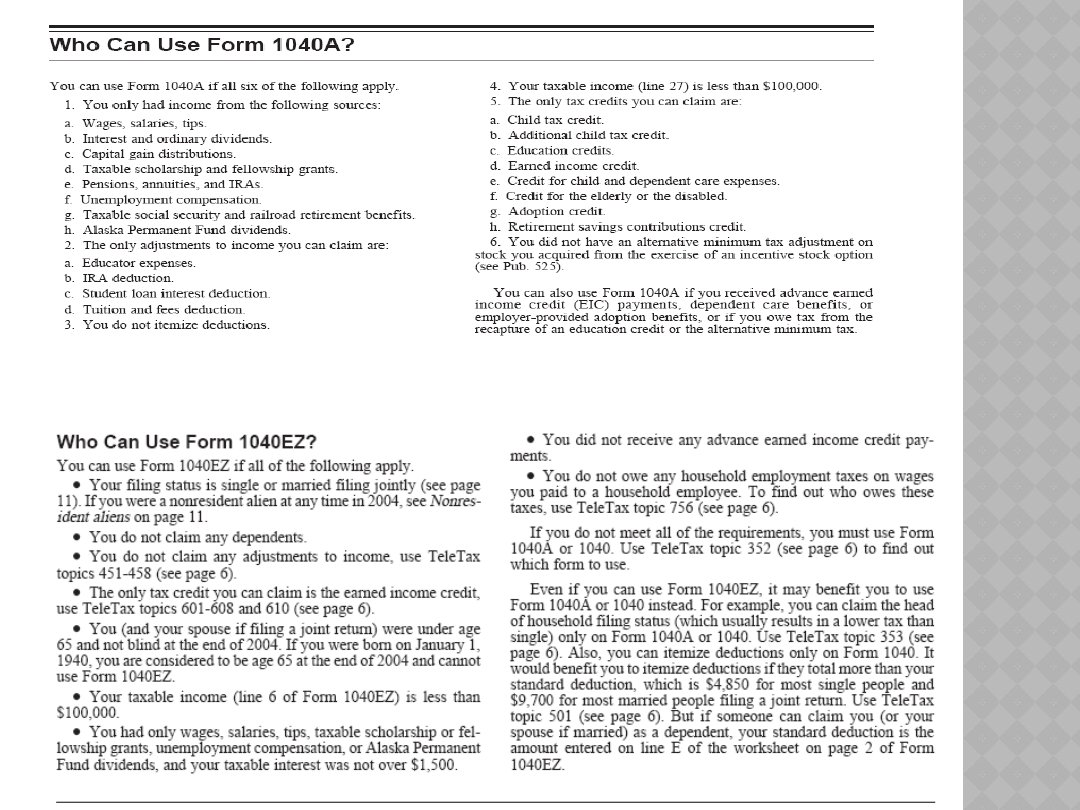

SKŁADANIE „PITÓW”

Deadline – 15 kwietnie

Im wcześniej – tym szybszy zwrot

pieniedzy

Różne formularze

Must use if you cannot file one of the others

20

21

CLASSIFICATION OF

BUSINESS EXPENDITURES

Capital Expenses

• Expenditures for depreciable assets:

– For facilities or productive equipment with useful

life in excess of one year

– Investment recovered through depreciation

• Expenditures for non-depreciable assets

– Land

– Other assets not used in a trade, in a business, or

for production of income

– Assets subject to depletion

Operating expenses

All ordinary and necessary expenditures,

including labor, materials, all direct and indirect

costs, facilities and equipment having a life of

one year or less

TAXABLE INCOME OF

BUSINESS FIRMS

Gross Income

- All expenditures except capital

expenditures

- Depreciation and depletion charges

Taxable Income

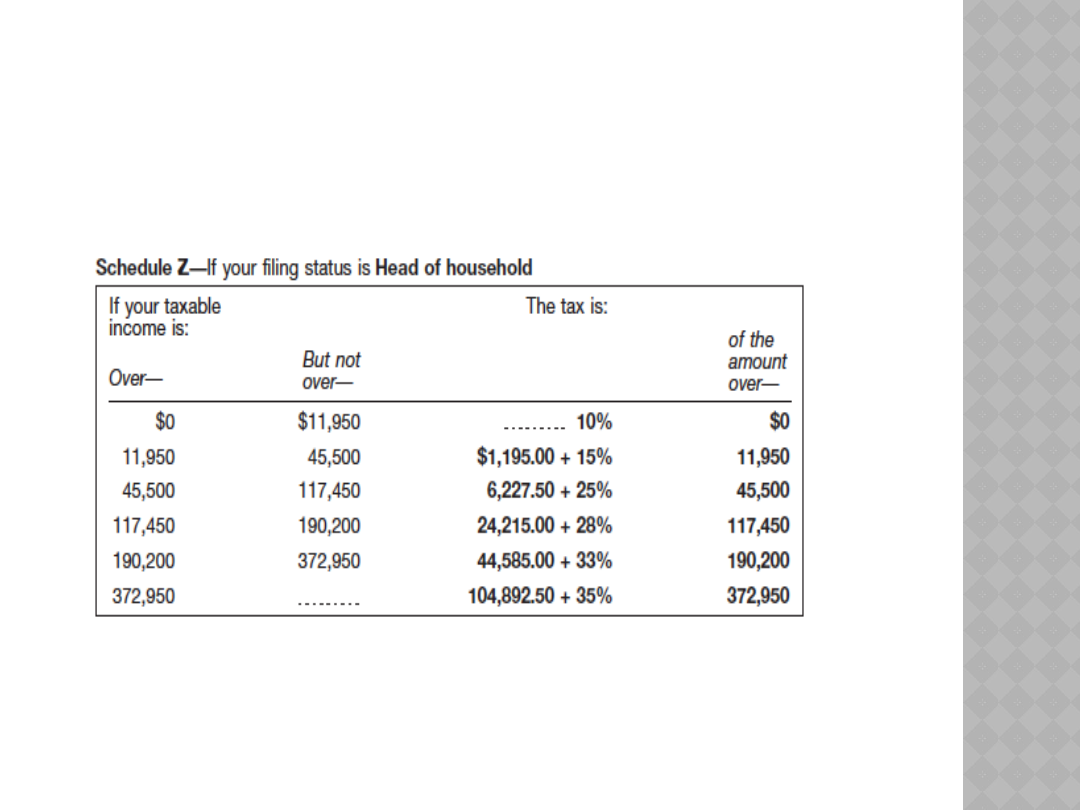

FEDERAL CORPORATE INCOME

TAX RATES

Taxable Income

Tax

Rate

Corporate Income Tax

Not over $50,000

15%

15% over 0

$50,000-75,000

25%

7,500 + 25% over 50,000

$75,000-100,000

34%

13,750 + 34% over 75,000

$100,000-335,000

39%

22,250 + 39% over 100,000

$335,000-10 million

34% 113,900 + 34% over 335,000

$10 million-15

million

35% 3,400,000 + 35% over 10 mil.

$15 million -

18,333,333

38% 5,150,000 + 38% over 15 mil.

over $18,333,333

35%

6,416,667 + 35% over

18,333,333

PAYROLL TAX

FICA - Federal Insurance Contributions Act

(FICA)

1935

legislation intended to provide retirement

and disability benefits for American workers

and their families

Imposed by the federal government on both

employees and employers

FICA taxes:

-Social Security (6.2% up to $106,800

(2009)

)

-Medicare (1.45% of total gross earnings, with

no cap)

25

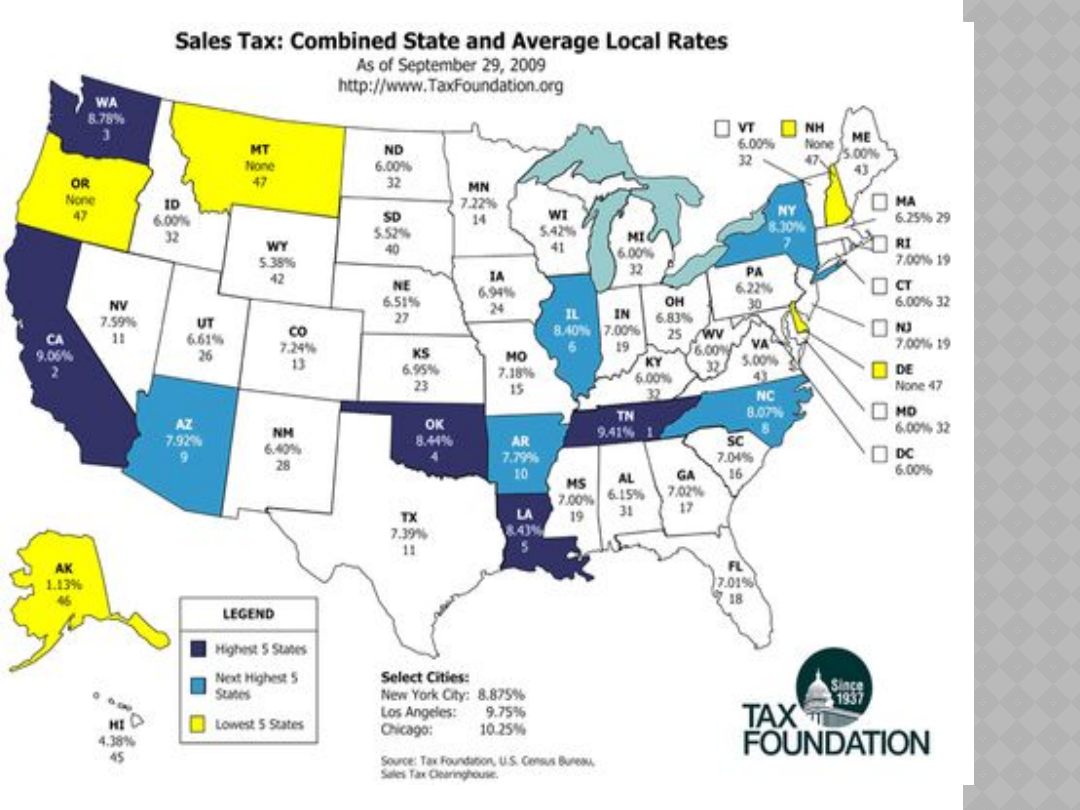

SALES TAX

45 stanów

Federal History (there’s not much)

Most other industrialized countries adopted sales

taxes after WWI to prop-up revenues

Facing strong resistance from labor and farm

groups, Congress rejected the national sales tax in

the early 1930s, and has never adopted one

Hence, state governments laid claim to the sales

tax

By WWII, half the states had sales taxes (on

goods, not services)—now a major revenue source

for most states

26

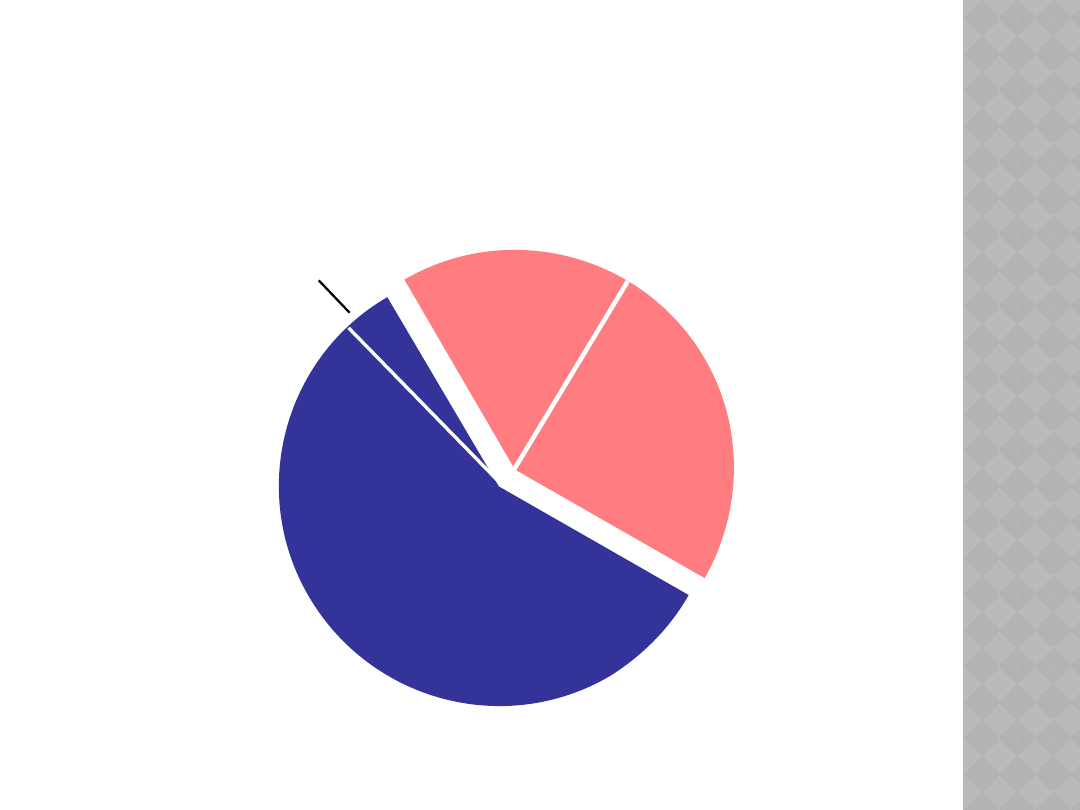

MOST SERVICE CONSUMPTION IS NOT TAXED

$140 BILLION TOTAL CONSUMPTION BASE

Goods

$57 billion tax base

41% of total

Services

$83 billion

59% of total

Untaxe

d

90

%

Taxed

10%

Taxed

55%

Untaxe

d

45

%

Personal consumption sales tax base

CY 2007

Sales Tax

28

1

Tennessee

!!!

9.41

%

41

Wisconsin

5.42%

2

California !

!!

9.06

%

42

Wyoming

5.38%

3

Washington

8.78%

43

Maine

5.00%

4

Oklahoma

8.44%

Virginia

5.00%

5

Louisiana

8.43%

45

Hawaii

4.38%

6

Illinois

8.40%

46

Alaska

1.13%

7

New York

8.30

%

47

Delaware

0%

8

North Carolina

8.07%

Montana

0%

9

Arizona

7.92%

New

Hampshire

0%

10

Arkansas

7.79%

Oregon

0%

29

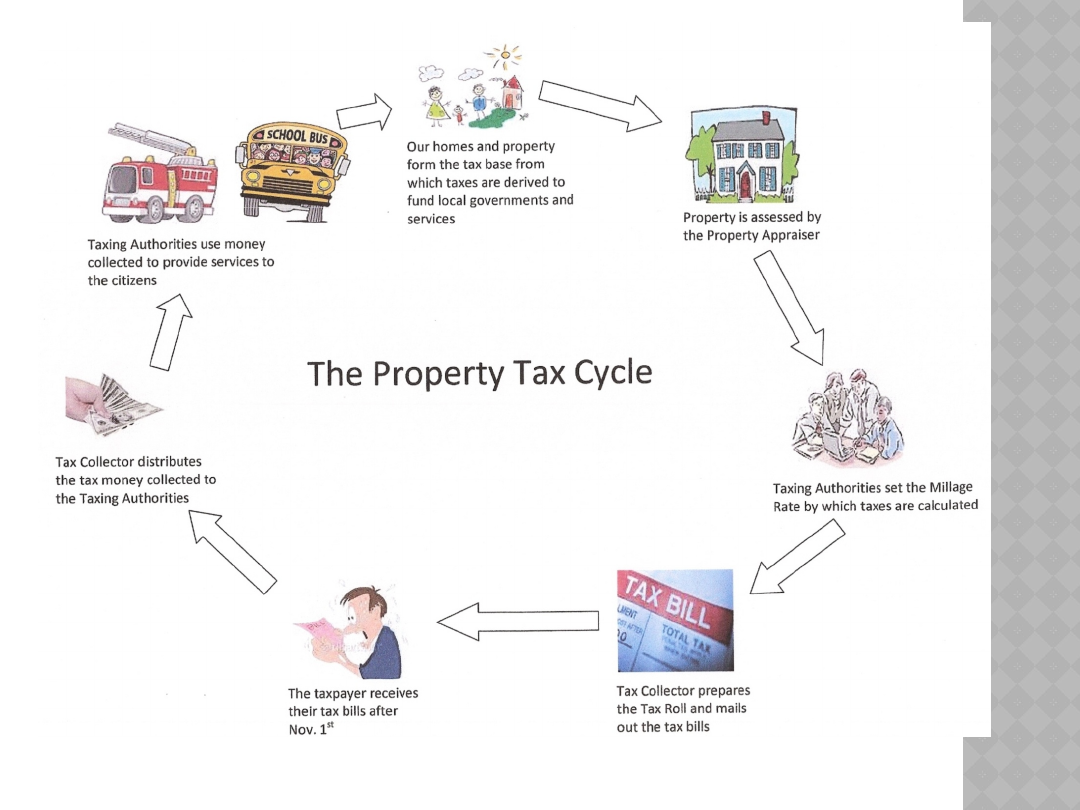

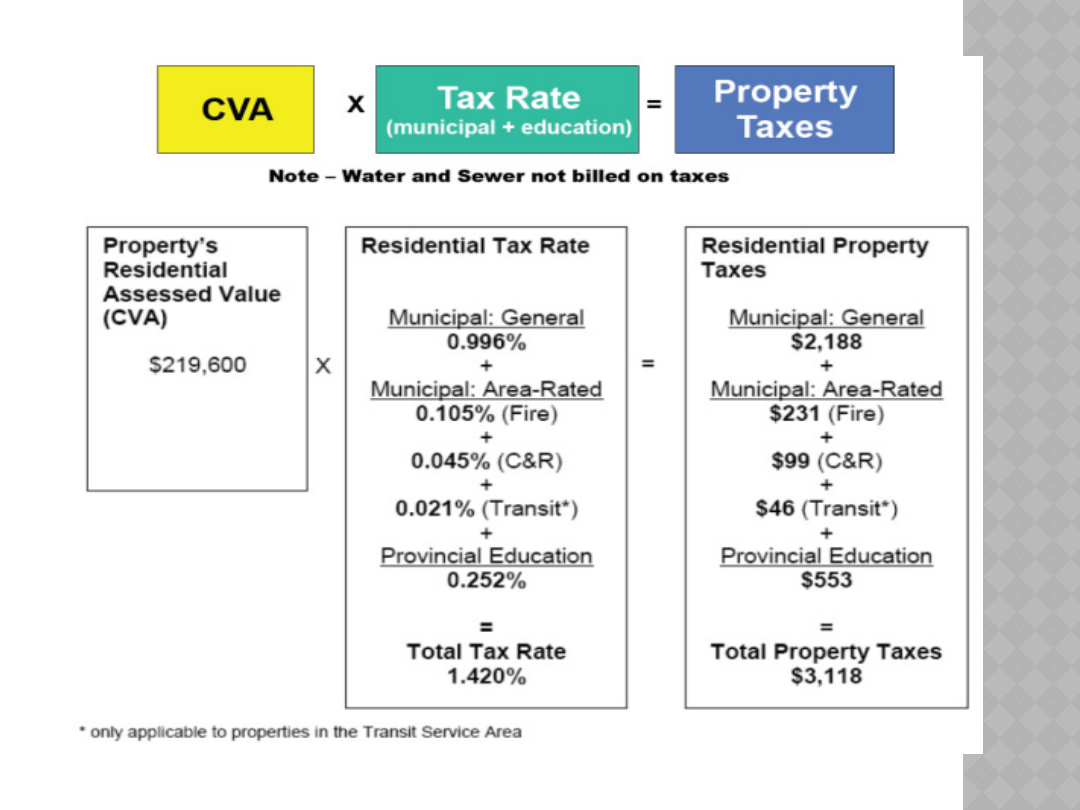

PROPERTY TAX

-podatek stanowy, jego wysokość ustają

władze lokalne

-Różne sposoby ustalania stawek oraz

wartości nieruchomości

- Nowy Jork – 4 klasy

30

CATEGO

RY

TAX RATE

Class I

17.364%

Class II

13.353%

Class III

12.631%

Class IV

10.312%

31

32

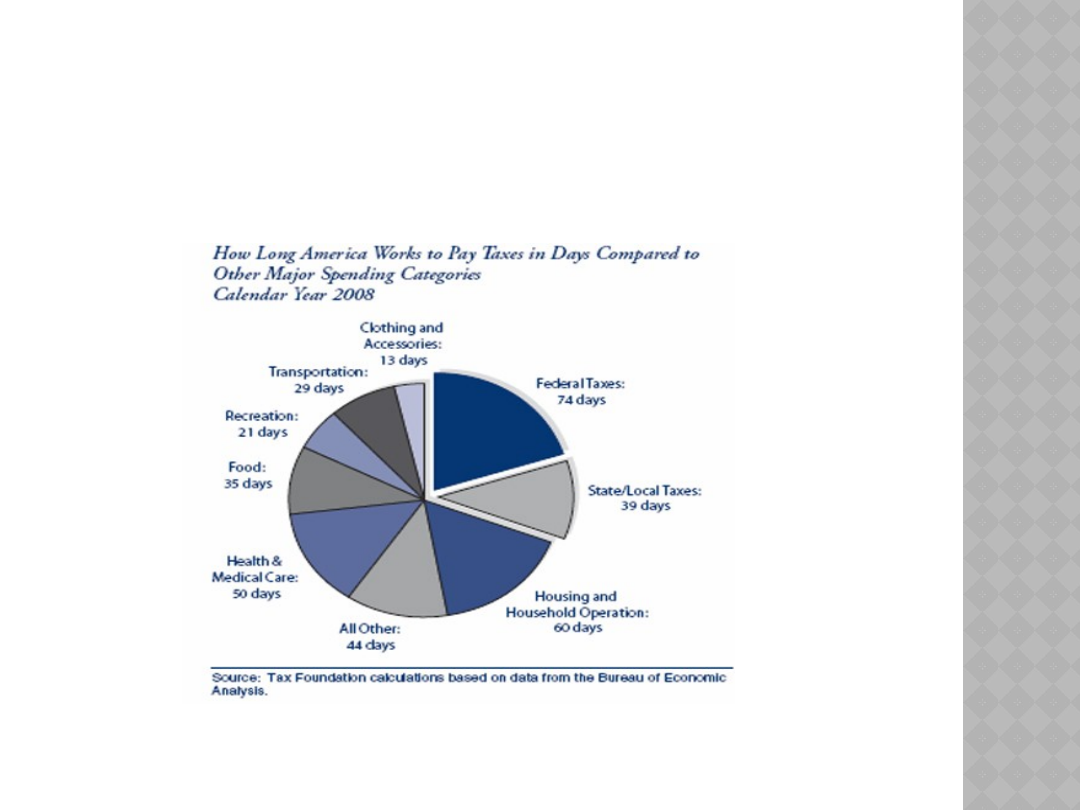

TAX FREE DAY

33

34

DZIWNE PODATKI

Candy tax – Chicago, 5-krotnie wyższy niż

jedzenie, od 2009

Jock tax – od 1991 roku, ok. 40 stanów,

‘economic nexus’ lub dochód w innym stanie

Crack tax – Tennessee, 2005-2009, dilerzy

narkotyków, $3,5 – marihuana, $50 – kokaina,

$200 – crack i metamfetamina

Sparkler and novelty registration fee –

Tennessee, $15 płacone rocznie

Sex sales tax – Utah, od 2004, właściciele firm

w których „nude or partially nude individuals

perform any service”, dodatkowe 10%

35

Playing card tax – Maryland, od 1975

Blueberry tax – Maine

Fur coat tax – Minnesota, od 2002

Fountain soda drink tax – Chicago, od

2009, 9% sales tax

Tattoo tax – Arkansas, od 2002, 6%

sales tax

Fresh fruit vending machine tax –

California, 33%

Bagel tax – Nowy Jork, tylko

przekrojone!!!, 9 centów za sztuke,

2010 rok

Litigation tax – Nowy Jork, 25 dolarow

za osobę

36

Dziękuję za uwagę!!!

37

Document Outline

- Slide 1

- Agenda

- Types of rules of tax law

- Statutory sources: statutes and laws

- Slide 5

- U.S. Taxes: Federal, State and Local

- Individual income tax

- Trochę historii

- Slide 9

- I stanowe…

- IRS

- Tax Form Terms

- Slide 13

- Slide 14

- Slide 15

- Tax Form Terms cont’d

- Slide 17

- Slide 18

- Taxable Income of Individuals

- skłADANIE „pITÓW”

- Slide 21

- Classification of Business Expenditures

- Taxable Income of Business Firms

- Federal Corporate Income Tax Rates

- Payroll tax

- Sales tax

- Slide 27

- Slide 28

- Slide 29

- Property tax

- Slide 31

- Slide 32

- TAX FREE DAY

- Slide 34

- Dziwne podatki

- Slide 36

- Slide 37

Wyszukiwarka

Podobne podstrony:

Rodzaje podatków w USA, USA

System podatkowy USA

5 kroków do apokalipsy podatkowej w USA

Burger King ucieka do Kanady, bo podatki w USA za duże

Jak płacimy podatki dochodowe w USA

finanse publiczne Podatki (173 okna)

03 skąd Państwo ma pieniądze podatki zus nfzid 4477 ppt

Budżet i podatki gr A2

3 Kategorie Wyd i Podatkowe

Podatki dochodowe

System podatkowy w Polsce

9 podatki UE

Podatki bezpośrednie

Podatki 2

amortyzacja podatkowa

SYSTEM PODATKOWY W POLSCE 2

System podatkowy Malty ppt

amortyzacja podatkowa teoria

więcej podobnych podstron